Investment Thesis

The past month has been tumultuous for electric utility companies in Florida as they raced against time to manage the aftermath of Hurricane Idalia. Thanks to year-round preparedness plans, power has been swiftly restored to most customers. With the immediate crises now subsiding, the landscape offers a fresh opportunity to re-evaluate investment potentials within Florida’s electricity sector. Two titans, NextEra Energy (NYSE:NEE) and Duke Energy (NYSE:DUK), are at the forefront, collectively powering most of Florida.

In a previous article earlier this year, I endorsed a Buy position for NEE. My rationale was anchored on anticipated economic upheavals following the Fed’s rate hikes in 2022. My premise was that monetary policy often unfolds in such a way that the full effects of rate adjustments don’t materialize immediately. This phenomenon, termed ‘policy response lag,’ which I came to understand during my academic years, suggests that the ramifications of a rate hike could be more pronounced in subsequent periods. My forecast was that the aftershocks of the monetary tightening would materialize in the second half of 2023, pushing investors to safe-haven stocks in the Utility sector.

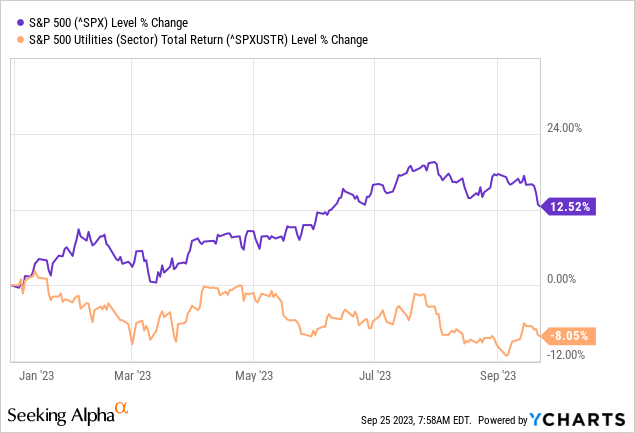

However, reality diverged from my predictions. The economy displayed admirable resilience and sidestepped any severe downturns. This active market, combined with high interest rates, changed investors’ preferences away from ‘bond-like’ assets such as NEE. This year, Utilities are the worst-performing asset class in the index.

In such times, I’m reminded of Warren Buffett’s advice: “Be fearful when others are greedy and greedy when others are fearful.” Drawing inspiration from this wisdom, I believe that now might be just the time to reconsider investments in Florida’s electricity sector, particularly with giants like NEE and DUK.

NEE, with its clear emphasis on renewable resources, aligns well with the current global push towards sustainable energy solutions. This makes it a strategically attractive investment choice. On the other hand, DUK has its appeal rooted in diversification. Unlike NEE, which has a concentrated focus on Florida, DUK spreads its operations across multiple states.

In the following paragraphs, we’ll delve into key facets of NEE by drawing direct comparisons with DUK. This comparative method not only illuminates the distinct characteristics and strengths of each entity but also aids in providing context.

Leverage in the Green Energy Shift

Florida currently permits utility companies an allowable return on equity ‘ROE’ of between 10% to 11%. For investors, this is an attractive proposition. The state’s policies ensure that all costs borne by utility companies, be it depreciation, interest rates, management compensation, or even the financial impact of hurricanes, are transferred directly to the consumers via a monthly bill that often breaks down different expense categories incurred by utility companies.

This cost-passing strategy provides investors with an extra layer of protection against potential economic threats. They are shielded from rising interest rates, inflationary pressures, and fluctuations in commodity prices. Furthermore, the demand for utilities, especially electricity, is inelastic.

The efficiency of utility companies and the integrity of regulators are ultimately tested through the monthly electric bills presented to the consumers.

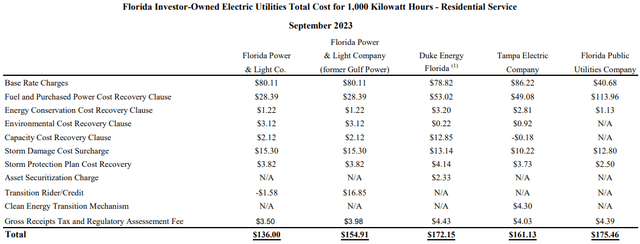

A sample bill calculation for the month of September from the Florida Public Services Commission website shows there is a noticeable difference in the electricity bills of different utility companies in the state. For example, for a consumption of 1000kW, DUK’s bill in Florida is considerably higher than that of NEE. Such differences, which are evident to the consumers, likely lead to scrutiny and discontent.

Florida Public Service Commission

A Florida resident covered by DUK is roughly paying 27% more than their fellow Floridian living in a county covered by Florida Power & Light ‘FPL,’ NEE’s primary subsidiary.

A review of the commission’s docket reveals a substantial number of disgruntled residents naming DUK’s high billing rates.

Despite these higher bills, DUK showcases a lower ROE compared to some of its Peers. This situation presents a dilemma. While DUK has the regulatory permission to increase bill rates further to elevate its ROE, it faces the risk of exacerbating the already heightened consumer resentment. In essence, DUK may have already exhausted its goodwill with its customers, many of whom feel they are already overpaying.

| YTD – Millions $ | Duke Energy Florida | Florida Power & Light |

| Net Income | $463 | $2,223 |

| Total Equity | $9,494 | $38,987 |

| ROE (annual est.) | 4.9% (9.8%) | 5.7% (11.4%) |

Beyond Florida, on a consolidated level, DUK’s ROE is nearly half that of NEE, given the challenging operating environment in states where DUK operates beyond Florida, namely Ohio, where competitive bidding for electricity provision hampers the operators’ profitability. It is interesting to note that Ohio is the only state that adopts a competitive bidding process for Utility companies.

Strategic Investments Amid Economic Challenges

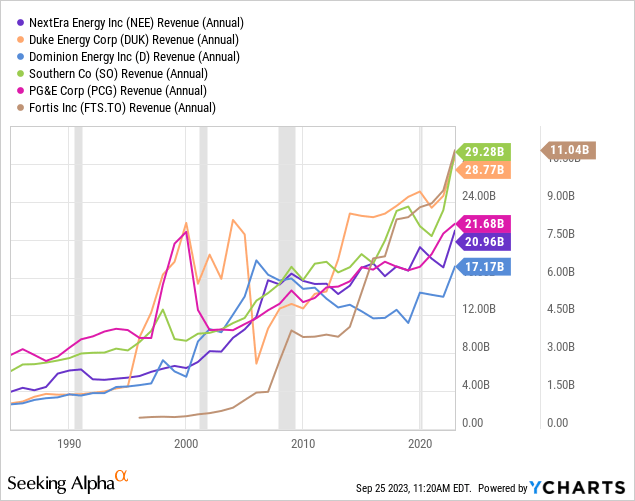

NEE displayed foresight by investing in cleaner energy sources before the challenges of material and wage inflation and rising interest rates became prevalent. In contrast, DUK finds itself navigating critical projects in a turbulent inflationary environment.

Although both companies continue investing heavily in generation and transmission lines (neither DUK nor NEE have positive FCF, funding capex mostly through equity and debt), DUK is occupied with revamping its older infrastructure, while NEE directs its investments towards growth projects. For example, DUK still needs to invest in the decommissioning of its coal generators while building cleaner replacements to maintain production. Meanwhile, NEE is installing solar, wind, and nuclear power generators to expand revenue.

Seeking Alpha

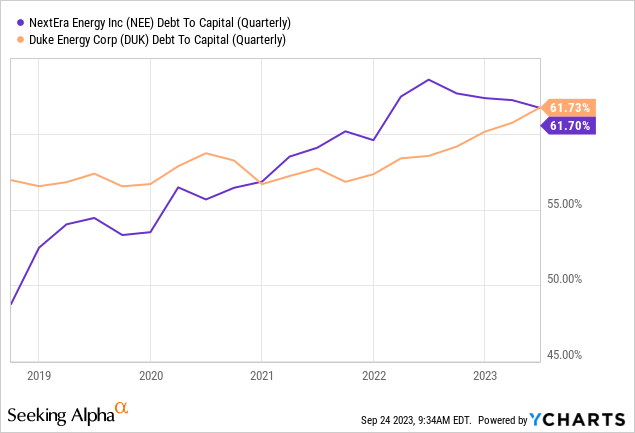

Both companies now have the same level of leverage by some metrics. However, NEE has been on a deleveraging trajectory for the past twelve months, while DUK is increasing its borrowings. I expect these dynamics to continue. NEE recently announced plans to divest its natural gas pipeline in Texas and use the proceeds to pay back its convertible bonds, possibly some of those maturing next year. In addition to decreasing leverage, this move also refines the focus of its NextEra Partners (NEP) subsidiary solely on renewable energy.

In addition to growth and balance sheet structure differences, DUK and NEE have different attitudes towards offshore wind and non-regulated power generation. DUK recently secured a bid to set up a 1.6GW offshore wind turbine project in North Carolina. Meanwhile, NEE predominantly focuses on onshore wind farms. In a recent interview, NEE’s relatively new CEO called offshore wind farms a ‘bad bet’.

This year, DUK announced its intent to offload its non-regulated energy generation business, which encompasses wind and solar farms not under state oversight. The non-regulated electric generation domain has a different risk/reward profile that NEE is actively harnessing, as opposed to DUK, which is shifting back to its core regulated electric utility domain.

The Right of First Refusal Debate and the Inflation Reduction Act

The Inflation Reduction Act’s push for increased renewables has underscored a pressing need to expand transmission lines connecting, say, government-subsidized solar panels in Texas (where a 1000 kWh from the grid costs $110) to California homes (where a 1000 kWh costs $200). In some cases, renewable energy projects face challenges connecting to the local grid.

Currently, there is a debate over who should have the rights and obligation to construct these power lines. The outcome of this debate impacts NEE and DUK differently, highlighting the increasingly dynamic nature of the once-quiet sector.

NEE, with its widespread non-regulated renewables projects under the NEER segment, faces significant challenges connecting its renewable power generators to the grid due to the right-of-first-refusal ‘ROFR’ laws that grant local, regulated utilities exclusive or preferential rights to build and maintain utility infrastructure. There is also a loss of economic opportunity. For example, NEE’s bid to develop a lucrative transmission line between its Solar power farms in Texas was upended by the state’s ROFR.

In contrast, DUK, which primarily focuses on regulated utility operations in multiple states, stands to benefit considerably from these protectionist policies. The advantage lies in its established status in regions where it operates as a regulated local utility protected by ROFR.

Summary

Gone are the days when the utility sector was perceived as mundane. The political intricacies, coupled with transformative changes, signal an era of rapid evolution in electricity production and infrastructure developments. The stakes are high, with hundreds of billions of dollars on the table.

The trajectories of NEE and DUK offer distinct narratives for investors. While NEE’s dedication to renewable resources places it at the vanguard of sustainable energy, DUK’s diversified operations and positioning in ROFR policies could offer unique advantages.

Both giants have considerable potential for attractive long-term returns suited for Dividend Growth investors. However, their respective futures are shaped by their unique strategic decisions discussed above. Understanding these nuanced interplays is critical to picking a company that fits your portfolio.

Read the full article here