When planning to write this article, I was thinking about how to name it properly so that the title that would be chosen would be able to efficiently convey my message. After spending some time thinking about what title to choose, I came across a famous phrase by Warren Buffett that he used in one of his letters to Berkshire Hathaway (BRK.A)(BRK.B) shareholders to explain why investors should never bet against America.

The idea behind using Warren Buffett’s phrase Never Bet Against America as a title for this specific article is fairly simple. After the challenging 2022, there was a lot of pessimism about the state of the American economy and a lot of talks about the decline of American influence around the globe. This narrative continues to be spread out even today despite the resilience of the American economy.

Therefore, the goal of this article is to highlight why it’s still foolish to bet against America, why U.S.-based assets are likely to remain the best type of investments out there, and why the companies within the S&P 500 Index (SP500)(SPX)(NYSEARCA:SPY) are likely to outperform its foreign peers in years to come.

The Recession That Didn’t Happen

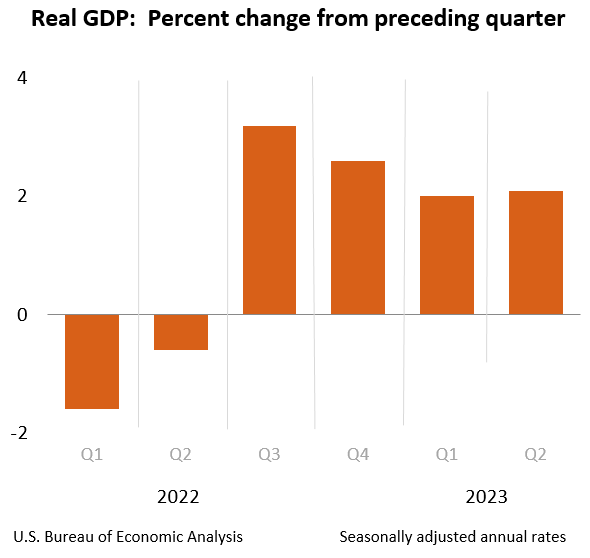

Ever since the start of 2022, we constantly heard that the recession is imminent and that the stock market is doomed. However, besides the two-quarters of negative growth, the American economy remained resilient, the job market remained strong, and the overall GDP in 2022 increased by 2.06%.

U.S. Real GDP (U.S. Bureau of Economic Analysis)

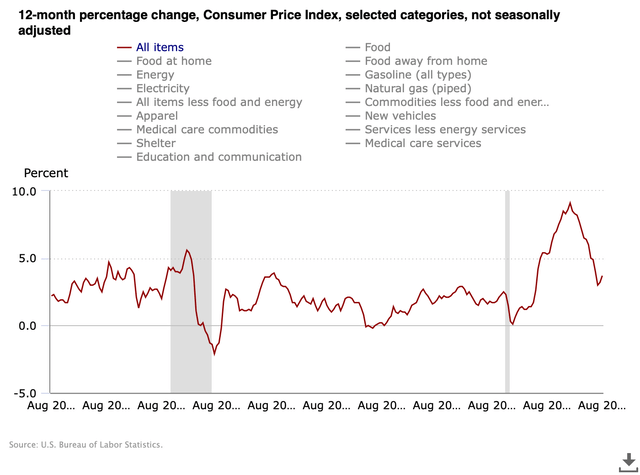

What’s more is that we also experienced the start of a disinflationary process at the beginning of this year, which resulted in a quarterly decline of CPI up until July. Even though the CPI stood at 3.7% in August, slightly up Q/Q due to the rise in oil prices, it was still around the pre-GFC historical levels. Therefore, it’s safe to say that the worst thing that we could experience is a soft landing somewhere in 2024. However, there’s also no guarantee that a recession would happen at all anytime soon considering that the U.S. economy is expected to increase at an impressive rate of 4.9% in Q3.

CPI Data (U.S. Bureau of Labor Statistics)

In addition to this, a lot of people forget that the rise of oil and food prices that greatly contributed to the rising inflation was caused primarily by the Russian full-scale invasion of Ukraine in February 2022, which led to the disruption of energy and fertilizer supplies for several quarters in a row. As those supply chain issues started to get fixed, the inflation began to decrease, and prices started to stabilize. Even though a year ago the Saudi-led OPEC+ oil production cuts took off over 2% of the global daily oil production from the market to prop up the prices, there’s an indication that such a move is starting to backfire.

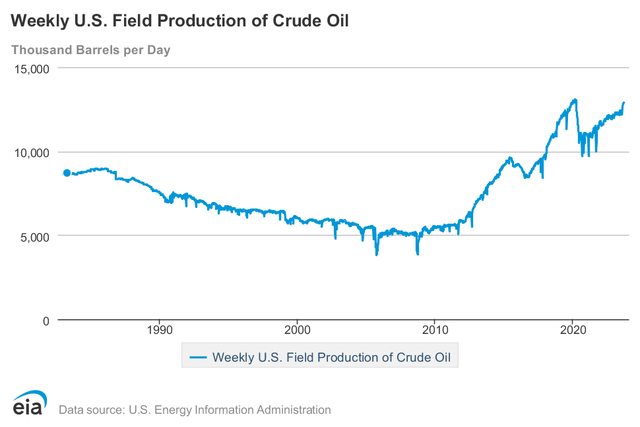

Despite the Saudi attempts to push the prices significantly higher, the latest EIA report indicates that the average price for Brent crude oil in 2023 and 2024 will be below $90 per barrel, which is also below the average 2022 levels. This would be possible thanks to the increase in oil production by the non-OPEC countries that could undermine the OPEC+ cuts. The biggest increase in production is expected to take place in the United States, which has been increasing its production after the COVID-related slump in 2020 and is expected to reach a new record of producing an average of 13.16 million barrels of oil per day in 2024.

U.S. Oil Production (EIA)

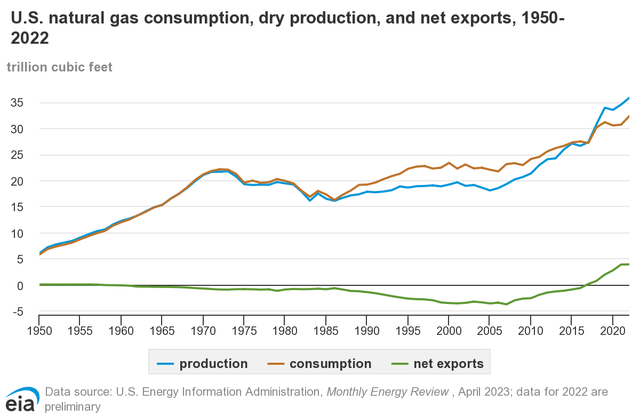

What’s more, is that the Russian invasion of Ukraine prompted the European countries to look for a more stable supplier of natural gas so that they no longer rely on the dictatorial regime that threatens to undermine the international world order. Russia has been known to be an unreliable supplier for years and has been manipulating the natural gas market for a long time, but only the full-scale invasion of Ukraine made Europeans act more strategically. As of today, American LNG supplies continue to flow to Europe at a record pace and help American natural gas companies generate aggressive returns despite the increase in natural gas production, as they’re profiting at Russia’s expense.

U.S. Natural Gas Production/Consumption/Net Exports (EIA)

All of those developments indicate that the United States economy is more resilient than a lot of people expected. At the same time, there are more reasons to be optimistic about the country’s future and its strategic posture across the globe. We already saw how stocks appreciated at a double-digit rate in the last year and even the banking crisis in March was quickly dealt with, which helped the market to continue to grow at an impressive rate.

There’s also a simple explanation for all of this. Markets are driven by the sentiment and not by the fundamentals. If there’s an indication that the worst is behind, you can be certain that the market would react to it much quicker than the underlying fundamentals. That’s exactly what has happened in the last year and there are reasons to believe that it will be the case for years to come.

SPY Performance (Seeking Alpha)

CAPEX Boom To Save The Day

There’s no denying that the world is changing, and American exceptionalism is no longer the norm in this new multipolar world. However, despite all the domestic and foreign challenges that the U.S. is currently facing, I would argue that it’s still the best market to invest in. Even though it’s likely that higher rates will stay with us for longer due to the inability to fully outsource the production to low-cost labor countries anymore to keep prices of goods elevated and drive inflation down, there are still more than enough opportunities to generate meaningful returns at home.

Before highlighting some of the opportunities, it’s important to understand the environment in which investors will now be operating. If the fall of the Soviet Union and later the admission of China to the WTO made our world more connected and interdependent, then the great financial crisis, the Covid-19 pandemic, and the Russian invasion of Ukraine all contributed to the rise of geopolitical risks that kicked off the trend of deglobalization. The latest data suggests that since November of 2008, there have been over 40,000 protectionism measures such as the enactment of tariffs or subsidies implemented by various governments across the globe against less than 10,000 free market measures. As countries begin to secure their supply chains and protect their markets in this new environment, the deglobalization talks will likely dominate the national discourse for years to come.

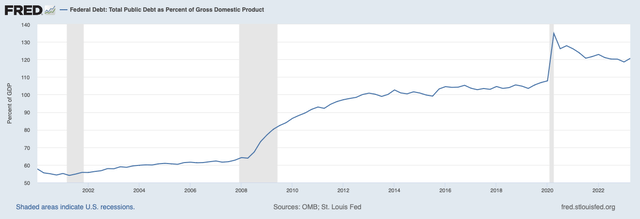

For the United States, this new environment presents both challenges and opportunities. The biggest challenge that the U.S. should tackle is the need to ensure that the rising debt doesn’t spiral out of control. Decades of fiscal irresponsibility, countless QE programs, and aggressive money printing during the start of the COVID-19 pandemic resulted in a record public debt-to-GDP ratio that gives little room for mistakes for policymakers and Fed officials.

At the same time, it’s not entirely correct to focus on the amount of debt that the U.S. owes since as long as the economy grows and the debt-to-GDP ratio is on the decline, the country would be able to service its debt and avoid a worst-case scenario. If we look at the latest data, we’ll see that the debt-to-GDP ratio is indeed on the decline from its record highs in part thanks to the growth of the economy that was discussed above. At the same time, such a decline in part is also possible thanks to the government’s ability to inflate the debt away. Here’s how it works:

High rates of inflation reduce the real value of debt, allowing governments to, in effect, pay off debts using money that is worth less than when they originally borrowed it.

The upside of this strategy is that the government doesn’t need to impose painful austerity measures that result in a loss of votes during the election cycle. The issue though is that it’s still a type of financial repression measure that undermines the purchasing power of the citizens. That’s why inflating the debt away should be considered only a short-term measure and stimulating growth should be a priority.

Public Debt-to-GDP (Federal Reserve Economic Data)

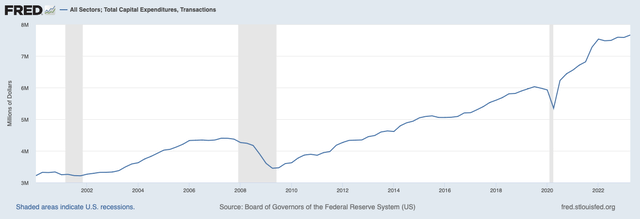

A year ago, famous investor Russell Napier gave a great interview in which he argued that governments will begin to enact financial repression measures to inflate the debt away and at the same time implement policies that would lead to an increase in capital expenditures to stimulate growth. Fast forward to today and we can see that it’s exactly what the government has been doing all this time. In addition to inflating the debt away, the current U.S. administration has been advocating for the implementation of various growth policies to keep the economy going and avoid a hard landing that could’ve been caused by higher interest rates. That’s where the opportunities kick in.

As China is becoming a systemic rival of the United States and is increasing its ability to undermine the international world order that was initially established at the end of WW2, the American policymakers along with the Biden administration decided to finally implement an industrial policy. Its goal is fairly simple. Since China no longer could be trusted, now is the time to move the manufacturing that previously was outsourced overseas back home. The passage of laws such as the Inflation Reduction Act and CHIPS and Science Act are prime examples of a policy that aims to expand the domestic industrial base in sectors that are of vital importance to American national interests.

Over the last year, hundreds of billions of dollars have been used on funding various industries and there’s an indication that around $2 trillion in additional federal spending is being freed up over the next decade. All of that funding is resulting in a CAPEX boom as companies use the federal funds to expand their businesses on American soil with the final goal of creating new growth opportunities.

U.S. CAPEX Data (Federal Reserve Economic Data)

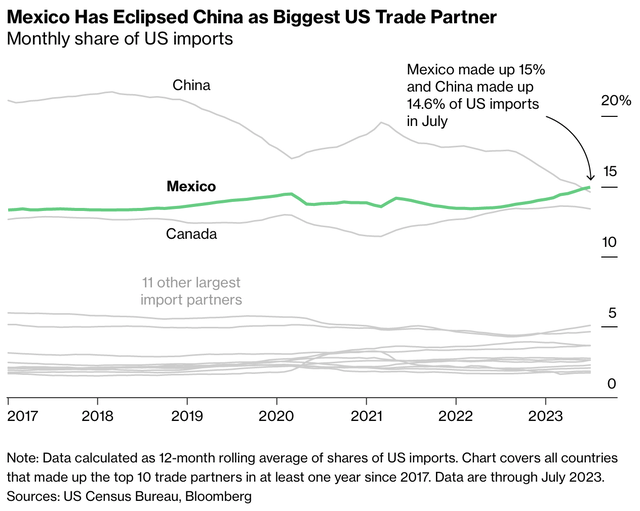

What’s more is that in addition to the government-led efforts to stimulate growth, private companies are also taking the initiative into their own hands and looking for additional ways to decrease their exposure to China. In the last year, there has been an increase in the use of terms such as nearshoring, reshoring, and friendshoring, which is a strategy of moving manufacturing and supply chains closer to home.

We already see companies like Tesla (TSLA) and HP (HPQ) move some of their production to Mexico, which has recently become the biggest trading partner of the United States, overtaking China. Such a move can decrease the geopolitical risks of the businesses as the U.S. relations with Mexico are likely to be more stable over the long-term. At the same time, this helps businesses continue to benefit from the cheaper labor cost that in the end results in greater growth.

Biggest Trading Partners of the U.S. (Bloomberg, U.S. Census Bureau)

Last but not least, technological innovation is another catalyst that’s able to stimulate growth. The robotization of the workforce along with the automation of the business processes are able to decrease the operational costs of companies and let them use the spare resources to acquire more customers. In addition to that, the aggressive growth of the generative AI industry also offers a great opportunity for businesses to expand their TAM. Earlier this year, Goldman Sachs (GS) published a report that stated that generative AI could raise global GDP by 7% in the following years. If that’s the case, it would make the government’s job of stimulating growth and decreasing its debt-to-GDP ratio much easier.

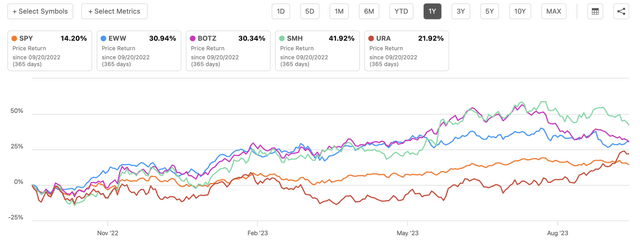

All of those developments indicate that there are more than enough growth opportunities for investors to profit from even in the current environment with higher interest rates. Below there’s a comparison chart that shows that even though the overall market appreciated by ~14% in the last year, ETFs that hold Mexican (EWW), AI (BOTZ), semiconductor (SMH), and uranium (URA) companies that have been one of the greatest beneficiaries of the changing market landscape or government’s efforts to stimulate growth outperformed the S&P 500.

SPY Performance Against Other ETFs (Seeking Alpha)

Considering everything that has been stated above, it’s safe to say that Russell Napier is likely to be right and that the CAPEX boom is going to remain with us for a while. This means that there are always going to be industries that the government favors more over others and various growth opportunities could be found in such industries as could be seen in the chart above.

What’s Next?

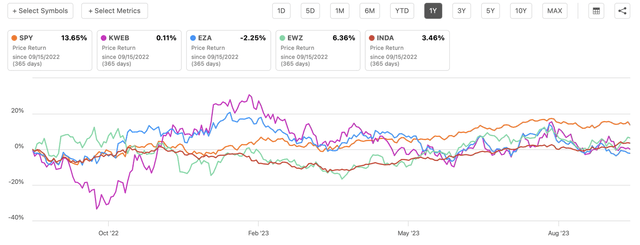

Even though investors now need to operate in a completely different environment than in the last two decades, as the return of the zero interest rate policy is not around the corner given the changing geopolitical landscape, there are still more than enough opportunities to generate meaningful returns in the right industries. What’s more, is that the resilience of the American economy during the challenging 2022 also shows that the U.S. remains to be the best market to invest in at this stage. The chart below shows that the ETF that mirrors the S&P 500 Index has outperformed ETFs that hold stocks of companies from BRICS nations such as China (KWEB), South Africa (EZA), Brazil (EWZ), and India (INDA).

SPY Performance Against Other ETFs (Seeking Alpha)

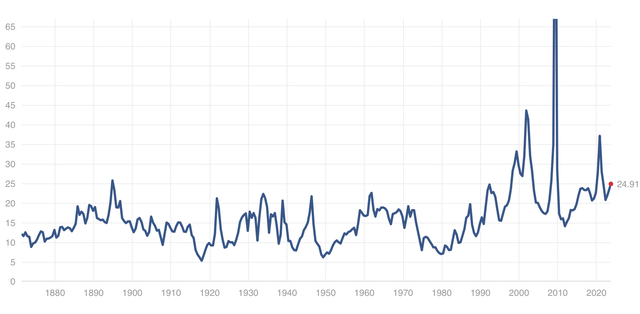

At the same time, there are also reasons to believe that the combination of private and government efforts to stimulate growth would help the companies from the S&P 500 Index to continue to expand their TAM for years to come. On top of that, while it’s true that the environment is now different, the current average P/E multiple of the S&P 500 Index is still extremely below the dot-com bubble levels, the pre-GFC levels, and the pre-pandemic levels. This indicates that America’s growth story even today is far from over, especially if we consider that the CAPEX boom is still in its infancy, and it would be foolish to bet against the biggest economy in the world.

Current S&P 500 PE Ratio (multpl)

Read the full article here