Dear readers/followers,

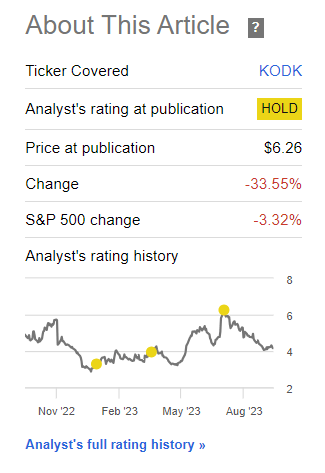

At least one reader contacted me in conjunction with my last article on Eastman Kodak (NYSE:KODK) and specifically, that I held a “HOLD” rating after what was after all a smashing development for the share price for Kodak. In a very short time, the company’s share price appreciated double digits, leading to outperformance for those few that were actually bullish on the company. It also led to at least one investor I know of investing in the business.

In my last article, I reiterated my conservative stance on this company despite its recovery outperformance – and my thesis remained conservative, seeing the danger of this reversal being just a momentary bounce.

This turned out to be the case – and the correction came far quicker than I could have expected. In fact, my article “timed” the apex of that bubble almost perfectly.

Seeking Alpha Kodak (Seeking Alpha)

This timing was just luck – just as my almost-historical timing of my ViacomCBS (PARA) back in 2021 when the company hit triple digits and I went very publicly negative on the stock and basically sold everything I owned in it, was also just lucky timing. While you can estimate trends on the market, you can never tell when something is going to happen with any degree of repeating accuracy. If that’s something you feel that you can do, then you’re technically claiming clairvoyance.

So with Kodak, despite my fortuitous timing, I say that this was luck, and if you really invested at the top, you should have maybe considered some of the risks of this company.

Let’s review results, and look at what we may expect after a more than 30%+ drawdown.

Kodak – Plenty of uncertainty remains despite shorter-term positives

I’m one of the few contributors that cover, on Seeking Alpha, what was once a storied world leader. And I maintain that my position from the get-go back in September of 2022 has been a correct one, almost a year after the fact.

Since I first initiated public coverage on this stock and went with my first “HOLD” rating, the company has declined more than 20% even with the bounce we’re seeing here. This speaks to the incredible volatility of this business.

Eastman Kodak’s legacy is one of analog photography, at least it was. Obviously, this technology, while still existing in niche segments of the field, has been more or less replaced 100% with digital cameras. Despite a 110+ year old history, this company went through perhaps one of the most spectacular declines that I have witnessed. And while we cannot “blame” Kodak for all of its failures, the company certainly could have adapted much better.

The decline came at the end of the 1990s because – as we now know – digital was and is the future. While Kodak tried to cling to a position of relevance in a changing world, in developing digital cameras, printing, and technology, leveraging its patents and its market position, all of those ventures eventually failed. It’s a long failure – one of over 10 years – but the eventual bankruptcy came in 2012, after which it also stopped making cameras.

So, Kodak today is a company that focuses on digital imaging. The shift was so significant that In late 2012, the company even sold its namesake photographic film product line, scanners, and kiosks. So what made Kodak in fact, Kodak, is not even left in the company’s lineup.

Instead, we’re playing Traditional Printing, Digital Printing, Advanced Materials, and Chemicals/Brand. And this is where the upside has come from in the last few months, and what caused this company to climb as significantly as it has. Advantages and arguments for Kodak today are the PROSPER Press systems and components, its digital printing solutions, and prepress solutions. Kodak can be said to be in a state of near-constant flux, weighing its legacy appeal against the digital and modern world. Remember, if you’re the sole company still qualitatively manufacturing a certain product, you’re bound to have some market – just ask the companies still manufacturing horse-drawn carriages. You may not have a billion-dollar market, but there is a market.

The one thing that prevents me from going into Kodak is actually fundamentals. The company has a CCC+ credit rating – the first ever company below a B/BB that I have reviewed, and remains the sole company where I continue coverage on the basis of its legacy.

The last earnings we have for Kodak are the 2Q23 ones, and this quarter is probably what, in part, spelled the decline for the stock. Revenues for the company were down a full 8%, and despite an impressive increase in gross profit and an improvement in cash balance, this was not enough to impress upon the market anything close to a turnaround.

This is what was surprising to me – because the bottom line saw significant improvements during the quarter, with better balance, better EBITDA, better GAAP Net income better gross profit. Despite this, the decline has been significant.

These improvements came as a product of operational efficiencies and pricing actions. So it’s not due to massive increases in sales, but the company becoming a more effective business, which is a positive. The results here continue to also be impacted by higher global costs, logistics, and in fact, lower volume. This makes the outperformance even more impressive to me.

What worries me at the same time though is the clear volume declines in some of the company’s main drivers, with near-double-digit declines in both Kodak PROSPER and SONORA lines.

On a high level, I see the improvements over the last few years as relatively clear. The company has focused on investing in efficiency and trying to drive revenues wherever it could get it, and we’re starting to see some improvements here – the improvements in earnings and profitability are in fact proof of this.

Despite some volume decline, Kodak has placed 2 new machines, the ULTRA 520 Press and the 7000 Turbo, both from the PROSPER lines, scheduled to be in production in 3Q23. Another big win during this quarter is the news that EssilorLuxottica (OTCPK:ESLOY) has chosen to add the brand to its portfolio of licensed brands. (Source: 2Q23 Earnings Report).

I cover EssilorLuxottica in my work, so this was something I was aware of.

On the fundamental side, the company also chose to extend debt maturity and entirely eliminate a revolver tied to assets, an ABL. In fact, the company characterizes its revenue drop as a conscious decision to prioritize for better profit and higher innovation – and the profit increases are as a result of this.

So, the overall picture I want to give about Kodak is actually an increase in attraction, despite the share price going down. Kodak remains a significantly risky investment, but the fundamentals are slightly improving – even if the visibility is, as I see it, no really better than it was before.

Let’s look at what this means for valuation.

Kodak Valuation – as difficult as before, even with improved fundamentals

Kodak remains, to say the least, tricky. The company, on a very fundamental basis, is traded at a significant discount to any logical valuation.

By every fundamental measurement, this company remains undervalued, if you compare the company to peers. Of course, comparing Kodak to any peers is really flawed, given the state of Kodak as things stand today. At best, Kodak can be compared to other companies trading at such dirt-cheap multiples.

I want to state clearly that Kodak is not a company such as Tupperware (TUP) or Wheels Up (UP). I’ve covered these businesses with targets and valuations for some time, and consider them both not investable. I consider it unlikely that Kodak is going bankrupt – that danger is over, despite a very substandard credit rating that the company has.

The signs for Kodak remain more encouraging than they are discouraging. If we look at tangible value, we could see a way to a $12/share price for the company – but that’s insane for what the company currently has, and where it is. I said before I would go no higher than $3-$4/share, and even at this point we see CCC+ and no forecasts with any sort of significant conviction. I continue giving you speculative numbers because they’re the only numbers I have.

And I continue to be extremely averse to gambling. Kodak may not be gambling on the level of UP or TUP, but it’s still a significant, volatile play with a very speculative upside.

Despite a 30% drop since my last article, I remain unconvinced about the company’s prospects.

For that reason, I give the company my updated thesis here.

Thesis

- Kodak is an impressive business – if we looked at it in 1995. Today, it’s a company with a mix of remaining legacy assets and segment ideas that it aims to expand. Until it does, its fundamentals, including some very basic things like Gross margin (less than 14%), imply the company is lacking and there are issues here.

- I believe the company can be bought once any sort of turnaround and clarity is present here – and once we’re looking at some sort of BB-rating.

- Until then, the company is a “HOLD” if you believe in it and own it, otherwise, I’d avoid or “SELL” Kodak.

- I could look at a price target of around $3-$4, but I would want better visibility before I invest in the company.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (Italicized)

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

I would say the company is fulfilling maybe one of my criteria – no more than that.

Read the full article here