Back in October 2022, I wrote an article about Sibanye Stillwater (NYSE:SBSW), highlighting the long-term strategic shift that management is taking, leveraging its successful track record. Since then, PGM’s prices have fallen on the back of negative market sentiment and recession fears. On the other hand, the rise in gold prices is making the gold business of the company cash flow positive, after the disastrous 2022, marked by strikes and skyrocketing costs. This development has the potential to partially offset the deterioration of the PGMs division results. At the same time, both lithium projects of the company achieved positive developments in Q1’23. Overall, Sibanye looks in a comfortable position to withstand market turmoil and operational difficulties on the PGM’s front and continue to push towards expanding presence in the green metals space.

Operational update

Sibanye Stillwater published its Q1’23 operational update. The market had a rather negative reaction with the stock being down more than 5% in the pre-market.

Post-announcement market reaction (Seeking Alpha)

PGMs division performance deteriorated

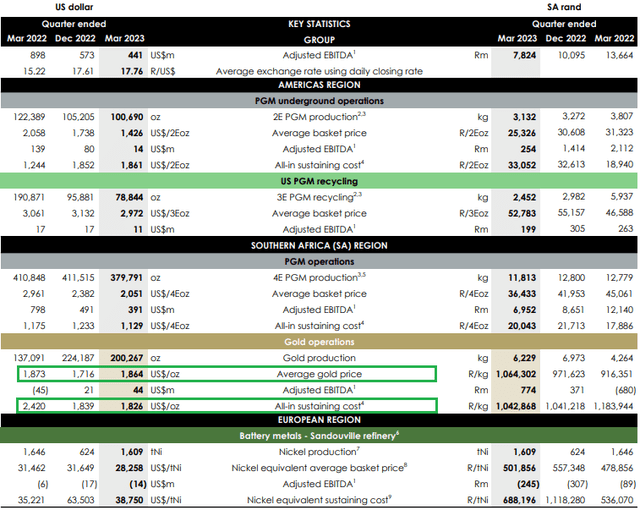

The release revealed persistent weakness in the PGMs business, mainly on falling metals prices, but further exacerbated by lower production numbers. Particularly bad were the results of the US PGMs division, where operations in the Stillwater West mine were disrupted in March 2023, due to structural damage of the shaft. As a result, the US division reported 17.7% lower production numbers and Adjusted EBITDA (AEBITDA) of only US$14M (-89.9% YoY).

SBSW’s Q1’23 Operational update (SBSW)

The main cash cow of the company – the South African’s PGMs division also posted lower production numbers of 379.8koz (-7.6% YoY) on planned closure of part of the operation and operational challenges, related to copper theft disruptions and adverse ground conditions. On the positive side, the SA PGMs division achieved slight reduction in AISC to US$1,129/4Eoz (-3.9% YoY). Still, AEBITDA fell to US$391M (-51.0%).

Gold to the rescue?

In 2022, while the PGM’s business was booming, the gold operations of SBSW were a serious drag as they generated AEBITDA of negative US$219M. The reason for this was a combination of the already high-cost profile of the operations, exacerbated by strikes, leading to lower production. Now that the strike problem has been dealt with and gold prices are rising on the back of geopolitical tensions and cracks in the US banking system, SBSW’s gold business could turn into an asset, rather than a liability for the company. For Q1’23 it generated AEBITDA of US$44M, compared to AEBITDA of negative US$45M a year ago. AISC fell to US$1,826 (-24.5% YoY), which was below the average realized price of US$1,864/oz. Now that gold prices surpassed the US$2,000 mark, SBSW’s gold business could become profitable again and help to offset some of the effects of lower PGM’s prices.

Progress on the green metals’ front

SBSW’s management is well aware that the electrification of the economy, especially a wider adoption of electric vehicles, could have long-term negative effects on PGMs demand, as they’re heavily used in ICE vehicles. For that reason, the company is aiming to diversify into the green metals space.

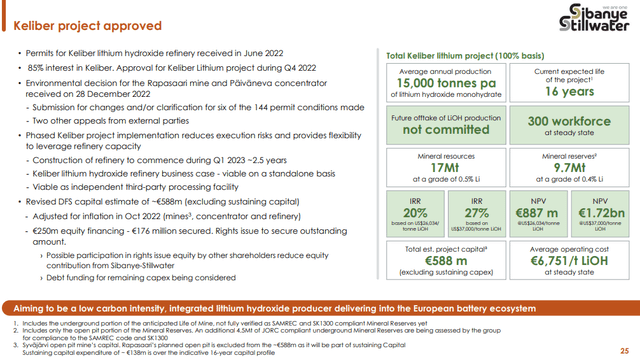

Keliber project overview (SBSW)

This is happening through two projects – Keliber (in Finland), where SBSW has 80% interest and Rhyolite-Ridge (in USA), where the company is a JV partner of ioneer (IONR) with 50% interest. The more advanced of the two – Keliber received environmental permit in Feb’23, clearing the path to construction. The other project – Rhyolite-Ridge received an offer from the US Department of Energy for a loan of up to US$700M to be used for construction.

Conclusion

Sibanye’s Q1’23 was weaker as falling PGMs prices and operational challenges have hit the main business of the company. However, not everything is bad, as the recent surge in gold prices could make the gold division profitable again and offset some of the lower results on the PGMs front. This puts SBSW in a superior position to pure-play PGMs players, as the gold business is acting like a hedge in the current situation. The diversification in the green metals’ space is also progressing as the Keliber project received an environmental permit.

Read the full article here