Investment Thesis

Core & Main’s (NYSE:CNM) revenue growth prospects are mixed with resilient demand in the municipal markets and a potential recovery in the single-family residential market expected to be partially offset by the softness in the light non-residential construction market and multifamily housing market. In terms of margins, the company’s gross margin should normalize in the coming quarters as inventory costs catch up with market prices. This, coupled with difficult comparisons from 2H 2022 should result in a Y/Y decline in gross margins in the back half of this year. I would prefer a wait-and-watch approach for some improvement in the end markets and bottoming of CNM’s gross margin before turning bullish on the stock. So, despite the stock’s low valuations, I have a neutral rating.

Revenue Analysis

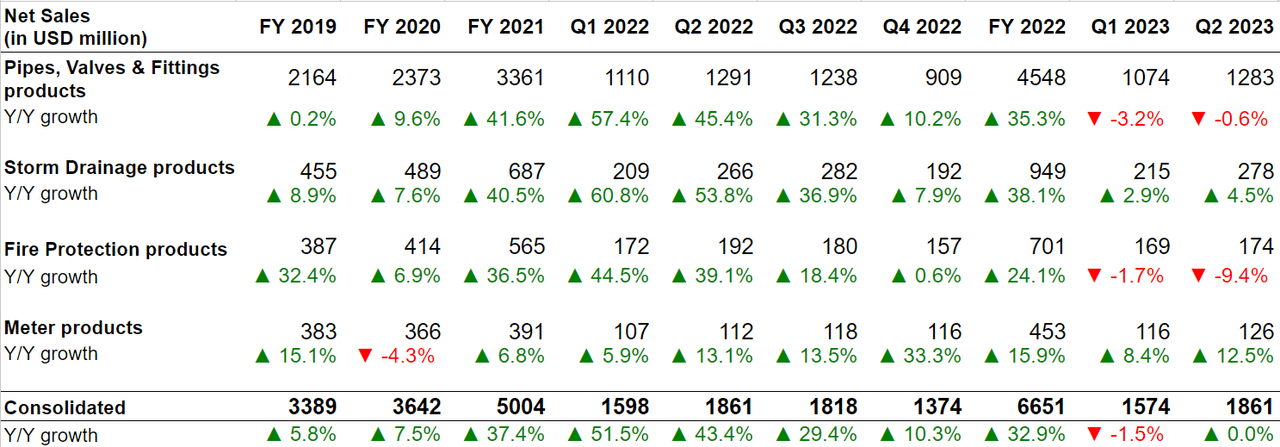

After seeing strong growth in the last couple of years due to healthy end-market demand, the company’s sales have seen some headwinds in the recent quarter as high interest rates began impacting demand, especially in the residential end-market. In the last quarter, the company’s sales remained flat Y/Y at $1.86 billion with an organic volume decline of mid-single digits offset by a low single-digit increase in prices and a 3% contribution from recent acquisitions.

CNM’s Revenue Growth (Company data, GS Analytics Research)

Looking forward, the company’s near-term revenue outlook is mixed.

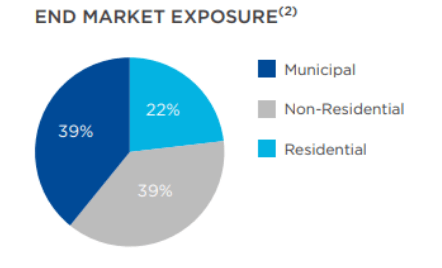

CNM’s End Market Exposure (Company Presentation)

The demand in the municipal repair and replacement end market remains resilient, supported by healthy municipal budgets, increased utility rates and benefits from IIJA funding which allocates ~$55 billion to water and wastewater-related infrastructure projects.

In the residential business, the company’s demand is tied to investment in lot development by the builders. While the demand in the first half of the year was weak, the second half is expected to be better due to the limited supply of developed lots and increased homebuilder interest in lot development after the strong spring selling season. The Y/Y comparisons in this market are also getting easier in the coming quarters thanks to depressed market conditions in the back half of last year. While high-interest rates still pose a risk, I expect some recovery in the coming quarters.

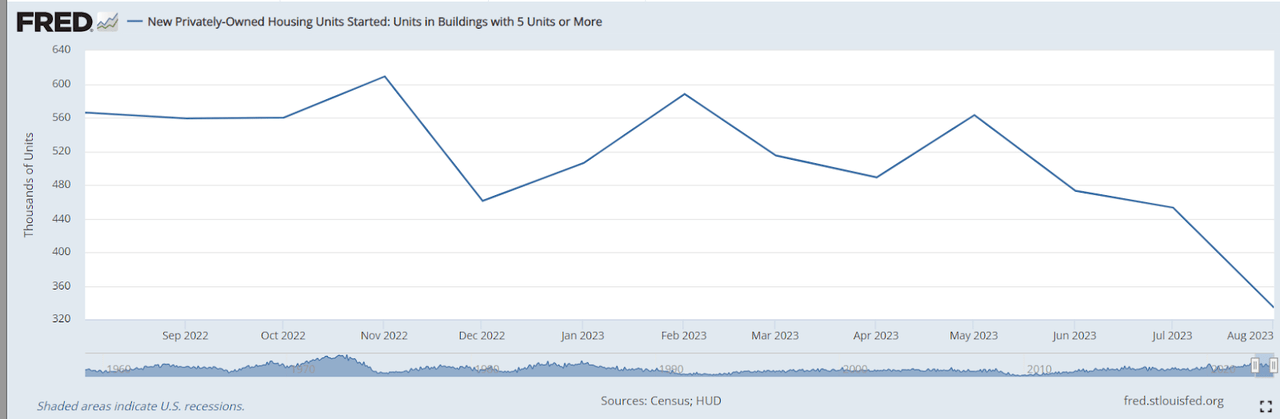

The company’s non-residential end market is expected to be weak though. The rising interest rate and tightening lending standards by banks are impacting non-residential starts. There are parts of the business that have already started weakening. For example, warehouse construction by e-commerce and Omnichannel retailers has meaningfully slowed after a strong last couple of years. The company also includes the multifamily housing business in this end market and multifamily housing starts have seen steep corrections in recent months.

Multifamily Housing Starts (FRED)

There is also pressure on other light non-residential starts like offices, retail restaurants, etc. due to high-interest rates. To some extent the weakness in light commercial business should be offset by strength in heavy industrial construction helped by the ongoing reshoring of manufacturing facilities in the U.S. catalyzed by government stimulus like the CHIPS and Science Act and Inflation Reduction Act, however, management still expects soft non-residential demand for its products in the coming quarter.

So, the company’s end markets are expected to be mixed in the near term with resilient demand in municipal markets and some recovery in the single-family housing market expected to be offset by a slowdown in the non-residential market (including multifamily construction). The pricing should be slightly positive. I am not expecting further price increases but the carryforward impact of price increases over the last few quarters should help. I believe the company can post flattish to low single-digit sales growth in the near term.

Margin Analysis

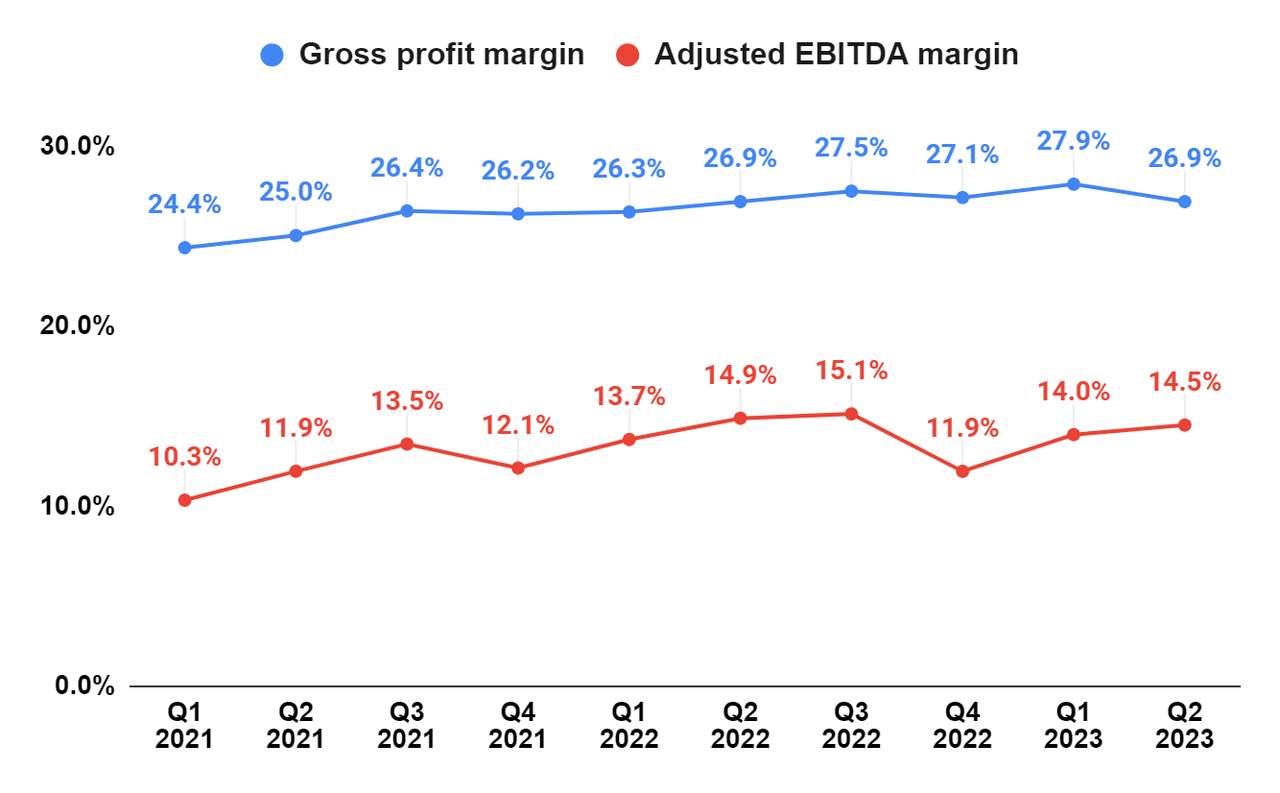

Last quarter, the company posted a gross margin of 26.9% which was in line with the prior year’s second quarter. Adjusted EBITDA margins were down 40 bps Y/Y to 14.5% primarily due to a 40 bps increase in SG&A as a percentage of net sales as a result of cost inflation and acquisitions.

CNM’s Gross margin and Adjusted EBITDA margin (Company data, GS Analytics Research)

Looking ahead, the company’s gross margin should normalize over the coming quarters as inventory costs catch up with market prices. One thing that has benefited the company’s gross margins in recent quarters is the high amount of low-cost inventory it was carrying on its balance sheet. Due to supply chain constraints last year, the company stocked more inventory than it normally carries. This inventory was bought prior to recent price increases from suppliers. This benefit was reflected in the company’s gross margins which peaked in Q1 2023 at 27.9%. As the company continues to sell its low-cost inventory and its inventory price catches up with the market price, its gross margins should see a correction from the recent peak. This has resulted in a sequential decline in Q2 2023 gross margin versus Q1 2023 levels. The company’s gross margin should continue to normalize in the coming quarters which coupled with difficult comparisons from 2H 2022 should result in a Y/Y decline in margins in the back half of this year.

Valuation and Conclusion

CNM Stock is trading at 13.41x consensus FY23 EPS estimates and 13.11x FY24 consensus EPS estimates which is not very pricey. However, the company’s near-term growth outlook is mixed. The company faces headwinds in the light non-residential construction market as well as the multifamily market which should be offset by resilient municipal markets and a potential recovery in the single-family residential market. The margin outlook isn’t very encouraging either and gross margins should continue to normalize. I would prefer waiting for some improvement in the end markets and bottoming of CNM’s gross margin before becoming more optimistic about the stock. For now, I have a neutral rating.

Read the full article here