Thesis

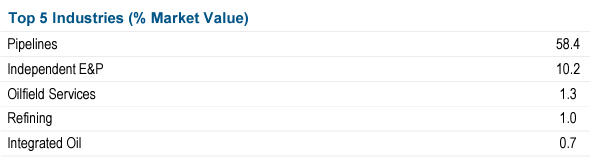

The PIMCO Energy & Tactical Credit Opportunities Fund (NRGX) is an energy equities closed-end fund (“CEF”). At least for now. The structure contains mainly master limited partnership equities (MLPs) and independent exploration and production companies:

Top 5 Industries (Fund Fact Sheet)

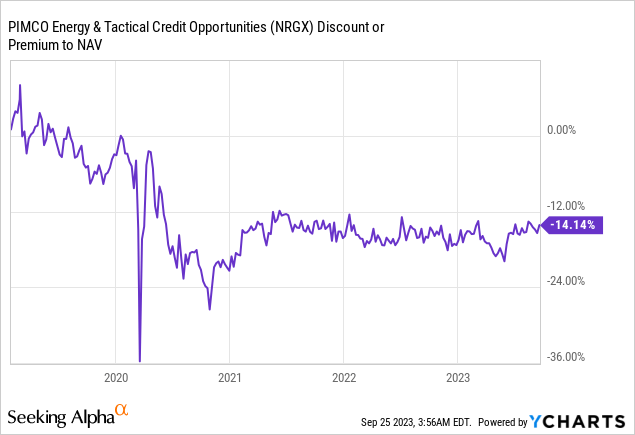

Just like most MLP CEFs, the fund is currently trading at a very large discount to net asset value:

MLPs were greatly affected by the 2020 Covid crash, and even if they did eventually recover in 2022, the market really does not like leverage on top of this asset class, thus trading CEFs in the space at a large discount to NAV.

There are several ways to close the gap to NAV for a CEF – those include share repurchases, decrease in the leverage ratio, outperformance of the general market for the asset class, or finally liquidation. Interestingly, NRGX has chosen to close the discount via a type of liquidation.

NRGX is becoming a credit fund

As per its Friday announcement, the CEF will become a credit fund:

NEW YORK, Sept. 22, 2023 (GLOBE NEWSWIRE) — PIMCO Energy and Tactical Credit Opportunities Fund (NYSE: NRGX) (the “Fund”) announced that it will change its name, ticker symbol, investment objectives and guidelines, and portfolio manager lineup, as further described below. Pacific Investment Management Company LLC (“PIMCO”), the investment manager of the Fund, expects that the changes will reduce the Fund’s focus on investments linked to the energy sector in favor of a primarily income-oriented objective and broader, multi-sector credit mandate, which PIMCO believes has the potential to strengthen secondary market demand for the Fund’s common shares.

The Fund will be renamed “PIMCO Dynamic Income Strategy Fund” and its New York Stock Exchange ticker symbol will be “PDX”. The Fund’s new investment objectives will be to seek current income as a primary objective and capital appreciation as a secondary objective. The Fund will also rescind its policy to invest, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in investments linked to the energy sector. The Fund will, however, continue to invest at least 25% of its total assets in the energy industry.

In accordance with Rule 35d-1 under the Investment Company Act of 1940, as amended, the Fund will provide shareholders with 60 days’ written notice of the rescission of the Fund’s non-fundamental 80% policy. All of the changes described above will be effective on November 21, 2023 (the “Effective Date”).

As per the above announcement, the fund will no longer be an energy sector CEF, but will move to having a multi-sector credit mandate.

It seems the CEF management team was mulling this move for a while, with the vehicle having an extremely high cash balance as of the last fact sheet:

Sector Allocation (Fund Fact Sheet)

We can notice in the above table an 18% allocation to “US Government Related” instruments, which denote T-Bills. A regular CEF usually carries only a 1% to 3% cash balance.

The CEF is not liquidating, but fully changing its mandate and collateral composition. Instead of running energy risk exposure, generally driven by oil prices, investors in this CEF will be exposed to risks driven by interest rates, credit spreads, and default risks associated with a yet-unknown pool of assets.

What is actually happening next

The fund has notified the market on Friday, September 22, regarding the upcoming changes, and it will begin liquidating most of its energy holdings. To note that the CEF cannot start purchasing credit instruments as per its new mandate until November 21, considered the “Effective Date” as per Rule 35d-1.

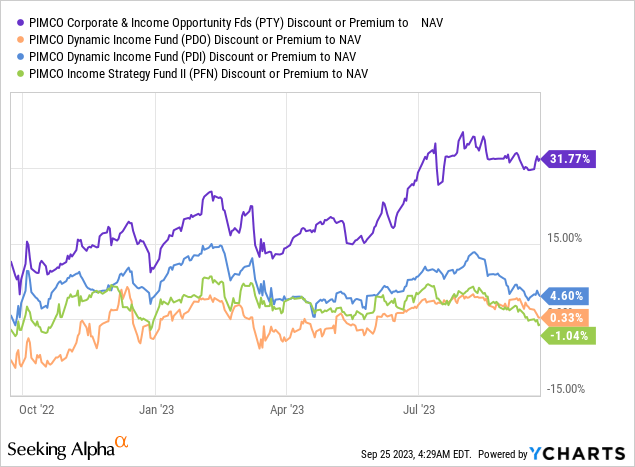

As an investor, one will see the fund moving into cash-like instruments, decreasing leverage and generally becoming a fund with less and less MLP exposure. This on its own should result in an aggressive narrowing of the discount to NAV. Furthermore, PIMCO is a golden standard in the credit CEF space, with most of its funds trading at premiums to NAV:

We can see from the above graph how the likes of PIMCO Corporate & Income Opportunity Fund (PTY) and PIMCO Dynamic Income Fund (PDI) trade at premiums to NAV, whereas the other two PIMCO credit funds are flat versus their stated net asset value. In a nutshell, NRGX moving to become a credit fund will see it trade at or above net asset value, given the precedence with the other PIMCO credit funds.

We, therefore, expect a 14% gain here in the NRGX shares, with the market closing the gap between the NRGX net asset value and its market price. We actually like this move by PIMCO because outside of providing a substantial instantaneous gain to current shareholders, it also eliminates a “black eye” from the PIMCO family. Big fund managers should never have their CEFs trade at substantial discounts because it speaks poorly regarding the platform. The PIMCO credit CEFs trade at premiums to NAV because the market is voting on PIMCO as an alpha generating platform in the space. Having a large number of CEFs from a particular platform trade at substantial discounts impedes the creation of new funds and subtracts from the brand name.

Inside ownership

The story runs a bit deeper for NRGX, with the PIMCO CIO Daniel Ivascyn running a very large position in this fund:

The estimated net worth of Daniel J Ivascyn is at least $52 Million dollars as of 2023-09-25. Daniel J Ivascyn is the SEE REMARKS of PIMCO Energy & Tactical Credit Opportunities and owns about 2,169,259 shares of PIMCO Energy & Tactical Credit Opportunities (NRGX) stock worth over $37 Million. Daniel J Ivascyn is the See Remarks of PIMCO Dynamic Income Fund and owns about 370,443 shares of PIMCO Dynamic Income Fund (PDI) stock worth over $6 Million. Daniel J Ivascyn is also the See Remarks of PIMCO Dynamic Credit & Mortgage Income Fund and owns about 290,295 shares of PIMCO Dynamic Credit & Mortgage Income Fund (PCI) stock worth over $6 Million.

With NRGX set for a gain of 14% on the back of its mandate change, Ivascyn is set for a nice payday based on pure mark-to-market changes. A fact acknowledged by famed activist hedge fund manager Boaz Weinstein:

Twitter / X Feed (X)

With PIMCO management deeply invested in NRGX with their own cash, it was just a matter of time until a viable solution to close the arbitrage would be found.

A substantial insider ownership creates a high alignment of interests between regular shareholders and insiders, with both having an interest in high returns for fund holders rather than just seeing the CEF as a way to clip high management fees.

Conclusion

NRGX is a closed-end fund. The vehicle is currently focused on MLP equity, but that is set to change. The fund just announced a mandate restructuring on Friday, September 22nd, with the CEF set to become a credit focused closed end fund.

This move is a game-changer for this name, with the CEF currently trading at a shockingly high -14% discount to NAV. PIMCO is a golden standard in the CEF space, but NRGX has been dragged down by its asset class, with MLP equity trading at discounts in all CEFs presently in the market.

We expect a substantial rally in the shares on the open on September 25, driven by the market narrowing the discount to NAV for the fund. The vehicle will start liquidating its energy exposure and moving into cash until the effective date of its new mandate, which is November 21st.

All PIMCO credit CEFs trade either flat to NAV or at premiums to net asset value, and NRGX is set to follow suit under its new name “PIMCO Dynamic Income Strategy Fund.” To note that PIMCO CIO Daniel Ivascyn has a substantial position in NRGX, and is set to benefit from this mandate change, together with the rest of the fund shareholders. Expect an aggressive rally in the name, hence we are a Strong Buy for the fund here.

Read the full article here