Ares Commercial Real Estate Corporation (NYSE:ACRE) is a commercial real estate investment trust with a large portfolio of senior commercial mortgage loans.

Though the trust has seen a QoQ improvement in its dividend coverage/payout ratio in the second quarter, I think risks have increased for Ares Commercial Real Estate due to the fact that the company paid out all of its distributable earnings in 2Q-23, and the gap between stock price and book value has narrowed considerably since my last write-up in May.

Ares Commercial Real Estate also stopped paying the $0.02 per share supplemental dividend it has paid since 2022. As a consequence, I am becoming a bit more risk-averse and lowering my stock classification to Hold.

My Rating History

Even though Ares Commercial Real Estate’s dividend payout ratio deteriorated in the first quarter due to a non-recurring loss on a senior loan sale, I slapped a buy rating on the trust. This happened primarily because of the excessive discount to book value of 30% that was present in the market at the time.

Before that, I justified my Buy rating with the company’s strong dividend coverage. Taking into account that Ares Commercial Real Estate paid out 100% of its distributable earnings and that the dividend risk has gone up, I think a Hold classification is more appropriate now.

Loan Portfolio And CECL Reserve

Ares Commercial Real Estate invests in senior commercial mortgage loans that are backed by various kinds of real estate. Commercial real estate has taken a hit lately due to rising interest rates which resulted in a sharp uptick in distressed commercial real estate assets as well as slowing demand for mortgage loans, which tend to be of a short-term nature and floating rate.

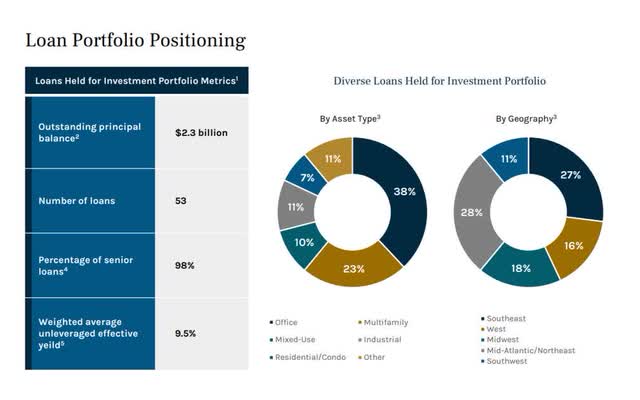

At the end of the second quarter, Ares Commercial Real Estate’s investment portfolio included $2.3 billion worth of loans, which were made primarily to the office and multi-family sectors. Thus, Ares Commercial Real Estate remains dependent on the overall health of the CRE market.

Loan Portfolio Positioning (Ares Commercial Real Estate Corporation)

Given the headwinds in the U.S. commercial real estate market, Ares Commercial Real Estate is at risk of seeing some of its borrowers default on their financial obligations.

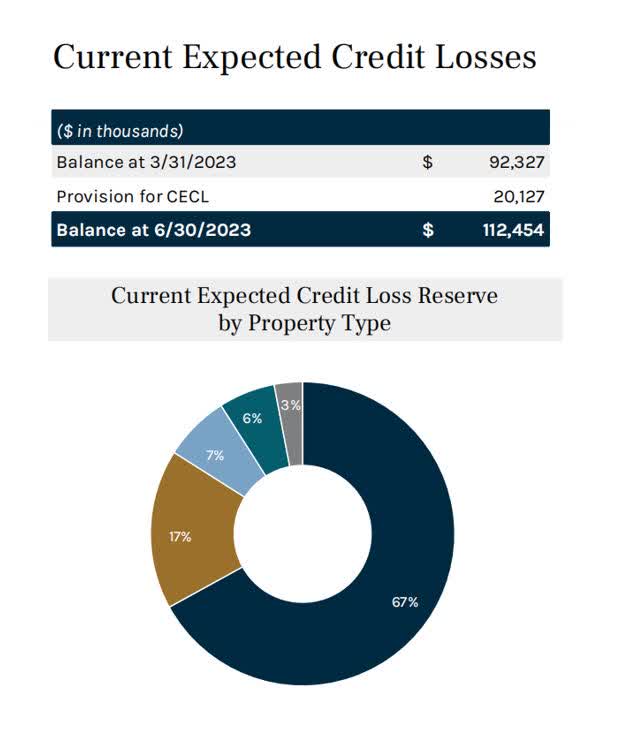

Ares Commercial Real Estate is estimating higher credit losses in the future, which is reflected in the Current Expected Credit Loss standard. As a consequence, the trust added another $20.1 million to its reserves in the second quarter. The majority (67%) of reserves relate to office properties.

Current Expected Credit Losses (Ares Commercial Real Estate)

No Margin Of Safety In The Payout Ratio

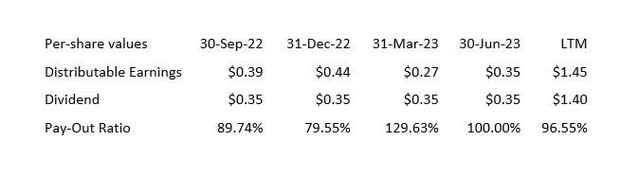

Ares Commercial Real Estate’s dividend coverage improved in the second quarter, QoQ, but the dividend no longer has as high a margin of safety as it did in the second half of last year.

Ares Commercial Real Estate earned $0.35 per share in distributable earnings in the second quarter, which matched the payout amount (regular dividend of $0.33 per share + a $0.02 per share supplemental dividend).

The payout ratio in the last year was 97%, indicating that the dividend has become a lot more risky in 2023. Together with the distress signals sent by the commercial real estate market, the trust may have to slash its dividend moving forward.

Ares Commercial Real Estate also no longer pays the $0.02 per share supplemental dividend that has spiced up passive income investors’ dividend returns in the last year.

Pay-Out Ratio (Author Created Table Using Trust Information)

Much Smaller Discount To Book Value

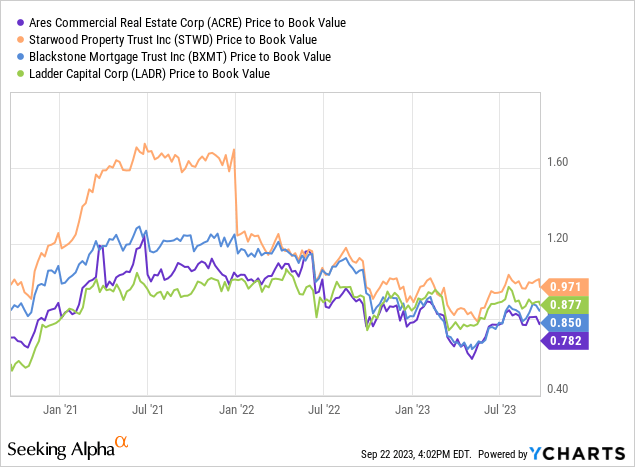

Ares Commercial Real Estate was a steal in May, but thanks to a major stock re-rating in the last couple of months, the trust’s valuation discount narrowed considerably.

Presently, Ares Commercial Real Estate is selling for a 22% discount to book value, which is still large, but the company traded at a much wider discount of 30% when I last presented my write-up for the trust.

Other mortgage trusts, like Starwood Property Trust Inc. (STWD), Blackstone Mortgage Trust Inc. (BXMT), and Ladder Capital Corp. (LADR) manage to trade at much narrower discounts to book value (or none at all, as is the case with Starwood Property Trust).

Why ACRE May Trade At A Lower/Higher Book Value Multiple

The downtown in the commercial real estate market in the United States is obviously a major problem, not only for Ares Commercial Real Estate but also for all companies that originate loans for the real estate industry.

An increase in loan defaults would be the clearest warning sign that the dividend could end up on the chopping block.

My Conclusion

Ares Commercial Real Estate’s dividend payout ratio has improved, QoQ, in the second quarter, and the trust only managed to cover its cumulative dividend payout (cumulative, meaning the $0.33 per share base dividend plus the $0.02 supplemental dividend) with distributable earnings.

The state of the U.S. commercial real estate market is a concern, as is the increase in Ares Commercial Real Estate’s CECL reserve. Taking into consideration that the REIT’s discount to book value has also narrowed considerably since May, I think the dividend has become a lot more risky lately.

I am not accumulating anymore, and my updated rating classification for ACRE is Hold.

Read the full article here