Unsurprisingly, 2023 has been a challenging year for new IPOs, as investors retreat from equity markets and especially from more speculative early-stage plays. CAVA Group (NYSE:CAVA), the Mediterranean fast-casual restaurant chain that wants to emulate Chipotle (CMG) in its category, experienced a predictable early pop that has since sharply eroded.

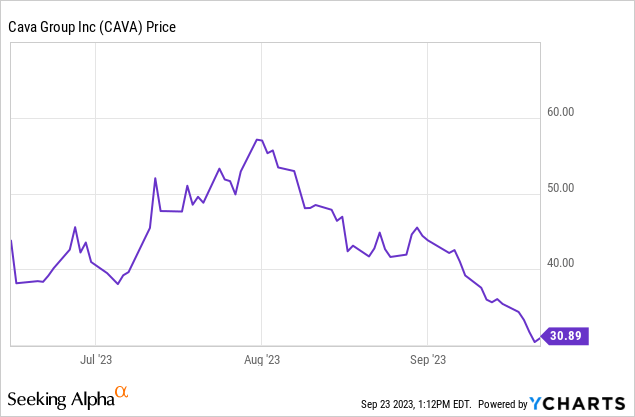

CAVA closed its first day of trading at $44, double its IPO price of $22. Today, the shares stand ~30% below Day 1 levels:

Cheaper price invites a less risky entry point

I last wrote on CAVA when the stock was trading in the mid-$40s, and I advised caution at the time. I was concerned with valuation primarily, as well as CAVA’s ability to execute as it deployed IPO cash to deliver new store openings.

While the latter still remains to be seen (Q2 results dropped since my last article which we’ll cover in the next section; so far they seem healthy but the company hasn’t yet made substantial use of its dry powder to expand across the U.S., so the execution question remains open to be answered), valuation is the area that has changed significantly over the past month.

At current share prices near $31, CAVA trades at a market cap of $3.51 billion. After we net off the $352.8 million of cash on CAVA’s most recent Q2 balance sheet (unencumbered of debt), the company’s resulting enterprise value is $3.16 billion.

Meanwhile for next year FY24, Wall Street analysts are expecting the company to generate $839.8 million in revenue, or 17% y/y growth (data from Yahoo Finance).

Now, there are a number of reasons this estimate may be very conservative:

- First, as we’ll discuss in the next section, CAVA’s same-store sale growth is clocking in at 18% – meaning that without the contribution of new restaurants, existing locations are already growing at a similar pace as what Wall Street is expecting CAVA to do overall

- As I noted in my prior article, CAVA generated roughly $300 million from its IPO, and a new store costs about $1.3 million in capex to build out – giving it firepower to open up to 200 new locations, versus a 2023 average of ~300 locations. Assuming its current pace of 20-25 openings a quarter and assuming CAVA can add ~100 of these 200 locations next year, we can point to ~25-30% growth from new locations alone (noting of course that new locations aren’t going to contribute the same as an average restaurant in its first year).

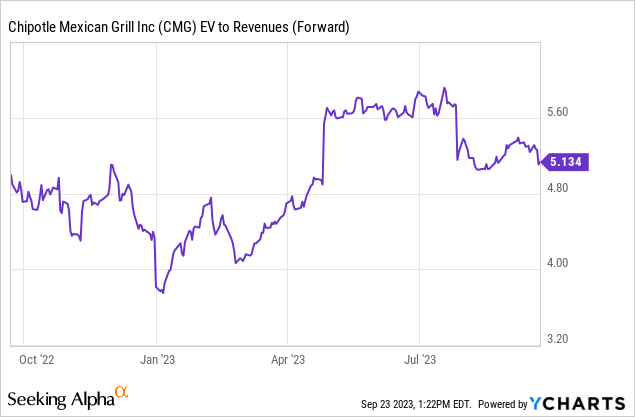

If we take Wall Street’s estimates at face value, CAVA’s revenue multiple is 3.8x EV/FY24 revenue (we think a revenue multiple is appropriate for CAVA given it is still in its expansionary phase and margin levels have not yet hit steady state).

Chipotle, meanwhile, trades at 5.1x revenue (and a ~36x FY24 P/E) – despite just 14% revenue growth expected for next year!

Given that this is the case, I can no longer make the argument that CAVA is terribly expensive (as was the case when the stock was in the $45-50 range), especially when revenue growth above 20% (and maybe closer to 30%) seems more likely to be in FY24 given the company’s new infusion of capital and ability to deploy a substantial number of new locations.

It’s a good time, in my view, to nibble on this IPO.

Q2 download

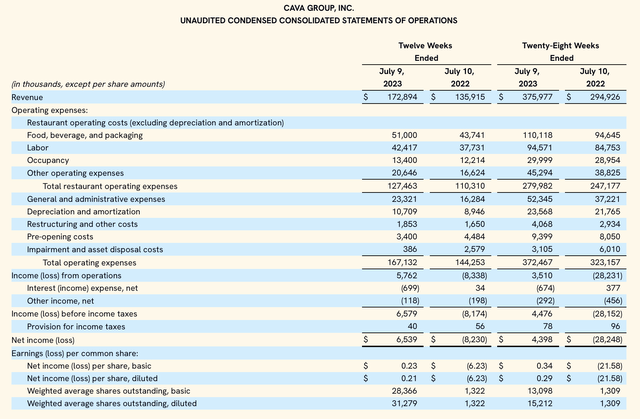

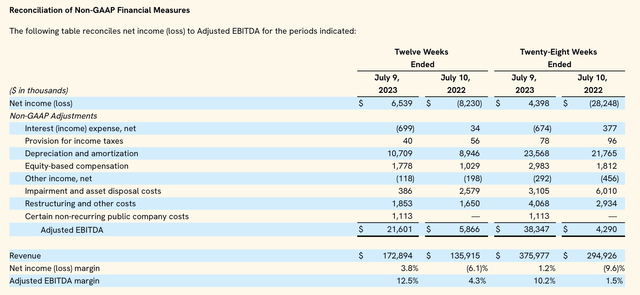

Let’s now recap some of CAVA’s latest Q2 highlights, its first public earnings release since its IPO. The Q2 earnings summary is shown below:

CAVA Q2 results (Cava Q2 earnings release)

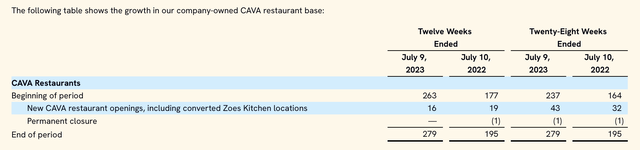

CAVA’s revenue grew 27% y/y to $172.9 million in the quarter. Revenue was driven by 18% growth in same-store sales (again, what makes me confident in CAVA hitting at least 18% growth in FY24) as well as 16 net-new store openings in the quarter to end at 279 locations, up 43% y/y.

CAVA openings (Cava Q2 earnings release)

Recall that of CAVA’s nearly 300 locations, barely around 20 are in the lucrative West Coast market, while CAVA dominates in the mid-Atlantic and Southeast regions. The company now has substantial capital to take its brand and know-how across the U.S. Note that within the 16 new locations opened the quarter, the company entered two new states: Missouri and Rhode Island. The company is now expecting 65-70 net-new openings for the balance of this year (it has 43 under its belt so far) and is banking on annual unit count growth of at least 15% throughout 2025.

Beyond store openings, the company is also expanding its operational footprint. A new food production facility in Virginia is slated to open in the first quarter of 2024. The company notes that the combination of this new site plus its existing Maryland production center has the capacity to support 750 restaurants, more than double CAVA’s current scale.

With this operational focus, CAVA has been able to slim down large swaths of cost as a percentage of revenue. Per CFO Tricia Tolivar’s remarks on the Q2 earnings call:

CAVA’s food, beverage and packaging costs were 29.3% of revenue, lower than the second quarter of 2022 by more than 230 basis points, driven by lower input costs and higher incidence of premium menu items driving favorable product mix. CAVA labor and related costs were 24.8%, down 200 basis points from the second quarter of 2022. The decrease was driven by leverage from increased sales, partially offset by an increase in average hourly wages towards the end of the quarter and an increased mix of new restaurants.

Consistent with our brand’s historical practice of investing in our team members, we made incremental investments in wages at the end of the quarter and continue to monitor opportunities to strengthen our brand proposition. CAVA occupancy and related expenses were 7.8% of revenue, an improvement of 70 basis points from the second quarter of 2022 due to increased sales leverage and a higher mix of lower occupancy restaurants.”

Restaurant-level operating margins (which strip out corporate overhead) expanded 400bps to 26.1%, indicating growing efficiency as more locations mature.

CAVA margins (Cava Q2 earnings release)

And as the chart above shows, CAVA’s adjusted EBITDA nearly quadrupled y/y to $21.6 million, representing a 12.5% margin in Q2 – 820bps better than the prior-year Q2.

Key takeaways

CAVA is expanding its geographical footprint, building out its operational infrastructure, improving its margins, and it’s trading at a lower revenue multiple than Chipotle (even relying on what I believe to be conservative consensus estimates). Given how sharply the stock has fallen in the past month, it’s a good time to eye an entry point in this stock in the high $20s.

Read the full article here