Investors in lead Industrial REIT STAG Industrial, Inc. (NYSE:STAG) have seen a remarkable revival since it bottomed out in October 2022. In a late-October article, I urged holders to buy, arguing why STAG had reached peak pessimism, even as Wall Street analysts “moved to cut their estimates markedly.”

As such, the dip-buyers in late 2022 correctly anticipated the US economy wouldn’t fall into a debilitating recession. Furthermore, the steep pullback in March was also defended robustly by astute dip-buyers, as the undue concerns of a significant credit crunch didn’t materialize. As such, top industrial REITs like Stag Industrial have also benefited from more stable market conditions, improving bid-ask spreads, which are beneficial for its acquisition and disposition activities.

However, the financial media has started to spook investors again following the Fed’s “hawkish pause” last week. As a reminder, the FOMC voted to keep rates unchanged in the 5.25% to 5.50% range. However, given the resilient US economy, the committee also tempered their forecasts for rate reductions in 2024.

Stories about an economic recession have reappeared as market participants contemplate the impact of a higher-for-longer Fed, adjusting their expectations on valuations.

As such, real estate stocks have also suffered the brunt of the broad market selloff last week, given the sector’s sensitivity and exposure to interest rate fluctuations.

STAG was also not immune to last week’s hammering, falling close to its late August lows ($34.50 level). As such, I believe it’s opportune for me to update holders on whether they should consider capitalizing on the recent pullback to buy more shares.

Stag Industrial posted a Fall business update recently. The company has continued to experience robust recovery of its underlying operating performance. Accordingly, Stag Industrial updated that “93.2% of expected 2023 new and renewal leasing has been addressed,” leading to a “cash rent change of 30.8%.” As such, the momentum from its second quarter or FQ2 earnings performance has continued, providing more clarity for investors for the second half. Management also maintained its FY23 same-store cash NOI guidance between 5% and 5.25%.

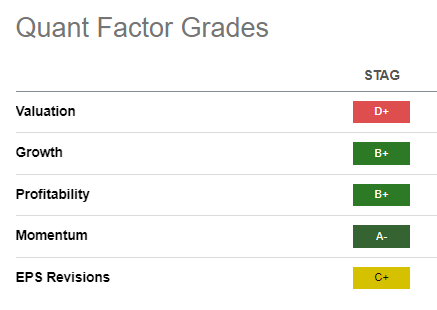

STAG Quant Grades (Seeking Alpha)

Seeking Alpha’s Quant assigned STAG with favorable factor grades for growth (B+), profitability (B+), and Momentum (A-). STAG’s momentum has been particularly solid, likely attracting REIT investors anticipating more robust performance from industrial leaders like STAG.

As such, I’m not surprised that STAG has significantly outperformed its real estate peers (XLRE) since STAG/XLRE bottomed out in July/August 2022. The question is whether buyers are willing to continue paying a premium against STAG’s premium valuation (assigned a “D+” valuation grade), given its robust recovery from its 2022 lows.

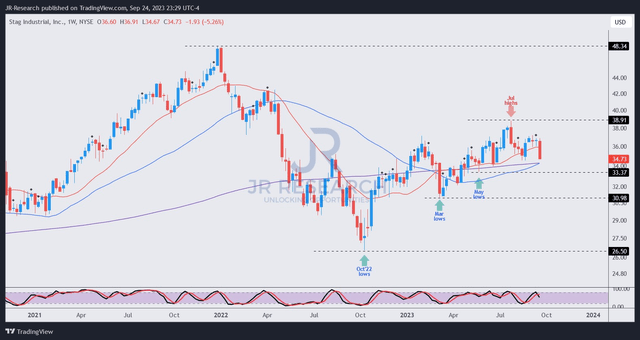

STAG price chart (weekly) (TradingView)

As seen above, STAG has regained its upward bias, corroborating robust buying sentiment. It has formed constructive higher lows and higher highs since its 2022 bottom ($26.50 level), justifying its “A-” momentum grade.

As such, I gleaned that the recent pullback from its July highs ($39 level) represents a solid opportunity for investors who missed buying more earlier this year to add exposure.

I anticipate robust support against its August lows ($34.50 level), with May lows ($33.40 level) providing a more aggressive dip-buying opportunity if we face further downside volatility.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here