Magellan Midstream (NYSE:MMP) holders will wake up Monday morning now owning shares of ONEOK (NYSE:OKE), after MMP unitholders agreed to approve the deal. The deal was hotly contested due to the tax consequences it would impose on long-term MMP unitholders, but the deal won support from proxy advisory service firms Institutional Shareholder Services and Glass Lewis, as well as top holder SS&C ALPS Advisors, which runs the Alerian MLP ETF (AMLP).

Holders of approximately 55% of the outstanding units voted in favor of the deal, while 76% of the units that voted approved the deal. MMP management went into full press mode to convince holders on the deal. They even reached out to me after my article urging unitholders to reject the deal (although I had travel plans at the time and was unable to speak to them.)

Merger

As a quick reminder, OKE announced in mid-May that it would acquire MMP in a deal valued at $18.8 billion, including debt, at the time. MMP unitholders would get 0.667 OKE shares for every MMP unit they owned, and $25 in cash.

The deal represented a 22% premium to MMP’s closing price before the announcement as well as to its 20-day VWAP. MMP unitholders will own 23% of the combined company.

Combined Company

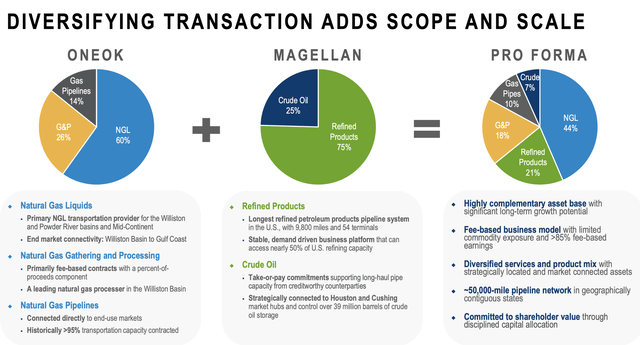

So, what exactly do MMP holders own now? First of all, they will own a combined company that is much more diversified.

MMP was a master limited partnership (MLP) that was focused on the transport, storage, and distribution of refined products and crude oil. The company had the largest refined petroleum products pipeline system in the U.S. and refined products made up about 75% of its EBITDA. About 85% of its operating income were fee-based.

MMP had been benefiting from an inflationary environment, as its pipeline tariffs were generally tied PPO or other inflationary factors. Its tariffs were increased 6% last year, and went up 11.5% July 1st of this year. However, the company wasn’t finding much in the way of intriguing growth projects and was instead focusing on its balance sheet and capital allocation.

While the next year was promising for MMP, given the lack of growth projects and the sale of the company, management obviously had some longer-term concerns around the business as the U.S. pushed forward with increasing electric vehicle (EV) usage.

OKE brings to the table a company that is also largely fee-based. However, the company is in the business of gathering and transporting natural gas and natural gas liquids (NGL). NGLs is its largest segment, where it provides gathering, fractionation, transport, and marketing services across various basins. It also owns gathering pipelines and processing plants primarily in the Bakken, Powder River Basin, and Mid-Continent. In addition, it owns intrastate natural gas pipeline and storage assets located in Oklahoma, Texas and Kansas.

For its part, OKE has been performing well as a standalone company. When reporting its Q2 guidance, the company grew its EBITDA 10% to $971 million and also increased its full-year EBITDA guidance.

While tied to NGLs and natural gas, the company mostly deals with associated gas and NGLs in oil regions. And on that front, the company has seen strong volume growth, with Q2 NGL volumes up 11%, led by the Rockies and Permian. Natural gas volumes were even stronger, up 16%.

Company Presentation

Synergies

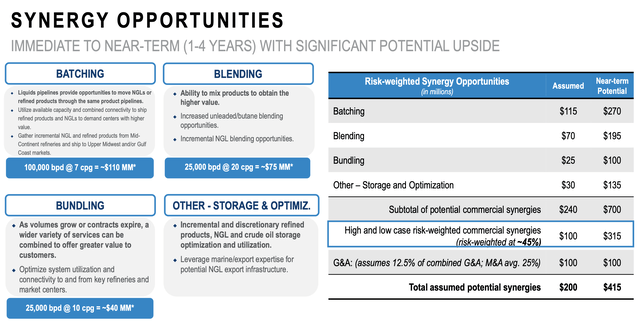

So the big question is with the companies handing different products and MMP not finding many growth opportunities, why did OKE want to acquire MMP. OKE originally pegged synergies between the two companies at $200 million, which isn’t a whole lot for a combined company that should generate about $6.3 billion in EBITDA this year. That adds only about 3% to EBITDA.

However, the company has been indicating that number is conservative, and pushing it up closer to $400 million. It said while $100 million of the synergies are taking out SG&A, it might be about to take out 25% of the cost, which would be closer to $200 million.

Company Presentation

The company has also started to talk about opportunities in batching, blending, and bundling. On the blending side, the company said it can mix products to create a higher valued product. It has a lot of normal butane on its system, and it thinks that upgrading it gives it a $75 million a year opportunity. On the bundling side, it said it would be able to optimize the two companies’ systems to improve utilization and connectivity when contracts come up. It views this as a $40 million a year opportunity. Meanwhile, it said that NGL and refined product pipelines can transport both through the same pipeline through a process called batching. By finding better markets, it thinks it can see $100 million in synergies.

Discussing batching at a Barclays conference, OKE CEO Pierce Norton said:

“We’ve had more conversations to understand exactly what batching is and how we will do it. And we do this today. We move refined products on our NGL pipeline today. And so how you do that is if you have or example, purity NGL pipelines, if you’re moving propane and you want to move unleaded on that, what you’re going to do is you’re going to put a buffer of normal butane in there. There’s going to be a couple of thousand barrels of normal butane. In terms of a pipeline, that’s miles of pipeline that will be under normal butane. So we’ll have propane, the buffer of normal butane, and then we’ll put unleaded right next to it. And the reason we use the buffer of normal butane is normal butane can be mixed into propane, there’s spec for that. And as well, know that normal butane can be mixed into unleaded for blending. So as that moves down the pipeline, we have a system where we can track that buffer as it goes down and you’re talking about miles of pipeline. So when it comes in, we will, what they call, cut, we’ll cut the batch. We’ll [add] more of the normal butane into the unleaded and that we get an upgrade on that or you get some blending on that and the other ones will stay in the propylene. That’s how we can batch down the pipeline. So you think about it that these 2 systems sit on top of each other. To the extent that it turns as the market changes or you get spikes in the market and there’s pinch points along Magellan’s system, we can move on to the NGL system around those pinch points or if there’s more long-term constraints on either one of the systems, we can move back and forth because the pipelines sit on top of each other to get to these locations.”

The synergy estimates may prove conservative, but operation synergies are generally more difficult to predict. However, the SG&A estimates could very well be any easier area to get some additional costs savings out of it. That said, I think showing the operational benefits of the deal will be more important for investors moving forward.

Combined Valuation

The current consensus has OKE 2024 EBITDA falling from 2023 levels and MMP growing slightly, so combined with $100 million in more immediate synergies, the combined company is set to generate about $6.1 billion in adjusted EBITDA in 2024. That values the combined company at roughly 10x 2024 EBITDA.

By comparison, diversified midstream operator Enterprise Products Partners (EPD) trades at 9.1x and Energy Transfer (ET) at 7.5x. I think both of these peers have a better asset base and trade at a lower valuation.

Conclusion

MMP investors will get hit with a tax bill, so save up some of that cash portion of the deal for the taxman. What they will get is a stronger, more diversified company without having to worry about a K-1. It will have about 4x leverage, and look to get that down a bit. Overall, the combined company will be solid.

That said, in my view there are better deals in the midstream space that are cheaper and have better assets, such as EPD and ET. I’d prefer to rotate into either of these two stocks, or some other midstream names I’ve discussed in the past such Plains All America (PAA) (article), Western Midstream (WES) (article), or Antero Midstream (AM) (article).

Overall, I rate the new OKE-MMP a “Hold,” and think the stock looks appropriately priced, but without much upside outside of the dividend.

Read the full article here