RiverNorth/DoubleLine Strategic Opportunity Fund (OPP) is a closed-end fund, or CEF, that has proven itself to be a very good way for investors to earn a high level of income from the assets in the portfolios. This is immediately apparent in the fund’s whopping 15.13% current yield. This is substantially higher than pretty much anything else in the market, including the normally very high yields that can be found in the traditional energy sector. However, as I have noted numerous times in the past, any time that a fund obtains a yield that is significantly above 10%, it is a sign that the market expects that the distribution will need to be cut in the near future. As such, we will want to pay very close attention to the fund’s finances as part of our analysis.

We last discussed this fund in the middle of March. At that time, the market expected that the Federal Reserve would begin cutting interest rates by September 2023. Obviously, the market was incorrect about that, which is in line with what I expected. Regular readers can attest to this, as I have been saying that the market has been overly optimistic about the potential for a rate cut for most of this year. Fortunately, this fund was not affected too much by the failure of the central bank to live up to the market’s expectations, as it is only down 3.46% since the time that my last article was published:

Seeking Alpha

The fund’s performance looks even better when we consider the distributions that it has paid out over the period in question. When we factor these in, investors in the fund are 5.10% richer than they were at the start of the period:

Seeking Alpha

Naturally, though, a great many things have changed since March and the previous analysis is now out of date. As such, it is prudent to revisit this fund and update our thesis to account for changes in the broader environment. We also naturally want to have a look at the fund’s recently released annual report, as that should give us a good idea of how well its distribution is covered.

About The Fund

According to the fund’s website, the RiverNorth/DoubleLine Strategic Opportunities Fund has the objective of providing its investors with a high level of current income and total return. The website goes into much more detail:

RiverNorth/DoubleLine Strategic Opportunities Fund, Inc. seeks to provide current income and overall total return.

While RiverNorth Capital Management, LLC believes markets are generally efficient, closed-end funds offer a unique structure whereby investors can purchase a diversified fund and potentially generate additional return through the change in the relationship between the closed-end fund’s market price and Net Asset Value. RiverNorth also believes combining a closed-end fund strategy with a proven fixed income manager such as DoubleLine Capital LP provides an attractive investment vehicle for investors.

This potential for additional return between the fund’s market price and net asset value is a belief shared by Saba Capital Management, which actually markets an exchange-traded fund that is built around this concept. This exchange-traded fund (“ETF”) is, of course, the Saba Closed-End Funds ETF (CEFS), which I will discuss in another article at a later date.

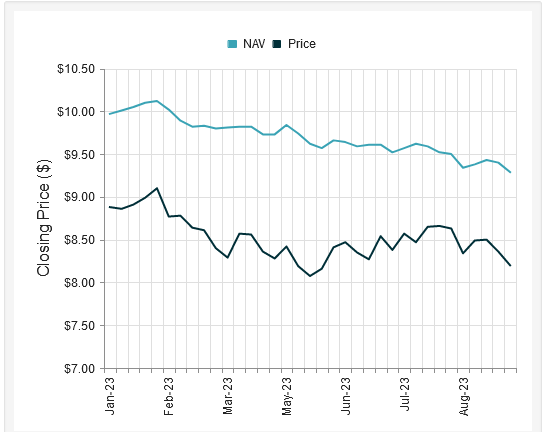

I have noted in several previous articles that closed-end funds have a tendency to deliver a substantially different performance in the market than their underlying portfolio delivers. The PIMCO funds are notorious for this, as I discussed here. The RiverNorth/DoubleLine Strategic Opportunities Fund shares this trait, although it is nowhere near as pronounced. This chart shows the fund’s portfolio performance against its market price over the past twelve months:

CEF Connect

We can see some similarities between the two factors. For example, the fund’s shares were consistently trading well below the fund’s net asset value over the entire period. This technically means that investors could get more money if the fund were liquidated than could be obtained by selling the fund’s shares in the market. In this case, though, the difference between the price of the fund’s shares and the liquidation value of its portfolio differs over time. Over the past 52 weeks, the fund’s shares have traded at anywhere from a 16.31% discount to a 3.87% discount on net asset value. Thus, RiverNorth’s theory does appear to be correct in that it can be possible to profit from changes in the difference between the fund’s shares and the net asset value. However, as is always the case with trading, it is important to time the purchase correctly, which is a difficult task to accomplish. In addition, funds that trade at a discount to net asset value very rarely switch to trading at a premium to net asset value. It has happened before, though, but these shifts usually occur during market panics or periods of euphoria.

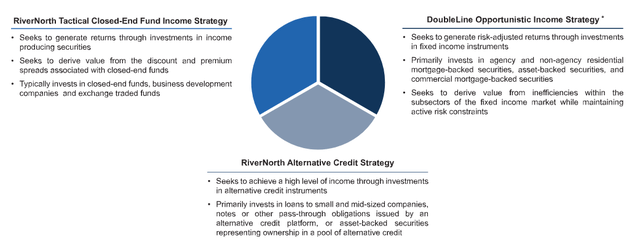

As I noted in previous articles on this fund, this one is fairly unique in that it utilizes two managers for its portfolio. We can see the basic structure here:

RiverNorth

This graphic, which comes directly from the fund’s website, suggests that the fund’s portfolio is divided up into thirds, with RiverNorth managing two-thirds and DoubleLine managing the remaining third. However, the fund’s portfolio is currently not weighted that way. In fact, right now, DoubleLine is managing 64% of the fund’s portfolio:

RiverNorth

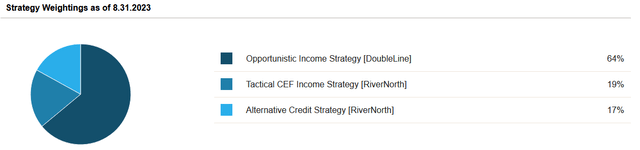

The last time that we examined the fund, only 61% was allocated to Opportunistic Income Strategy, so clearly that weighting has increased. This is the part of the fund that is invested in traditional fixed-income assets such as traditional fixed-rate coupon bonds. As such, the expectation here appears to be that these assets will outperform relative to the rest of the portfolio. This has not been the case over the period of time since we last discussed the fund. As we can see here, alternative credit securities, such as floating-rate notes, have substantially outperformed fixed-rate bonds:

Seeking Alpha

In this case, the two indices that were selected for comparison are the Bloomberg U.S. Aggregate Bond Index (AGG) and the Bloomberg U.S. Floating Rate Note <5 Yrs Index (FLOT). These two indices seem to be as good as any, since the former tracks fixed-rate domestic bonds and the latter tracks domestic floating-rate notes. The floating rate note index substantially outperformed the aggregate bond index since March, which was expected. As I explained in a previous article, floating-rate securities hold their value when rates increase because they will always deliver a yield that is competitive with other debt securities in the market. Fixed-rate securities, in contrast, have a coupon that does not change over time so their price will adjust based on the market interest rate in order to compete with brand-new securities with similar securities.

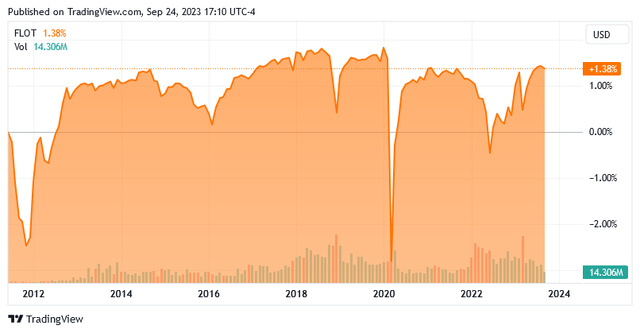

The fact that the RiverNorth/DoubleLine Strategic Opportunities Fund is heavily weighting its assets towards the fixed-rate portion of its portfolio positions it very well to profit from a decline in interest rates. I noted this in my previous article on the fund, but it now appears that the fund is even more committed to this thesis. After all, the securities that comprise this portion of the portfolio should increase in price when interest rates decline. The same cannot be said for floating-rate securities, as is evident by the floating-rate index being almost perfectly flat for more than a decade:

Seeking Alpha

The immediate question then becomes whether or not the Federal Reserve will cut rates. Chairman Powell has been consistently stating that the central bank will keep rates “higher for longer,” but the exact meaning of that is uncertain. If the central bank were to cut rates down to 3% and keep them there permanently, that would still be “higher for longer,” based on the rate that we have become accustomed to over the past fifteen years.

Goldman Sachs and Bank of America both suggest that the first rate cut could come sometime in the second quarter of 2024. Of course, this prediction was made in mid-August and the headline consumer price index actually increased in August to 3.7% year-over-year. This may or may not impact the Federal Reserve’s decision to cut, and of course, the second quarter of next year is still several months away so a lot could happen with inflation by that time. It is therefore quite uncertain when interest rates will begin declining and pushing up bond prices. Fortunately for this fund though, it seems unlikely that the Federal Reserve will take rates much higher from today’s levels. Thus, the fund will probably not take huge losses from this outsized portion of its portfolio going forward. The worst is almost certainly behind us at this point.

Leverage

One of the defining characteristics of closed-end funds like the RiverNorth/DoubleLine Strategic Opportunities Fund over other types of funds is their use of leverage to boost the effective total return and yield of the portfolio. I explained how this works in my previous article on this fund:

Basically, the fund is borrowing money and using that borrowed money to purchase fixed-income assets. As long as the purchased assets have a higher yield than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. As the fund is capable of borrowing at institutional rates, which are significantly lower than retail rates, this will usually be the case.

Unfortunately, the use of debt in this fashion is a double-edged sword because leverage boosts both gains and losses. As such, we want to ensure that a fund is not employing too much leverage because that would expose us to too much risk. I do not usually like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the RiverNorth/DoubleLine Strategic Opportunities Fund has leveraged assets comprising 36.17% of its portfolio. This is clearly above the one-third maximum that I would like to see. It is not drastically above that level though, and as I noted in my previous article, the fund can probably handle a higher level of leverage than an equity closed-end fund. This is because fixed-income securities tend to be less volatile than common equities. The fund’s current level of leverage is above the 34.77% level that it had back in March though, which is somewhat concerning as this is a sign that the fund’s leverage and therefore risk is increasing. If the Federal Reserve does surprise the market and raises rates in November, then this could cause the fund to suffer some significant losses.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the RiverNorth/DoubleLine Strategic Opportunities Fund is to provide its investors with a high level of current income. In order to achieve this objective, it invests primarily in debt securities that deliver the majority of their returns in the form of direct payments to their investors. The fund’s portfolio also includes closed-end funds, which do the same to an even greater degree as their yields tend to be higher than ordinary bonds. The fund then applies a layer of leverage to boost its yields beyond that provided by the securities in the portfolio. It takes all of this incoming money and pays it out to its shareholders, net of expenses.

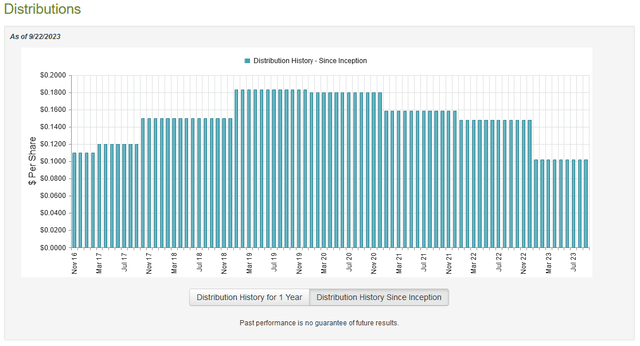

As might be expected, this gives the fund a very high yield itself. The RiverNorth/DoubleLine Strategic Opportunities Fund pays a monthly distribution of $0.1021 per share ($1.2252 per share annually), which gives the fund a whopping 15.31% yield at the current price. The fund has, unfortunately, not been particularly consistent with its distribution over the years. In fact, it has changed its payout many times over its lifetime:

CEF Connect

The fund’s distribution history was quite good until 2020, when the first of a series of distribution cuts began. The most recent cut was by far the largest though and was almost certainly caused by a series of losses in 2022 as rising interest rates pushed down bond and other asset prices. This distribution history will almost certainly prove to be a turn-off for any investor who is seeking a stable and secure source of income to use to pay their bills. With that said though, most fixed-income funds have had to vary their distributions over time as interest rates have a significant effect on the profitability of investing in this market. This fund is, admittedly, not exclusively a fixed-income fund but as it has been weighted heavily to that sector for a while, we can consider it one.

However, the fund’s past performance is not necessarily the most important thing for anyone who is purchasing the fund today. After all, any investor who buys the fund today will receive the current distribution at the current yield. Such an investor will not be adversely affected by actions that the fund has had to take in the past. As such, the most important thing is how well the fund will be able to sustain its current distribution. Let us investigate this.

Fortunately, we do have a very recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the full-year period that ended on June 30, 2023. This is a much newer report than the one that we had available to us the last time that we discussed this fund. This is quite nice because it should give us a good idea of how well the fund performed over the first half of this year, which was generally far more optimistic than most of 2022. As I mentioned in a few previous articles, the market was expecting that the Federal Reserve would cut rates during the second half of 2023 during much of the first half of the year and was pricing bonds accordingly. This could have given the fund the potential to earn some profits by selling appreciated bonds in a friendly market.

During the full-year period, the RiverNorth/DoubleLine Strategic Opportunities Fund received $22,307,745 in interest and $4,109,979 in dividends from the assets in its portfolio. When we combine this with a small amount of income from other sources, the fund reported a total investment income of $26,482,261 over the period. It paid its expenses out of this amount, which left it with $21,517,833 available for shareholders. This was, unfortunately, not nearly enough to cover the $32,884,481 that the fund paid out in distributions over the period. At first glance, this will almost certainly be concerning as we typically like a fixed-income closed-end fund to fully finance its distributions out of net investment income. This one is obviously failing to accomplish that.

However, the fund does have other methods that can be employed to generate the money that it needs to cover the distribution. For example, the fund might have been able to earn some capital gains by selling appreciating securities into the optimistic market that existed earlier this year. Unfortunately, it failed to accomplish this during the period. The reported net realized losses of $6,667,210 and had another $9,087,794 net unrealized losses during the period.

Overall, the fund’s net assets went up by $1,535,659 during the period, but it was only able to accomplish this because it did a $33,999,204 capital raise during the year. The fund’s net assets would decline if we were to exclude this capital raise. That is a repeat of the previous year, during which the fund conducted a $67,529,800 capital raise but still saw its net assets decline. The fund basically failed to cover its distributions for two years in a row and it is depending on issuing new shares to fund the distribution. This certainly explains why the market appears to think that this distribution is unsustainable, as it is. Ultimately, the fund cannot rely on new investors reliably injecting new money into it just to re-distribute that money to existing investors.

Valuation

As of September 21, 2023, (the most recent date for which data is available as of the time of writing), the RiverNorth/DoubleLine Strategic Opportunities Fund has a net asset value of $9.22 per share but the shares only trade at $8.10 each. This gives the fund’s shares a 12.15% discount on net asset value at the current price. This is quite a bit better than the 10.45% discount that the shares have had on average over the past month. As such, the price looks quite reasonable if you want to purchase this fund today.

Conclusion

In conclusion, the RiverNorth/DoubleLine Strategic Opportunities Fund is a rare fund that has multiple fund managers who are each only responsible for a portion of the overall portfolio. This allows it to have a unique strategy that relies on closed-end funds, floating-rate alternative credit securities, and traditional fixed-rate bonds. The fund’s current portfolio positions it very well to take advantage of rate cuts as the large allocation to fixed-rate bonds will appreciate in value as rates go down. However, investors may have to wait a while for that to happen, as the Federal Reserve seems unlikely to cut rates in the near term. That would not be a problem if the distribution were sustainable, but the fund is relying heavily on new investors to finance distributions to the existing shareholders. This is unsustainable and as such, buying this fund today might be a gamble.

Read the full article here