Investment thesis

Our current investment thesis is:

- UTZ has a solid business model, with a strong national presence in the US across many household brands. We suspect its strong brands and product innovation, in conjunction with resilience in the snacking industry will contribute to long-term revenue growth.

- The company has supplemented organic growth with M&A but with a rapidly bloating balance sheet, we suspect this might slow.

- We are also concerned that margin improvement has been mediocre, which does not look positive for the future. At its organic growth rate and small margin improvement, there are likely many better FMCG alternatives to UTZ.

Company description

Utz Brands, Inc. (NYSE:UTZ) is a leading American snack food company that produces and markets a wide range of snack foods including potato chips, pretzels, cheese snacks, and more. The company has a rich heritage dating back to 1921.

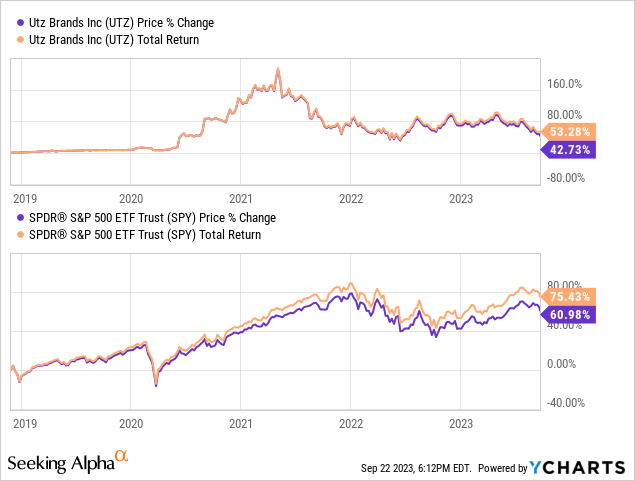

Share price

UTZ’s share price has performed well since it was listed, returning over 50%. During this period, the company has continued to deliver its strategic values.

Financial analysis

UTZ Brands financials (Capital IQ)

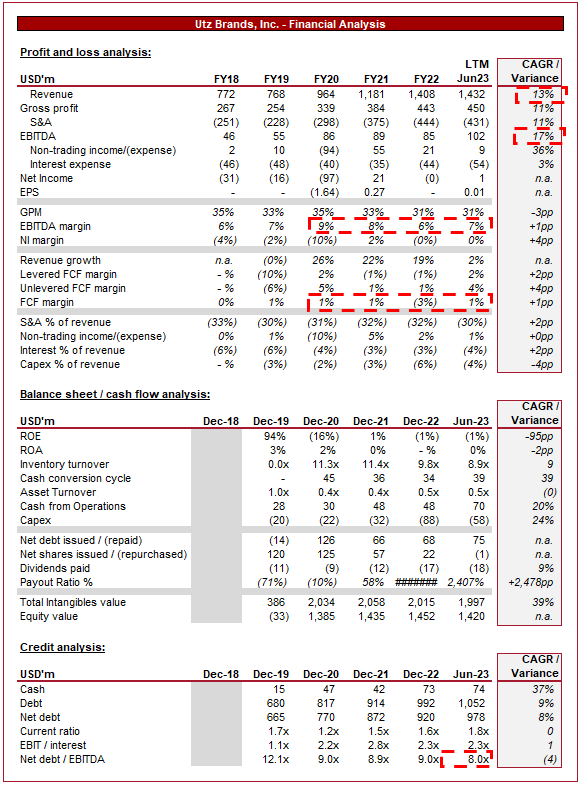

Presented above are UTZ’s financial results.

Revenue & Commercial Factors

UTZ’s revenue has grown well during this short period, with a CAGR of 13%. Organic growth has been materially enhanced by M&A, as Management has sought to rapidly increase the company’s scale.

Business Model

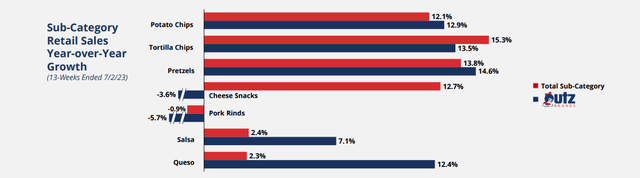

UTZ offers a diverse portfolio of snack products, catering to various tastes and preferences. This includes traditional snacks like potato chips and pretzels, as well as innovative offerings to meet changing consumer demands. These product categories are consumer staples, with consistent, non-cyclical demand, growing in line with macro development.

The majority of the sub-categories are performing well, with UTZ moving broadly in line with the industry as a whole.

Sub-categories (UTZ)

An interesting development within the industry is a trend toward healthier options, as consumers become increasingly aware of physical and mental wellness. The company has responded well, with a focus on introducing healthier snack alternatives.

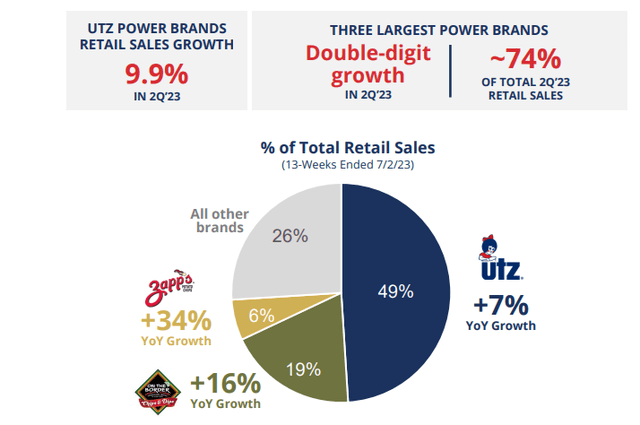

The company operates under several well-recognized brands, including Utz, Zapp’s, Golden Flake, Boulder Canyon, and more. Each brand has a distinct identity and target audience, increasing the company’s reach.

The company’s three largest brands comprise the vast majority of its revenue and so although the business benefits from diversification, it is not to the extent of many FMCG businesses.

Brands (UTZ)

UTZ’s emphasis on product quality, taste, and freshness, has contributed to strong customer loyalty and recurring purchases. In conjunction with its classic offerings, the company continuously introduces new flavors and product variations to respond to consumer preferences and market trends. This has allowed the company to maintain its market-leading position in the various snacking segments.

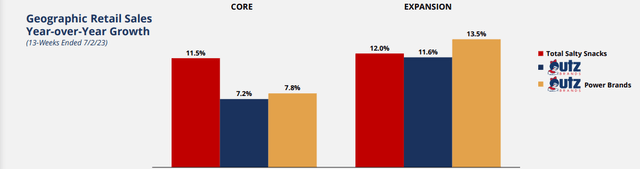

UTZ sells its products through various retail channels, including grocery stores, convenience stores, and online platforms. UTZ’s presence is primarily in the US, with significant scope for international expansion, leveraging its strong brands. As the following illustrates, UTZ has achieved strong growth in Expansion, outperforming the wider market. This said, there is a clear weakness with its non-power brands, clearly lagging the wider market.

Geographical growth (UTZ)

The company has grown well through strategic acquisitions of other snack food companies, expanding its product offerings and market presence. There is a clear focus on rapidly increasing the scale of the company, likely to achieve economies of scale and margin improvement.

Competitive Positioning

We believe UTZ’s primary competitive advantages are:

- Brand Recognition. The company operates several well-established brands and labels that resonate with consumers, leading to brand loyalty.

- Product Diversification. UTZ’s brands offer a wide variety of snack options, allowing the company to capture different segments of the snacking market.

- Innovative Offerings. The company’s scale allows it to cost-effectively introduce new flavors and innovative products to keep things exciting and relevant to changing consumer preferences.

- Retail Partnerships. Distributor relationships (and brand strength) allow UTZ to access various retail channels and be at the forefront of shelf space.

- Regional Appeal. The company’s regional brands, like Zapp’s in Louisiana and Golden Flake in the Southeast, have strong regional appeal and customer loyalty.

Economic & External Consideration

Current economic conditions have contributed to a weakness in various discretionary industries, as a tightening of consumers’ finances has led to reduced spending.

The attractiveness of businesses that focus on consumer staples is inelastic demand, as the expectation is for consumers to maintain food spending. This is in part due to the price of the products relative to earnings.

In UTZ’s most recent 2 quarters, the company experienced top-line growth of +3.1% and +3.6%. The key takeaways from Q2 are:

- Revenue in line with expectations, with organic net sales of +4.3% – This is an impressive performance given we are over a year into the high-inflation period and the business is still seeing price (+6%) / volume (-1.7%) mix growth.

- Productivity improvements contributing to Adj. EBITDA growth of +7% – We believe this is driven by scale and inflationary pressures subsiding, in conjunction with M&A integration.

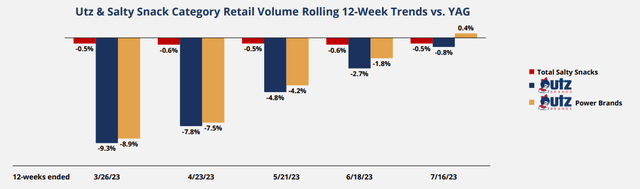

- Consumption volume trends are improving – As the below illustrates, the retail volume sales have rapidly improved MoM. This bodes extremely well for UTZ, as the business has not really felt any weakness thus far.

Consumption volume (UTZ)

- Based on the strong Q2 and consumption trends, Management is raising FY23 EBITDA outlook – This is a positive development but much needed and expected by investors.

Margins

UTZ margins have fluctuated between 6-9% at an EBITDA-M level in the last several years, with no clear upward trajectory. This has been a disappointing development in our view, primarily due to the increased scale achieved.

This is in large part due to GPM erosion, falling 4ppts since FY20. Inflationary pressures are partly the reason but beyond this, we are not overly impressed. We expect some natural improvement as efficiency gains are made from the company’s increased size but beyond this, past performance implies further gains will be difficult to achieve.

Balance sheet & Cash Flows

UTZ currently has a ND/EBITDA ratio of 8.0x, with interest comprising 4% of revenue and an interest coverage of only 2.3x. This is a concerning financial position for a business hoping to conduct further M&A going forward. This is compounded by UTZ’s inability to achieve good FCF margins, relying on debt and share issuances.

Outlook

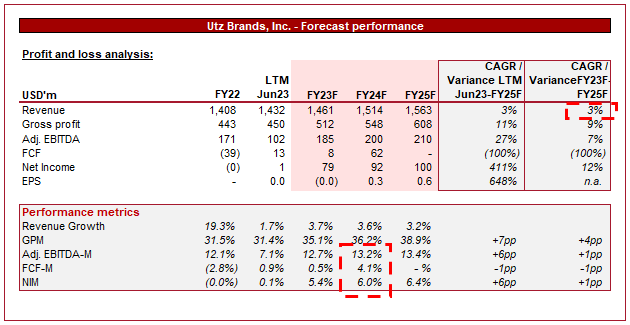

Outlook (Capital IQ)

Presented above is Wall Street’s consensus view on the coming 5 years.

Analysts are forecasting a significant slowdown in growth, with a CAGR of 3% into FY25F. This appears to be a reasonable estimate given the mild organic growth achieved relative to M&A. Further, margins are expected to incrementally improve YoY, but not to a significant degree. This again is a reasonable forecast as inflationary pressures subside and operational improvements are achieved.

Industry analysis

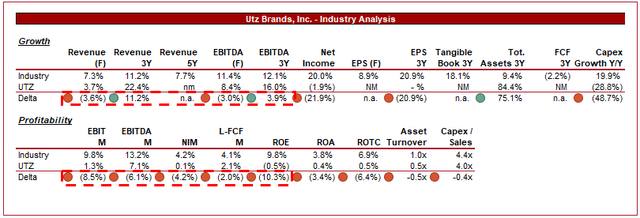

Packaged Foods and Meats Stocks (Seeking Alpha)

Presented above is a comparison of UTZ’s growth and profitability to the average of its industry, as defined by Seeking Alpha (41 companies).

UTZ’s performance is underwhelming relative to the cohort. Despite the M&A-led growth, the company has not clearly exceeded the industry average, implying an inherent organic weakness. Further, the company’s margins are noticeably below the industry average, with no medium-term hope to reach the average.

We do believe UTZ has any qualities materially above-and-beyond any of the peers within this group. The company benefits from such traits as demand inelasticity but this is broadly shared. For this reason, it is a difficult sell for UTZ unless its valuation sufficiently discounts its underperformance.

Valuation

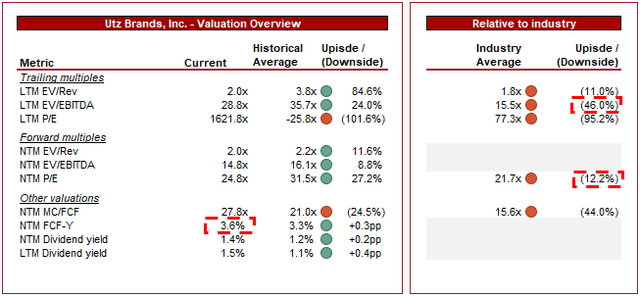

Valuation (Capital IQ)

UTZ is currently trading at 29x LTM EBITDA and 15x NTM EBITDA. This is a fairly rich valuation for what is a business struggling to achieve consistent margins and organic growth. Relative to its peers, the company is trading at a premium, which we struggle to justify based on current financials alone.

Investors are likely pricing a continuation of its current M&A strategy, with future operational improvements following greater scale. We do not believe there is upside beyond the execution risk associated with this. Also, if we are honest, we are not overly confident other either occurring to a sufficient level in the coming 5 years.

Final thoughts

UTZ is a solid business. The primary quality of the business is its revenue resilience, with impressive price/vol mix despite an extended period of inflationary conditions. Management’s supplementary M&A approach is likely the correct one, although we struggle to see how this will be funded going forward. This leaves the businesses, at least in the conservative case, in their current form going forward. At this level, we are not overly attracted.

Read the full article here