Safehold (NYSE:SAFE) is a pure-play ground lease REIT with a market cap of around $1.2 billion. SAFE is very unique since there are no direct peers (at least in the public capital market space) that operate in the same economic segment.

Namely, the underlying business model of SAFE is based on relaxing the need for CapEx for property developers and / or owners (e.g., other private or public REITs) by taking positions in the land and leasing them out long-term.

For the property developers such a construct not only decreases the immediate need of capital, but also enhances the return profile of the investment. For example, given that there is a decreased need for equity, the ROE and IRR metrics get improved. Plus, the refinancing risk is mitigated by having to roll over smaller amounts of capital.

In other words, SAFE offers its customers the opportunity to reduce the required CapEx upfront and instead distributes this amount typically over ~100 years with rent escalators and mark-ups attached.

Safehold investor relations

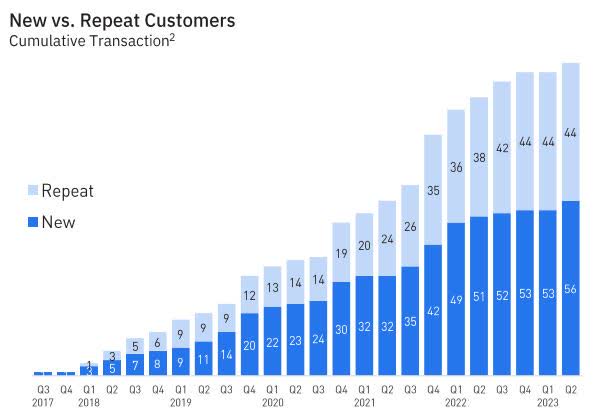

Historically, SAFE has been successful in attracting and retaining customers that find this solution beneficial in the context of their capital allocation strategy.

According to Marcos Alvarado’s (President and Chief Investment Officer) comments during the Q2, 2023 earnings call, new deal pipeline is strong for SAFE:

While overall, the real estate capital markets remain dislocated with volumes far off the highs. We’re beginning to see pockets where our ground lease is a constructive capital solution in this difficult environment and we’re encouraged by the momentum in our pipeline.

This is not that common for other equity REITs as elsewhere the property cap rates have not yet moved enough to provide meaningful spread from the cost of capital.

The key reason for this (i.e., increased demand for SAFE’s offering) is the high interest rate environment, which has rendered capital expensive and less accessible. Hence, there is a more clear merit of decreasing the CapEx need upfront.

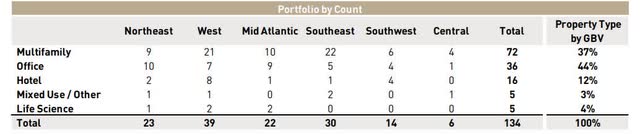

As of now, SAFE carries a relatively diversified portfolio of ground leases.

Safehold investor relations

It has $6.1 billion of ground lease portfolio spread across 134 assets and 5 property segments. This is a remarkable growth considering that in 2017 when the IPO was made, SAFE had only 12 assets.

Investment case

Now, there are several factors, which have got me interested in SAFE.

First, the stock has now reverted back to its IPO level despite the presence of diversification, stronger capital structure and, in general, better momentum in the business.

YCharts

If we measured the performance starting from late 2021, we would arrive at a 66% loss (via price depreciation component, excluding the collected dividends).

YCharts

Compared to the overall REIT market, SAFE’s performance looks very depressing.

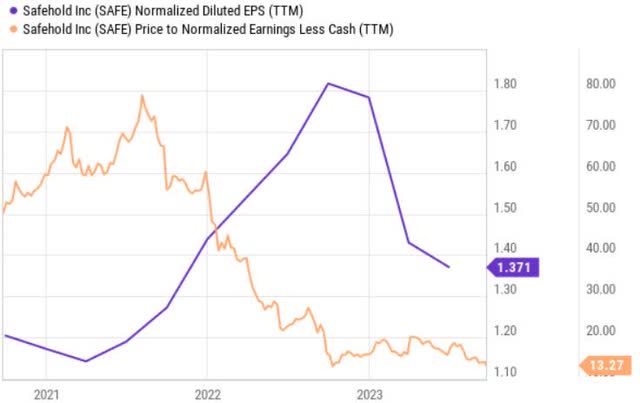

Second, the aforementioned decline has been largely driven by multiple contractions.

YCharts

We can see here that the earnings have gone up, while the multiple has followed the same trajectory as the share price.

YCharts

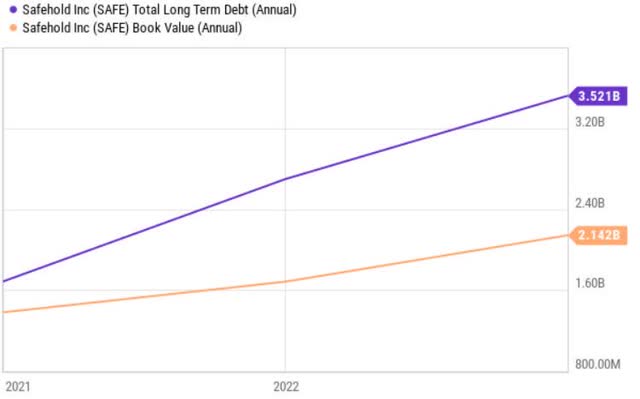

Granted, during this time SAFE has assumed incrementally more debt than what has been accumulated in the equity book value, thereby increasing the overall risk profile of the entity. However, as I will elaborate below, I believe SAFE’s capital and funding structures are in a very safe territory.

Third, is that SAFE’s business operations provide ultra reliable cash flows closely resembling bond-like characteristics. The inherent durability and stability of SAFE’s cash flows stem from the following aspects:

- Over 90 years of remaining life for stipulated ground leased providing reliable and predictable streams of income.

- All of these leases are subject to CPI adjustments and CPI look backs in case specific threshold levels of inflation are breached. This element introduces the real and like-for-like growth component of SAFE’s cash flows.

- Disciplined underwriting policy, whereas of Q2, 2023 the weighted average GLTV and rent coverage of SAFE’s customers were 42% and 3.7x, respectively.

Finally, the capital structure of SAFE is robust, which adds an extra layer of safety in terms of the underlying cash generation.

Safehold investor relations

The current leverage ratio is 1.9x, which is sound both in absolute and relative terms. The weighted average term of outstanding debt maturities is 23 years. Taking into account that 75% of this debt is fixed and significant maturities that are associated with the fixed rate debt start to materially kick in only in the 2031-2035 period, we can safely assume that the interest rate risk is greatly mitigated.

There is 26% of the total debt expressed in floating terms. Yet, the positive nuance is that the current interest rates have already percolated through the cash flows due to the SOFR. In other words, we would see a further uptick in the interest cost if the Fed decided to make additional hikes or if SAFE issued new debt. The former aspect does not seem too likely or even if the Fed fund’s rate went up, its magnitude would be limited. The latter aspect is also not an issue since the Management would tap into new debt financing only under circumstances, when the expected IRR is greater than the cost of capital.

All in all, the buy thesis looks rather attractive:

- SAFE’s valuation multiples are at their historical lows.

- Cash flows are extremely predictable and safe supporting the 6.4% dividend.

- The capital structure is robust with very limited interest rate risk over the foreseeable future.

Counterargument to the buy

Despite all the positive dynamics reflected above, SAFE is heavily exposed to the “higher for longer” scenario. The long-term and relatively fixed nature of the cash flows makes SAFE rather similar to a bond, introducing a notable concentration of duration risk.

YCharts

By comparing SAFE to long-term corporate bonds, we can see that the return trajectory has been rather similar. The difference in returns is largely explained by SAFE’s more pronounced skew towards duration risk because of 90+ year contracts.

As a result, the value of the future cash flows (i.e., ground lease contracts) has gone down accordingly, in sync with the increase in the discount rate.

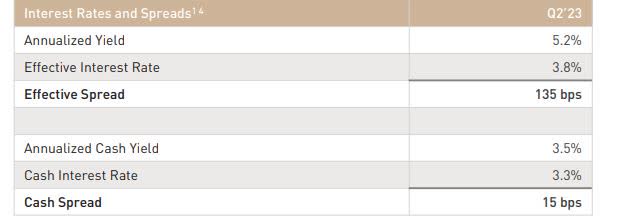

Q2, 2023, earnings

The most worrisome aspect, however, is the decline in the cash spreads. As of now, the weighted average cash interest expense of SAFE is at 3.3% and consumes the lion’s share of the annualized cash yield. So, on a cash basis, SAFE generates only 15 basis points of value to its shareholders.

If we add the CPI escalators and CPI look backs, the annualized yield becomes more attractive, yet still not sufficient to offer an ample headroom.

In case the interest rates continue to climb higher, the spread will obviously narrow even more rendering the investment case unattractive.

Bottom line

SAFE is a financially and fundamentally sound vehicle providing investors with stable and growing cash flows. The recent drop in valuations creates a solid entry point for long-term investors.

However, if the interest rates remain elevated for a very long period of time or, even worse, increase even further, the spread between SAFE’s cost of financing and cash yields would narrow or temporarily enter negative territory.

In a nutshell, this is an interest rate dependent case, which would provide notable upside if rates were to go down. Given that it is extremely hard to predict the rate of change dynamics in the Fed Fund’s rate, I rate SAFE as a hold.

Read the full article here