Skking is a niche business with an affluent customer base, but subject to the whims of Mother Nature.

“True genius resides in the capacity for evaluation of uncertain, hazardous and conflicting information.”

Winston Churchill

We’re now two days away from the FY23 annual earnings call of Vail Resorts Inc. (NYSE:MTN).

After a long rummage through figurative mountains of metrics (pun intended) on the performance of MTN stock over the past several years one cannot but come away puzzled.

Every strong, ongoing catalyst to sales and earnings growth is accompanied by several big questions, including of course, the biggest of all—the acts of Mother Nature in either dumping or depriving the company’s 41 resorts with the gift of snow.

There are many others, running from the ridiculous to the sublime: Skiing is a leisure choice of the rich or near rich given the outrageous prices commanded by resorts these days. It will run short of rich people soon.

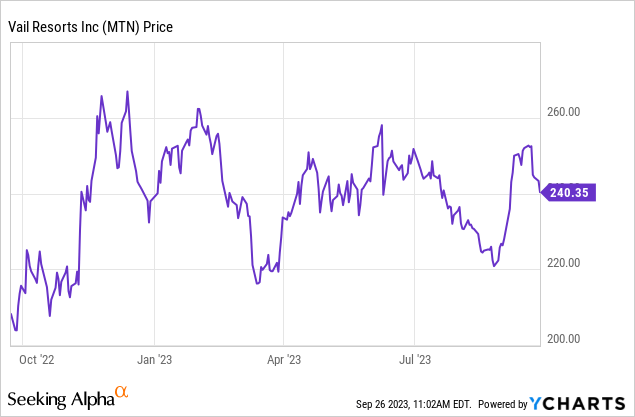

Above: A bit off recent high but possibly looking stronger just ahead.

A call to an ex-colleague who has taught periodically at the Harvard Business School brought this suggestions: “Why not apply a SWOT analysis to the shares and see where you come out on a buy, sell or hold recommendation?” he said.

That thought clicked at once. So with the help of a small panel of ex-colleagues who are skiers, finance folks or those who have run hotels in those areas, we’ve applied the SWOT analysis template to the shares of Vail Resorts.

Our objective was to extract from all we studied what we believe seem to be the fundamental truths that could go into a decision machine as to whether the stock at its current price is undervalued, fairly valued or overvalued. We avow that we have, by now, slogged through power points, metric comparisons, tech analysis, financial deep dives and trading trends of the stock in an attempt to get a grasp on what kind of trading action we could see post earnings call.

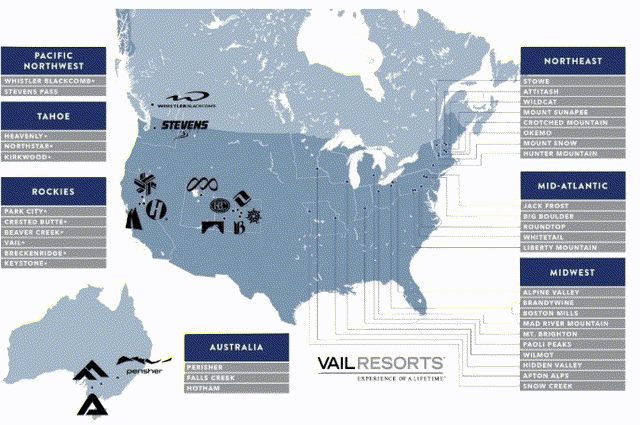

Above: Locations of MTN resorts. Advance weather outlook despite El Nino, indicates good snowfall in northern US and Europe.

It depends on earnings results of course, but there’s much more. Briefly, is this a good business running on an effective business model? Does it have a real moat or not? Has Mr. Market missed something awarding its price, or is Mr. Market all too aware of its triumphs and flops. Now we’ll try to condense all that with the SWOT analysis, used first at the Harvard Business school as a process to take students through corporate case history studies.

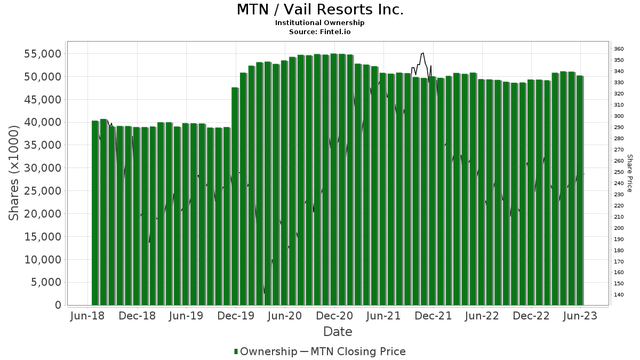

Above: Institutional ownership stays strong because of solid returns and dividends post COVID.

The SWOT analysis for those unfamiliar with it has four elements: S trengths, W eaknesses, O pportunities, T hreats

The basic view first:

Price at writing: $244.43

52-week range: $201.91 —$269.50

P/E (ttm) 33.65

EPS: (ttm) $7.23

Div/Yield: $8.24(3.37%)

One-year consensus target: $264.25

According to the Alpha Spread analysis MTN is overvalued by 20% based on this calculation:

Present value $9.8b

Cash and equiv.$896m

Firm value

Debt $2.8b

Minority int. $326m

Equity value:

Shares outstanding 38.6b

MTN DCF value: $195.33

SWS

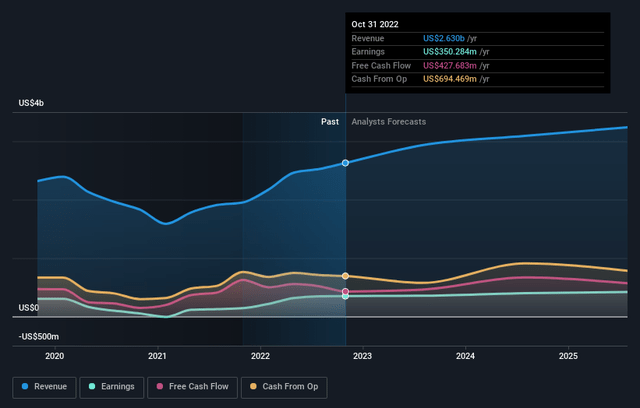

Above: Long-term outlook deservedly bullish but dividends are very much part of the rationale to hold this stock.

There’s a $20 spread between MTN’s forward PT and its current price at writing. And Alpha Spread DCF analysis comes up with 20% overvalued. Most other thinking on the company tends to reflect this kind of divided opinion. That’s nothing new of course for many stocks. That’s why we believe a broader outlook might be well served using the SWOT analysis.

MTN’s basic business is running 41 ski resorts around the globe in the US, Europe and Asia. It’s a niche business in the huge travel and leisure sector. Of its three geographic nodes, Europe is the largest, US next, Asia third. There are an estimated 135m skiers globally. That market is expected to grow in total numbers but ski days per participant are expected to sag. Essentially, MTN, as the dominant commercial operator in a niche, has a basic business model of building potential revenue stream per head with related businesses such as the rental and sale of gear and the hotel/dining verticals at some of its resorts.

We now see how a SWOT analysis may contribute to a foundational understanding of the prospects for the company ahead and its share price.

Strengths:

By any measure, the fortress strength of MTN is provided by the moat of Mother Nature. You can print money, you can print stock, but you can’t print mountains. MTN resorts occupy every major mountain area on the globe adaptable for skiing. There has not been a single ski resort opening globally anywhere since 1980. And there’s not likely to be any. So MTN is the biggest, most efficient operator in a business in which the barrier to entry is manned by Mother Nature and she isn’t likely to go anywhere.

The threat of new supply is fundamentally zero.

EPIC Pass model: In what was clearly one of the great marketing ideas of the travel and leisure space, MTN invented its EPIC Pass marketing tool. The logic here is a citadel of success driving the company’s results. EPIC pass is essentially a season ticket for at will access to any MTN resort running on a tech platform for reservations, equipment rental or sales, etc. The elegance of the deal is that it’s pre-paid and non-cancelable. That means, in short, MTN gets all the money up front, making it a free cash flow delight for management.

Introduced in 2008, its track record of success is clear:

2009 launch price: $579

FY 2023 price: $841

FY24 price: $900.

Total members: 2.3m

MTN marketing focus: The conversion of daily lift ticket buyers to EPIC pass holders and converting renters of ski gear into buyers of ski gear either on their retail site or at resorts.

Customer base: MTN’s customer base is highly affluent, with more than 63% of all its skiers having an income of $75,000 or more and of those 45% with incomes over $100,000 or more.

Weaknesses

A great customer demo but an aging one. MTN has benefited over the past decades from the baby boomer generation which has constituted the bulk of its new skiers every year. That generation is now aging out of skiing as they approach their elder years and no longer wish to deal with the physical challenges of skiing. They tend to migrate to the golf or tennis court. Behind them the millennial generation does not yet appear to be taking their place in great numbers. Increasing that segment of the customer base presents a marketing conundrum. On the one hand, millennial and GenZ people are physically at the prime age to ski.

On the other, the generation is characterized by its preoccupation with constantly looking at screens: Their smartphones, social media obsessions, TV viewing and physical activities like running, visits to local gyms or home workouts. So MTN has the challenge of solving this marketing problem considering that millennials constitute ~80m people in the US alone. They love their pop culture and diversions but mostly as observers rather than participants in physical exertion type sports. Baby boomers were spenders, their heirs tend to be more careful with money—for good reason it should be added and skiing is expensive no matter how operators like MTN incentivisation. Snow boarders occupy the ultra young demo but are still under the financial limits of their families.

Few leisure pursuits are more dependent on favorable weather conditions at specific parts of the year than is skiing. A warm, higher than historical averages temperature in areas close to or within the geography of MTN’s resorts is always a threat. Of course, snow making always is available but it’s not the same as that which Mother Nature can gift MTN’s seasons.

El Nino is a villain here that has a mind of its own as to when to decide to visit the globe. There’s no way therefore that solid, predictable revenue or earnings forecasts can be drawn without taking it into consideration. MTN’s resources in meteorology are clearly formidable. But the endgame always is that at best they have learned how to adapt.

Opportunities

MTN wisely looks at its customer base realistically i.e., that its expectation for exponential growth of total skiers long term is not anything to bet big capex on. So instead they have concluded that their efforts at building per capita revenue from their existing participants holds the best promise for sales and earnings growth in the near years at least. And that’s where the gear and hotel/dining elements come into play. You begin with the daily lift buyers in for a day’s fun, then home. Convert them to EPIC pass holders, increasing the average number of ski day visits. And you convert those to vacationers who now stay at your hotels, dine at your restaurants and as they marry and form families make ski vacations part of their lifestyles.

Threats

If MTN cannot built is customer base in the years ahead by finding ways to replace aging baby boomers with younger, affluent demos, they clearly face difficult times in continuing to churn out impressive P/Es. That threat also is being faced by other verticals in the travel and leisure sector. In gaming, the urgency among casino operators as we have often noticed here on SA is to get the customer base younger.

Industry equipment makers responded by designing new slot games with nifty self activation and group play features. This did not work. Instead, deliverance came from the 2018 US Supreme Court decision on sports betting, opening the floodgates to young gambler demos. Their presence at casino sports books grew. They migrated onto the casino floor playing blackjack and slots. It was a gift. No such assistance appears to be in the cards for the skiing niche.

MTN revenue (ttm) is $2.886b. Exponential growth in sales does not appear to us to hold the promise for valuations moving ahead on sales growth alone. A combination of recession and inflation together or apart remain a bigger threat to the share price’s future than it does to other verticals in the broader travel and leisure sector.

Conclusion: A sleep tight stock with a nice dividend

If MTN reports ebullient growth in revenue and earnings in two days it could result in a nice little spike for the stock. But over a longer period, we’re in a bit of a crazed market where investors are looking for four baggers in AI, or breakthroughs in pharma ,etc. Yet it’s clear that MTM occupies a solid niche, and has a business model that drives revenue consistently. It has a true moat courtesy of Mother Nature.

This is a well-managed company with clear goals in its niche. The SWOT analysis shows it’s managing its capital well, is servicing its market efficiently, it understands its potentials and limitations. What this yields at the end is most attractive: Its dividend returns. Its dividend and yield is $8.24 (3.37%) which we believe even in these times of Fed raising, is a nice return with what we see as a margin of safety built into its moat.

Read the full article here