Introduction

Over the last three years, the spike in housing prices has surprised most market participants. This is because conventional wisdom would say that as rates go up the economy would go into a downturn; the economy going into a downturn would cause lower demand to buy homes and simultaneously higher rates would make a mortgage unaffordable, which would push prices lower.

Of course, this hasn’t been the case over the last three years. The economy has been a lot stronger than most though and the housing market has gone higher.

In this write-up, I’m going to examine why the housing market has gone higher and what I see on the horizon that will cause this to revert lower.

Why Have Housing Prices Gone Up?

Housing prices have gone up primarily due to a shortage of supply, which has caused the market to go up on a low amount of volume.

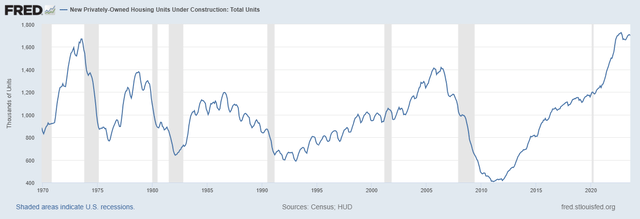

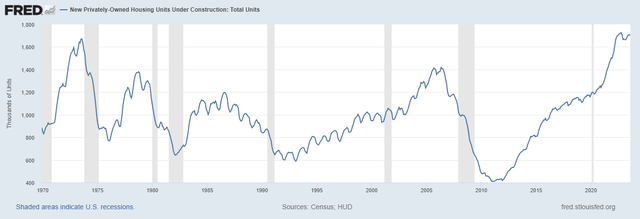

The shortage of supply was due to both a lack of existing and new homes for sale. After the GFC, developers were very careful to not oversupply the market with too much inventory, which meant that we went into 2020 with little supply of new homes. This can be seen in the chart below:

New Privately-Owned Housing Units Under Construction: Total Units (FRED)

Source

As can be seen on the chart, during and after the GFC there was a large downturn in the amount of new homes under construction. This started to slowly recover in 2012, but even in 2020 the number of new homes being constructed was well below the 2006 high; for reference, the number of homes being built in 2020 was the same as in 2003-2004.

Throughout the 2010s, there was a continued shortage of supply, causing prices to go higher. Higher prices could be sustained due to continually lower mortgage rates and existing homes that were being sold provided more supply.

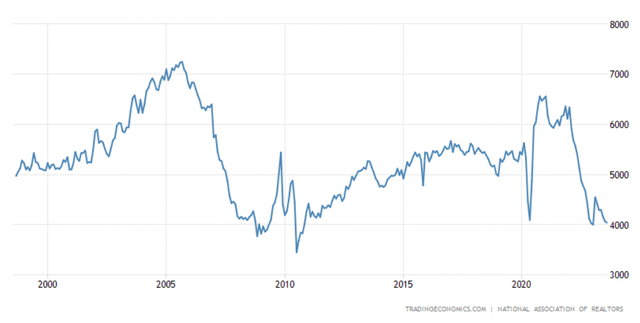

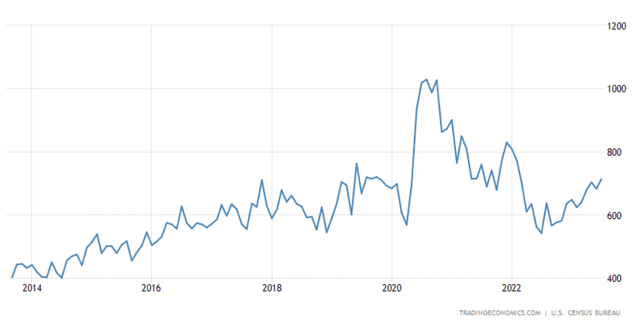

Post-2020 though, as mortgage rates went up there were very few homes on the market as borrowers who locked in a low rate were unlikely to sell. This can be seen in the chart below, which shows existing home sales:

United States Existing Home Sales (Trading Economics)

Source

As can be seen, existing home sales went from a 15-year-high in 2021 to a low not seen since just after the GFC in 2023.

This has largely removed existing homes from the market for buyers.

This gets us to where we are, which is that over the last two years, there have been few existing homes on the market and until recently there wasn’t a large number of new homes on the market, so there was little inventory of homes which meant that just a small spike in demand cause a large rise in home prices.

The Volume of Homes Being Transacted Is Low

One of the most important, key points that has been left out of many discussions of the rise in the housing market is the thin volume. Similar to how in the stock market it is a bearish signal to see a stock rise precipitancy in price with very little volume, there is a similar dynamic in the housing market. Low volume indicates that just a few buyers and sellers are setting the price, hence there is a lack of liquidity, and when a liquidity event does happen it will bring the price back to a point of high volume, which in the stock market we refer to as a high volume node.

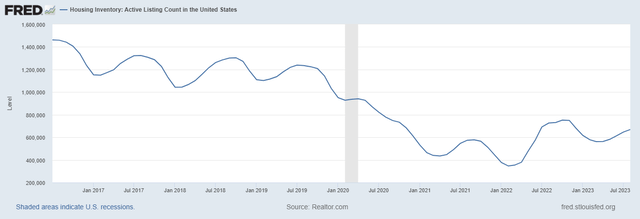

Below is the US housing inventory:

Housing Inventory: Active Listing Count in the United States (FRED)

Source

As can be seen, housing inventory has collapsed over the last two years due to the lack of existing homes on the market. The current housing inventory is only about a quarter of what it was in 2017.

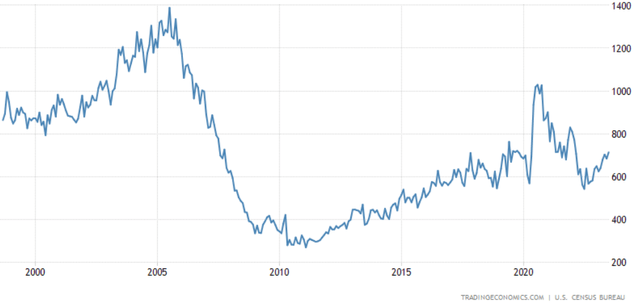

Most recently, new homes that are being built by homebuilders have started to increase enough to the point where it is offsetting the lack of existing homes on the market. This relates to the point about volume, as there are very few homes on the market, so it takes a lot fewer buyers than before to increase prices by a lot. This increase in new home sales is seen in the chart below:

United States New Home Sales (Trading Economics)

Source

The Homebuilding Gravy Train

Due to existing homes not being sold as much as they previously were, homebuilders had a large opportunity to fill in the supply gap and build out more supply. The gap between the high demand in 2022 and the lack of inventory was a gravy train for homebuilders, although now I fear that too much supply has been built out and existing homes might start to come onto the market.

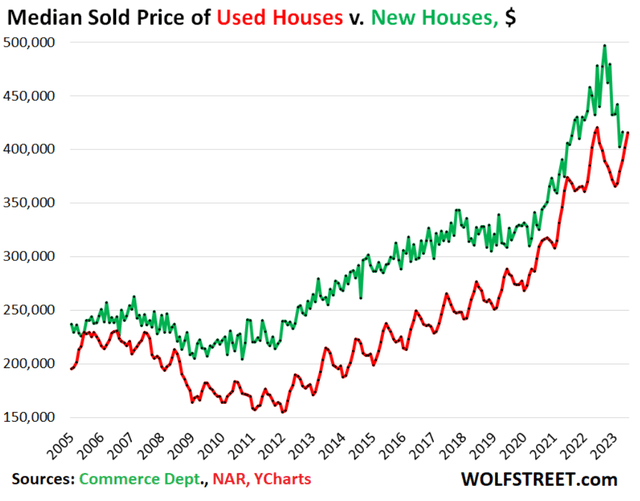

One stat that points to this being the case is the sale price of used vs. new homes:

Median Sold Price of Used Houses vs. New Houses (Wolf Street)

Source

Normally, the price of a new home is well above that of a used home. However, due to the market dynamics of existing homeowners holding on to their homes while new homes make up a majority of the inventory, now new homes are cheaper than existing homes. The last time this happened was in 2006.

My view is that this gravy train is now done. Developers simply won’t be able to introduce as much supply since the price of new homes has fallen even while those of existing homes are still going up, which tells us there is too much supply of new homes. To add to this, the number of houses under construction is still at an all-time high:

New Privately-Owned Housing Units Under Construction: Total Units (FRED)

Source

As can be seen, new homes are being built at a record pace even though prices for new homes are collapsing. Construction would have to go down drastically to prevent oversupply.

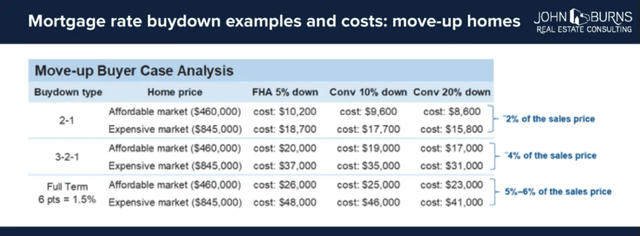

Rate Buydowns

Homebuilders know that there are affordability issues with higher rates, so they are offering buydowns.

A buydown can be thought of as a subsidy to the buyer.

For example, the builder might subside 3% interest in year one, 2% in year two, and 1% in year three. This means that an 8.5% interest rate for the borrower will turn into a 5.5%, 6.5%, and 7.5% interest rate, respectively. Then it reverts to a normal interest rate.

Below is a chart of what it looks like across different types of buydowns or discounts and different purchase prices:

John Burns Real Estate Consulting

Source

The whole idea of a mortgage rate buydown makes me worry about the health of the mortgage market as a whole. The whole reason to have a buydown is that the buyer wouldn’t be able to afford the mortgage payments with the normal interest rate, so a buydown is used; this creates the risk that in a few years after the buydown is over the payments go up, and the borrower can’t afford those higher payments. This is largely why I worry about the popularity of mortgage buydowns turning into what happened prior to the GFC, when many buyers got teaser rates which they could afford, but when those rates reset higher they couldn’t afford to make the payments.

Back of The Napkin Math On Housing Inventory

I’d like to do some quick back-of-the-napkin math on where inventory is now, how much is being introduced, and how much is being acquired.

Total Housing Inventory:

United States Total Housing Inventory (Trading Economics)

Source

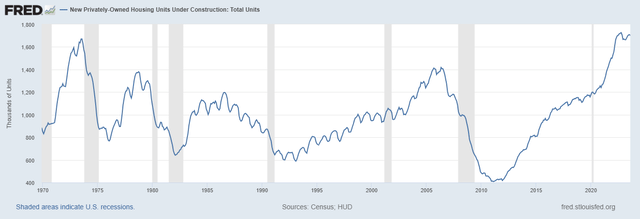

New homes under construction:

New Privately-Owned Housing Units Under Construction: Total Units (FRED)

Source

New home sales:

United States New Home Sales (Trading Economics)

Source

With the current inventory at around 1mm with about 1.7mm new homes under construction, the inventory of homes just a couple of months to a year from now will be 2.7mm; at the same time sales for these new houses, if optimistic, is 800k. This means that the inventory of homes a year from now will be 1.9mm. This is a 90% increase in inventory.

For this reason, I believe there is far too much inventory being introduced into the market. Moreover, as I mentioned at the beginning the volume of deals being done is very low, so just a small uptick in inventory would make a big difference in prices.

Mortgage Rate Risk

The biggest risk I see in the housing market (and one of the least talked about) is the risk of mortgage rates going lower. While conventional wisdom says that lower mortgage rates are good for the housing market, in this case, the opposite is likely true. As we went over, prior homeowners who locked in low rates have been selling their houses at the volume since just after the GFC; now if rates come back down many homeowners will use that as an opportunity to sell their existing homes, which will introduce a large amount of supply that wasn’t in the market over the last two years.

Key Takeaways

- Housing prices have gone up over the last three years due to a shortage of inventory.

- Existing home sales are their lowest since 2011.

- Due to low inventory and a lack of existing homes on the market. homebuilders have been able to create large amounts of supply at a high price.

- New houses are introducing more inventory than demand for inventory.

- Mortgage rate buydowns have been used by homebuilders to address affordability concerns, but they come with a higher risk of default. This is also a sign that the housing market has become too unaffordable.

- Mortgage rates going down is a major risk for homebuilders since it reintroduces a large amount of supply from existing homes.

- A bearish position through buying puts on the SPDR S&P Homebuilders ETF (NYSEARCA:XHB) is the easiest way for retail investors to take advantage of this thesis.

Read the full article here