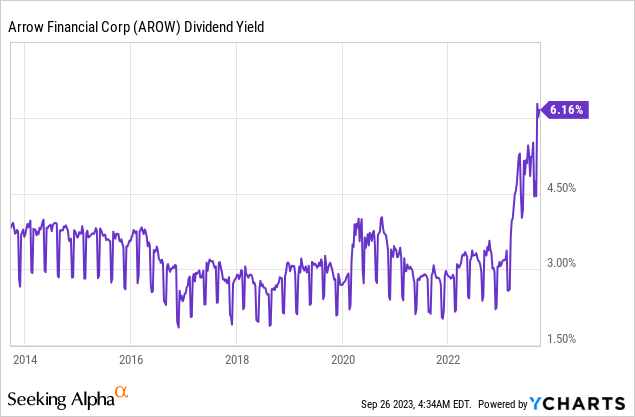

Arrow Financial (NASDAQ:AROW) has plunged 48% this year, and thus it has dramatically underperformed the S&P 500 (+14%) and the Financial Select Sector SPDR Fund ETF (XLF), which has shed only 2%. The vast underperformance has resulted from the extremely negative market sentiment on regional banks, the poor business momentum of Arrow Financial and a delay in the release of the earnings report for the first quarter earlier this year. While the stock is under pressure in the short run, it has been sold off to the extreme. It is thus offering a 10-year high dividend yield of 6.2% and has 30% upside potential whenever the company stabilizes its performance and market sentiment reverts to normal.

The reasons behind the plunge of the stock

Regional banks have incurred an indiscriminate sell-off this year due to the collapse of Silicon Valley Bank, Credit Suisse and First Republic. The liquidation of these banks caused an extremely negative market sentiment, as the shareholders of these banks were wiped out and the shareholders of other regional banks panicked at the thought of incurring equally devastating losses.

However, Arrow Financial is different from the banks that went out of business. Silicon Valley Bank and First Republic had a few large corporate depositors, who caused great trouble to the banks when they withdrew their funds. On the contrary, Arrow Financial is not exposed to this risk, as it has numerous small depositors. In its latest earnings report, the bank reported flat total assets and deposits of $4.1 billion and $3.5 billion, respectively. Therefore, there is no outflow of deposits and hence there is no sign of an imminent bank run.

The only negative aspect of the earnings report was a contraction in the net interest margin of the bank. Net interest margin contracted from 3.0% in the prior year’s quarter to 2.6%, primarily due to an increased cost of deposits amid heating competition for deposits among banks. Due to the surge of interest rates to a 15-year high, consumers have begun to look for higher deposit rates, and thus they have caused higher deposit costs to banks. The contraction of net interest margin and a decrease in non-interest income resulted in a 51% decrease in earnings per share, from $0.71 in the prior year’s quarter to $0.35.

The negative business momentum is not likely to disappear this year due to persistently high interest rates. As a result, analysts expect Arrow Financial to incur a 44% decrease in its earnings per share this year, from $2.86 in 2022 to $1.61.

However, deposit costs cannot keep rising indefinitely. Whenever the Fed begins reducing interest rates from their 15-year highs towards normal levels, deposit rates are likely to somewhat deflate and the net interest margin of Arrow Financial will probably stabilize or improve. Analysts expect the bank to partly recover next year and grow its earnings per share from $1.61 to $2.31.

Finally, the other factor behind the slump of the stock of Arrow Financial this year was a 3-month delay in the release of its financial results for the first quarter. When a company cannot release its quarterly results in time, it usually signals that it is facing exceptional difficulties, and thus it causes panic to its shareholders.

Management did not clarify why it did not file its quarterly report in time. However, this issue now seems to belong to the past, as the earnings report for the second quarter was released in time. Richard Parsons speculated that the release of the report was delayed probably due to a change in the CFO position of the company. Obviously, the new CFO needed additional time to make sure that the results were properly reported. Indeed, this explanation has merits, as the coincidence of the delay and the change in the CFO position is not likely to be accidental.

Of course, a change in CFO does not justify a delay in the financial results but the performance of Arrow Financial in the first two quarters of the year does not justify panic. The vast majority of banks have incurred a decrease in their net interest margin due to higher deposit costs this year. Moreover, the stable deposits of Arrow Financial bode well for its resilience during the ongoing financial turmoil.

Finally, it is important to note that Arrow Financial has an exceptional performance record in place. To be sure, the company has grown its earnings per share in 8 of the last 9 years, at a 10.6% average annual rate. The consistent performance combined with the strong growth rate are testaments to the solid business model of the bank in my view.

Dividend

Arrow Financial has one of the longest dividend growth streaks in the financial sector. The company has raised its dividend for 27 consecutive years and hence it is a Dividend Champion. It also has a healthy payout ratio of 46%, and thus it can easily continue raising its dividend meaningfully for many more years. The bank has grown its dividend by 5.0% per year on average over the last decade and over the last five years.

Moreover, Arrow Financial has proved exceptionally resilient to recessions and downturns. To be sure, in the Great Recession, when most banks incurred excessive losses and cut their dividends, Arrow Financial incurred just a 5% decrease in its earnings per share and continued raising its dividend. That performance during the worst financial crisis of the last 90 years is a testament to the robust business model of the bank.

Arrow Financial proved resilient to the coronavirus crisis as well. It grew its earnings per share by 9% in 2020 and by another 21% in 2021, to new all-time highs. The defensive business model of Arrow Financial is a key behind its exceptional dividend growth record.

Due to its plunge, the stock is currently offering a 10-year high dividend yield of 6.2%.

Thanks to all the above factors, the dividend has a wide margin of safety. Therefore, the stock is attractive for income-oriented investors, who are likely to greatly benefit when the market sentiment over regional banks normalizes.

Valuation – Expected Return

Arrow Financial is currently trading at a nearly 10-year low forward price-to-earnings ratio of 10.6x. This earnings multiple is much lower than the 10-year average price-to-earnings ratio of 13.9x of the stock. It is also remarkable that the stock is trading at only 7.4 times its expected earnings in 2024.

The depressed valuation has resulted primarily from the extremely negative market sentiment over regional banks and the delay of the report for the first quarter. Whenever the market sentiment normalizes and analysts focus on the fundamentals of Arrow Financial, the valuation of the stock is likely to revert towards its historical average.

If the stock reverts to its 10-year average valuation level, it will rally approximately 30% (=13.9/10.6 – 1) of its current price. The upside will be much greater if the bank meets the analysts’ expectations for earnings per share of $2.31 next year (forward P/E ratio of 7.4x). Overall, the stock seems to have been beaten to the extreme by the market due to its aforementioned issues.

Risk

The primary risk of Arrow Financial is the above-mentioned delay of the release of the earnings report for the first quarter. If there is a significant problem with the financial statements of the bank, and it shows up in the future, it will probably exert pressure on the stock price. However, as mentioned above, this issue was probably caused by the change in the CFO position, and thus it now belongs to the past, particularly given that the earnings report for the second quarter was released on time.

Final thoughts

Due to the aforementioned headwinds, Arrow Financial has plunged to a nearly 10-year low. However, this bank has exhibited a consistent performance record and resilience to downturns, and thus it is likely to endure the ongoing downturn in its business. As soon as the market sentiment normalizes, the stock is likely to highly reward investors based on its current depressed price.

Read the full article here