Investment Thesis

IBM (NYSE:IBM) has a rich history of being at the forefront of technological evolution in the past. Founded in 1911, IBM played a pioneering role in developing and popularizing the punched card system, which revolutionized data processing and computation during the early 20th century.

During World War II, IBM’s tabulating machines were instrumental in aiding the war effort, helping to process vast amounts of data and contributing to the development of early computing technology.

In the 1950s and 1960s, IBM introduced the IBM 700 series of mainframe computers, which became a cornerstone of large-scale data processing for businesses and governments worldwide.

In the 1980s, IBM was a leader in the personal computer revolution, with the introduction of the IBM PC, which set industry standards and helped bring computing to the masses.

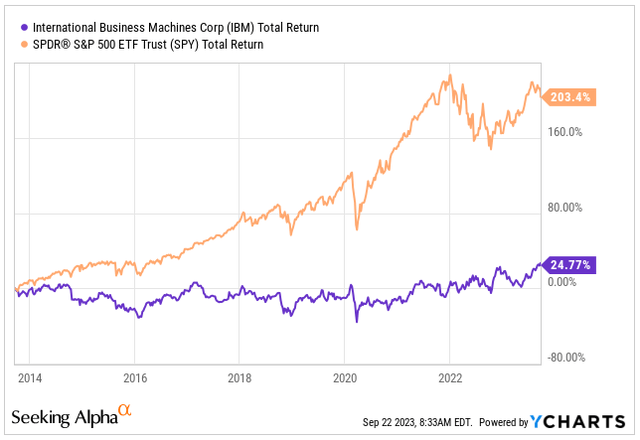

Despite its impressive historical journey, the last decade has been quite a challenging one for both IBM and its investors. To be precise, the company has fallen significantly behind the market, trailing by a staggering 178% in terms of total return over the past decade. Now, one might argue that the S&P500 Index (SPY) has been disproportionately influenced by a handful of tech juggernauts that have powered its growth. However, isn’t IBM operating in the same industry? Shouldn’t it have found a way to thrive in this tech-driven landscape of last decade?

Total Return (Seeking Alpha / YCHARTS)

As we stand at the dawn of the next technological revolution, characterized by Artificial Intelligence, we are poised to witness profound shifts in our interactions with technology. These developments not only promise to redefine our relationship with machines but also carry the potential to enhance productivity for generations to come. The question that naturally arises is whether IBM, a longstanding technological innovator, can once more claim a pioneering role in this ongoing revolution.

Let’s have a look.

AI at the Forefront of IBM’s Agenda

To see how AI could affect IBM’s growth, let’s start by looking at how IBM makes money today.

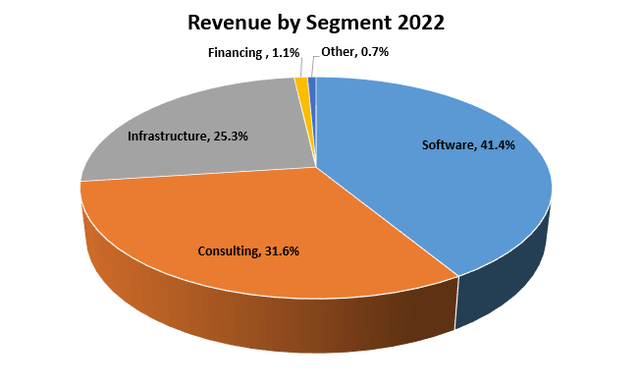

In 2022, IBM posted a total revenue of $60.53 billion, marking a noteworthy 5.5% increase compared to the previous year. The lion’s share of this revenue comes from the Software segment, which raked in a substantial $25 billion, accounting for 41.4% of the overall revenue. Notably, this happens to be the most profitable segment for the company, boasting an impressive gross margin of 79.6%. The second most crucial business unit is Consulting, making up 31.6% of the total revenue, while Infrastructure takes the third spot with 25.3% of the revenue pie.

Revenue by Segment (IBM IR)

It’s thought by many that the AI revolution truly began with the debut of ChatGPT. This marked the moment when AI technology became accessible to the public and demonstrated its practical applications, catapulting it into the mainstream consciousness.

IBM’s venture into generative AI actually dates back to 2020, although it largely remained under the radar until the buzz surrounding ChatGPT emerged. IBM is distinctively positioned with its hybrid cloud and AI capabilities.

It all began with a substantial investment in infrastructure, laying the foundation for what would eventually become a pioneering platform for training during the early stages of transformer experimentation, paving the way for generative AI and large language models.

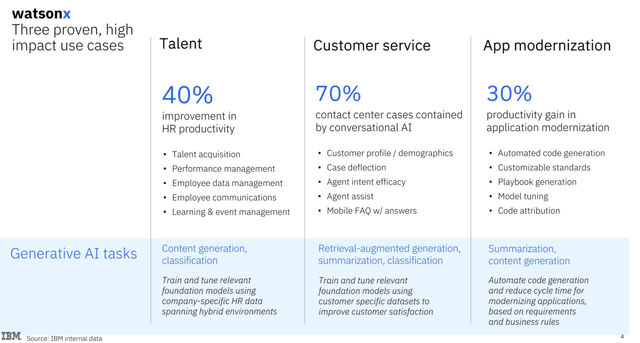

Instead of channeling its efforts toward a consumer-centric engine, IBM’s software product, Watsonx, is resolutely committed to providing tailored generative AI solutions exclusively designed for enterprises. This strategic emphasis spans across key areas such as HR solutions, customer service enhancement, and application modernization.

IBM is concentrating its efforts on domains where significant repetitive tasks exist, and where companies are eager to invest in digitized solutions to enhance their operational efficiency and drive productivity.

Generative AI Use Cases (IBM IR)

I see the enterprise oriented approach as quite encouraging, as it appears that the company has finally identified a niche market in which they can excel. The landscape for AI solutions aimed at individual consumers seems already saturated and fiercely competitive.

IBM is focusing on its core strengths, constructing models grounded in datasets it knows intimately, encompassing code, natural language processing, IT data, and more.

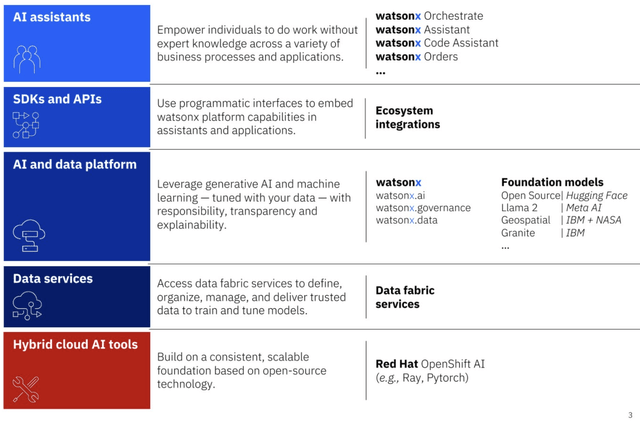

Furthermore, their Software and Consulting portfolios extend to AI assistants via WatsonX, a platform with the potential to significantly boost the productivity and efficiency of their clients’ workforce.

In addition, IBM is committed to increasing its investment and bolstering its presence in the Data Platform market, with a focus on enabling seamless interactions with their clients’ data—a pivotal element for the successful execution of AI initiatives.

Moreover, they are also providing data services and hybrid cloud AI tools, effectively broadening their array of offerings and enriching their core competencies. This expansion ultimately provides their clients with a comprehensive and well-rounded product package.

Product Offering (IBM IR)

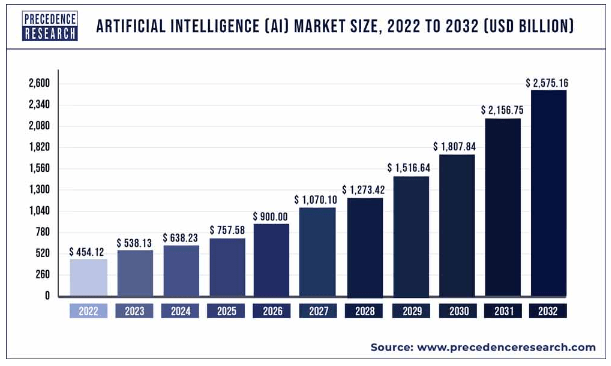

When we consider the broader landscape of the AI market, it’s projected to approach a substantial size of approximately $2.6 trillion by 2032, with more than half of this value attributed to generative AI solutions—the very arena in which IBM is actively competing. This implies that we should anticipate the generative AI market to exhibit a robust CAGR of approximately 42%.

This presents an immense opportunity, one that’s bound to see fierce competition from numerous companies. Nevertheless, I hold an optimistic view that IBM is strongly positioned to seize this opportunity effectively within both their Software and Consulting segments.

AI Growth Forecast (Precedence Research)

While the market’s growth potential is undeniably substantial, the critical question that still looms is the extent of the addressable market that IBM can effectively tap into. Given the early stage of this emerging industry, pinpointing an exact figure remains challenging.

Giving us a taste of what we may expect, as of Q2 2023, IBM has reported promising YoY growth in their Software division, at an impressive rate of 8%, with Data & AI experiencing an even more robust growth of 11%. In contrast, Consulting has witnessed a more moderate growth rate of 6%.

Based on this information, I envision that IBM’s potential lies in achieving a consistent annual revenue growth rate of approximately 5-7% in both Software and Consulting in the next 10 years driven by the AI initiatives, if executed well.

Significantly Undervalued with Robust Growth Prospects

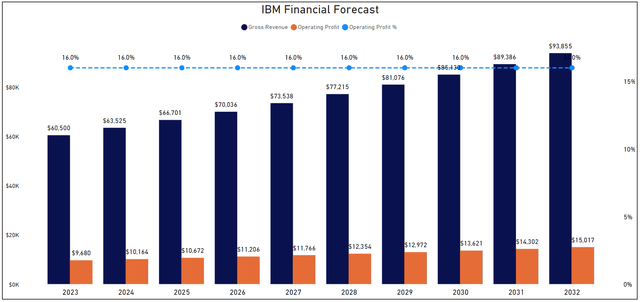

Given the inherent risks associated with the early stages of the AI revolution, which undoubtedly holds the potential to improve the lives of many, as previously mentioned, it remains challenging to precisely quantify the extent to which IBM can seize this opportunity. Taking a cautious approach, I’m assuming a modest growth rate of 5% annually for the next decade, without factoring in any improvements in IBM’s operating margin.

Nevertheless, it’s worth noting that IBM, with its vast workforce of 288,000 employees, stands to benefit significantly from AI by automating numerous processes, thereby enhancing efficiency and potentially improving operating margins.

In a “bear case” scenario for AI adoption, I anticipate the company could achieve nearly $94 billion in revenue by the end of 2032. This would represent a 55% growth from the current revenue levels. Concurrently, the operating margin is expected to exceed $15 billion.

IBM Financial Forecast (Author’s Graph)

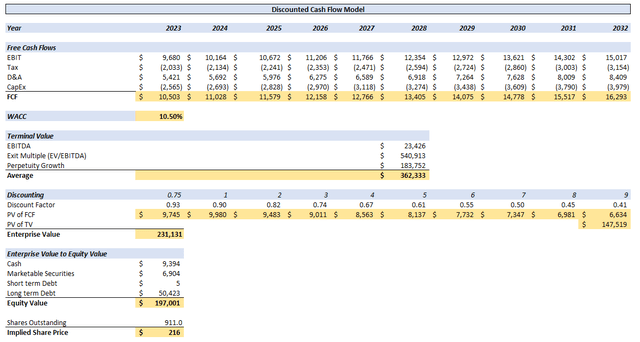

In order to calculate the Fair Value of IBM I am using the DCF Model.

Additional assumptions for the DCF analysis are:

-

A tax rate of 21.0%.

-

D&A and CAPEX amounting to 56% and 26% of EBIT, respectively.

-

WACC of 10.5%.

-

EV/EBITDA multiple of 23.09.

-

A Terminal Growth Rate set at 1.5%.

After discounting these values over the next 10 years, the PV of FCF amounts to approximately $83.6 billion, while the PV of TV reaches $147.5 billion. Consequently, the total Enterprise Value is estimated at $231.1 billion. Following adjustments for Cash, Marketable Securities, Short & Long-term debt, the resulting Equity Value is assessed at $197 billion.

DCF Model (Author’s Graph)

According to my calculations, the estimated Fair Value for the company today is $216, suggesting a significant undervaluation of approximately 47% compared to today’s price of $148.

Conclusion

IBM has a remarkable history of staying at the forefront of technological evolution since its inception.

However, it’s essential to acknowledge that the past decade has posed challenges for the company, marked by declining revenues and a substantial underperformance in comparison to the broader market, trailing by a significant 178%.

Nonetheless, we find ourselves at the initial stages of a new AI revolution, one that promises to enhance productivity and the quality of life for many individuals.

IBM has been deeply immersed in AI since 2020 and has identified its niche in the enterprise sector, offering data services and hybrid cloud AI tools. These tools hold the potential to significantly boost the efficiency of numerous companies.

Anticipating robust demand for AI solutions in the coming decade, driven by the compelling prospect of cost savings and heightened productivity, we can foresee enterprises growing faster and becoming more profitable, while seeking better and faster AI solutions.

Considering a conservative growth rate of around 5% in my “bear case scenario” for AI adoption, I believe IBM is poised for exceptional performance. Coupled with its current significant undervaluation, estimated at more than 47% below its fair value, I confidently rate the company as a STRONG BUY for those seeking to capitalize on the AI boom.

Read the full article here