Introduction

MarketWise Inc (NASDAQ:MKTW) is quite an interesting company that is focusing mostly on the retail investor side of the market. The company offers a variety of content and technology platforms that are meant to empower individual investors and let them have a larger set of research papers and analyses at their fingertips. The company generates its revenues through a subscription-based model where people pay to gain access to the content the company has.

This model makes it incredibly important to be able to raise the subscriber base efficiently and through as little cost as possible to maintain margins. But they also need to focus on retaining subscribers. The last report showcased some difficulties for the companies on this remark and I think as interest rates further increase, the spending power of Americans decreases and priority services like MKTW diminish. The valuation already looks quite rich for MKTW and I don’t see any significant catalyst in sight that would ignite significant net income growth. As a result, I will be issuing a sell rating for the company right now.

Company Structure

MKTW operates as a versatile platform encompassing various subscription services under multiple brands. This innovative company provides customers with access to a subscription-based business platform that delivers a wealth of high-quality financial research, applications, training programs, and valuable resources. While serving a diverse audience, MKTW predominantly focuses on catering to the needs of American consumers, making its services readily accessible to this vital market segment.

In its pursuit of effectively engaging with its target audience, MKTW has made substantial investments in customer relationship management systems, harnessing the power of artificial intelligence for in-depth analysis of subscriber data. Additionally, the company has diligently compiled an extensive and sophisticated database containing valuable customer information. These strategic initiatives serve to enhance MKTW’s ability to connect with its audience and provide tailored services and solutions.

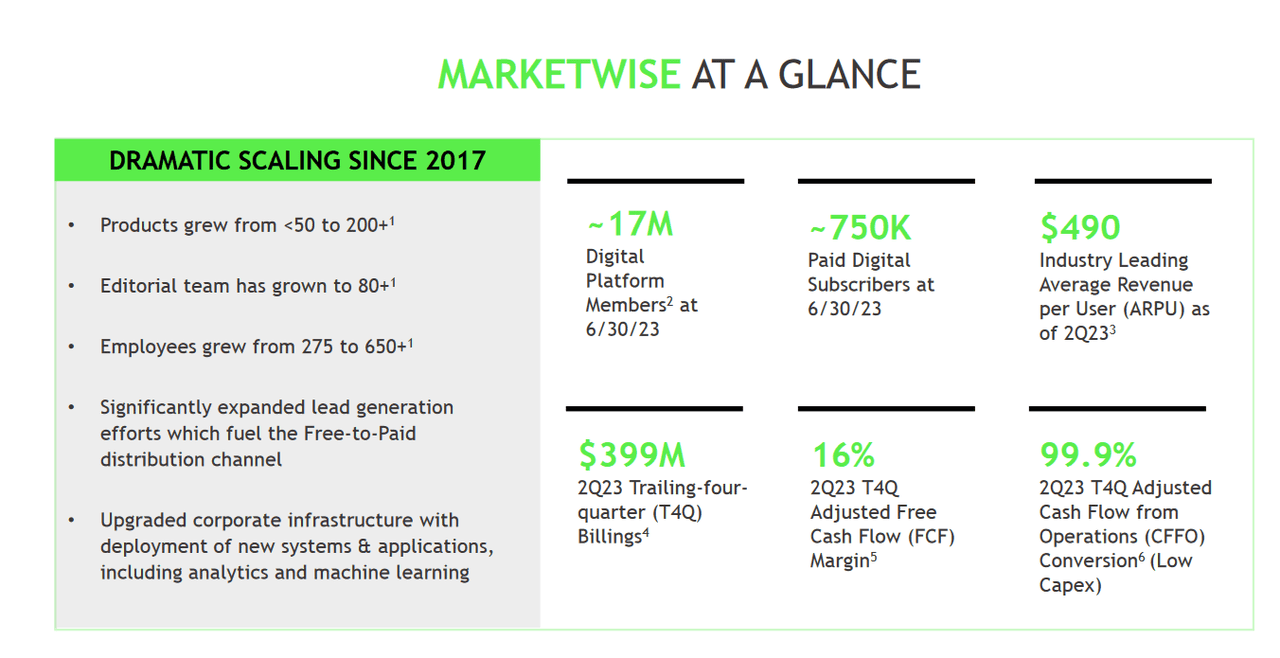

Market Overview (Investor Presentation)

One thing that MKTW has not been is idle. Since 2017 the company has rapidly expanded its product offerings and it’s now over 200; the editorial team has grown to over 80 individuals. The company due to this managed to average an industry-leading average revenue per user of $490. The scalability of the company is perhaps what is the most enticing. The intake of new subscribers is not that difficult. But maintaining them is perhaps the bigger challenge. But as long as MKTW continues to invest in its content and analysis offerings then the idea is that organic and nonorganic subscriber growth will continue.

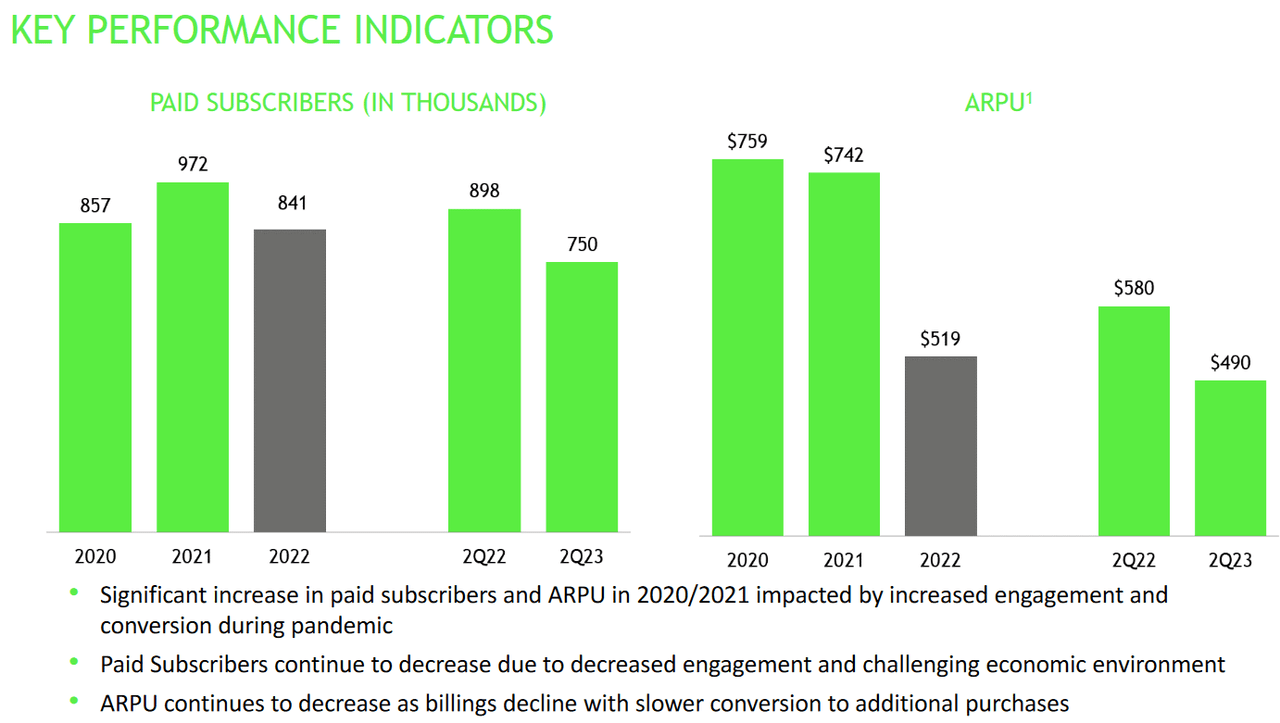

Operational Performance (Investor Presentation)

What is worrying though is that MKTW is noting a decline in subscribers. The bull run we saw in 2021 made the markets a very hot topic as a lot of investors saw it as easy money. For now, though, the market has been less rewarding and fewer people are interested in investing. This of course has harmed the subscriber growth for MKTW and I fear it’s something that may continue as long as interest rates remain high. With less spending power for Americans, investing takes a back seat in terms of priority.

Earnings Transcript

From the last earnings call that the company held, I think there are some worthwhile comments to bring up here. The CEO of MKTW Amber Mason had the following to say to investors.

-

“Let’s get started. First, let’s discuss our Q2 results. Frankly, what we experienced in the second quarter is a lot like what we’ve seen in the past few quarters. Investors and subscribers are still engaged in buying financial research, but at lower levels than we saw during the boom years of 2020 and 2021. The good news is that many of our internal metrics show that we’ve reached a plateau of sorts”.

This statement I think can be quite detrimental to the share price if the next few quarters show an even lower set of activity for the business. The CEO states that they see a plateauing of this decline, but if that isn’t the case the market may be spooked and the share price will likely be cut even lower. To support this, MKTW is already trading at a pretty high earnings multiple of 37 on an FWD basis, far above the sector median of under 10.

-

“Furthermore, our adjusted cash flow from operations margin for the first half of 2023 improved to 17% as compared to 11% for the first half of 2022, reflecting the success of our cost reduction efforts over the past year”.

Successful cost reductions have been a hot topic this year as rising interest rates have put pressure on the earnings of businesses. I think that this result is a good indication that perhaps MKTW is on the right track to deliver growing EPS over the long-term at least if they can be this agile in cost reductions.

Valuation & Comparison

The valuation is something I have an issue with here with MKTW. The earnings multiple is at 37 on a FWD basis. That is over 3x the sector median of 9.6. I fear that if the coming reports showcase an additional decline in subscriber activity then it will result in the share price dropping very quickly and investors are left holding very heavy bags.

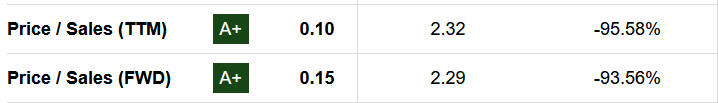

P/S (Seeking Alpha)

The only part I could see MKTW being appealing to is the p/s for the business. Right now at just 0.15 on an FWD basis, but it is climbing as well, indicating lower revenues for the coming periods. But generating strong earnings is important and if MKTW can’t expand margins it will continue to look very expensive in my opinion.

Where I think that MKTW could potentially outperform would come from its ability to cut costs bring in more members and lower member acquisition expenses. That would give some fuel to the potential scalability of the business model. If they could raise the average revenue per user as well that would bring more confidence in their ability to grow earnings at a stronger rate. Margins are hard to expand with companies like MKTW and I think this is the key area to watch. If interest rates go down and MKTW expands its net margin it could rally the stock price.

Risk Associated

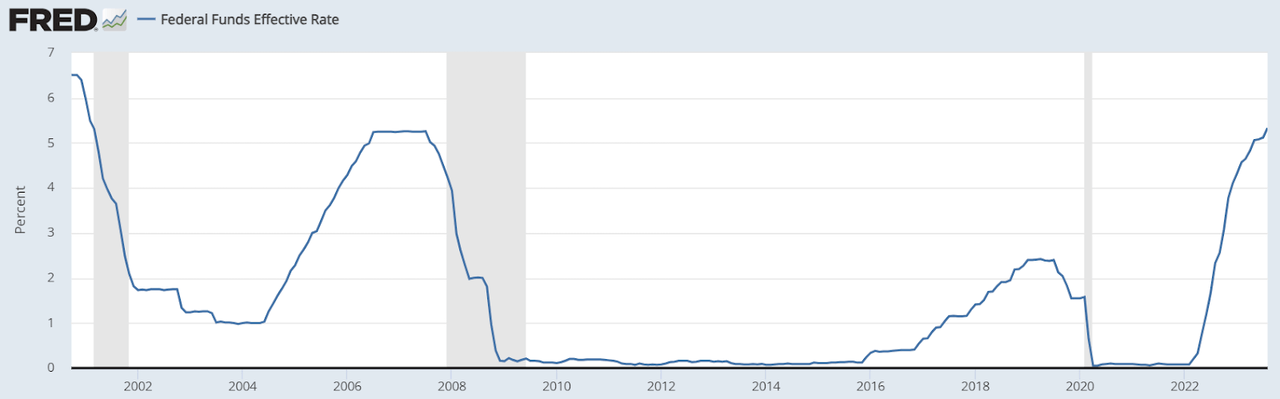

Despite the current resilience seen in economic data, it’s essential to acknowledge the looming risk of an economic downturn for MKTW. The Federal Reserve’s intent to implement two additional interest rate hikes within the year raises concerns about the growing likelihood of a recession shortly. These factors underscore the importance of robust risk management and strategic planning to navigate potential challenges in the financial landscape.

Interest Rates (FRED)

MKTW’s vulnerability to market sentiment introduces a heightened downside risk compared to its counterparts in the sector. As a company intricately tied to market dynamics, it must be particularly vigilant about potential fluctuations and negative sentiment that can impact its performance. Therefore, proactive risk mitigation strategies and a comprehensive understanding of market sentiment are paramount for sustaining its success in the sector. The share price is already down nearly 30% in the last 12 months, even when the market itself has been showing a lot of positives. Major companies in the financial sector like JPMorgan Chase & Co (JPM) are up over 10% so far this year. I think this showcases some of the priorities investors have right now, to go with the bigger players and leave aside the more speculative companies for a while. The history of share dilution though for MKTW I think further adds to the company being speculative and risky still. This is likely to add pressure to the downside for a while longer.

Investor Takeaway

MKTW has been under a lot of pressure over the last 12 months as the share price is down nearly 30%. I fear that this will continue unfortunately supported by the fact subscribers are declining and higher interest rates are creating less excitement around the markets. Dilution has been present with MKTW throughout the last couple of years and this is adding to my sell case further.

Read the full article here