Dear readers/followers,

Water Companies like American States Water (NYSE:AWR) are among the companies that unfortunately need to be repriced for this interest rate environment. Much like other utilities, many of which I have been re-reviewing in the last few months, they rely on stable cash flows and earnings provided by regulated operations. Even with the addition of non-regulated service businesses, they are still in a position of having a tricky set of earnings growth prospects – because most of the time, they don’t control their own growth.

AWR is a really good company. But a good company is no longer a good enough argument for investing – especially if that company is being traded at a premium, which is the case for this one.

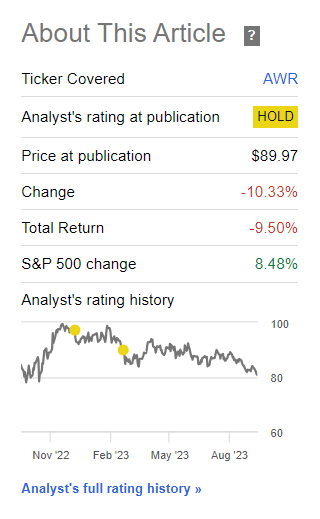

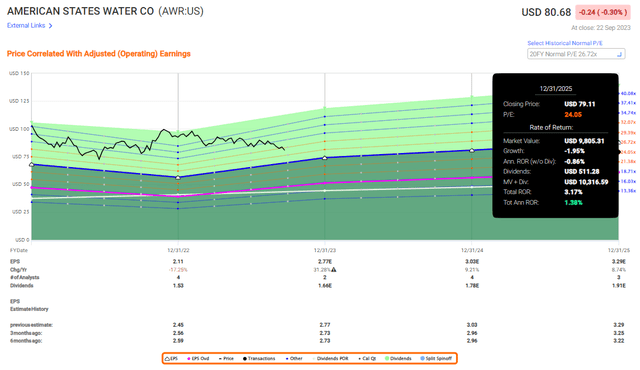

AWR RoR (Seeking Alpha)

As you can see, my positions in the company of not purchasing shares (and not holding any either, for that matter) have turned out fairly well. The last article was in February, but interest rates have gone higher faster than I expected, which warrants an update for this particular company.

American States Water – Plenty to like about conservative Water Operation, but the valuation needs to be right.

A dividend king is always, by itself, an argument for many investors to purchase shares. This is not the case for me. If it was, I would have been looking at companies like Walgreens (WBA), which is closing in on that title – but I don’t consider that to be enough of an investment argument. While nothing is wrong with the fundamentals, there’s everything wrong with the company’s valuation here, and that’s even after a double-digit decline.

But first, let’s establish that AWR is a pretty great company. A-rated debt, with 76% institutional ownership, and this company’s history means that that yield and those fundamentals are what you can take to the bank. True “blue chip” safety.

Unfortunately, a 2% yield isn’t even half the risk-free rate anymore. And because AWR, like other companies, is trading at such an extreme premium, it seems to me that investors and the market as a whole have forgotten what these sorts of companies do when the rates rise and when we’re seeing the sort of market environment we’re currently having.

What exactly am I talking about?

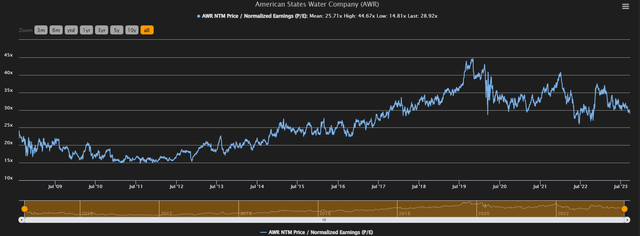

AWR P/E (TIKR.com/S&P Global)

I’m talking about what you see above. Unlike many other analysts, I tend to look at long historical trends. Beyond 5 years, sometimes even beyond 10-15 years. I realize why the company, at least in part, has seen some of the repricing it has from 2010-2019. But note also at the time the very extreme situation we had in terms of interest rates. Anything yielding 1%+ with this sort of safety was premiumized when you could barely get 0.4% risk-free for your money during ZIRP. (Source: 2Q23 AWR)

That’s no longer the case. And if you ask yourself the question “How low can this fall?”, I would say that you only need to look back 10 years. At times, AWR has traded below 15x P/E. It’s currently below 30x, which might have been a superb valuation during ZIRP, but when interest rates are 5%+, things look very different.

The latest earnings confirm that AWR is moving forward like the very “boring” company it is, albeit this quarter with a massive amount of earnings variances. 2Q23 saw some revenue reversals and favorable gains from investments held to fund retirements. Overall, we should however focus on regulatory decisions for this player – which remains one of the largest publically traded water companies in the entire nation.

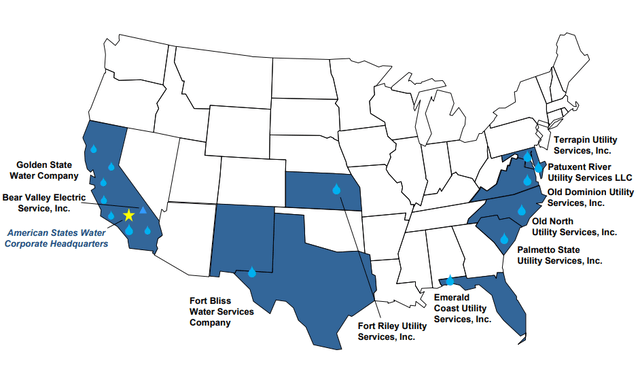

AWR IR

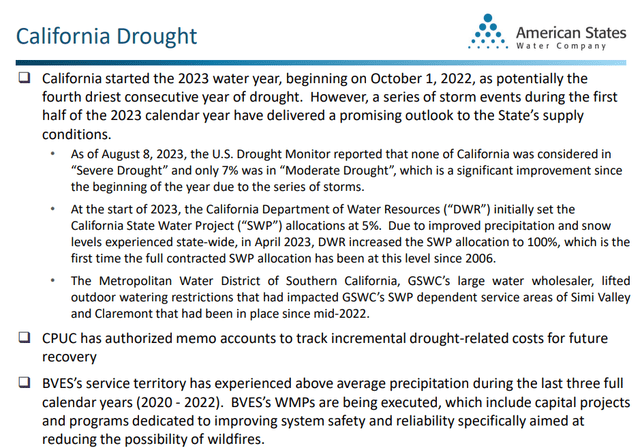

AWR’s results, all variances included and accounted for, were more or less in line with expectations. The rate/regulatory decisions out of California, which have taken some time, are finally decided. No positive surprises there, but no negative ones (significantly speaking). Company and analyst calculation for the RoE relative to the expected cost of capital outcome actually was much better than I expected, especially to where the commission was during 2018. I frankly expected this to be lower – and for the company potentially not able to keep its 57% equity layer, which AWR actually has managed. This is especially impressive given the state of consumer advocacy positions in California, which of course have been arguing in favor of these equity layers coming down. (Source: 2Q23 AWR)

How regulators determine what a utility is allowed to earn, or the utility’s RoE, is a science in itself, and too deep of a subject to get into during a single article – but for those interested in delving into the subject, I recommend this basic article. The logic is very similar for both energy/electricity as well as for water – anything regulated like this, basically.

So, a few things. First of all, AWR is very likely to continue to grow its earnings. I forecast a high single-digit increase in earnings, and I see the recent dividend bump on the part of the company as a confirmation of the continued positive trend. This latest bump of 8.2% was much more than a token increase and puts the company’s dividend at a 9.4% CAGR for the 5-year period of 2018-2023. It’s impressive. The company has paid a dividend every year since 1931. (Source: 2Q23 AWR)

It’s also, given the latest results from California regulators, fair to say that the company has a favorable regulatory environment, given certain mechanisms that have been applied.

Couple this with its very stable customer base, a good management team, proven management capabilities, and continued opportunities for ongoing privatization (very few public players, highly fragmented market), and you can see why the company may be in for positive years on a forward basis. I would personally expect the company to see continued positive growth rates here.

The company’s diversification also means that while we do have exposure to California, it’s only “part” of this company’s total – and by the way, the next few years for California are actually looking better, with increased levels of precipitation. (Source: 2Q23 AWR)

AWR IR

The simple short of it is, that AWR is a well-managed, well-working, and profitable business with continued upside in earnings and dividends. Beyond weather and environmental risks, I see no real potential downturns for this company, as regulators are limited in the pressure they can put on these businesses. The latest set of decisions from California regulators confirms this. With a dividend king status and over 65 years of dividend growth under its belt, the company has many things that would make it investable to the conservative investor.

The problem is, that valuation isn’t one of those things.

AWR Valuation – The company is cheap only on a 5-year basis

In this approach to evaluating the company, I’m normalizing the valuation to the longest-term trends that are possible. I’m including the last 5 years, during which ZIRP caused AWR to be excessively valued – at times over 40x P/E – but I’m also including the 2011-2013 period and somewhat before.

The company’s 20-year normalized P/E comes to between 26-27x. That’s still high, but at this level, I’m willing to consider it more or less valid, due to A-rating, the company’s fundamentals and operating geographies, and growth prospects.

The problem is, if we completely abandon ZIRP-valuations, which 24-27x P/E would mean, then this company is still too expensive here.

At 24x P/E, even with a double-digit 3-year growth rate CAGR of 11%, you’re getting barely 1.3% per year by investing in AWR – and that’s with the company’s 2.13% dividend.

AWR Upside (F.A.S.T. Graphs)

I repriced utilities in my last article, pushing one down over 10% due to the current interest rate. My last PT for AWR was $85/share. At 24x-27x P/E, the company would at a 2025E basis be traded at between $79/share on the low side to around $85/share on the high side in that range. My price target technically holds water still – pardon the pun – but I’m still cutting it to $77/share to account for higher risk-free rates and the real risk of poor returns I see due to the company being so highly valued for such a long period of time.

Even at a 27x forward P/E for 2025E, what you’re getting out of this investment if those earnings materialize is not even 6% per year, inclusive of dividends (Source: TIkr.com/S&P Global). If you want your 15% per year, as is my goal for any investment that I am looking to make, you need to make the argument that AWR, in a 5%+ interest rate environment, is still worth 33x+ P/E.

And that, by the way, is with that 11% EPS growth realized. If growth is lower, then you need to estimate higher.

Are you starting to see the problem I’m accounting for here?

There may be investments that should be worth 30-40x P/E even in a 5%+ interest rate environment, with the cost of capital and risk-free rates through the roof, but a highly visible water utility where you know fairly well what you’re getting, that’s not one of those investments. At least not as I see it.

AWR is in a downward trend, and I for one am hoping that this trend continues to where we might be able to invest in the company at a double-digit upside.

Once this is possible, I’ll be the first to confirm my “buy” here.

S&P Global analysts haven’t cut their targets, but nor are they as high as they once were with triple-digit share prices. 3 analysts are giving the company $88 to $95/share – however, out of 3 analysts, all of whom as per their targets consider the company cheap, all but one are at a “hold” currently. So that’s a “hold” rating despite their price target for the company being met, which gives me some problems with their conviction here.

You’ll find my own thesis for AWR below.

Thesis

My thesis for AWR is as follows.

- AWR is a dividend king and a water company with an A-rating and extreme levels of overall safety. It has an attractive operating structure and mixes around 80% regulated business with around 20% unregulated. The company has degrees of future-proofing and is a conservative allocator of capital, largely backed by the state of California.

- At the right and attractive price, this company becomes as I see it, a “must buy” – but that time is not today. At nearly 32x normalized P/E, this company is still a no-go for me here as of September of 2023.

- I view AWR as a “hold” – and I wouldn’t touch it above a PT of $77/share. Even $77/share is high, but at least there I could see a conservative upside, which I really can’t see at this price.

- I made a case for AWR being an interesting option play in my last article. That is no longer the case. I’ve been through the premiums, and there’s no scenario where I see a favorable play here.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative and well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.

The company, unfortunately, does not fulfill any of my valuation-specific metrics and criteria and therefore is a “hold” here.

Read the full article here