Investment thesis

We view Kyowa Kirin (OTCPK:KYKOF) shares as being a cheap option on the positive outcome for the atopic dermatitis (eczema) drug currently being developed in partnership with Amgen (AMGN). Despite being 40% down from our initial rating, we are reiterating our buy rating.

Quick primer

Kyowa Kirin is a Japanese pharmaceutical company created by the merger of Kyowa Hakko and Kirin Pharma in 2008. Known for its antibody-based treatments, the current key earnings driver is its proprietary rickets treatment Crysvita collaborating with Ultragenyx (RARE). In June 2021, the company announced that it will jointly develop and commercialize its in-house atopic dermatitis (eczema) drug KHK4083 with Amgen which is currently in Phase 3 studies. The company is 53.4% owned by beverage company Kirin Holdings Company (OTCPK:KNBWY).

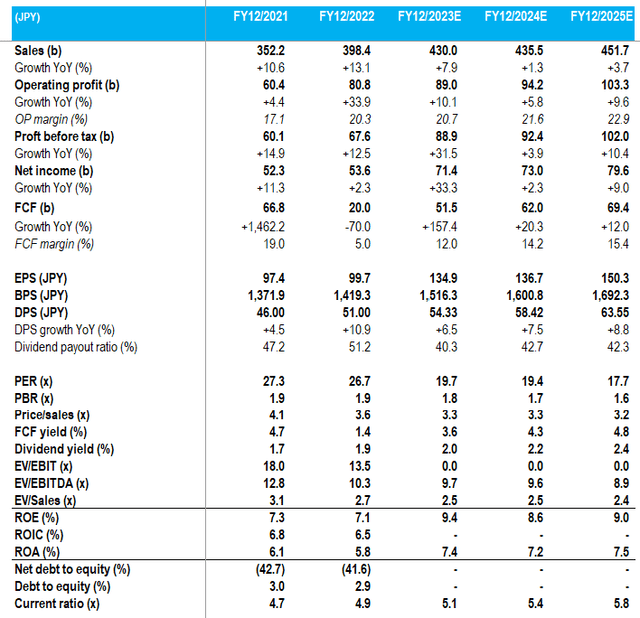

Key financials with consensus forecasts

Key financials with consensus forecasts (Company, Refinitiv)

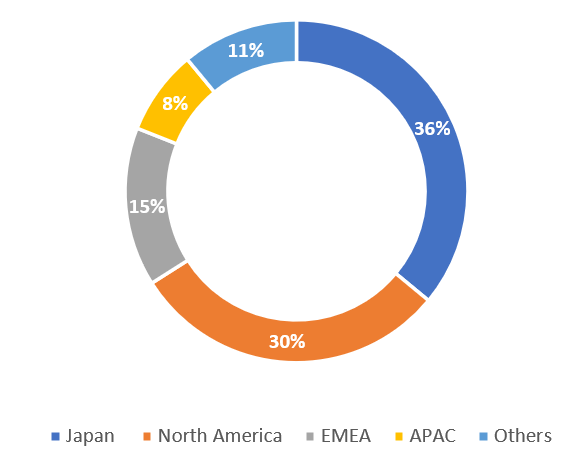

Sales split by geography – H1 FY12/2023

Sales split by geography – H1 FY12/2023 (Company)

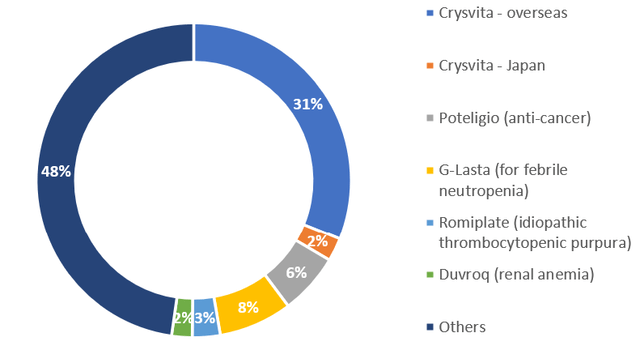

Sales split by major products – H1 FY12/2023

Sales split by major products – H1 FY12/2023 (Company)

Updating our view

We are updating our view from July 2021 where we rated the shares as a buy; the shares have fallen 40% since, stemming from 1) the cancellation of a development project for the investigational cancer treatment drug zandelisib with MEI Pharma (MEIP) in July 2023, and 2) the phase 3 trial of KHK4083, a treatment for severe atopic dermatitis (eczema) with Amgen was put temporarily on hold and tweaked in August 2022.

The pharmaceutical industry can be akin to the game sector where bestselling ‘hit’ releases are required to maintain earnings growth and meet market expectations. Unfortunately, Kyowa Krin’s recent track record for new drug trial success has been poor – the agreement with MEI Pharma may have been too risky given its small size and resources, and oncology is not Kyowa Kirin’s strong point.

We want to re-assess Kyowa Kirin’s earnings outlook, and whether the company remains well-capitalized to fund its business to maintain its R&D pipeline.

KHK4083 is still in play

We have no edge in terms of assessing whether KHK4083 will have a successful phase 3 trial outcome. However, the development partnership with a major player such as Amgen provides a level of reassurance, and the primary completion of the Phase 3 trial remains unchanged for March 2024 which is now 6 months away. We infer that investors should hear some news flow relatively soon in order to get a greater picture of how this treatment will progress. Over half of trial drugs fail to gain approval at Phase 3, and the tweak to the study in August 2022 does heighten the level of uncertainty. However, market expectations currently look relatively muted with consensus forecasts (please see table above) indicating single-digit growth for the next two years with no sign of any contingent milestone payments (worth USD850 million) or royalties being booked.

With an addressable market size estimated at around JPY400 billion/USD2.7 billion, the business opportunity for Kyowa Kirin remains very high. At this point in time, we believe the market is pricing KHK4083 as a relatively cheap option.

Company is well-capitalized

Kyowa Kirin is cash-rich with a net cash balance of JPY372 billion/USD2.6 billion and no borrowings in H1 FY12/2023, equivalent to roughly half of its equity (page 14). With annual R&D expenditure trending at around JPY70 billion a year, this is more or less covered by annual free cash flow generation – the company remains on track to continue its R&D pipeline in our view.

Although this would not necessarily be a positive market event, in any circumstance where the company needs to raise capital, we believe its parent Kirin Holdings would be in a position to assist either via equity raise or loan – the two companies are more aligned than before in terms of product development, particularly in health science although this expected to be a project for the longer term.

Valuation

We believe the shares are attractive on current consensus forecasts which do not imply any upside from a successful outcome for KHK4083. This optionality looks positive to us, and the shares do not look expensive trading on PER FY12/2024 19.4x. Whilst the prospective dividend yield of 2.2% is nothing special, we believe there is limited downside to the shares with a strong balance sheet and free cash flow yield of approximately 4.0%.

Thesis catalysts

Positive development with the collaboration with Amgen on KHK4083 will increase earnings visibility significantly. Negative development with overseas partner MEI Pharma was a negative optic but is not terminal, and the shares will re-rate as the company maintains its R&D efforts.

Risks to the thesis

KHK4083 may be rejected at Phase 3, which may lead to a dissolution of the partnership with Amgen and potential balance sheet write-offs.

Conclusion

Despite being down 40% on the shares since our initial rating, we are reiterating our buy rating. Despite some concern over the phase 3 trial being halted last year, we believe the potential of the KHK4083 drug is being valued as a cheap option. However, this is a high-risk high-reward call, so we recommend a small allocation to any equity portfolio.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here