Summary

This post is to provide an update on my thoughts on the business and stock of Installed Building Products, Inc. (NYSE:IBP). IBP specializes in insulation installation for residential and commercial builders across the contiguous United States. They also offer a diverse range of installation services for various related building products. These services are available through their national network of more than 230 branch locations, covering all 48 continental states. Over the past, IBP’s revenue has been growing at a CAGR of 15%. Over the years, its growth rate has been increasing, from a high single digit of 9% in 2019 to 36% in 2022. This growth was driven by the booming US housing market. In terms of adj. EBITDA margins, it has improved steadily from 13% in 2019 to 16% in 2022.

Based on the following factors, I recommend a buy rating. Single-family housing [SF] construction hit its lowest point in the second quarter but is projected to recover and see increased volume growth by early 2024. The recovery is already in progress, and the comparisons are becoming notably more favorable. Additionally, there are no indications of a slowdown in the multi-family [MF] and commercial construction sectors. This growth is attributed to IBP’s efforts to expand its presence in the MF sector by entering branches that had not previously served MF customers. Moreover, they are witnessing positive outcomes from their initiatives to cross-sell related products. Both of these sectors show promise for future expansion. Finally, the company anticipates that favorable trends in pricing and product mix will persist in the latter half of the year. This positive development is a consequence of the shift in business growth towards the MF and commercial sectors, which typically yield higher average prices per project compared to the SF housing sector. IBP expects that the pricing and mix factors will continue to contribute positively to their performance in the later part of the year.

Investment thesis

IBP posted robust results for the second quarter, with net revenue reaching a new high of $692.1 million, marking a 2.3% increase. The growth in installation revenue, which climbed to $651.9 million or a 2.2% increase, was primarily attributed to IBP’s strong performance in the multi-family and commercial new construction sectors. Other revenue, encompassing IBP’s manufacturing and distribution operations, saw an increase from $38.8 million to $40.2 million, solely due to improved sales in existing branches. Furthermore, adjusted EBITDA hit an all-time high of $122.2 million, and net income rose by 2.8% to achieve a new second-quarter record of $61.6 million.

SF housing construction hit its lowest point in the second quarter. After experiencing significant declines of approximately double digits in SF housing during that quarter, IBP expressed optimism about the demand for the latter half of the year. They pointed out that they observed positive growth in orders from public builders, which hadn’t occurred in over a year, and there was a general sense of positivity among local and regional builders. While there is usually a delay between the increase in housing starts and the installation work that benefits IBP, the company’s management appeared confident that the second quarter marked the low point in SF housing volume. They still anticipate a decrease in volume during the second half of the year, although it is expected to be less severe than the decline seen in the first half. Furthermore, with cycle times returning to normal, IBP is expected to gain from the improving trends in housing starts. The company predicts that production builders will outperform smaller regional builders in the latter half of the year as they accelerate speculative starts and inventory. IBP found encouragement in the fact that the management foresees a return to volume growth by early 2024, with the recovery already in progress and comparisons becoming significantly more favorable. In simpler terms, the housing market hit its lowest point in the second quarter, but there is optimism for increased demand in the latter part of the year, and IBP is well-positioned to benefit from these positive trends.

There are no indications of a slowdown in the MF and commercial sectors. IBP managed to counterbalance weaker SF sales in the second quarter through strong performance in the MF sector and an uptick in demand in the commercial sector. IBP specifically highlighted their success in gaining market share in the MF sector by expanding into branches that previously didn’t cater to MF customers. Additionally, they are experiencing positive results from cross-selling initiatives with related products. In the MF sector, there is a historically high level of backlogged projects that extend over a year. As for the commercial sector, there was an improvement in both the level of bidding activity and the rate at which bids were accepted during the second quarter, which sets a positive tone for the second half of the year. While IBP is mindful of potential challenges related to tightening credit in both the MF and commercial sectors, they have not yet observed any negative impacts on bidding or project backlogs. Although commercial profit margins are still below the overall consolidated level, the management pointed out significant improvements over the past year. In simpler terms, IBP is performing well in the MF and commercial sectors, despite weaker SF sales in the second quarter. They have expanded their presence in MF markets and are successfully selling related products, and both sectors show promise for the future. While there are concerns about credit tightening, it hasn’t affected their business negatively so far, and commercial profit margins have improved substantially over the past year.

Favorable pricing and product mix trends are expected to persist in the second half of the year. In the second quarter, there was a price and mix improvement of 7%, with a greater emphasis on the mix component, although pricing also showed positive results. This shift in business growth towards the MF and commercial sectors has contributed positively to the product mix because these sectors typically have a higher average price per job compared to the SF housing sector. Due to the relative superior performance of local and regional builders compared to production builders, there was also a mix benefit during the first half of the year. However, this trend is anticipated to reverse in the second half. Nonetheless, IBP expects that the price and mix components will continue to make a positive contribution in the second half. As the SF housing market strengthens, IBP anticipates that insulation manufacturers may consider implementing a price increase in the fall. Given IBP’s continued focus on pricing rather than volumes, a modest price hike would be beneficial for the company. The company has set a target of achieving gross margins of 30–32% for the full year, which implies relatively stable performance year-over-year when compared to 2022 at 31%. This is a noteworthy accomplishment, especially considering that IBP has been able to offset volume declines through improved labor efficiency.

“We had a very strong gross margin quarter. I mean there are a lot of puts and takes in that, but if you just look over the past five quarters, right, I mean, gross margin has averaged around 32% and I think that, and we’ve talked about this before, that in that 30% to 32% range, I think makes sense, particularly, when you’re looking at it on a full-year basis. So, we feel good about where we are gross margin-wise, but we also feel good that kind of 30% to 32% range as well.” Source: Q2 2023 earnings call transcript.

Valuation

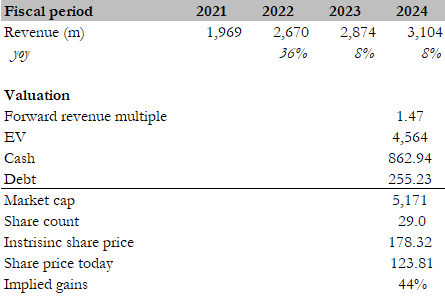

I believe the fair value for IBP based on my model is ~$178. My model assumptions are based on the back of these factors. SF housing construction reached its lowest point during the second quarter, but it is anticipated to rebound and experience volume growth by early 2024. The recovery is already underway, and the comparisons are becoming significantly more favorable. Furthermore, there are no signs of a slowdown in the MF and commercial construction sectors. IBP’s efforts to increase its presence in the MF sector by entering branches that did not previously serve MF customers are what are driving this growth. Additionally, they are seeing positive outcomes from initiatives to cross-sell related products. Both of these sectors hold promise for future growth. Lastly, the company expects that the favorable trends in pricing and product mix will continue in the second half of the year. This positive development is a result of the shift in business growth towards the MF and commercial sectors, which typically yield higher average prices per job compared to the SF housing sector. IBP foresees that the pricing and mix components will continue to contribute positively to their performance in the latter part of the year.

IBP’s peers are TopBuild (BLD) and Frontdoor (FTDR). The median forward revenue multiple peers are trading at is 1.46, which IBP is in line with. However, IBP has a higher EBITDA margin of 17.41% compared to peers’ medians of 9.24%. IBP’s 2-year revenue growth rate of 8% is also higher than peers’ median of 6%. Given its higher margin and growth rate than peers, I believe IBP’s forward revenue multiple is slightly conservative. Even at these conservative multiples, my target share price is $178. Given the positive outlook on IBP’s future demand and pricing mix, I recommend a buy rating.

Own calculation

Risk

Downside risk includes slower growth than anticipated in the U.S. residential markets and a more challenging environment for the company to implement price increases from manufacturers due to heightened inflationary pressures.

Conclusion

In summary, the housing market faced its lowest point in the second quarter, but there is a positive outlook with expectations of a rebound in SF housing construction by early 2024. Growing orders from public builders and increased positivity among local and regional builders are the main drivers of this optimism. Although there may be a volume decline in the second half of the year, it is expected to be less severe, and IBP stands to benefit from improving trends in housing starts.

Additionally, as a result of IBP’s successful expansion and cross-selling initiatives, the MF and commercial sectors exhibit resilience. The company anticipates continued positive contributions from pricing and product mix trends in the latter half of the year. Despite challenges such as inflation, IBP has demonstrated strong gross margins and efficient operations.

Based on these factors, my target share price is $178, indicating a favorable investment opportunity. IBP’s current performance, higher margins, and forward growth rate compared to peers support this assessment. Therefore, I recommend a buy rating.

Read the full article here