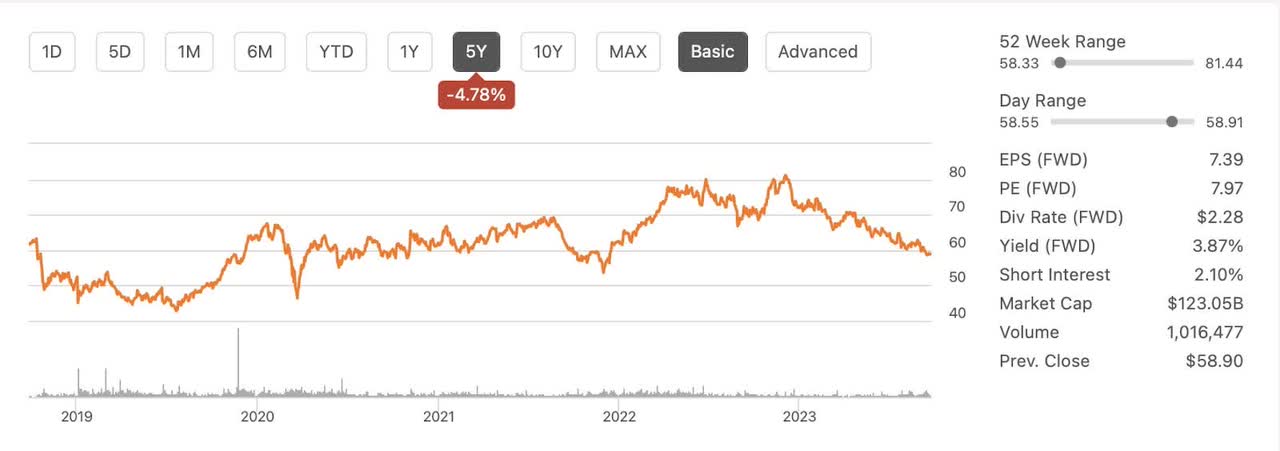

When Bristol Myers Squibb (NYSE:BMY) acquired Celgene for $74 billion dollars in November of 2019, it was a combination of two struggling companies each trying to stay ahead of Merck in the oncology space. I remember it well because I was an owner of Celgene stock as I thought it was highly undervalued. BMY seemed to agree with my assessment and took them out at a premium. I received $50 and a share of BMY for each share of Celgene I had. It was a big win for me having bought Celgene shares for around $65. I looked closely at BMY to determine if I should keep the shares or sell them. I sold them for a little over $60. As a deep value investor BMY just didn’t pass the smell test. The smell over the last few years hasn’t gotten any better. In fact, BMY is currently selling for less than I sold it for in December of 2020. BMY has been dead money over the last five years losing about 5% of its value while paying nearly 4% in dividends annually. The future doesn’t look much better. With pricing pressures, dropping revenues and government pricing regulations looming, I would argue that BMY is currently in a worse position than it was when I sold it over 2 years ago. Currently, I have rated it a hold.

BMY 5 Year Chart (Seeking Alpha)

BMY, headquartered in New York, specializes in biopharmaceuticals. It develops, licenses, manufactures, markets, and sells products worldwide. These include treatments for various diseases like hematology, oncology, cardiovascular, immunology, fibrotic, and neuroscience conditions. Some notable products are Eliquis for stroke risk reduction, Opdivo for cancer, and Revlimid for multiple myeloma. They serve various customers, including hospitals, clinics, and government agencies. Founded in 1887, the company was formerly known as Bristol-Myers Company. Bristol Myers Squibb is well-prepared to handle the challenges posed by International Reference Pricing (IRA) and is focused on defending the value of its products, particularly Eliquis.

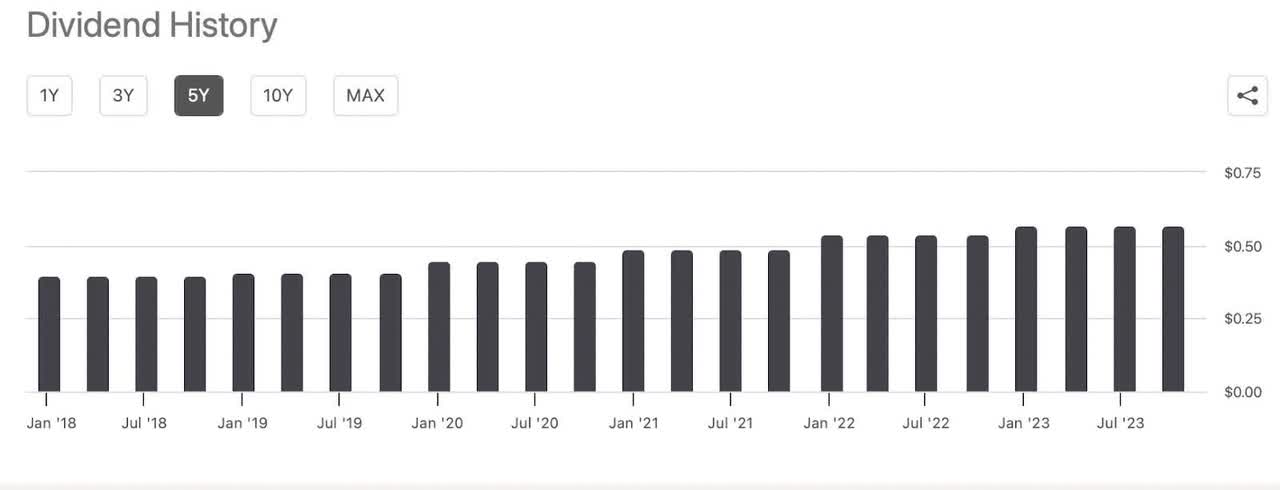

Dividends

The best thing about BMY currently is the dividends. Paying almost 4% and with a payout ratio of almost 30% there is no reason to believe that the dividend is in any danger of being cut. The consistent raises over the last five years have shown the company’s dedication to returning value to its shareholders. This combined with the $4 billion dollar share buyback program should keep a floor under the stock price.

Seeking Alpha

The Concerns

During a recent conference call, Bristol Myers Squibb’s Chief Operating Officer, Christopher Boerner, discussed the company’s strategy in response to the impact of the Inflation Reduction Act (IRA) on the pharmaceutical sector. Boerner’s claimed BMY was prepared, “So first, I think at a macro level, we’ve been anticipating IRA and the price setting components of IRA for some amount of time. So what I would say, at the highest level is that we feel very good about the team that we have in place to navigate this, the capabilities that we’ve built.” This statement highlights that BMY has been proactive in preparing for IRA and has confidence in its team and capabilities to address the challenges but it also shows that changes are coming and they will be a headwind to earnings growth.

Boerner further explained BMY’s strategy in engaging with CMS regarding Eliquis is “to defend the value of that product for patients as well as for the healthcare system.” He also noted, “we have a wealth of clinical real-world pharmacoeconomic data in order to do that.” This evidence underscores BMY’s commitment to ensuring that their products continue to provide value to patients and the healthcare system, supported by substantial data.

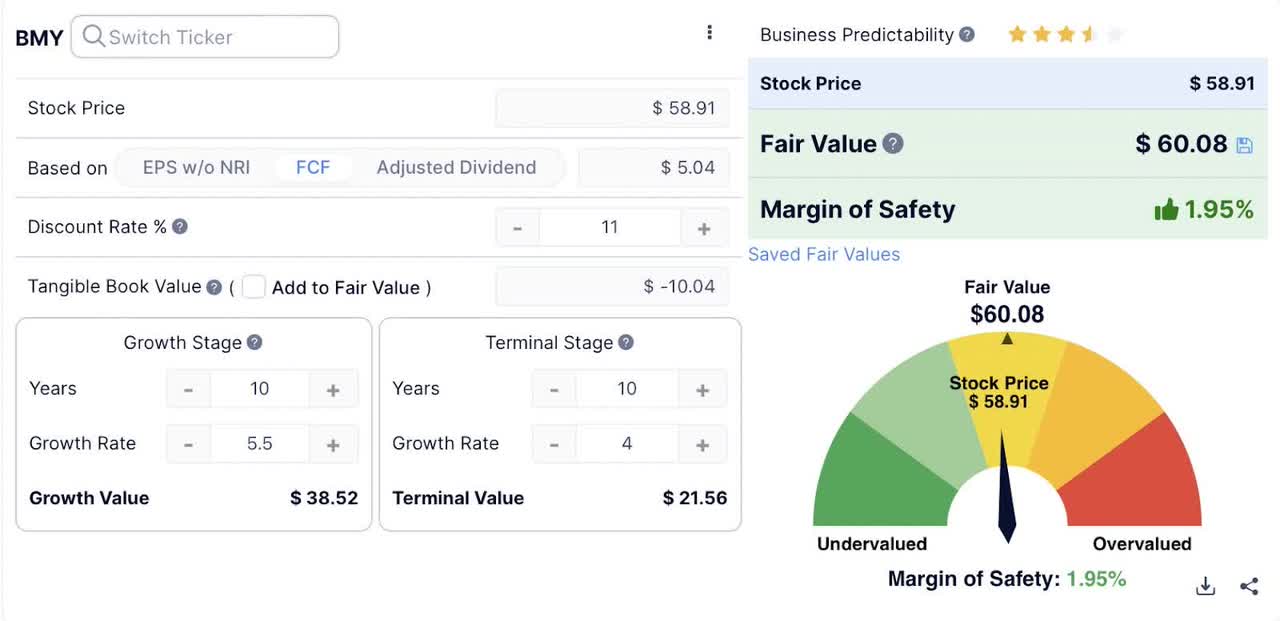

This is bad news for BMY investors because defending price points on old legacy products instead of creating new ones is a losing strategy in my opinion. For these reasons I believe a 5% growth rate might be towards the upper range over the next few years. Even a modest growth rate of 5% in free cash flow would, put them at close to fair value now.

Free Cash Flow DCF (Guru Focus)

For BMY to have any significant margin of safety, it would need to return to double digit rates of growth which will not happen over the next few years.

We believe this to be unlikely because Bristol Myers Squibb grapples with impending patent expirations, scheduled for the mid-2020s, which pose a challenge to two of its major revenue generators: Opdivo, a cancer treatment, and Eliquis, a blood-thinning marvel developed in collaboration with Pfizer (PFE).

The patent shield for Revlimid, a potent cancer drug acquired through Bristol’s acquisition of Celgene in 2019, has already dissipated into the ether. What was the driving force behind BMY’s revenue growth will not continue to do so.

This expiry casts a foreboding shadow over the fate of Bristol’s current flagship pharmaceuticals. During the fourth quarter, the sales of Revlimid saw a precipitous decline, plummeting by 32% year-on-year to a modest $2.26 billion. This descent commenced last year when Teva Pharmaceutical (TEVA) introduced the inaugural generic alternative to Revlimid.

BMY’s Eliquis contributed a commendable $2.69 billion in sales, while Opdivo held its ground with approximately $2.22 billion in revenue. Notably, Eliquis and Opdivo are esteemed as “growth brands” by Chris Boerner alluding to their significance in the company’s revenue streams. Together, these three pharmaceutical drugs, Revlimid, Eliquis and Opdivo constituted nearly 63% of the total sales for the December quarter.

The Hope

Bristol Myers Squibb envisions a transformative shift in its revenue composition by 2030, as outlined in a presentation at the J.P. Morgan Healthcare Conference early in January. The trio of Eliquis, Opdivo, and their cohorts from the current portfolio is anticipated to represent a diminishing slice of the sales pie. The lion’s share is predicted to derive from the burgeoning new product lineup.

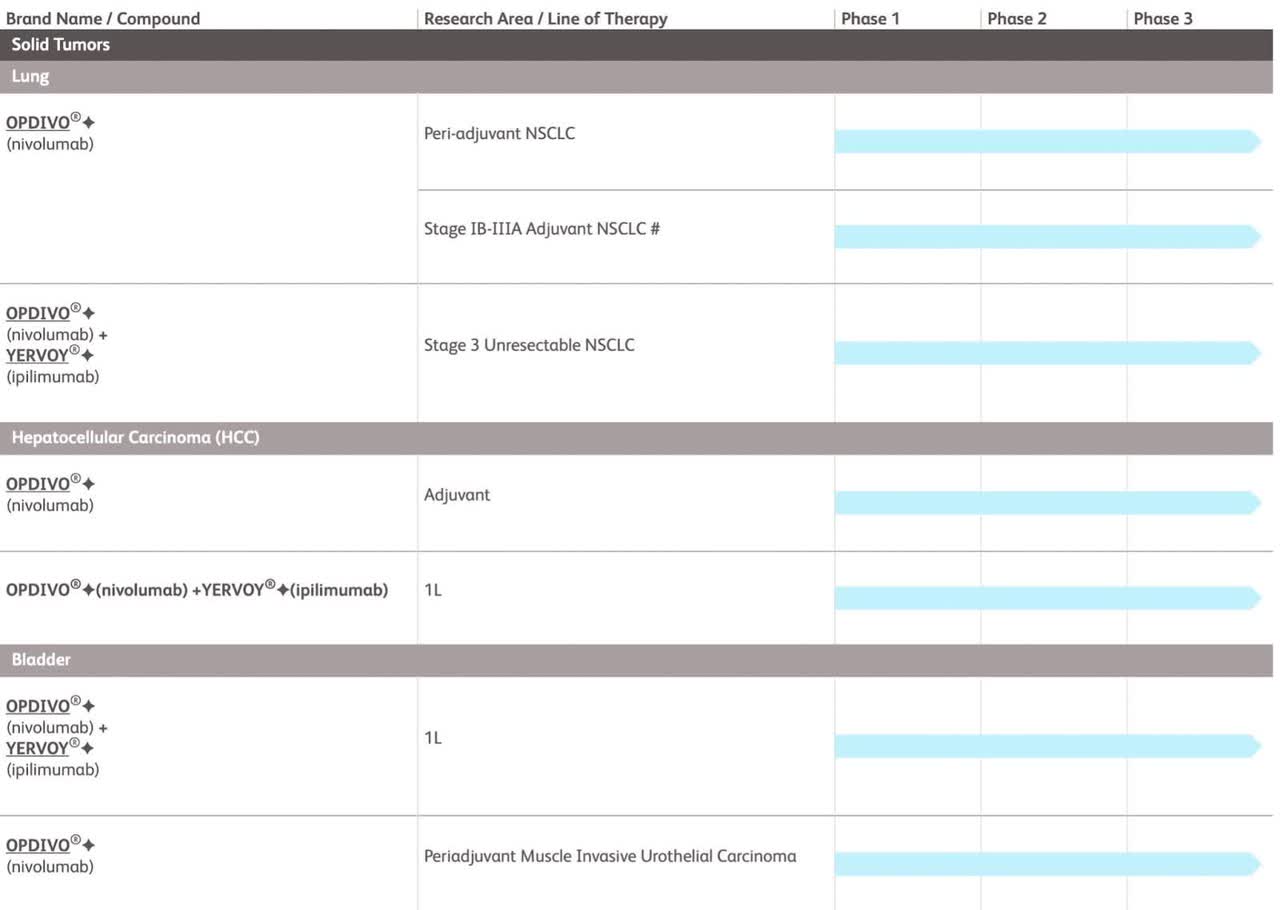

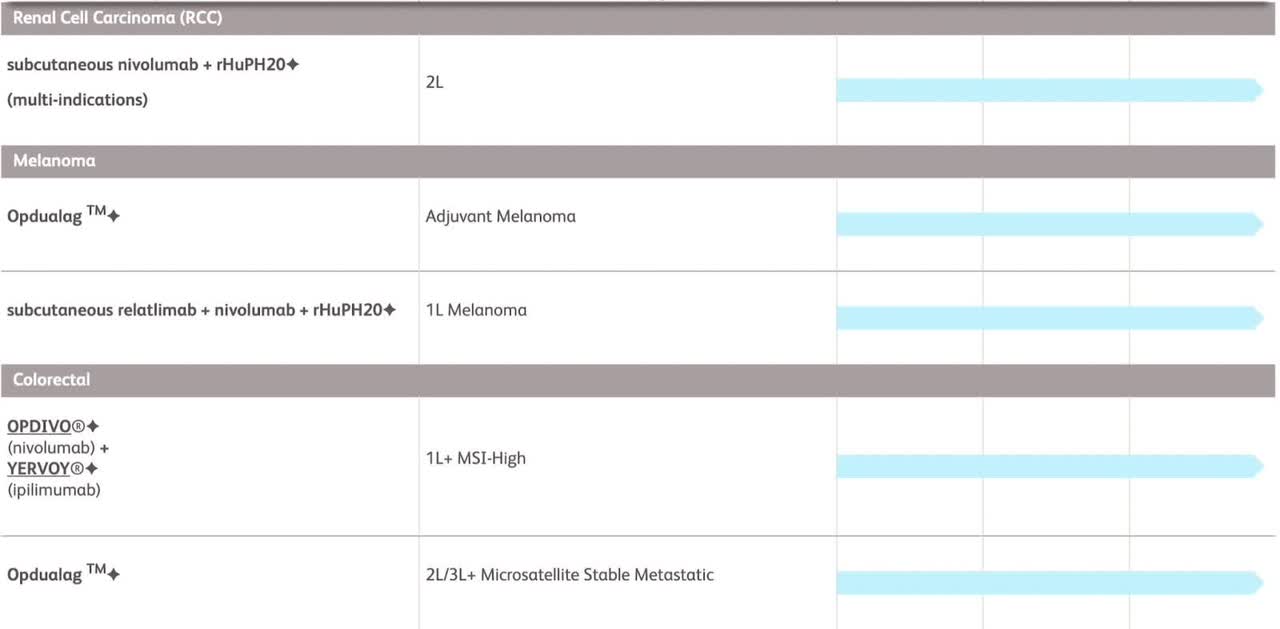

With 45 drugs in development impacting 40 different areas of disease, The second half of this decade could indeed be promising. Among the company’s current late-stage drug candidates, there are two treatments targeting multiple myeloma, a lung cancer therapy, and two drugs aimed at addressing other lung-related ailments. These pharmaceuticals are all in the experimental phase, with Phase 3 clinical studies either in progress, planned, or already completed. Just taking a look at the cancer drugs in phase three of development shows how things will likely change at BMY over the next decade.

BMY Pipeline (BMY Webpage)

Not included in the list above is repotrectinib which Bristol Myers anticipates gaining FDA approval for in the latter half of 2023. The drug is envisioned as a novel standard of care for patients afflicted with a specific type of lung cancer.

As for multiple myeloma, ongoing studies are in progress for two experimental drugs named iberdomide and mezigdomide. Additionally, Bristol Myers has initiated the final-phase examination of cendakimab in patients experiencing an allergic condition affecting the esophagus.

The sales potential for these pharmaceuticals is substantial, with Chris Boerner noting “We continue to see execution in the pipeline. We have six late-stage assets we believe have well in excess of $10 billion in sales potential.” If this turns out to be true then the second half of this decade could eventually lead to another virtuous growth cycle for BMY.

Final Thoughts

Since its acquisition of Celgene in 2019, BMY’s stock has languished marked by challenges and uncertainty. While the acquisition seemed promising at the time, the company has faced headwinds, leading to a stagnation in its stock price over the last few years. The looming patent expirations for key revenue-generating drugs like Opdivo and Eliquis, coupled with the expiration of Revlimid’s patent, have cast a shadow over the company’s future prospects.

BMY’s defensive strategy to defend the value of its legacy products, might not be as successful as they would like. The anticipated 5% growth rate may be optimistic over the next three years, given the impending patent expirations and pricing pressures in the pharmaceutical industry.

While Bristol Myers Squibb envisions a transformation in its revenue composition by 2030, driven by a new product portfolio, investors may remain cautious in the short term. With numerous late-stage drug candidates in development, including treatments for multiple myeloma, lung cancer, and other lung-related conditions, there is potential for future growth. However, the market may adopt a wait-and-see approach, and it’s unlikely that significant changes will occur over the next three years.

BMY currently presents challenges and uncertainties for investors that have made it a value trap recently in the eyes of some. While the company holds promise in its late-stage drug pipeline, the moderately high dividend, and a share repurchase program, the road ahead appears rocky, and achieving substantial growth in the near term may be an uphill battle. As such, a “hold” rating may be prudent for investors seeking to navigate this complex landscape. As always, please do your own due diligence before buying any positions and good luck investing.

Read the full article here