West Fraser Timber (NYSE:WFG) checks many of my boxes for investment. It is a diversified wood products company and its business model is simple and effective. I was reminded of this quote from Warren Buffet when diving into its business model –

I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.

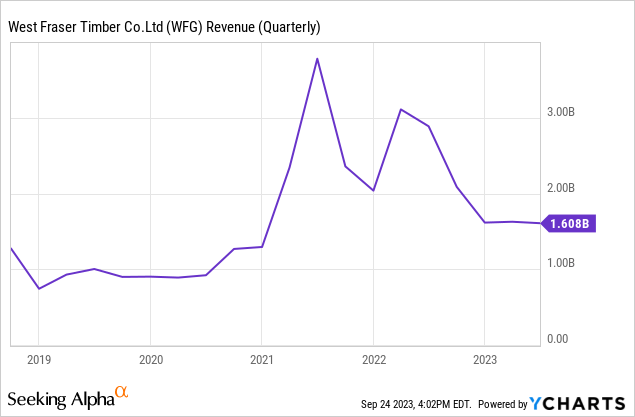

But what stopped me from an investment? The short-term macro. Lumber prices, after having their best year in 2021, have been reverting to their mean which in itself is not a surprise. The concern is a housing slowdown that can push lumber prices far below the mean and this would have a direct effect on the stock price. But this company is on my radar and would plan on adding it to my portfolio when the conditions become conducive again. This analysis is about how their business model can see near-term pain, how well they have maintained their business despite the cyclical nature of the industry they are in, and what needs to change before it becomes a good investment.

The business and its Achilles heel

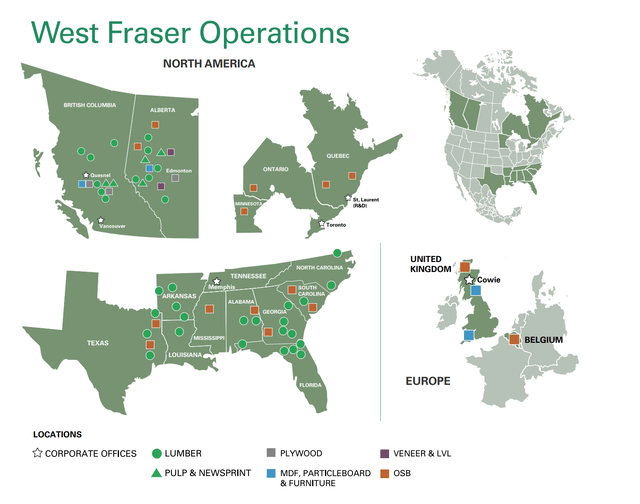

Annual Report

West Fraser Timber Co. Ltd. operates as an integrated wood products company primarily in North America and its business model revolves around forestry and lumber industry. The company is vertically integrated, meaning it is involved in multiple stages of the supply chain, from harvesting timber to manufacturing and distributing finished products. This integration provides greater control over quality and costs.

Timber Harvesting: West Fraser Timber engages in the sustainable harvesting of timber from its extensive forestland holdings. This involves logging, tree felling, and transportation of logs to sawmills.

Sawmills: The company operates sawmills where timber logs are processed into lumber products. These products include softwood lumber used in construction and other applications.

Wood Products: West Fraser Timber manufactures a wide range of wood products, including lumber, plywood, and other building materials. These products are sold to customers in the construction and building industries.

Pulp & Paper: In addition to wood products, the company produces pulp and paper products, which are used in various applications such as packaging, printing, and tissue products.

Value-Added Products: West Fraser Timber focuses on value-added products, which involve further processing lumber and wood into specialized products to meet customer demands. This can include treated lumber and engineered wood products.

Although West Fraser Timber serves diverse markets, its exposure to construction is both a boon and a bane, and demand for its products tends to correlate with economic cycles. This is what the company had to say in its annual report –

Demand for new home construction and our wood building products may decline in the near term should interest rates remain elevated or continue to rise and consequently impact consumer sentiment and housing affordability…

Financial results are dependent on Global economic conditions particularly U.S. and Canadian housing markets and their mix of single and multifamily construction…

Unemployment levels, interest rates, the availability of mortgage credit and the rate of mortgage foreclosures have a significant effect on residential construction…

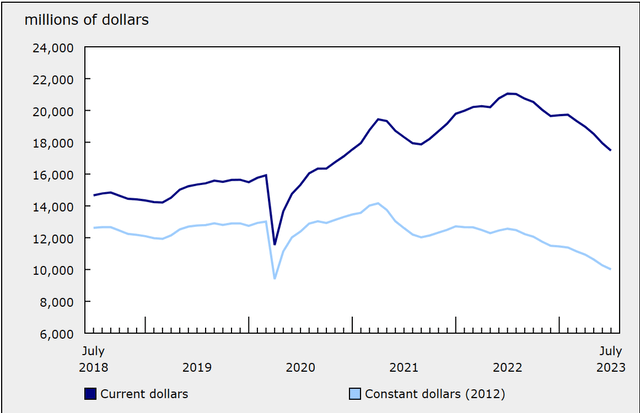

Multiple factors align with these risks currently. In a recent statement by the Fed, Powell emphasized that any relief from high borrowing costs will not be swift or generous, suggesting a commitment to a “higher for longer” approach to interest rates. Investment in building construction (Canada) is also off its highs and has been trending downward according to StatCan.

Investment in Building Construction (StatCan)

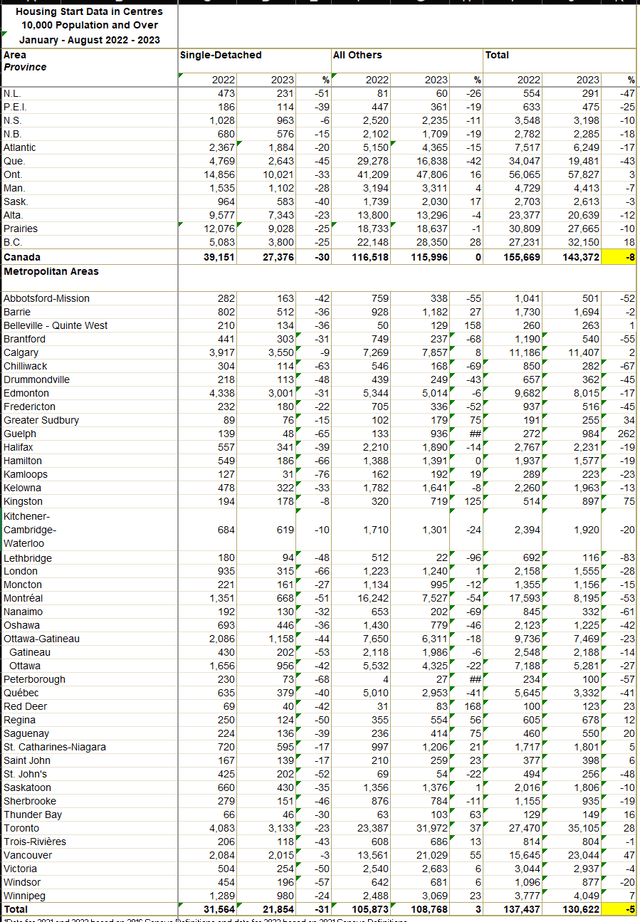

Data from CMHC also shows that Housing starts from January to August of this year have shown high single-digit declines overall in Canada.

Housing Start Data – Canada (CMHC)

Unemployment levels have held up so far and it’s probably too early to look at the rate of mortgage foreclosures. But in Canada at least where mortgage fixed rates are mostly for 5 years, each year brings more renewal and higher rates would squeeze homeowners as they are up for renewal. All in all, these factors would play into the demand for lumber which would in turn affect West Fraser. The timing simply does not look right to get into this stock now.

Why is it on my radar?

The company has all the hallmarks of a superbly managed business. Short-term outlook aside, the company has plenty of experience surviving the different cycles of the economy and it knows how to weather any downturn. Case in point during the last recession, revenue took a dive between 2007 and 2009 of almost 30%. Even though it reported a loss for those years, the company managed to cut expenses to the point where it barely threatened the company. Its balance sheet largely remained unchanged and it maintained a debt-to-equity ratio of approximately 0.3 during those years.

This is the message the CEO had reflected in its annual report –

In our 68-year history at West Fraser, our strategy has remained simple and durable. That is, to be the low-cost producer, and to reinvest in the business while maintaining a prudent balance sheet. This proven and resilient strategy has historically allowed our Company to emerge from market downturns stronger and ready to execute on opportunity. The West Fraser team is experienced in navigating these commodity market cycles, has a proven track record, and is prepared for this cyclicality..

This is all true as when we look at the balance sheet it is obvious that the company has taken great care to be prepared for a slowdown.

West Fraser Timber has a total shareholder equity of $7.4B and a total debt of $500.0M, which brings its debt-to-equity ratio to 6.7%. Its total assets and total liabilities are $9.7B and $2.3B respectively. It has cash and short-term investments close to $1B. The best part is it earns more interest ($50M) than it pays ($24M). The company is cashflow positive although TTM ($653M) has seen a big drop from the previous immediate years related to the slowdown in sales in the recent quarters.

Also from its latest quarter –

Early in the second quarter of 2023, we continued to experience challenging demand markets, particularly in the Pulp & Paper segment where we managed through several unscheduled downtime events at our mills, including an extended maintenance shutdown at Hinton Pulp as well as curtailment of our Cariboo Pulp mill related to fibre supply constraints. Combined with declining pulp prices that led to a significant inventory write-down, the Pulp & Paper segment experienced higher losses than expected..

Valuation

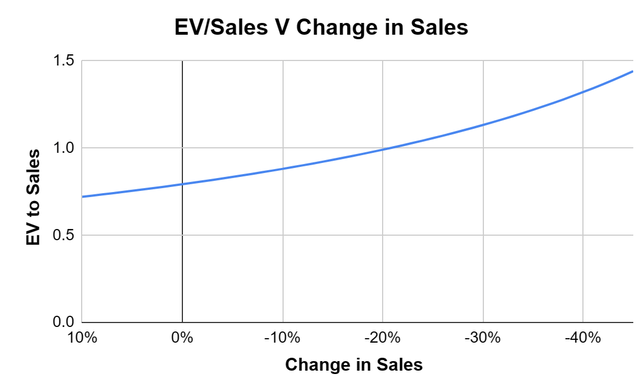

As the company has been making a loss in recent quarters, its earnings multiple has become unusable. But its low debt makes its EV at $5.47B. Looking at its sales in the LTM at $6.9B we obtain an EV/Sales ratio of 0.8x. Very attractive at present levels. But if home prices take a fall and we see a deep recession it would end up hurting our Sales. It would then make sense to model the EV/Sales under a range of scenarios.

Author Computed from Company data

We saw in the last recession the revenue dived more than 30%. So when accounting for a scenario even worse than the last recession we can expect our forward EV/Sales to be between 0.8 – 1.5 (From No change in sales to up to a 45% drop in sales). We are assuming that the company does not have to turn to debt (If it does then we may see the number inflating beyond our range)

The new quarters could become crucial as we will need to observe how the company can get back to profitability while maintaining the overall health of its balance sheet. I rate this company as a Hold and wish to add it to my portfolio when the timing is right.

When would this become a buy?

Its present valuation based on its book value alone is attractive but its profitability can take a further dive, making the case for lower stock prices. As we saw from the data, I believe we are close to the end of a booming cycle. Multiple market participants are calling for a soft landing or a no landing but this looks highly unlikely given the conditions we are in (Yield curve inversions are a time-honored recession signal). I would wait for these conditions to ease and the housing market to pick up again before reevaluating my position on the stock.

Read the full article here