Digital marketing agency network S4 Capital (OTCPK:SCPPF) is one of my worst-performing holdings at the moment and has been a crushing disappointment to me.

I last covered the name in June with my “strong buy” article S4 Capital: Bargain Buy For The Digital Economy. Shockingly even since then (following weak performance in the months prior to the article) the shares have lost a further 47% of their value in a matter of months.

I continue to hold my shares and continue to rate the company as a strong buy but with the caveat that I think the risks here are also very large and possibly growing. I now see this as an increasingly polarised situation. Either the company will live up to some of what I see as its potential and the share price could soar in consequence, or it will keep losing value until there is no more to lose.

The Basic Problems

I have written extensively on S4 and my June piece sets out some of the reasons why I remain bullish.

But there are also a number of problems here, which have now come home to roost.

One is the key man risk. The company was the brainchild of Sir Martin Sorrell after he left WPP (OTCPK:WPPGF). But cancer treatment this year has raised questions about Sir Martin’s health. I think there is a lot of talent at S4 so do not see the prospect of Sir Martin’s retirement (which is not currently on the cards) as existentially problematic, but I definitely think the company will do better with him around and firmly in the driving seat. The investment case for S4 still rests heavily on the idea that what he did at WPP he can do here.

The second problem is communication, which is just horrible. After the fiasco of delaying accounts repeatedly last year, the City appeared to me to lose what confidence it had in S4. That lesson does not seem to have sunk in, with a profit warning towards the end of July being followed by another one with the interim results under two months later. Poorly signalled and often vague communication is hurting what remains of the already battered investor confidence. A further example is an AI briefing in June. Notice was given only on the morning of the briefing and when I tuned in, it seemed rambling, not focussed on hard business metrics and had such poor sound that I gave up (bear in mind this is a digitally focussed company). Such poor communication and the sense of a general lack of strategic planning (again, something that should be a core competence for a company in this line of business) is deeply concerning to me as a shareholder.

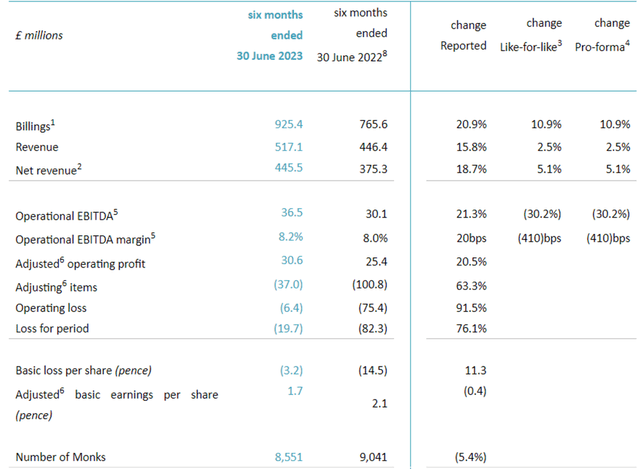

The third problem is that the business model still remains ultimately unproven. After years of strong revenue growth, the company’s recent profit warning set expectations for like-for-like net revenue to decline this year compared to last. The company remains lossmaking (albeit in the first half the loss was around three quarters lower than the same period last year, at £20m) and there is £110m of net debt on the balance sheet (albeit that is lower than at this point last year).

Company announcement

The company has been opaque about the terms of the acquisitions that fuelled its initial growth. But lower costs associated with those takeovers fed into the first half numbers. S4 said it expects further such payments to push net debt to £180m-£220m by the end of the year, but also that it expects to be cash generative next year with no material such payments. That sounds like excellent news, but given the firm’s track record of last minute communication and shifting expectations, I will believe it when I see it (which I certainly hope we do).

Balance Sheet and Cash Burn

Net debt has actually been falling. At the end of June it stood at £109m, down from £136m at the same point last year.

The company has indicated that it expects net debt by the year end to rise to £180m-£220m. That reflects anticipated payments in respect of past mergers.

Beyond that, though, I expect net debt to fall sharply again. The past payments will dry up and, for now at least, no new mergers (with associated costs) are on the cards as the company is unwilling to do deals until its share price reaches where it was last Spring before it delayed publication of its accounts.

The company has indicated that, in the short-to-medium term future, it intends to deploy free cash flow against dividends and share buybacks.

For now, free cash flow is negative but only a little so: the first half saw negative free cash flow of £1.7m, a hair’s breadth better than the number at that stage last year. That ought to turn into free cash flow next year as merger payments dry up.

One risk to that, though, is if earnings fall dramatically. The company already forecasts declining revenues. Although it expects to be free cash flow positive next year, such a risk is one to be borne in mind.

Where We Go From Here

The company has been shrinking its workforce and continues to suffer from the tech clients that dominate its client roster being more careful about their spend. That is a risk I continue to see for S4, although the upside could be that it is forced to broaden its search for client industries, perhaps making it stronger as a business in the long term.

Investor confidence here is shot in many cases although not all. It was announced this week that Capital Group from California has built a 5% stake.

The interim results this week bombed, with the shares going down by around a quarter. S4 is 63% lower this year and around 91% down from its 2021 highs. The company has said it will not use shares to fund deals at a price lower than where they entered last year’s self-inflicted accounting shambles (around six times higher than their current price) which I do not expect to see any time soon. So the focus will be on organic growth, and proving the business model. In its interim results S4 even dangled the prospect of buybacks and a dividend, which struck me as tone deaf although if it does indeed turn cash generative next year then maybe a dividend is viable and could potentially win it back some friends in the investor community.

I continue to believe the business has huge potential. But if it keeps messing up and the shares continue to fall, I do see a risk that it could go to zero. Unless it is cash generative, it relies on the charity or belief of lenders or shareholders to keep it going when at some point in the future it burns through its cash. With its chaotic recent record, I would not rely on that being forthcoming.

The alternative is that the business does what we know Sir Martin is capable of: moves into cash generation and proves its business model even without further acquisitions (for now). If that happens, the current valuation looks like an absolute bargain.

Bombed out Share Price

What, then, is a fair value of S4?

It does not want to use shares to help fund any more acquisitions at a price below that which preceded last year’s accounting delay. Back then shares were over £4 each. I find that a somewhat odd policy but it gives us – perhaps – some inkling of what the board thinks the shares may be worth.

But if so, why then are directors not scooping up shares with their own money at the current price of around 70p each, given that they did so when the price was much higher? The last self-funded director purchase was almost a year ago.

Directors have their own reasons to buy or sell any shares and overall S4’s board has more flesh in the game than most U.K. boards. Nonetheless, the complete absence of director buying at current levels is increasingly alarming for me. A vehicle for Victor Knaap and Wesley ter Haar (directors of an early acquisition of S4) sold some of their holding at £5 apiece back in 2021 and have not spent any of their own money increasing their stake since then (albeit it remains sizeable).

If the company does indeed turn cash flow positive next year, even amidst a tech downturn, its current market capitalisation looks awfully cheap to me given its large customer base, talented leadership (with caveats mentioned above) and an increasing focus on monetising its business model profitably rather than simply chasing growth.

The risks, here, look high though. Increasingly when it comes to my S4 holding (one of my largest and currently the one that is most in the red) I am looking to my gut feeling rather than to hard financial metrics, which is never a good sign.

It is difficult to put a real target price on a lossmaking company that expects revenues to shrink (albeit they are well over double the current market cap) and has a number of ongoing sizeable challenges. However, I struggle to believe that it does not merit a much higher valuation than it currently commands. Accordingly I maintain my “Strong Buy” rating – but clearly, this stock is not for widows or orphans.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here