Introduction

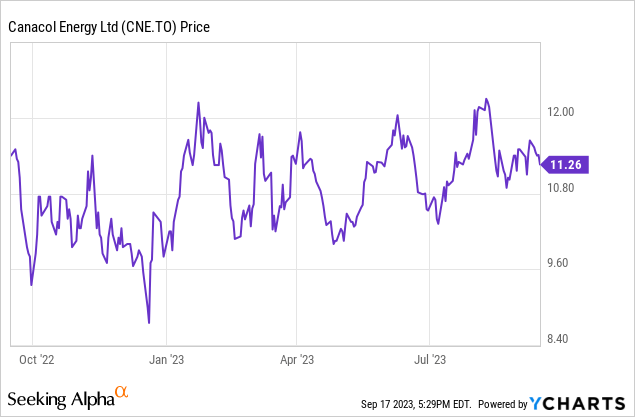

I have been following Canacol Energy (TSX:CNE:CA) (OTCQX:CNNEF) for several years now, but I haven’t really been too happy with the share price evolution. Despite being able to sell its natural gas at very flat prices (which could perhaps explain why investors abandoned the Canacol ship to pursue an investment in other natural gas producers that actually do offer better exposure to the North American natural gas prices) and despite a strong (and covered) dividend, the share price remains too low.

I will continue to keep an eye on Canacol Energy as it remains a sizeable position in my portfolio. The generous dividends are helpful, but I still hope to generate capital gains as well.

The cash flow remains pretty strong thanks to the stable natural gas price

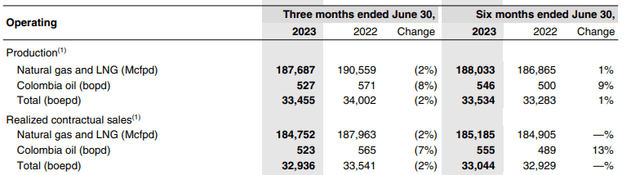

Canacol’s production rate has been pretty stable lately, as it’s geared toward covering the demand rather than pushing the production substantially higher. During the second quarter of the year, the output remained virtually unchanged at 33,500 boe/day, of which 98.5% came from natural gas. The total sales number was about 185,000 MMcf per day after taking the local field consumption into consideration.

Canacol Energy Investor Relations

The natural gas was sold at an average price of US$5.13 per mcf and whereas Canacol was “punished” for its relatively fixed price around US$5/mcf when the North American natural gas prices were trending higher, it’s very clear Canacol is now taking advantage of the stable Colombian prices as the realized price is substantially higher than the prices in North America.

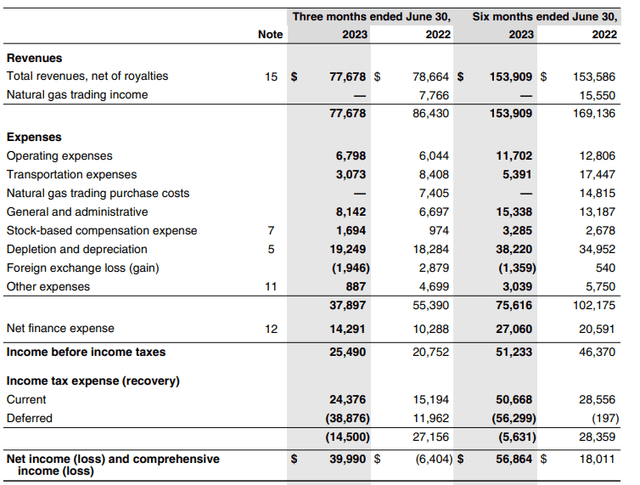

As the output is stable and the realized price is pretty stable as well, it probably doesn’t come as a surprise to see a pretty flat total reported revenue, which came in at US$77.7M. That’s almost exactly the result generated in the first quarter of the year, so there definitely aren’t any negative surprises.

Canacol Energy Investor Relations

That being said, the operating expenses and transportation expenses increased somewhat. Due to the very low cost nature of both, the increase sounds pretty bad when expressed in a percentage (the production cost increased by 30% but this represented just $1.8M, or less than 3% of the revenue).

And of course the company remained profitable: The pre-tax income was $25.5M and there was a tax benefit of $14.5M resulting in a net income of $40M or $1.17 per share.

As explained in previous articles, the tax bill varies tremendously in Colombia as the quarterly tax bill takes the FX changes on the available tax pools into consideration. The normalized corporate tax rate in Colombia is 35% with a small surcharge based on the oil production (but Canacol barely produces any oil, so that surcharge is negligible).

Based on a normalized 35% tax rate, the underlying net income would have been US$16.6M for an EPS of US$0.49. That’s approximately C$0.65 based on the current exchange rate.

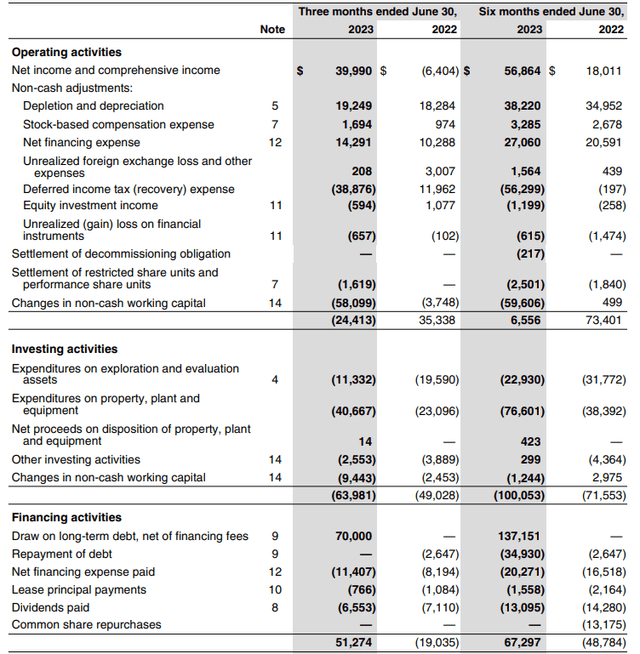

The cash flow statement also is a little bit distorted by those tax changes. The total reported operating cash flow was a negative 24.4M USD and even after adding back the $58.1M in working capital changes, the $33.7M implied result was pretty low. This was caused by an effective high cash tax payment related to a restructuring at the end of the previous financial year. The normalized tax payment would have been around $9M for Q2, but Canacol had to fork over in excess of $24M. The tax payments should normalize in the next few quarters.

Canacol Energy Investor Relations

This also means that if we really want to figure out the company’s normalized cash flow, we should work with the normalized tax payments, indicating we should add about $15M in taxes paid that were not owed. That being said, we should also deduct $12M in lease and interest payments as those weren’t included yet.

The normalized operating cash flow result was approximately $36.7M during the second quarter.

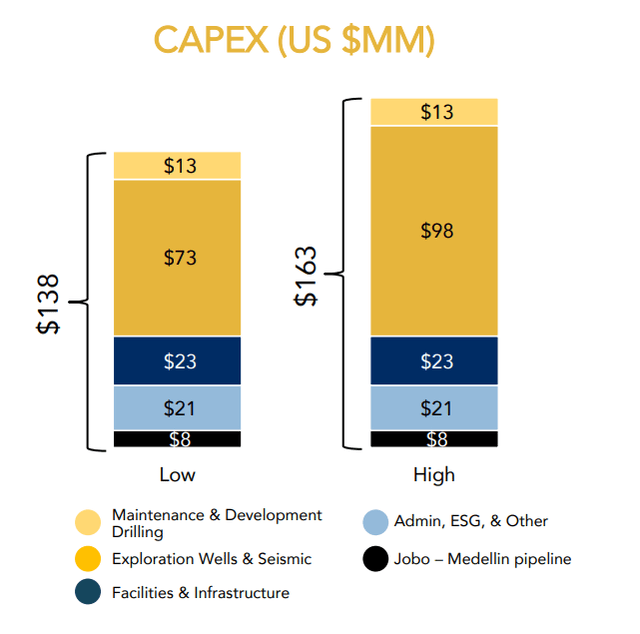

As expected, the capex remained very high as Canacol spent about $52M during the second quarter. This means the company was essentially free cash flow negative but I already explained in the previous articles Canacol is currently temporarily “overspending” on capex to increase its reserves. It’s aiming for a reserves replacement ratio of in excess of 200% and you can’t make an omelette without breaking eggs: The budget includes $73-98M to be spent on exploration wells.

Canacol Energy Investor Relations

As shown above, the total capex excluding the new pipeline and excluding the exploration drilling would be around $57M. And that’s less than $15M per quarter.

Am I thrilled the company is spending this much on capex? Not really. But it is a “necessary evil” as the completion of the Jobo-Medellin pipeline will boost the demand for Canacol’s natural gas and it will remain important to keep the 2P reserves at an attractively high level.

Meanwhile, Canacol continues to pay a dividend of C$0.26 per share on a quarterly basis. This is costing the company approximately US$6.5M per quarter (and if it wasn’t for the aggressive drill campaign, this dividend would be very well covered). With Canacol’s share price trading at just C$11.26, the dividend yield is approximately 9.2% (subject to the Canadian dividend tax rate).

Investment thesis

I have a long position in Canacol, and despite the generous dividend payments, I’m not a very happy shareholder as the company’s share price has been pretty disappointing and at this moment my total return is pretty much zero.

That being said, the company continues to deliver on its promises and the sole point of criticism I had in the past few years (reserve expansion) is now being dealt with. I have been adding a little bit to my existing position in the past few days.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here