Thesis

The SPDR SSgA Ultra Short Term Bond ETF (NYSEARCA:ULST) is a fixed income exchange traded fund. As per its literature:

The ETF seeks to maximize current income consistent with preservation of capital and daily liquidity through short duration high quality investments

The fund contains a mix of investment grade corporate bonds and treasuries. The fund manager takes an active approach in terms of portfolio construction, so the mix between corporate paper and treasuries can change over time. Currently the collateral is composed of about 22% treasuries, while the rest is made up of corporate names.

The fund falls in the short dated bond category, with a very low duration of only 0.6 years. These sorts of instruments have held up quite well in the past year as the Fed has raised rates. They make less of an attractive instruments now with the yield curve at very high levels in the front end. That is the issue we have with this name – its current 30-day SEC yield is only 4.88%, which fails to compete with some Treasuries only short dated funds (such as BIL which we covered here or SGOV, covered by us here), while at the same time taking some credit risk.

2023 has been an interesting year so far – we have seen defaults in the investment grade space, namely financials. ULST has around 20% of its collateral in financials, which makes it susceptible to further failures in the space. The fund is granular enough to sustain any small defaults, but it makes little sense to take that risk when the front end of the risk free government curve gives you the type of yields seen here.

ULST has been a good parking vehicle as Fed Funds moved higher, but does not compete well in today’s environment when yields have peaked in our opinion. A retail investor is better served by either buying a 1-year CD or investing via funds such as BIL or SGOV here rather than taking any sort of credit risk via ULST. You are not compensated to do so.

Analytics

- AUM: $0.54 billion

- Sharpe Ratio: 0.62 (3Y).

- Std. Deviation: 0.93 (3Y).

- Yield: 4.88%

- Premium/Discount to NAV: n/a

- Z-Stat: n/a

- Leverage Ratio: 0%

- Composition: Fixed Income – Short Term Corp Bond

- Duration: 0.6 yrs

- Expense Ratio: 0.2%

Holdings

The fund contains a mix of Treasuries and investment grade bonds:

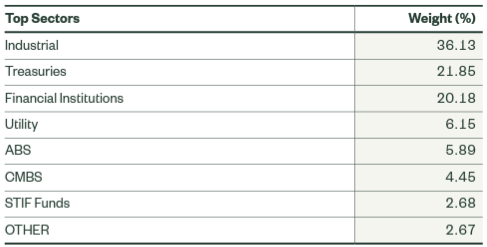

Sectors (Fund Fact Sheet)

The fund is actively managed, which means the collateral mix can change as the portfolio manager sees fit. We can see the top sector is composed of industrial names, but Financial Institutions make up 20% of the collateral. Given the recent weakness in the sector and the default of a number of investment grade issuers in the space, this sectoral allocation does not seem so safe anymore.

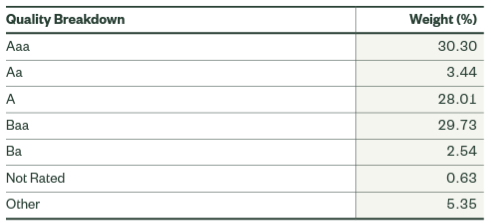

The collateral is mostly investment grade, with some fallen angels:

Ratings (Fund Fact Sheet)

Fallen angels are issuers which were investment grade before getting downgraded. We have taken a look through each name in the portfolio (currently) and we do not find any of the ‘problem banks’ currently in the news. However, one does not know how the situation will develop in the future, and what will be traded in this portfolio.

Performance

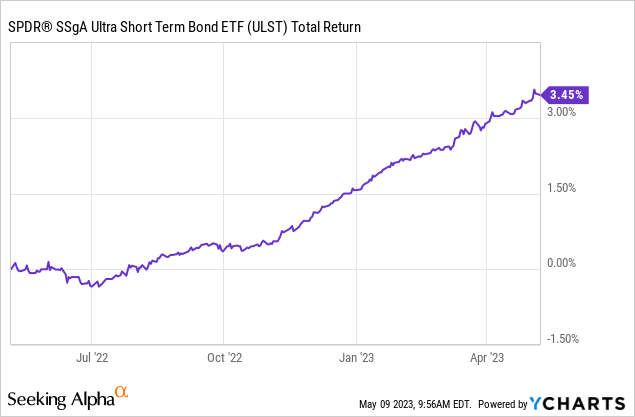

The fund is up almost 4% in the past year:

Due to its low duration, the vehicle was able to navigate very well the rising rates environment witnessed.

Conclusion

ULST is an exchange traded fund focused on the short end of the curve. The fund contains a mix of corporate bonds and treasuries, with an aggregate duration of only 0.6 years. The vehicle has been a nice cash parking vehicle in the past year, generating an upward sloping total return of almost 4%. We believe rates have peaked, and we are concerned about ULST’s large financials bucket (at over 20% of the holdings). With the fund providing only a 4.88% 30-day SEC yield, we believe there are better alternatives out there (such as SGOV or outright CDs) that a retail investor can purchase. We are on Hold with respect to this name if you already own it.

Read the full article here