S&P 500 (NYSEARCA:SPY) was down for 3 straight days after the Fed’s meeting. Fed just announced their most recent assessment of the economy, and we believe there are a few points that investors should consider for the management of their portfolios in 2024.

1. Fed Shifts Attention from Inflation to Unemployment

While Fed Chair Powell states that fighting inflation remains the primary focus, the Fed’s updated projections point to a potential shift towards increased vigilance on unemployment and GDP growth as well.

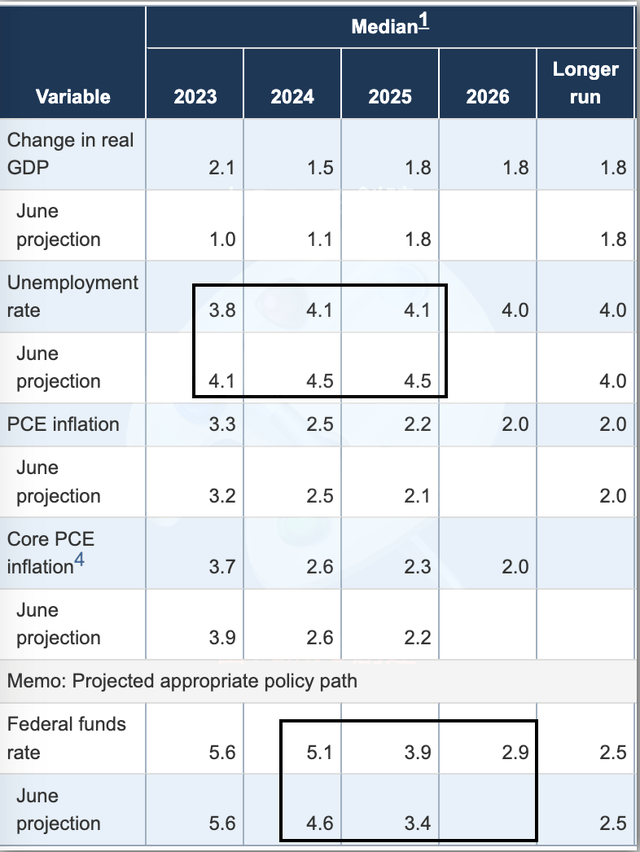

In the Federal Reserve’s latest projections, they lowered their core PCE inflation forecast to 3.7% for 2023 from a prior 4.3% estimate, while keeping their 2024 inflation outlook unchanged at 2.6%. However, despite tapering near-term inflation views, the Fed significantly raised its federal fund’s rate path, now expecting to keep rates “higher and longer”. Specifically, the Fed increased its 2024 Fed funds rate projection to 5.1% from 4.6% previously and boosted its 2025 estimate to 3.9% from 3.1% before.

FED

This suggests that the Fed is worried that strong employment can boost GDP growth and thus “may” have a potential impact on inflation. Since they lower or even maintain the core inflation forecast, we can assume it’s just the Fed’s precautious measure as their model currently points to higher GDP growth due to stronger-than-expected employment but not causing high inflation.

2. US Economy Anticipates Significant Constraints in 2024

Based on the Fed’s projection, real GDP growth will slow down or “should” slow down in 2024 and see a rebound in 2025. We think that this means the Fed is likely to continue to hamper GDP growth in 2024 and thus is likely to have a strong restriction effect on the US economy. This also may be the driver behind the recent stock pullback after the Fed’s meeting.

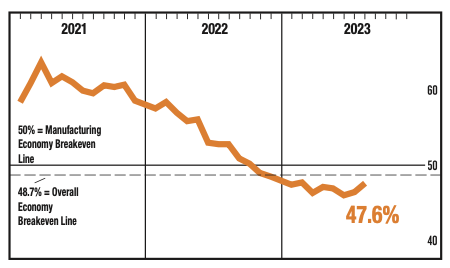

In addition, there are lagging effects from the Fed’s high rate policy, hence Fed decided to watch and learn. As evidence, manufacturing PMIs turned negative in late 2022 and have stayed below the 50 expansion/contraction threshold in 2023. Service PMIs remain slightly above 50 but are well off 2022 levels.

Manufacturing ISM (ISM) Service ISM (ISM)

With policy impacts spreading through the economy, the Fed seems intent on tamping down demand to combat residual inflationary pressures. This points to considerable economic restraint in 2024 until the Fed sees concrete disinflation and moderating wage and employment trends.

Investors should prepare for a restrictive policy environment in 2024 that will weigh on growth. The Fed is deliberately looking to cool the economy through rate hikes and QT, suggesting meaningful headwinds even as inflation moderates. Markets may need to reset expectations for the pace of expansion next year.

Valuation

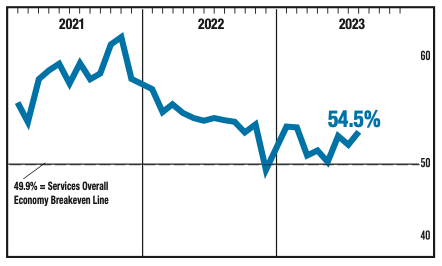

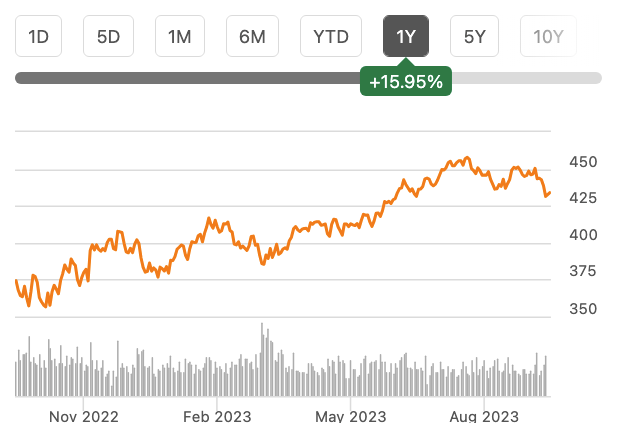

Current valuation levels for the S&P 500 reinforce our view that active stock picking will be crucial in 2024 rather than just passive index exposure.

Yardeni Research

Specifically, the S&P 500’s P/E ratio is trading around the median of its historical range at approximately 19x. This indicates valuations are fair relative to history but not necessarily cheap.

Additionally, the index’s PEG ratio has risen above 1.5x recently, putting it near the top end of its historical band. A PEG above 1x typically signals weaker expected returns from an index as earnings growth is already priced in.

Given these metrics showing the S&P 500 at around fair value at best currently, we do not see attractive risk-adjusted returns from broad passive investing in the index. The upside appears limited without a re-rating higher.

Stock Picking (Alpha Investing) Set to Lead 2024 Investment Trends

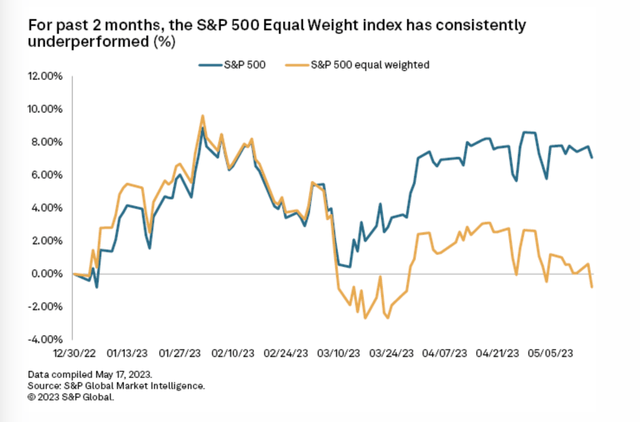

The divergent performance between the S&P 500 and the equal-weighted S&P 500 underscores that alpha generation was crucial in 2023 and we believe will be as important for investors in 2024.

S&P Seeking Alpha

Redfinitive (Redfinitive)

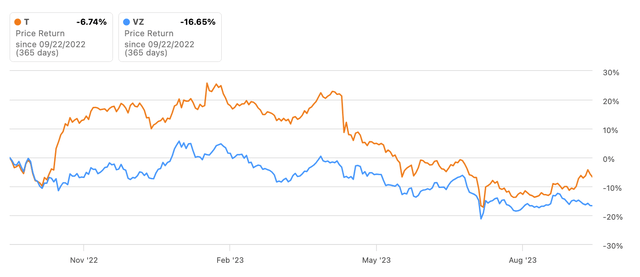

In this high-rate environment, sectors dependent on cheap financing like telecom and housing are suffering from demand destruction. AT&T(NYSE:T) and Verizon(NYSE:VZ) exemplify telecoms losing growth prospects amid reduced leverage capacity for buyback and dividends.

Seeking Alpha

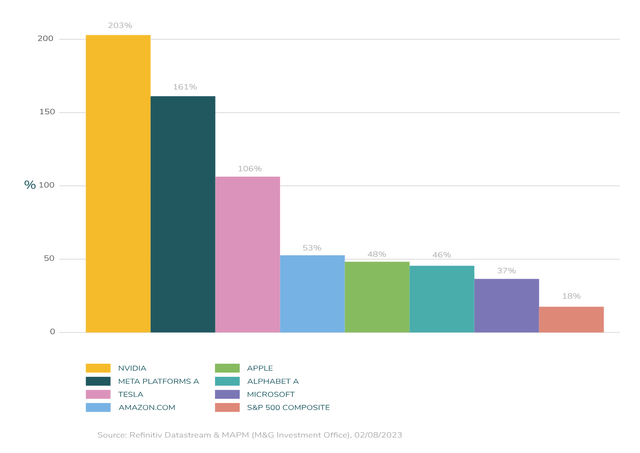

However, companies like Nvidia (NVDA) and Microsoft (MSFT) that can still grow earnings in a restrictive climate have richly rewarded investors. The mega-cap tech leaders benefited from strength in two key areas in 2023 – both robust balance sheets to maintain spending while others cut back, and AI/cloud computing tailwinds. Stock picking has been key to outperform in 2023.

With the economy and earnings outlooks stabilizing, active selection of recovering cyclical growth/value stocks could finally pay off. While major tech stocks power markets in 2023, investors should focus on different themes and sectors in 2024 as the high-rate environment should have an uneven impact on different sectors/cycles.

Tech Product Category Expansion and Penetration Rate: The Dual Focus for Growth

Despite the effects of interest-rate sensitivity influencing consumer spending, we believe that these sectors are nearing their lowest point. With robust employment, the diminishing supply is likely to align with the foundational demand. However, in the coming year growth prospects appear less uniform across big tech. Rather than automatically defaulting to big tech in 2024, investors should prioritize identifying companies that can deliver growth in a restrictive environment. The ability to expand the user base will be a key separator.

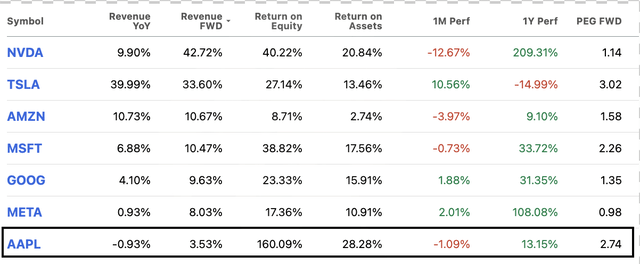

For example, among the mega-cap, we are cautious about Apple (AAPL) heading into 2024, questioning its product and services growth momentum as its valuation is relatively expensive.

Seeking Alpha

Among mega-caps, we remain constructive on Alphabet (GOOG) (GOOGL), Amazon (AMZN), Microsoft (MSFT), and Tesla (TSLA) based on their opportunities in cloud computing, e-commerce/consumer, enterprise software and energy transitions, respectively. Nvidia is a wild card to us with its booming data center business but risks outside core computing verticals.

With less uniform outlooks, investors need to be selective in identifying durable growth opportunities. As many of the AI growth stories have been included in stock valuation, we believe that large tech product category expansion and penetration rate are the two main growth areas of focus.

Focusing on Customer Growth: A Priority for Struggling Small and Mid-Cap Companies

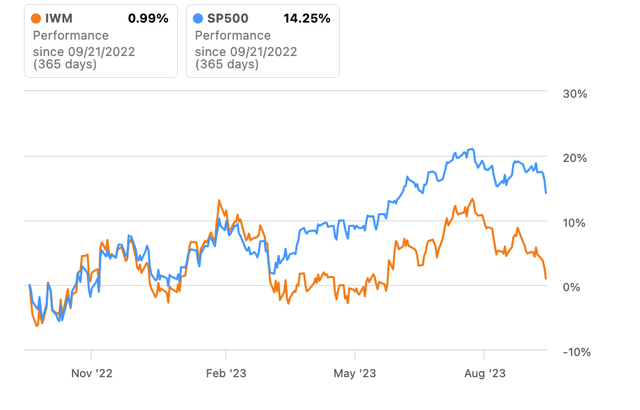

Beyond mega-caps, selected mid and small-cap stocks also present alpha opportunities in 2024 as parts of the economy stabilize after a restrictive period.

Seeking Alpha

Many smaller companies struggled with growth and cash flows in the higher rate environment of 2022-2023, causing small/mid-cap indexes to lag the S&P 500. However, downtrodden valuations have created bargains.

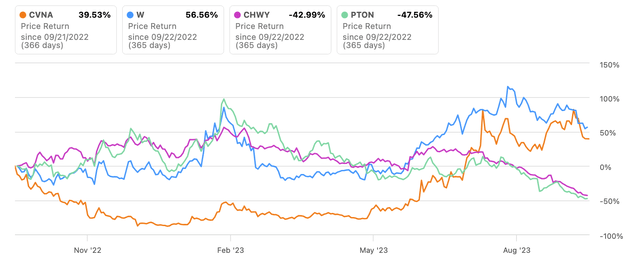

Astute stock picking can uncover smaller firms seeing improving customer trends and cash flows after right-sizing for weaker demand. For example, we recommended buying Carvana(NYSE:CVNA) and Wayfair(NYSE:W) in April based on early signs of stabilization – both stocks are up over 500% and 70%, respectively, since then.

Seeking Alpha

The keys were slowing customer losses and positive free cash flow, which shifted these stocks from distressed to growth valuations. The sharp share price recoveries underscored how deeply pessimistic markets got on certain cyclical names.

In contrast, in other examples, we were positive about Chewy(NYSE:CHWY) and Peloton(NYSE:PTON). However, their stocks were hampered as their customer churn continued deteriorating, signaling fragile demand, despite both generating positive free cash flow again.

Hence, for small or mid-cap traded at distressed value, customer growth capabilities should be the top criterion amid muted macro conditions in 2024 as customer growth can sustain the growth story.

Persistent Rise in E-commerce Penetration

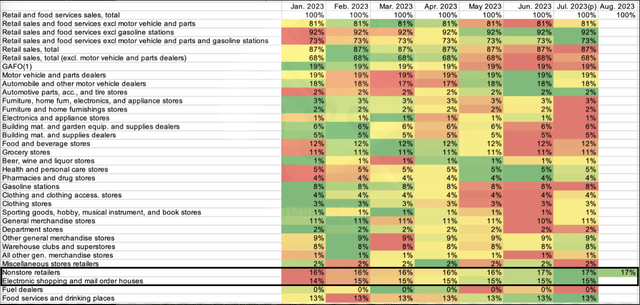

A key ongoing trend is the continued penetration of e-commerce and non-store retailers, even in a rising rate environment. This theme underpins our interest in analyzing companies like Carvana, Wayfair, Chewy, and Peloton.

Many investors underestimate these unprofitable e-commerce platforms, assuming they cannot reach profitability. However, the secular shift to online purchasing still has room to run in our view. According to US census data, even while other sectors suffered uneven development in 2023, the penetration of non-store merchants showed an upward trend.

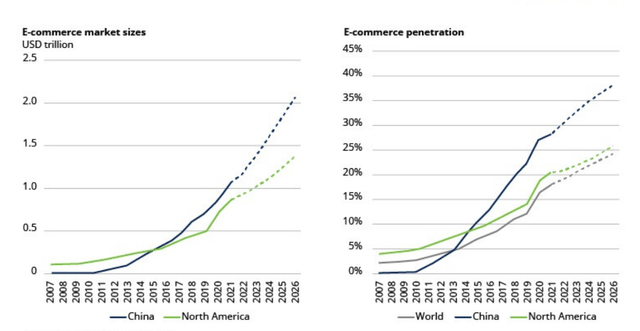

US census, LEL

Compared to the US, China has a higher rate of e-commerce penetration. We think this is because there are fewer physical store networks in China, which has sped up the adoption of e-commerce. E-commerce, however, is changing more than just how customers buy goods and services; it is also transforming how businesses use data-driven insights to streamline operations. Hence, E-commerce leaders should adopt these techniques early as AI technology advances, giving them a competitive advantage. We therefore are optimistic for continued e-commerce penetration growth in the US.

Euromonitor

Conclusion

We believe 2024 will be another year that rewards active stock picking over passive index investing strategies.

The restrictive monetary policy environment is likely to have uneven impacts across sectors and companies. Those able to sustain growth amidst headwinds will stand out.

Rather than relying on broader indexes in 2024, investors should focus their research on identifying individual names with upside potential as market expectations readjust lower.

Attractive opportunities are emerging in recovering areas of the economy after deep pessimism in 2022-2023. Being selective with cyclical value exposures could pay off.

Additionally, structural growth stories in areas like small or mid-cap e-commerce and technology have been over-penalized due to the downswing, providing a chance to buy into secular trends at better valuations.

With crosscurrents persisting, having exposure to the right stocks and avoiding landmines matters more than just index exposure next year. We recommend investors spend time researching alpha opportunities to make sure their portfolio is positioned to outperform.

Given headwinds for passive investing, we are neutral on the overall S&P 500 index for 2024 and see better risk-adjusted returns in stock picking rather than broad exposure.

Read the full article here