I was one of those people who were skeptical about Nvidia Corporation’s (NASDAQ:NVDA) growth potential due to the increase in geopolitical risks. I also changed my mind a few months ago when the company aggressively increased its guidance just as I was testing various generative AI apps to improve my workflow efficiency.

Since Nvidia recently released another impressive earnings report which indicated that the company’s growth story is far from over, I tend to believe that it’s unlikely that its shares will greatly depreciate anytime soon given all the momentum that the business has. At the same time, there are also reasons to believe that despite having over $1 trillion in market cap, Nvidia’s stock is not really overvalued and could appreciate further in the following quarters.

Nvidia’s Growth Story Is Not Over Yet

My latest article on Nvidia was published just before the company released its recent earnings results for Q2. I argued that it’s crucial for the management to once again overdeliver so that the business keeps its momentum. That’s exactly what has happened, as Nvidia’s revenues in Q2 increased by 101.6% Y/Y to $13.51 billion and were above expectations by $2.43 billion thanks to the surge in data center sales. At the same time, the company’s non-GAAP EPS during the period was $2.70, above the estimates by $0.61. In addition to that, Nvidia once again surprised everyone by updating its outlook for Q3 where it expects to generate $16 billion in revenues, above the consensus of $12.42 billion.

There are several reasons to believe that Nvidia could achieve that target. First of all, the generative AI industry is expected to grow at a CAGR of over 40% in the following decade, which already makes it possible for Nvidia to expand its total addressable market, or TAM, at a similar rate as the industry grows. On top of that, there’s an indication that Nvidia’s flagship H100 GPUs will be sold out well into the next year and the company is expected to triple the output of its chips to up to 2 million in 2024, up from around 500,000 units that the company is expected to produce this year. At the same time, Nvidia’s foundry partner Taiwan Semiconductor (TSM) recently stated that the demand for Nvidia’s chips will persist for the next year and a half, which gives reasons for optimism about the company’s future.

What’s more, is that earlier this month Nvidia has submitted its first benchmark results for the upcoming Grace Hopper super chip that’s going to be more powerful than H100 and is expected to be released in 2024. In addition to that, there are reasons to believe that the company is working with TSMC on the silicon photonics tech to develop next-generation chips, and significant orders for them are expected to be placed later in 2024.

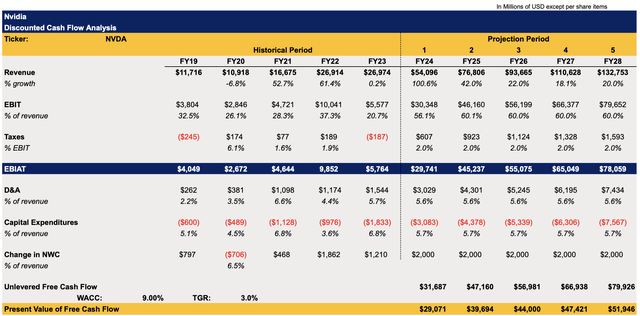

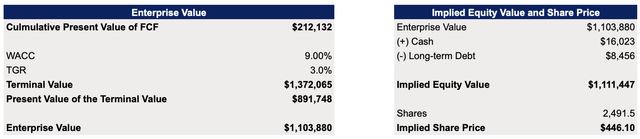

Considering all of this, it makes sense to believe that Nvidia’s growth story is far from over. However, questions are now being raised about whether the company’s stock has an upside left as well since it already aggressively appreciated and now trades at over $1 trillion market cap. To answer those questions, I’ve made a new discounted cash flow (“DCF”) model that now is more closely aligned with the latest Street forecasts which suggest that the company would continue to grow at an aggressive rate in years to come.

The revenue and earnings assumptions in the model are mostly in-line with the Street estimates. The tax rate is minimal, as Nvidia uses several offshore jurisdictions for tax optimization purposes. All the assumptions for other metrics in the model are similar to the company’s historical records. The WACC in the model stands at 9% while the terminal growth rate is 3%.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

This DCF model shows that Nvidia’s fair value is $446.10 per share, which is close to the current market price.

Nvidia’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

However, considering that the consensus on the Street is that Nvidia’s fair value is over $600 per share, it’s possible that the upside could be greater than I currently estimate. Add to all of this the fact that tech companies almost always trade at a significant premium, and we could assume that my DCF could be too conservative given the forecasted aggressive growth of the overall generative AI industry in the following years.

Several Risks To Consider

Despite those growth catalysts described above, it’s important to understand that a weaker growth of the overall global economy could nevertheless result in a weaker growth of Nvidia’s sales. While it’s unlikely to be the case now, as various reports indicate that the company sells its advanced GPUs at a 1000% profit margin, the macro challenges could undermine Nvidia’s growth story in the long-term.

On top of that, even though the geopolitical risks decreased since last October when the Biden administration announced new export restrictions on advanced chips to China, it would still be too naive to think that such risks won’t return in the future. Last month, the U.S. has already expanded the export restrictions to several countries in the Middle East. At the same time, Nvidia recently warned that further restrictions could hurt American companies, as its own data center sales to China account for 20% to 25% of the overall data center sales. As such, potential further restrictions would certainly negatively affect Nvidia’s performance and could undermine the bullish thesis.

The Bottom Line

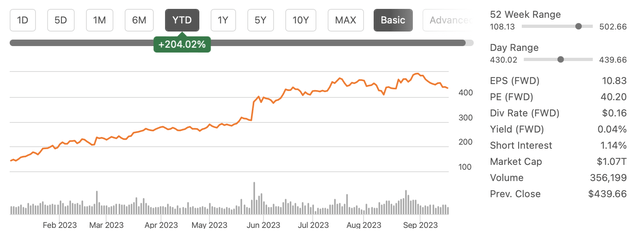

Despite all of the macro and geopolitical risks, the latest sales data along with the improved guidance point to the fact that Nvidia Corporation’s growth story is far from over and its stock has more room for growth. While the company’s shares recently slightly depreciated along with the rest of the market, I expect them to rebound in the foreseeable future as they have a strong technical support level of around $400 per share while the overall business still has momentum going for it. As such, I’m planning on opening a long position in the company soon and will likely hold it for the long-term since there are reasons to believe that Nvidia will continue to power the current generative AI revolution for years to come.

Nvidia’s Stock Performance (Seeking Alpha)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here