This article considers gold (XAUUSD:CUR) and the SPDR Gold Shares ETF (NYSEARCA:GLD) as a means for portfolio diversification, makes the argument that gold will likely outperform equities over the next 5-10 years, and introduces a new way of considering the inherent value of gold. Investors might consider tilting their portfolio weights in favor of gold, pivoting away from an equity-dominant allocation.

Let’s Address the Elephant In the Room

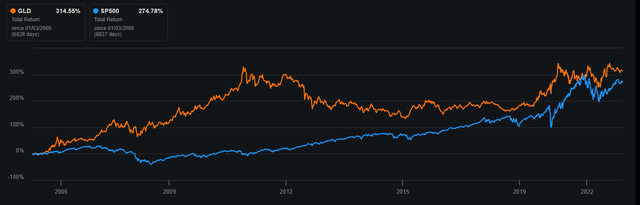

Why has a passive bar of metal outperformed the S&P 500 since January 2005?

Since GLD was launched in late 2004, it has beat the S&P 500 total return by about 40% – amounting to well over 1% of outperformance per year. Of course, there have been a few years when GLD has massively underperformed – gold basically had a lost decade after 2011 – but the long run result is quite clear, and it should cause investors to pause and think about what is going on.

GLD vs SP500 (Seeking Alpha)

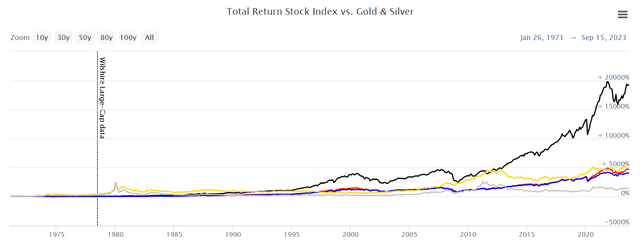

And this isn’t exactly a special time in history. Since 1971, the year when the price of gold was no longer pegged to a fixed dollar number, gold has matched the price return of the S&P 500 and Dow Jones Industrial Average. And up until the gold lost decade in 2011, it had even matched the total return of equities.

The chart below shows the time series since 1971 according to Longtermtrends. The black line is the equities total return index. The gold line is the return of gold. The red and blue lines are the price returns of the S&P and Dow Jones. The silver line is the return of silver. The black and gold lines intersecting in 2011, right before gold’s lost decade, shows that gold kept pace with the total return of equities for 40 years from 1971 to 2011.

Total Return Stocks vs Gold (LongTermTrends)

Also, while its long-term return is not inferior to that of stocks, the price action year to year and month to month was uncorrelated. Basic statistics and portfolio theory demonstrates that combining uncorrelated assets with similar expected returns will substantially decrease portfolio volatility and increase a portfolio’s sharpe and sortino ratios (ie. risk-adjusted returns). Gold is a compelling asset class that deserves consideration for the serious long-term investor.

But how did we get here? I learned a few years ago in college that gold was not a good investment because it did not produce cash flows like stocks or bonds. A bar of metal is not linked to a value-creating enterprise. Warren Buffett has famously stated this as some of the shortcomings of gold. Yet, the price action over the last 50 years speaks for itself. Has the market been wrong for 50 years – just hopelessly fantasizing about castles in the air glittering like the metal it loves so much?

If gold has no yield, then why are central banks buying so much of it and forgoing yielding assets like U.S. treasuries? Even if ditching treasuries is for the purpose of diversifying away from the dollar, why not get stuff like domestic real estate which can at least be used to generate a rental cash flow?

The last thing about this that doesn’t any make sense is that people will sometimes say that gold has natural demand as an industrial commodity: this is supposedly what gives it some intrinsic value. I used to say this too. Unfortunately, it’s one of those things that sounds reasonable at first but completely falls apart upon closer inspection. Silver, copper, and steel have way more industrial applications than gold, yet they are not nearly as coveted. Usually, the way to explain this is to say that there is way more silver, copper, and steel than there is gold. Producing gold is harder so there is a structural supply shortage. But if we looked at things like stock-to-flow ratios to get a sense of new supply versus existing supply, we see that gold also isn’t exceptional. For example, rhodium is an industrial commodity that has a higher stock to flow ratio than gold, but central banks do not hold any rhodium reserves.

A Theory About Gold

We need to broadly rethink how we think about gold. Better yet, maybe we need to remember how we thought about gold.

“Gold is money, everything else is credit.” – J.P. Morgan

This line is familiar to many with some background in economic or financial history. It is a nod back to the days of the gold standard, when base money could not be created out of thin air.

The truth is that fiat that is backed by no physical commodities is something that is truly new in human history. Currency debasement is nothing new – the Romans mixed gold with other metals so they could increase the money supply. Mixing debased the currency, but there was still a physical limit on coins that could be created. Since 1971, there has been no limit whatsoever on how many dollars can exist. Given that this is a new “experiment,” there is possibly a market-wide unspoken (and perhaps even subconscious) acknowledgement of gold as the last thing that was truly sound money – it was the last reference point of an unmanipulable measurement of value.

As a thought experiment, we should consider how the value of sound money would change in a normal economy. If we define sound money as something that has a fixed inflation rate (in the case of gold this is normally under 2% annually) and was used broadly as a medium of exchange and unit of account, then we should expect that the price of things denominated in the sound money should fall over time. The percentage it would fall should be related to advances in technological efficiency – the economy’s capacity to produce goods and services.

Put differently, if the amount of money stayed the same but people can suddenly create twice as many goods and services, then obviously the price of goods and services must decrease. (Prices wouldn’t necessarily decrease by 50%, because the marginal utility of goods and services across the economy will likely not be constant, but we know for a fact that prices should not stay the same or rise.)

The decrease in the price of things is caused by an increase in productivity. This is the same thing as saying that the value of sound money goes up due to an increase in productivity – purchasing power did indeed increase.

This is quite curious because something else also increases in value when productivity increases, and this thing is a lot more commonly regarded as a textbook investment today. I’m talking of course about equities, or ownership in the firms which became more efficient at producing things.

Let’s recap.

The economy gets more efficient and creates more goods and services. When measured in sound money terms, the prices of goods and services should fall because the supply has increased. This is another way of saying that the value of the money has increased. Incidentally, another thing that increases in value with sound money is a broad basket of firms which, through their R&D and improved organizations of human and physical capital, were largely the sources of productivity increases.

Both the sound money ((gold)) and the basket of firms (S&P 500) reference the same underlying thing: economic productivity. However, they reference it in slightly different ways. Sound money is like a claim on a growing output of productivity (the produced goods and services) because at any point you can trade your money for goods and services. The basket of firms is a claim on the underlying means of producing those goods and services; as a shareholder you earn a yield from the economic profit of this production.

In a way, the returns of sound money and equity indices should be nearly equal over the long term, assuming a totally free market. This is because the market cap of all businesses is a market estimation of the discounted cash flow of all businesses – an estimation of all future production discounted to the present day. The value of money at any given moment is everything it can buy right now plus a discounted value of things it could buy in the future (one could think of this as embedded optionality or a liquidity premium, both interpretations are logically sound). Both calculations reference estimates of future productions, and both calculations discount these estimates to the present day. Therefore, a shift in expectations of future production must affect both numbers by the same percentage, causing the long-term returns to track closely together.

This model definitely oversimplifies a lot. For one, there is no way to get a market value of all businesses since most businesses are not tradable and some cannot even be tracked or known (since we are talking about totally free markets this would also include businesses that operate outside of the law). Using the S&P 500 as the basket of firms introduces a natural bias towards gigantic companies. Also, the value of all things within an economy is ultimately endogenous, self-referencing, and reflexive, so isolating variables in the above manner of thinking doesn’t always work in real life. Moreover, “sound money” is a completely theoretical object, although gold does approximate it in many ways. Finally, this model doesn’t seem to explain where debt or credit cycles fit into the picture. So, it is quite imperfect.

However, I think approaching portfolio management with the understanding that “gold is (sound) money” and that “markets have a sort of monetary regression chain which stretches back to gold as the original measure of value” is better than approaching it from the perspective of “shiny brick doesn’t have yield.” And this isn’t really my opinion as much as it is an observation that one perspective offers a much more logical explanation about why gold has been able to keep up with a benchmark that most investors cannot beat.

The Structural Bullishness of Gold Today

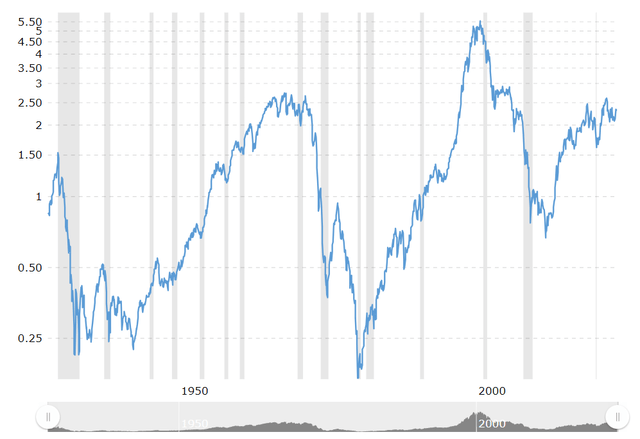

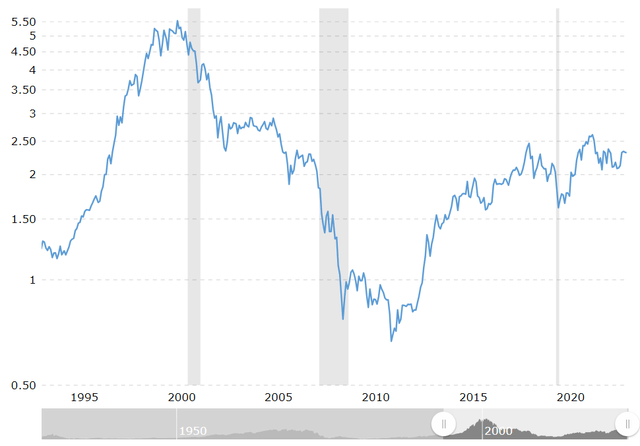

With that understanding, we can now look at the below chart. It is a time series of the (SPX) to Gold ratio, which enumerates how many troy ounces of gold it takes to buy 1 “share” of the S&P 500. In accordance with the theory, the ratio exhibits stationarity and oscillates between 4 and 0.25. If gold was truly a useless rock without yield, then we might expect the ratio to go up over time. (In other words, to look more like the SPX to USD ratio).

SP500 to Gold Ratio (macrotrends.net)

Today, this ratio stands at relative highs. Another way to consider these cycles is that between the major reversals in the time series, we are seeing lost decades in either equities or gold. For example, the period from the peak of the dot-com boom in 1999 to when stocks finally came out from the 2007-2008 crash in 2009 is basically a lost decade in equities. On the SPX to gold ratio chart, this time is covered by the downward trend from 1999 to 2011. Remember, 2011 is basically when the gold lost decade started. From 2009 to today, equities have had a bull market, the same way gold had a bull market from 1999 to 2011. From 1999 to 2009, equities had a lost decade, the same way gold had a lost decade from 2011 to today. Now that gold has seemingly come out from its lost decade, the writing seems to be on the wall for gold outperformance over the next 5-10 years.

The exact timing of these cycles is of course the million-dollar question. What triggers investors to reevaluate and reprice the relationship between equities and gold?

The simple answer based on the theory above is that the trigger is when the estimate of future production implied by sound money is becoming overly detached from the estimate of future production implied by equities. If these estimates should be similar in the long run, then short term deviations should get corrected over time. Personally, I suspect the cycles themselves could be caused by short term credit cycles, which generally last between 5-15 years.

The complex and more complete answer is that it is all investor sentiment, which is hard to tell in the present moment. Multi-decade time series like the above chart puts these sentiments into perspective, and right now it is indicating structural bullishness.

The Haven Asset Factor

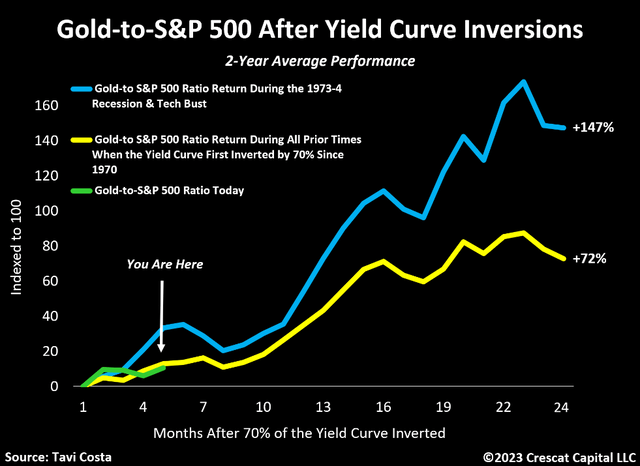

Gold is also seen as a haven asset. Buffett called it a way to go long on fear. This gives gold a unique advantage, especially right now. Much of the yield curve has been inverted for a while. Inversion has been one of the most reliable leading indicators for recessions.

Below is a chart made in April by Tavi Costa, first shared on his Twitter. (Note that this chart uses the gold to SPX ratio rather than SPX to gold, so think inverse of the chart above.)

Gold to SP500 After Inversions (Tavi Costa)

Now that it is September, we can fill in the green line for the next four months. The gold to SPX ratio has decreased from what it was in April. However, this is just four more months out of what historically takes a year or two to play out.

The fact that the economy today isn’t very stable, as evidenced by rising energy prices causing a surprise recently, contributes to the attractiveness of gold. If big volatility returns to the equities markets, then we may see inflows to gold as a haven asset.

The Inflationary Mega-Trend

I have written about the BRICS gold standard before, noting that there was nothing to it besides a potential buy the rumor, sell then news trade. The article is here.

However, there is a prevailing trend in which de-dollarization will continue even if there won’t be any meaningful progress in introducing another state-controlled monetary system. Countries will continue to diversify away from the dollar as it is only natural for countries to desire greater sovereignty. Gold is superior to switching into another fiat currency. In the process of buying gold, central banks might sell some of their existing fiat currency holdings. This is a tailwind for gold and a headwind for the dollar.

Concurrently, we are entering a time where inflation could become increasingly persistent. Some of this has to do with de-globalization. Over the last year, we’ve seen many American companies talk about nearshoring or friendshoring. This transition will be difficult and it’s something many countries around the world will undergo. As this happens, productivity of certain manufactured goods will of course be disrupted.

On top of this, today’s inflation is increasingly driven by money printing used to fund a persistent fiscal deficit. This has the effect of increasing aggregate demand, while not increasing productivity (and in some cases government overreach is choking out productivity). In such a scenario, higher interest rates might make the problem worse, especially because it increases the fiscal deficit.

Here’s a very quick summary of how that works. The government must service its debt by paying interest. The higher the yield of U.S. treasuries, the higher the interest payments will be. This is truer when more maturities are shorter, and the U.S. government must refinance more debt at the higher short-term rates. The U.S. has been running fiscal deficits for a very long time, and it probably won’t stop anytime soon. A shortfall in the deficit must be covered by borrowing money or printing new money. Both have been and will continue to be done. As rates rise, this deficit will get larger and more money either needs to be borrowed or printed to cover the shortfall. As we know, it is investors, financial institutions, pensions, sovereign states, and the Fed which hold U.S. government debt. And it is mostly held by the “public.” As the public receives these higher interest payments, they now effectively have more money to spend, which is going to be inflationary. Again, this is very much simplified, but it’s a gist of the current situation.

Unfortunately, we are at a point where the debt burden is getting to a point of breakneck acceleration. After all, interest compounds exponentially. Together with the de-globalization and de-dollarization going on outside the U.S., this is a setup for extremely persistent inflation over the next decade. I’m not exactly expecting hyperinflation, but I do not think inflation is going away anytime soon. Gold, as a scarce hard asset, is a primary beneficiary in this environment.

Risks

The main risk to this thesis is that the past does not have to repeat. We have decades of history which imply that something could happen over the next decade, but in truth anything can happen. It is possible that gold’s monetary properties have slowly chipped away over the years, such that it doesn’t fit the description of sound money anymore. Many things have monetary properties, and the conception of what exactly qualifies as a store of value, medium of exchange, and unit of account will obviously evolve over time. For example, people pile into index funds and real estate because these enable the owner to steadily grow their purchasing power. These assets have, to an extent, usurped some of the store of value functions that sound money should normally have. If yielding assets like securities and real estate are seeing more inflow not just as investments but also as stores of value, then the dynamic has indeed changed. The increased “monetization” of these other assets could explain why the SPX to gold ratio hasn’t gone below 0.66 over the last 30 years. A new normal for stationarity, hovering around 2-2.5 rather than 1 could come from equities taking away some of gold’s “sound money premium”.

SP500 to Gold Ratio (macrotrends.net)

Aside from all this, gold the monetary asset is potentially at risk of becoming more obsolete with the advent of Bitcoin (BTC-USD). Bitcoin is superior to gold in every way as a monetary asset. It is literally digital gold in the sense that if you could have gold’s scarcity, verifiability, durability, and quality as a bearer asset, but also wanted to improve gold by adding instant transportability, better divisibility, more censorship and seizure resistance, then Bitcoin would be it.

I have written two technical articles about Bitcoin on Seeking Alpha. The first article, The Bitcoin Thesis That No One Is Talking About, answers the question of where Bitcoin’s intrinsic value comes from (Bitcoin objectively has utility; this is an undisputable fact and you will see it in the article). The second article, Bitcoin: Why I’m Buying 14-Year-Old Tulips With Both Hands, covers ongoing and impactful Bitcoin developments that are relatively unnoticed by many crypto analysts.

The main way gold evades these risks is through the Lindy Effect. Traditions die slowly and important traditions may never pass at all. Gold is pretty to look at and it is too deeply embedded into cultures and the human psyche to be waved away. From the Bible to other ancient texts, gold has always symbolized wealth. People like things which we can hold and feel. Magic Internet Money like Bitcoin just doesn’t “feel” right to many people. There might be a generational factor here, and this might change with time, but the point is that gold is likely here to stay in the foreseeable future.

Conclusion

A 5-10 year period of gold outperformance versus equities is likely upon us. Since 2009, investors have become too accustomed to equity outperformance. Even when ZIRP briefly returned after March 2020, equities surged from the lows of the COVID-19 market crash and outperformed almost everything else. The assumption is that equities are safe, and that the S&P will eventually go up. The assumption is historically sound, but when the whole crowd is behaving one way, it could be more profitable to consider another way.

I don’t know if we will see a lost decade for the S&P 500, though I wouldn’t be very surprised if we do. Markets have a curious way of surprising most people. The long-term themes like de-dollarization and recurring inflation from fiscal factors are also persistent tailwinds for the price of gold.

Read the full article here