The AllianceBernstein Global High Income Fund Inc. (NYSE:AWF) is a closed-end fund, or CEF, that can be employed by those investors who are seeking to earn a very high level of current income from the assets in their portfolios. The fund’s usefulness as a source of income is apparent in its 7.98% current yield, which is significantly higher than most other assets in the market. That almost goes without saying, since the market has been incredibly optimistic about the Federal Reserve cutting interest rates in the near future and has been pricing assets as though it has already done so. It is only just now that the market appears to be waking up to the reality that high rates are going to be a fixture of the economy for a while, as the yield on the ten-year U.S. Treasury (US10Y) has gone up substantially over the past three months:

CNBC

Despite this, the current 4.5170% yield of the ten-year U.S. Treasury is still significantly below that of the AllianceBernstein Global High Income Fund. The fund therefore does still have some appeal that income-seeking investors cannot find in risk-free securities.

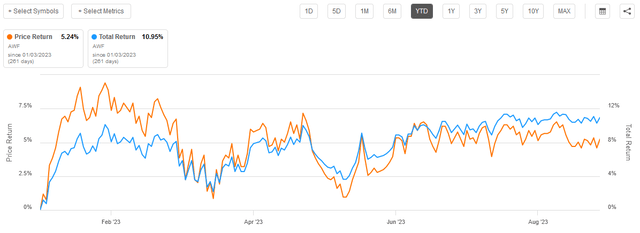

As long-time readers may recall, we last discussed the AllianceBernstein Global High Income Fund around the end of July. The fund’s performance since that time has been much better than might be expected. In fact, its price has been almost perfectly flat, but when we add in the distribution, shareholders who bought on that date have made a profit:

Seeking Alpha

The fund’s 1.34% total return since our last discussion is better than the performance of the domestic bond market, as the Bloomberg U.S. Aggregate Bond Index has been down since that time. The same is true for U.S. Treasuries since rising yields imply falling security prices. As such, the fund certainly might be attractive based on this information. Therefore, it is a good idea to revisit the fund and see what may have changed, and if such changes are sufficient for us to update our thesis. This article will focus specifically on that.

About The Fund

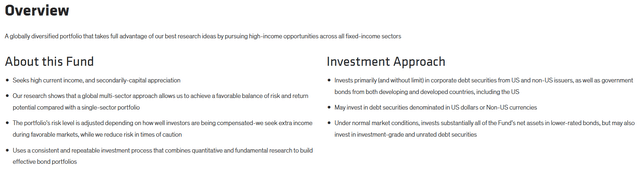

According to the fund’s website, the AllianceBernstein Global High Income Fund has the primary objective of providing its investors with a high level of current income. Admittedly, though, the fund’s overview on its website reads like marketing materials:

AllianceBernstein

The fact that the fund states that it takes advantage of AllianceBernstein’s best ideas is marketing fluff. The rest of the statements there certainly sound appealing, however. In particular, the statement that the fund will attempt to increase its income during favorable market conditions and seek to reduce its risk during challenging market conditions will probably appeal to most investors who are simply seeking a high level of income without unnecessary risks. With that said, the fund’s success at accomplishing this is always up in the air, since it implies a certain level of market timing that may not always be possible.

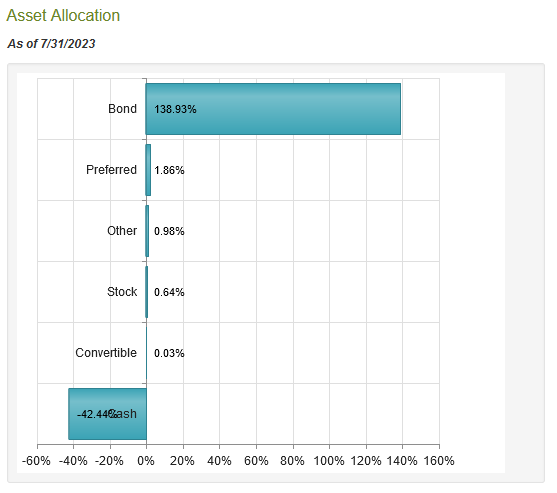

As the fund’s description above states, the AllianceBernstein Global High Income Fund invests in the global debt markets. As such, we would expect to find its portfolio filled with bonds and possibly preferred stock. This is exactly what we do see, as shown in this chart:

CEF Connect

It is quite certain that the first thing anyone who sees that chart will notice is that the fund’s bond allocation is significantly above 100%. This is possible because the fund employs leverage as a method of boosting its effective yield and returns. We will discuss this in more detail later in this article. For now, though, the takeaway is that this is a debt fund that invests in assets issued mostly by corporations located in both the United States and internationally.

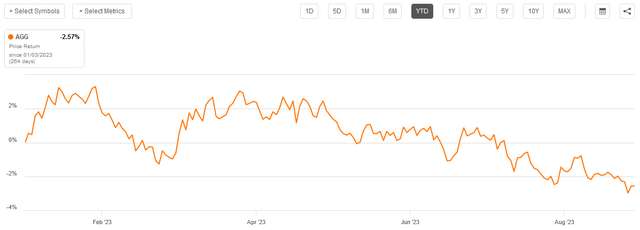

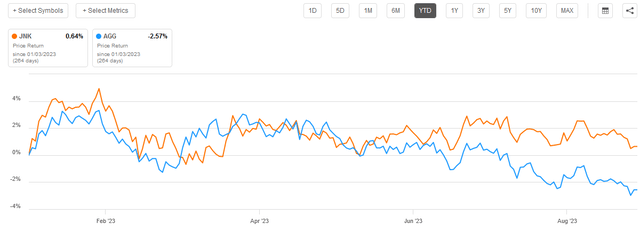

The fact that the fund has leveraged exposure to bonds certainly would not appear to fit with its earlier statement that it seeks to reduce risk when caution is appropriate. This is because of the risks of holding a levered bond portfolio in the current environment. Since the start of the year, the Bloomberg U.S. Aggregate Bond Index (AGG) has fallen 2.57%:

Seeking Alpha

The biggest reason for this is rising interest rates. After all, when interest rates rise, bond prices decline. During much of the first half of the year, the market was optimistic that the Federal Reserve would quickly reduce interest rates, which is the reason why bonds were actually up during most of the January through August period. However, there was never a reason to believe that rates would be cut. As I pointed out back in April, all of the progress that had been made in reducing the headline inflation number was due to the Federal Government flooding the market with oil from the Strategic Petroleum Reserve and dragging down prices. The core consumer price index barely budged, so once the Strategic Petroleum Reserve ran out of crude oil, inflation would go right back up. That is what we have started to see over the past two months, and we are seeing that the market is waking up to this reality, as bond prices have been consistently down year-to-date since around the start of August.

The reason that this is relevant to the fund is that leverage amplifies losses when the market moves against you. As it is quite certain that rates will not be going down anytime soon, it makes no sense to be holding a leveraged bond portfolio and eating larger losses than would be had simply by holding unleveraged assets.

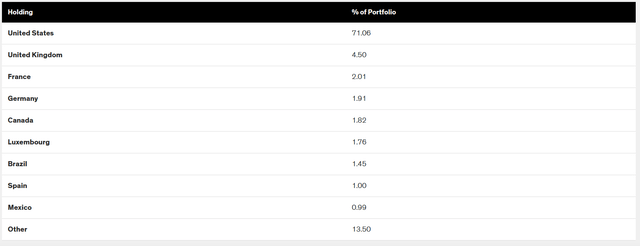

With that said, the AllianceBernstein Global High Income Fund invests in bonds issued by companies all over the world. As such, it is exposed to a variety of interest rate regimes as opposed to simply the one imposed by the Federal Reserve. As of the time of writing, 71.06% of the fund’s assets are from American issuers:

AllianceBernstein

As such, the Federal Reserve’s interest rate policies are by far the most important for the fund’s performance right now. They do not particularly favor holding a leveraged portfolio for reasons that were already discussed. According to Goldman Sachs, the central bank is unlikely to reduce interest rates until the second quarter of next year. However, even then they are expecting that the bank will only cut by 25 basis points.

A closer look at Goldman’s analysis reveals that the bank is expecting that the Federal Reserve will hold rates at close to 5% or higher for an extended period of time, which in this case means a lot longer than a few months. The market is currently expecting rate cuts to come within the first quarter of 2023, but Goldman Sachs thinks that is highly unlikely unless a recession occurs. In short, there should be no real reason to be optimistic about bond prices going up anytime soon, and the inverted yield curve makes the classic strategy of borrowing at short-term rates to purchase long-term bonds a rather risky proposition. While it is possible that some of the other countries that are represented in this fund’s holdings will take a different approach with respect to rates, the fact that securities issued by American entities currently account for 71.06% of the portfolio outweighs anything positive that may happen abroad.

Despite this negative backdrop, the AllianceBernstein Global High Income Fund has been performing very well. As just mentioned, the fund’s share price has been perfectly flat since my previous article on it was published in July. The fund has done even better year-to-date, as its shares are up 5.24% and it has delivered a 10.95% total return:

Seeking Alpha

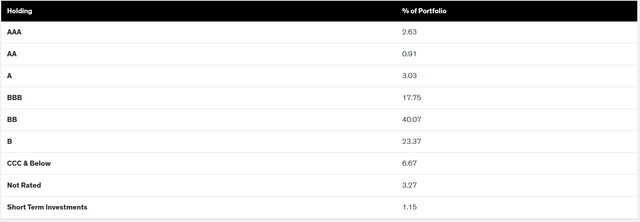

Obviously, this has substantially outperformed the Bloomberg U.S. Aggregate Bond Index over the same period. One possible reason for this is that the fund has a fairly high allocation to high-yield securities (“junk bonds”). We can see this quite clearly by looking at the credit ratings of the securities in the fund:

AllianceBernstein

A junk bond is anything with a credit rating of BB or lower. As we can see, that describes 73.38% of the fund’s portfolio. As I discussed in a previous article, junk bonds have become rather popular among some investors recently. This is partly because of interest rates. Basically, investors are hoping to lock in high yields for their assets before the Federal Reserve cuts rates. This demand for investors has driven up the price of junk bonds even while investment-grade bonds are falling. For example, consider the following chart showing the price return of the Bloomberg High Yield Very Liquid Index (JNK) against the Bloomberg U.S. Aggregate Bond Index:

Seeking Alpha

As we can see, junk bonds are actually up slightly year-to-date, which is an enormous improvement over the bond market as a whole. As the portfolio of the AllianceBernstein Global High Income Fund consists primarily of junk bonds, the value of the assets in its portfolio is holding up much better than the overall bond market. It is uncertain whether or not this investor attraction to junk bonds will continue forever, especially since junk bonds were generally tracking the broader bond market up until very recently, but it may explain why the fund’s price has been holding up better than we might expect.

Leverage

As has been mentioned a few times in this article, the AllianceBernstein Global High Income Fund employs leverage as a strategy to boost the effective yield of the assets in its portfolio beyond that which any of them actually possess. I explained how this works in my last article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase bonds and other fixed-income assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As this fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates, this will usually be the case. With that said, the benefits of leverage today are much less than they were a year ago because borrowing costs are much higher.

However, the use of debt in this fashion is a double-edged sword because leverage boosts both gains and losses. As such, we want to ensure that a fund is not using too much leverage because that would expose us to too much risk. I do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the AllianceBernstein Global High Income Fund has levered assets comprising 23.97% of its portfolio. It is possible that other sources calculate the leverage differently since CEF Connect and Morningstar put the fund’s leverage at 0.90%. Nonetheless, the 23.97% figure comes directly from the fund sponsor so that is most likely to be correct.

Overall, this fund’s leverage appears to be low enough that we do not have to worry too much about it, especially because interest rates probably will not go up too much more. However, if the Federal Reserve does hold rates at high levels beyond the first quarter of next year, we could see some big losses as the leverage will cause the fund to take much larger losses than it would in the absence of leverage.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the AllianceBernstein Global High Income Fund is to provide its investors with a very high level of current income. In order to achieve this objective, it invests in a portfolio consisting primarily of junk bonds from both domestic and foreign issuers. As speculative-grade securities typically have fairly high yields, this provides the fund with a significant amount of income. This fund takes it a step further though and applies a layer of leverage to artificially boost its yield beyond that of any of the underlying assets. The fund collects its investment profits and pays them out to its investors, net of the fund’s expenses.

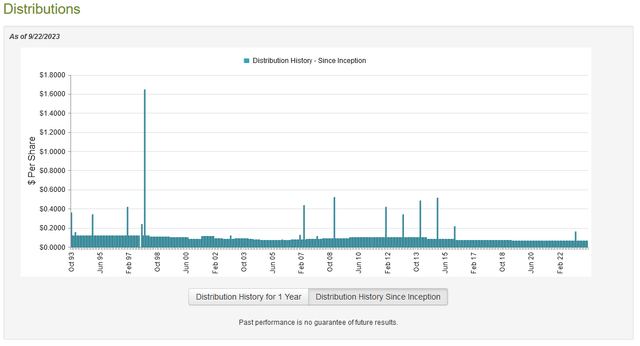

We might expect that this would give the fund a fairly high yield itself. That is indeed the case as the AllianceBernstein Global High Income Fund pays a monthly distribution of $0.0655 per share ($0.786 per share annually), which gives it a 7.98% discount to net asset value. Unfortunately, the fund has not been particularly consistent with respect to its distribution as it has varied it numerous times over its lifetime:

CEF Connect

As we can see, the fund has both increased and decreased its distribution numerous times since it was first conceived back in 1993. This could prove to be a turn-off for those investors who are seeking a safe and secure source of income to use to pay their bills or finance their lifestyles. However, it is not unusual for a fund to vary its distribution over time as the amount that it can afford to pay out depends a lot on how accommodating the market is during a given time period. In the case of this fund, interest rates play a large role in how much the fund can earn, and interest rates are entirely out of its control.

As I have pointed out numerous times, the fund’s history is not exactly the most important thing to anyone purchasing shares of the fund today. This is because today’s buyer will receive the current distribution at the current yield and will not be affected by actions that the fund has taken in the past. The most important thing for us today is how well the fund can sustain its current payout.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the full-year period that ended on March 31, 2023. As such, this document will not give us any idea how this fund performed over the past six months. This is disappointing because the market went from a condition of great optimism to one of caution since the time that this report was published. On the other hand, this report should give us a good idea of how well the fund navigated the turbulent market conditions that dominated 2022. This could be very helpful because sometimes seeing how well a fund performs during a hostile market can give better insight into the quality of its management than we would get by looking at its performance during a strong market. After all, anybody can make money during a bull run.

During the full-year period, the AllianceBernstein Global High Income Fund received $67,880,521 in interest along with $1,271,615 in dividends from the assets in its portfolio. This gives the fund a total investment income of $69,152,136 during the period. It paid its expenses out of this amount, which left it with $59,434,784 available for shareholders. This was, unfortunately, not nearly enough to cover the $76,201,166 that the fund actually paid out in distributions during the period. At first glance, this is quite concerning as we usually like a fixed-income fund to be able to fully fund its distribution out of net investment income.

However, the fund does have other methods through which it can obtain the money that it needs to cover the distribution. For example, it might be able to take advantage of price changes that occur with bonds in order to generate a profit. As might be expected given the time period covered by this report, the fund failed miserably at this task. It reported net realized losses of $59,646,186 and had another $49,324,368 net unrealized losses. Obviously, the fund failed to cover its distribution and instead saw its net assets decline by $125,736,936 during the period. This represents the fund’s second straight year of declining net assets, as its assets went down by $65,586,789 during the previous year. At least during the previous year, the fund did have sufficient net investment income and net realized gains to cover the distributions. Overall, though, this fund may have to cut the distribution if it cannot turn around its financial fortunes in short order.

Valuation

As of September 22, 2023 (the most recent date for which data is currently available), the AllianceBernstein Global High Income Fund has a net asset value of $10.59 per share but the fund’s shares only trade for $9.87 each. This gives the shares a 6.80% discount on net asset value at the current price. That is a very reasonable discount, but it is not quite as good as the 7.18% discount that the shares have averaged over the past month. As such, it may be possible to get a better price by waiting for a bit, but the current price is acceptable if you want the fund.

Conclusion

In conclusion, the AllianceBernstein Global High Income Fund is a fixed-income closed-end fund that can help investors earn a high level of income from the assets in their portfolios. It is certainly not perfect however, as it is running a leveraged bond portfolio at a time when the market is growing increasingly pessimistic about the potential for lower interest rates in the near future. This has been causing bond prices to decline, and of course, leverage amplifies losses. This fund invests mostly in high-yield bonds, which have been holding their value better than regular bonds, but there is no guarantee that will be the case forever.

The biggest risk here, though, is that the AllianceBernstein Global High Income Fund Inc. has seen its net assets decline for two straight years, and this is making it very difficult for it to be able to sustain the distribution going forward. A distribution cut would also certainly drop the share price and reduce the income of anyone buying the fund today. It may be wise to be cautious about purchasing this fund.

Read the full article here