Let’s face it: Wells Fargo (NYSE:WFC) doesn’t have the best reputation.

At the center of numerous scandals throughout the last decade, including one that saw bank employees opening fake customer accounts (and recently for having fake accounts opened for non-customers), the bank doesn’t have the best public image, especially when compared to other too-big-to-fail institutions, like JPMorgan Chase (JPM) and Bank of America (BAC) that have seen comparatively few negative headlines.

That said, recently, Wells Fargo has been discounted by the market on a number of different metrics, and bank’s underlying business remains robust.

Combined with a massive liquidity cushion and a renewed focus on building complexity control infrastructure, we think the bank is well positioned to outperform over the medium term, especially when considering the company’s potential ability to return capital to shareholders.

Today, we’ll do a deep dive into the troubled megabank and make the case that shares of Wells Fargo ultimately deserve a spot in your portfolio.

Financial Results

As always, let’s start with the bank’s financials.

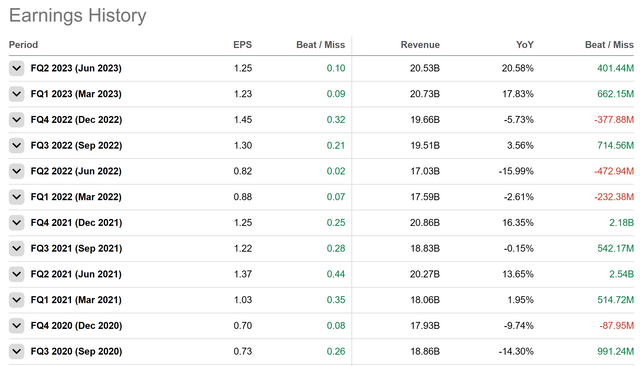

Revenue, as one might expect, has been strong over the last few quarters, as net interest income has surged:

Seeking Alpha

Surprisingly, the bank has beaten EPS estimates for 12 quarters running, which is impressive given how many eyeballs the bank has on it. That said, the beat/miss schedule for revenue has been a bit choppier & with less consistency.

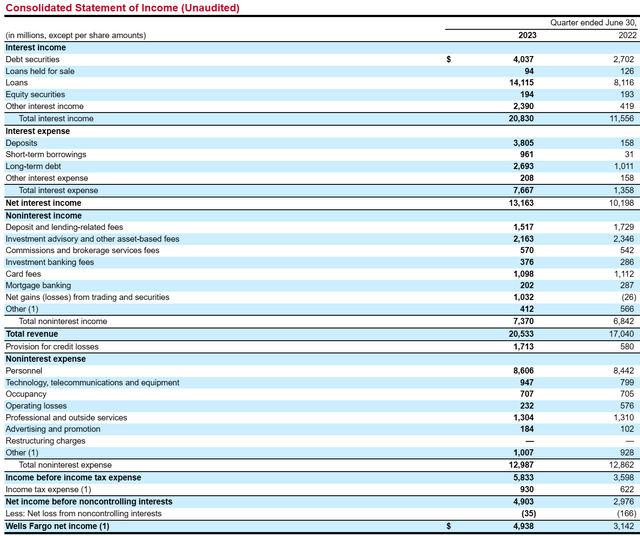

Nominally, the bank is stable and doing well. Wells Fargo saw increased NIM’s YoY, which led net income to grow from $3.1 billion to $4.9 billion between 2022 and 2023:

10Q

While revenue and income have been robust and consistent, partially due to the company’s 4 diverse business segments, and partially due to the macro environment which has caused higher interest rates, the real gem here is the company’s fortress balance sheet.

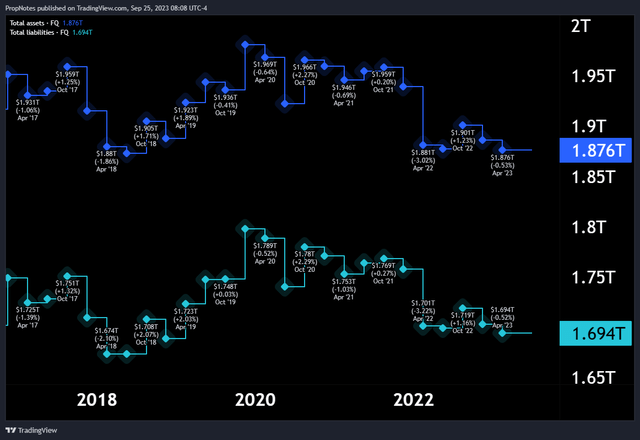

At last tally, the bank totaled $1.87 trillion in assets, vs. $1.69 trillion in liabilities:

TradingView

More specifically, Wells Fargo has $1.34 trillion in client deposits to buttress against the bank’s $933 billion loan book.

This is an exceptional 144% deposit collateralization ratio, which is only rivaled by the other TBTF banking institutions.

This puts the bank into the realm of ‘ultra-safe’, in an era where the echoes of the SIVB bank run are still fresh in the minds of regulators and the investing public.

Also of note are the $402 billion of non-interest bearing deposits that make up a fair-sized chunk of the bank’s deposit base.

Rates have gone up from essentially nothing to over 5% over the last few years, and less than 20% of these deposits have gone out the door, which means that they are, for the most part, return-insensitive – corporate checking accounts and such.

These accounts are a massive hidden asset for WFC, which can still use them to back loans and other, higher-interest investments.

The final piece here is the bank’s newfound focus on control infrastructure.

Wells Fargo has four separate lines of business, each with their own discrete risk and compliance challenges. These challenges can compound, especially when it comes to ensuring collateral for things like complex OTC derivatives.

One can easily see how WFC, between all these lines of business, likely has an internal byzantine patchwork network of complex risk-management software all stitched together, combined with manual checks and other procedures.

Wells Fargo has argued, somewhat convincingly, that this complexity is what has caused past issues for the bank.

That is why, at the very top of their recent earnings report, management had the following to say:

Wells Fargo’s top priority remains building a risk and control infrastructure appropriate for its size and complexity.

In other words – ‘we know we need to fix our operations to make the bank more efficient, more profitable, and less risky.’

To us, this is the perfect focus for a bank that has already achieved market saturation with respect to product and marketing.

We expect that this focus may ultimately deliver results that make the business more profitable, more durable, and more valuable in the future.

Overall, Wells Fargo runs a stable, profitable, de-risked banking business that has numerous advantages and hidden assets, and management is taking the right steps to ensure its continued healthy operation.

Capital Returns

But what about Dividends?

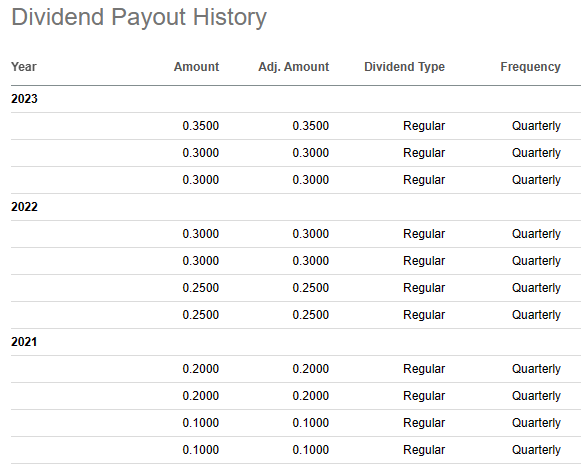

We mentioned early in the article that Dividends could be a key driver of returns, and we meant it.

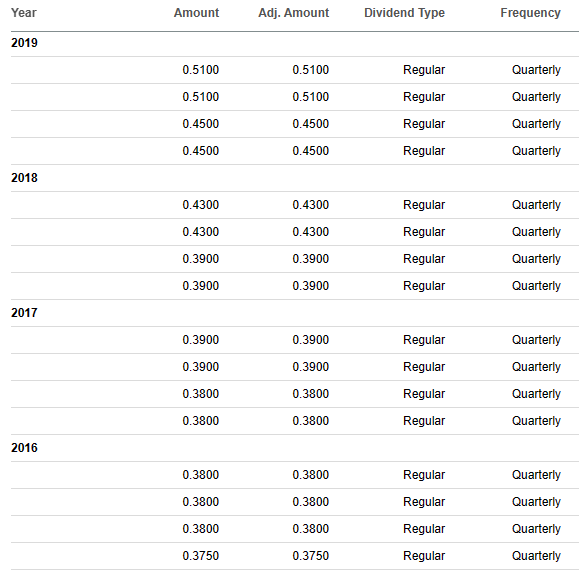

In short, Wells Fargo is incredibly conservative when it comes to dividend payouts, and we expect that the pace of recent increases will likely continue until the bank gets back in line with where they were pre-pandemic.

Right now, the company pays a 3.5% dividend to shareholders, or 0.35 cents per share per quarter.

This number has grown back quickly as the bank re-instated its dividend following the Covid panic cut:

Seeking Alpha

Since 2021, the bank has increased its payments by 4c on average every quarter, in order to get the payout back to where it was.

Before the pandemic, WFC was paying a 0.51c dividend, which represents a 45% premium to where the dividend is currently:

Seeking Alpha

If mapped out onto the stock, buying now – and expecting that the bank will continue to hike back to where it was pre-pandemic when rates were lower – would yield almost 5% on cost, likely within the next few years. This may seem paltry, especially given that money market funds yield something similar right now in the open market for virtually no risk.

That said, Wells Fargo will likely have the net income available to pay a dividend like this through all phases of the market cycle.

In addition, right now the payout ratio sits at an industry-low 22%, which means that there’s MUCH more room to hike capital returns to shareholders, as rates are expected to stay higher for longer, which should buttress EPS.

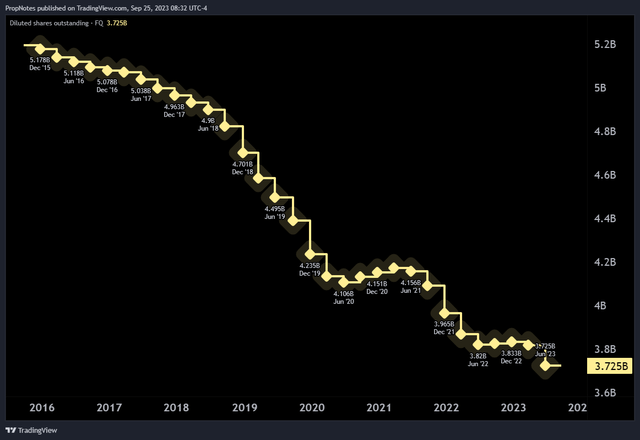

Finally, WFC has also been doing a great job buying back shares to increase EPS mechanically:

TradingView

Since 2016, the bank has reduced its outstanding share count by more than 28%, which has allowed the company to increase dividend payouts per share.

The Valuation

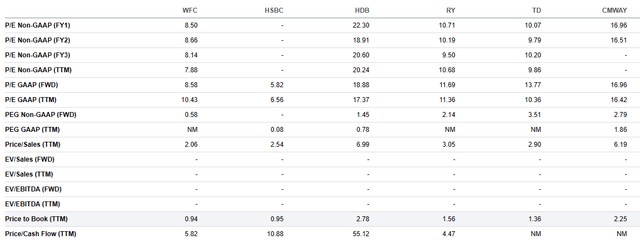

Between the bank’s solid operations and attractive potential for capital returns to shareholders, one might think that the bank is expensive relative to regional peers.

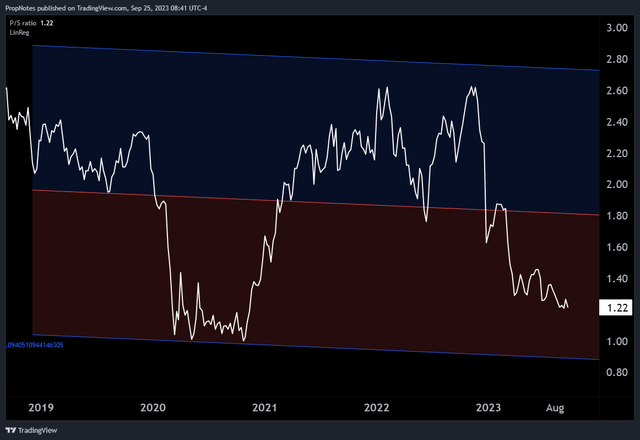

As luck would have it for us, right now, the bank is historically cheap.

On a sales basis, Wells Fargo is trading at 1.22x, which is similar to where it was at pandemic lows:

TradingView

Additionally, Wells Fargo is competitively cheap when compared to other banks of the same size and market cap, especially when compared to the important Price / Book metric:

Seeking Alpha

Ultimately, we think that the bank looks attractively priced in the market, and buying now does so with a large margin of safety.

Risks

There are some risks to this thesis, chief among them being regulatory.

If Wells Fargo continues to anger regulators over shady consumer banking practices or runs afoul of any new capital buffer ratios that could be put in place as a result of the bank run earlier this year, then the bank could see its share price decline significantly.

Summary

That said, we think the rewards outweigh the risks, and now is a great time to add exposure to a world-class bank, with an attractive, growing dividend, at a good price.

Cheers!

Read the full article here