Oil and gas producer, Kosmos Energy (NYSE:KOS) reported Q2 2023 revenue of $273.32 million, indicating a drop of 55.98% (YoY). It missed Wall Street forecasts by $27.21 million, while its EPS of $0.06 missed estimates by $0.03. Despite the revenue decline, the stock is up 20.10% (YoY) and is trading 17.54% below the 52-week high of $8.55.

Thesis

Kosmos Energy expects further production growth into 2024 as more Jubilee wells come online from offshore Ghana, as well as other multi-year investment programs. Further, with the rise in commodity prices, I expect the company to generate significant free cash flow since the company is already nearing its inflection point. Delivery of the growth projects is expected to result in a reduction in its capital program through H2, 2023. This financial resilience will see a debt-pay down that will allow Kosmos to focus on other growth initiatives into 2024.

Growing Production and lower CapEx

The Q2 2023 revenue of $273 million was generated from a net production of 58,000 barrels of oil equivalent per day (boepd) and sales of 45,200 boepd. These revenues were equivalent to $66.38 per boe against production expenses of $64 million/ $15.45 per boe with the capital expenditures in the quarter at $170 million. On quarter-to-quarter analysis, Kosmos Energy’s production expense in Q1 2023 was $84 million against capital expenditures of $206 million. As seen, there was stronger financial performance in Q1 2023 with revenues coming in at $394 million and a realized pricing of $70.91 per boe.

Kosmos ended Q2, 2023 with a total long-term debt of $2.4 billion and a net debt of $2.3 billion. In contrast, Q1 2023 saw the company end with a total long-term debt of $2.3 billion and a net debt of $2.1 billion. The available liquidity in Q2 2023 stood at $0.7 billion against $1.0 billion in Q1 2023. The slight increase in debt indicates lower free cash flow at -$175 million against net cash generated from operating activities of about $18 million.

I believe, Kosmos Energy will generate a significant free cash flow into 2024 as production rises to meet its growth target. At the same time, CapEx is expected to fall until it reaches an inflection point in 2024. This principle holds since KOS’ FCF as of Q4 2022 was $23 million while the FY 2022 FCF stood at $343 million at a time it had fully paid back the Ghanaian assets that it had acquired from Occidental Petroleum (namely Anadarko WCTP block incurring a net debt leverage of <1.5X by the end of 2022). These actions hurt the FCF generated in 2023.

Still, despite a reduced free cash flow balance, Kosmos’ net production remained almost flat at 58,000 boe/d with the full-year 2023 guidance remaining constant at 65,000 to 69,000 boe/d. The company’s is optimistic that the additional growth will come from new wells located at the Jubilee Field in Ghana.

Development projects coming online

Kosmos stated that it started the Jubilee South East development (led by Tullow Oil) in July 2023 responsible for about 50% of its production growth target into 2023. Kosmos paid $455.9 million in cash for the acquisition of Anadarko WCTP to Occidental Petroleum Corp in October 2021. The acquisition as noted earlier took about 14 months and was completed by the end of 2022. It also includes participating interests of 18% and 11.1% in the Jubilee Unit Area and the Ten Fields, respectively. Overall, Kosmos’ interest in the Jubilee Unit area increased to 42.1% (from 24.1%) while its interest in the Ten Fields grew to 28.1% from 17.0%.

The other project intended to come online is the Greater Tortue Ahmeyim (Phase 1) in both Mauritania and Senegal, where Kosmos is in partnership with BP p.l.c. (BP). However, BP announced that it had extended the timing of the first gas from the GTA Phase 1 from Q3 2023 to Q1 2024. This push was attributed to the delayed “completion of the subsea work-scope.” I also believe that the GTA’s involvement in two countries is intended to transform them into global LNG players. Firstly, the Torque field is approximated to contain about 15 trillion cubic feet (tcf) of recoverable natural gas. Phase 1 of the project contains the “ultra-deepwater system with 4 gas-producing wells. A mid-water FPSO vessel, and an FLNG facility. It is expected to deliver approximately 2.5 million metric tons per annum (mmtpa) of natural gas.”

It is important to consider that while Kosmos is a non-operating partner in this transaction, the partnership with BP Plc will ensure the success of the project. I am looking at the available liquidity and capital expenditure expected in this project, and I view BP’s inclusion as a necessity due to its financial muscle. We must also remember that while Kosmos is reducing CapEx into 2024, BP’s Q2 2023 CapEx was $4.3 billion with the 2023 guidance set for $16 billion to $18 billion.

The third key project is the first oil at Winterfell in the US Gulf of Mexico, expected in Q1, 2024. Kosmos indicated “that the Tiberius infrastructure-led exploration (ILX) well is drilling in Keathley Canyon Block 964, targeting a four-way structural trap with potential oil resources of ~135 MMbbl.” Together with its partner, Beacon Offshore Energy, Kosmos also stated that the “Odd Job subsea pump project” will enter service by H2 2023 and is structured to maintain long-term field production.

2023 Guidance

For Q3 2023, Kosmos intends to raise production to range 67,000 to 70,000 boe/ day while operating expenditure for the quarter was set to range from $20.00 to $22.00 per boe. This increase is significant considering the production guidance set at the end of the first quarter for FY 2023 was 65,000 to 69,000 boe/ day.

As we know, Kosmos holds at least 5 mining licenses in Ghana’s offshore location, Cameroon’s onshore site, and in the Kingdom of Morocco’s offshore (55% stake at the Boujdour Maritime block and 75% stake at the Essaouira block). Reports from the North African state indicated that it was expanding natural gas exploration in a bid to diversify sources of energy and lower its hydrocarbon uptake. The government licensed the exploitation of a new natural gas site in the western part of the country, an action seen to potentially improve Kosmos’ chances of progress in the Western Sahara region.

Risks and Valuation

Kosmos realized an 8.7% (QoQ) increase in net debt at $2.3 billion. Further, free cash flow decreased by about 975% (QoQ) from -$20 million in Q1 2023 to -$175 million in Q2 2023. Also, despite recording a higher net production of 58,800 boe/day, Kosmos still realized lower revenues in Q2 2023 indicating an increase in operating expenses in the quarter.

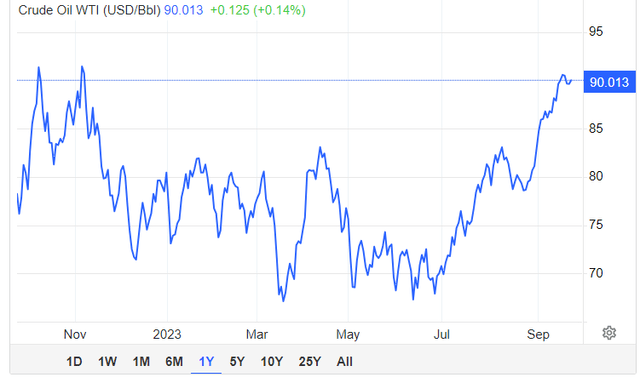

KOS stock movement has coincided with WTI crude futures that have hit a 10-month high, slightly above $91.

Trading Economics

There are global concerns that Russia’s fuel export ban could slow the commodity’s supply and raise the price. Recent reports indicated that Russia extended its decision to cut oil production to 300,000 bpd to the end of 2023. However, this move may be viewed as a temporary shock, with markets expected to recover into 2024. However, Kosmos is keen to fill the supply gap with more production expected in H2 2023. That being said, a decline in WTI crude futures may harm Kosmos Energy’s share price.

In regards to valuation, the KOS EV/Sales (FWD) ratio stands at 3.35 against the industry average of 2.18 showing a difference of 53.51%. Forward price/sales ratio is 1.96 against the industry average of 1.53 (a difference of 28.07%). These metrics indicate that KOS is slightly overvalued, and we may continue seeing some downside to the stock in the near term.

Bottom Line

Kosmos Energy has had a rough Q2 2023 brought to focus by declining revenues amidst modest production growth. Safe to say, H2 2023 presents a good opportunity for the company to deliver key development projects and other significant step-ups in production. I believe KOS’ strategic partnership with BP will ensure projects such as the Phase 1GTA is realized in Mauritania and Senegal by Q1, 2024. For these reasons, I propose a hold rating for the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here