Thesis

Norwegian Cruise Line Holdings, LTD. (NYSE:NCLH) endured significant challenges during the pandemic, resulting in a substantial debt burden that will affect its future net income margin. For the purpose of this projection spanning from 2023 to 2028, I will assume a 5% net income margin.

I have conducted calculations for two potential scenarios for the stock’s future performance. In the event of a 20% dilution, the stock could achieve a target price of $47.43. Conversely, if there is no dilution, the target price could reach $56.92. These two scenarios yield annual returns ranging from 35% to 46%, which, in my opinion, provides a sufficient margin of safety for potential investors.

In the present, my discounted cash flow [DCF] analysis suggests a fair value of $16.31 for the stock. This implies that the stock is currently overvalued by approximately 5%. Taking these factors into account, I rate Norwegian Cruise Line Holdings as a “Strong Buy.”

Overview

Norwegian Cruise Line (Norwegian), as many are aware, ranks among the top three largest cruise companies. At the outset of the pandemic, it faced severe challenges. However, its recovery strategy stood out for its distinctiveness compared to other cruise companies. While Carnival Corporation (CCL) was slashing prices in an attempt to attract as many customers as possible, Norwegian chose to maintain or even increase its prices, asserting that they were delivering superior value. This strategic approach has proven highly beneficial for the company, and it is anticipated that Norwegian will achieve a positive net income by the close of 2023.

In addition to its pricing strategy, Norwegian is actively expanding its fleet. As of December 21, 2022, the company operated 29 ships with 62,000 berths, and they plan to add 900 more berths by converting some double-occupancy cabins into studios. Norwegian anticipates receiving the final two Prima Class Ships in 2027 and 2028, completing the following delivery schedule:

- Norwegian Cruise Lines: 5 Prima Class Ships (2023-2028)

- Regent Seven Seas: 1 Explorer Class Ship (2023)

- Oceania Cruises: 2 Allura Class Ships (2023-2025)

By 2028, when this expansion concludes, Norwegian expects to have a total of 82,000 berths, reflecting an increase of 20,000 berths.

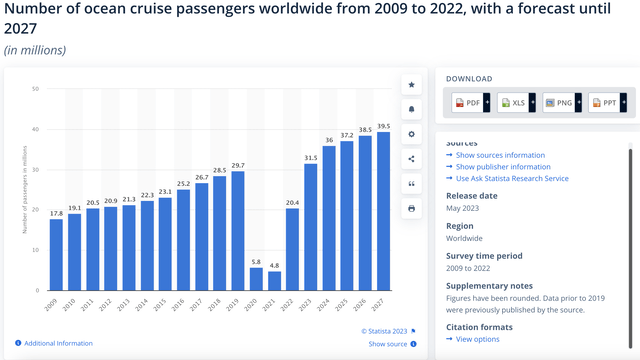

Furthermore, there is the anticipated growth in the cruise industry’s revenue, projected to increase at a rate of 9.29% between 2023 and 2027. Notably, Norwegian, catering to a wealthier clientele, possesses greater pricing power and, theoretically, resilience. Affluent passengers tend to exhibit more resilience during challenging economic periods compared to the average middle-class individuals who opt for Carnival or Royal Caribbean Cruises, Ltd. (RCL). However, it is worth mentioning that the average cruise-goer’s income is approximately $114,000, as of 2014, when the U.S. GDP per capita stood at $55,123.

In summary, the entire cruise industry exhibits a certain degree of resilience to economic downturns, with the exception of prolonged ship idleness, as witnessed during the two-year pandemic-related hiatus.

Statista

With the Q3 2023 earnings release approaching, I find it challenging to make a definitive prediction about Norwegian’s performance for that quarter. However, it’s important to consider the unexpected surge in oil prices following Saudi Arabia’s production cut extension announcement. If analysts haven’t adjusted their predictions accordingly, it could potentially indicate that Norwegian may fall short in Q3.

Nevertheless, I refrain from approaching stocks with a speculative mindset akin to gambling. It’s far more practical to attempt to forecast where the company might stand in 5 years rather than within a mere 2-month timeframe. However, as you will discover in the financials section, Norwegian possesses the ability to reduce costs, which could potentially lead to exceeding quarterly expectations.

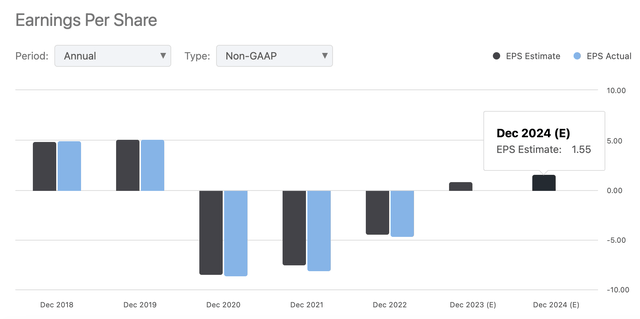

Seeking Alpha

Financials

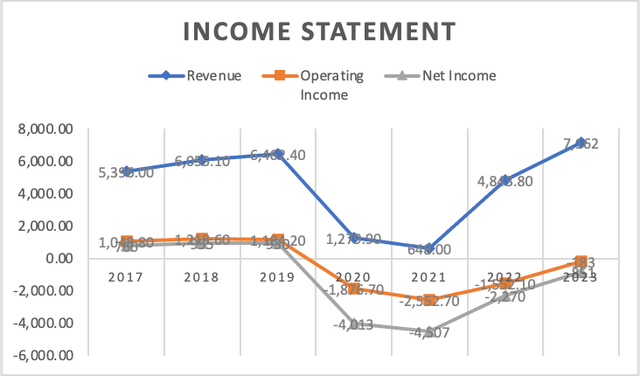

We are all aware of what lies ahead: relatively stable figures, with a sudden collapse in 2020. This is precisely what you will find in the income statement section. 2023, which refers to a trailing twelve-month [TTM] basis, Norwegian has already surpassed its 2019 revenue, which stood at $6.4 billion, with the current figure reaching $7.1 billion.

Author’s Calculations

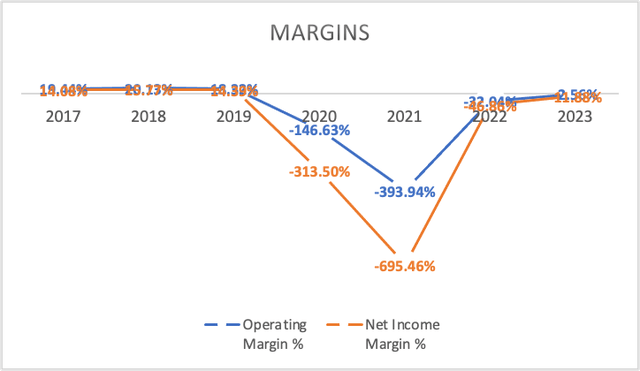

Now, let’s delve into Norwegian’s margins. Currently, all of them are in the negative territory. The operating margin hovers around the -2% mark, suggesting the possibility of turning positive by year-end. The same trend applies to the net income margin, which currently sits at -11.8%.

Author’s Calculations

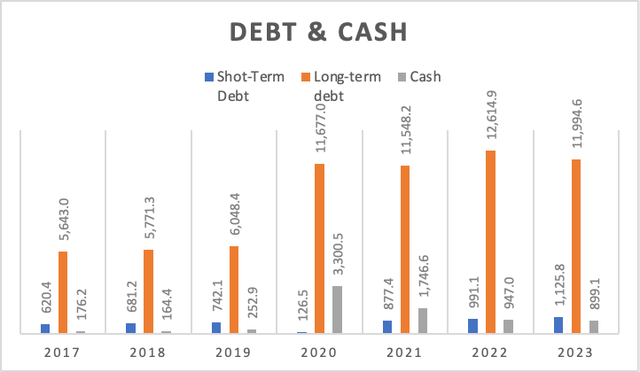

However, what truly matters is Norwegian’s long-term debt, currently totaling $11.9 billion. The primary concern here is that, in my opinion, Norwegian may struggle to achieve the net income margins it enjoyed during 2017-2019, averaging 14.75%. If we apply the current interest expenses of $670.3 million to the years 2017-2019, we see net income margins of 2%, 5%, and 4% respectively.

Author’s Calculations

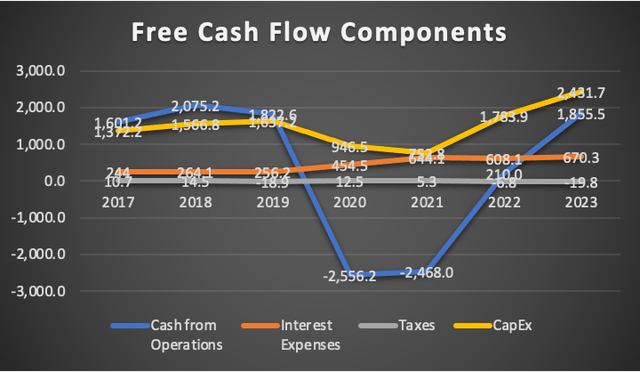

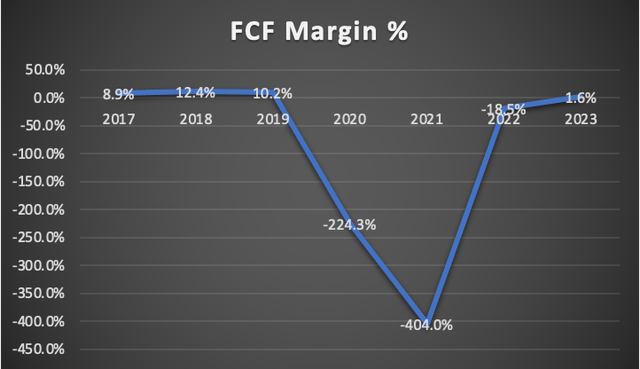

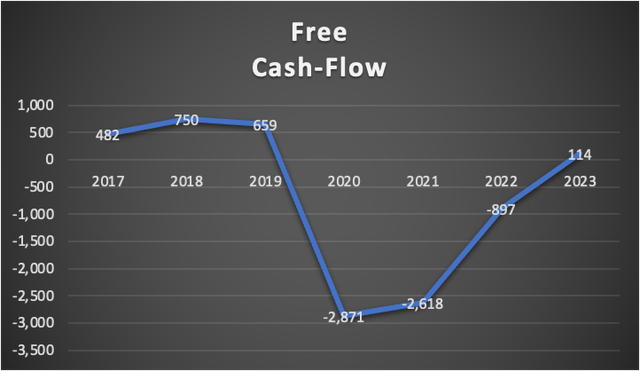

Next, let’s consider its free cash flow, which doesn’t come as a significant surprise. What works in Norwegian’s favor is that its currently elevated capital expenditures [CAPEX] are primarily attributed to the ships ordered for the period from 2023 to 2028. Nevertheless, they have the potential to turn this around, given that the current free cash flow stands at $114 million. Yes, I understand it’s already positive, but it remains susceptible to turning negative as early as the next quarter.

Author’s Calculations Author’s Calculations Author’s Calculations

In summary, Norwegian may not be in the best financial shape presently. However, from a valuation perspective, they have the capacity to rectify their free cash flow situation at their discretion. Moreover, their revenue is expected to exhibit robust growth throughout 2028.

Valuation

To assess the valuation of Norwegian, I have compiled a table containing all the essential variables required for calculating EBITDA. First, we consider revenue, which serves as the foundation for deriving net income. My projection anticipates revenue growth at the market rate of 9.29%. Norwegian is well-positioned to achieve this growth rate, thanks to their existing order of 8 ships slated for delivery between 2023 and 2028.

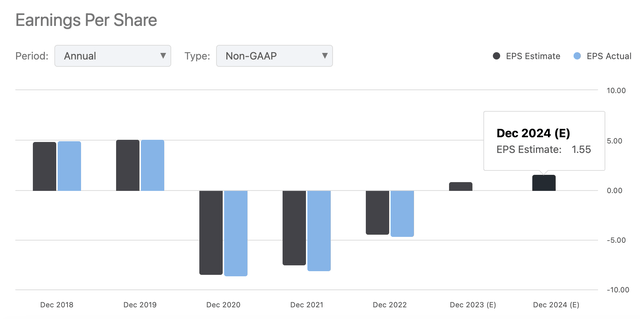

Now, let’s delve into net income. As previously discussed in the financials section, it’s unlikely to reach the previous net income margin due to the burden of servicing a $670 million debt acquired during the pandemic. Consequently, the average net income margin of 14.75% from 2017-2019 is adjusted down to 5% for 2023-2028. This adjustment, as you can verify in Seeking Alpha’s NCLH Summary section, falls below Analysts’ expectations.

EPS Estimates for NCLH (Seeking Alpha)

Additionally, we calculate Depreciation & Amortization [D&A] and interest expenses using margins tied to revenues, specifically 11.78% and 9.35%, respectively.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2023 | 8,620.00 | $357.17 | $349.05 | $1,364.49 | $2,170.46 |

| 2024 | 9,420.80 | $471.04 | $481.75 | $1,591.52 | $2,472.36 |

| 2025 | 10,295.99 | $514.80 | $526.50 | $1,739.37 | $2,702.05 |

| 2026 | 11,252.49 | $562.62 | $575.42 | $1,900.96 | $2,953.07 |

| 2027 | 12,297.84 | $614.89 | $628.87 | $2,077.56 | $3,227.41 |

| 2028 | 13,440.31 | $672.02 | $687.29 | $2,270.56 | $3,527.23 |

| ^Final EBITA^ |

| D&A Projection | Interest Projection | |

| 2023 | 1,015.436 | 805.97 |

| 2024 | 1,109.770 | 880.84 |

| 2025 | 1,212.868 | 962.68 |

| 2026 | 1,325.543 | 1,052.11 |

| 2027 | 1,448.686 | 1,149.85 |

| 2028 | 1,583.269 | 1,256.67 |

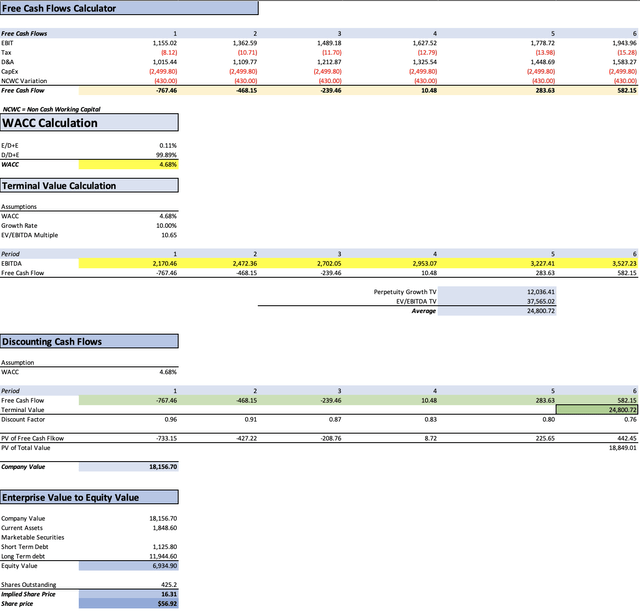

Subsequently, I construct the DCF model, incorporating the assumption table below and the discounting of projected free cash flows for Norwegian spanning from 2023 to 2028.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 15.20 |

| Debt Value | 13,757.50 |

| Cost of Debt | 4.87% |

| Tax Rate | 2.27% |

| 10y Treassury | 4.22% |

| Beta | 1.96 |

| Market Return | 10.50% |

| Cost of Equity | 16.53% |

| Assumptions Part 2 | |

| EBIT | 1,541.20 |

| Tax | 19.80 |

| D&A | 844.00 |

| CapEx | 2,431.70 |

| Capex Margin | 29.00% |

| Assumption Part 3 | |

| Net Income | 851.10 |

| Interest | 670.30 |

| Tax | 19.80 |

| D&A | 844.00 |

| Ebitda | 2,385.20 |

| D&A Margin | 11.78% |

| Interest Expense Margin | 9.35% |

DCF1 (Author’s Calculations)

One key observation in the DCF analysis is that Norwegian is projected to achieve positive free cash flow in 2026. It’s worth noting that if we include the net income Analysts anticipate, which stands at $659.06 million (a figure $188.02 million higher than my projection), it still wouldn’t be sufficient to attain positive free cash flow by 2024.

The DCF analysis yields a present fair price of $16.31, indicating a modest overvaluation by 5.27% based on my metrics. However, the future price is estimated at $56.92, translating to a remarkable upside of 231.5% or an annual return of 46%.

Furthermore, it’s important to highlight that Norwegian’s current cash reserve, currently at $899.1 million, suggests that they could deplete their funds when they encounter the expected negative free cash flow of -$767.46 million in 2023. This predicament necessitates either taking on additional debt or pursuing dilution. In the case of dilution to raise $1.47 billion to cover the negative free cash flow for 2023-2025, the future stock price would reach $47.43, still promising a substantial 35% annual return.

In conclusion, taking all these factors into account, I am rating Norwegian as a “strong buy” and forecasting a target price range of $47.43 to $56.92 for 2028, which could deliver an annual return ranging from 35% to 46% throughout 2028. The dilution calculation has demonstrated a sufficient margin of safety to warrant investment.

Risks to Thesis

As you may have observed, the stock price appears to have effectively mitigated nearly all conceivable risks. Even in the event of dilution required to offset the anticipated negative Free Cash Flow expected for 2023-2025, the stock has the potential to deliver an annual return of 35%.

The primary macroeconomic risk in this context revolves around the possibility of an economic downturn. In theory, a cyclical industry like the cruise industry might witness a reduction in passenger volumes during such downturns. However, as indicated in the overview section, even during 2009, passenger volumes remained robust. This trend is exemplified in Carnival, for instance.

Statista

Lastly, the only pertinent business-related risk factor to consider is the potential for management missteps. Predicting such occurrences is inherently uncertain. Nevertheless, it’s worth noting that Norwegian’s CEO, who previously served as the founder of Oceania Cruises, assumed the role of CEO for the newly merged company after Oceania Cruises was acquired by Norwegian. This suggests a level of competence and decision-making acumen that can be reasonably relied upon.

In conclusion, it’s evident that the stock has efficiently managed and mitigated risks on various fronts. While macroeconomic downturns and business-related risks are ever-present factors to consider, the historical resilience of the industry and the capable leadership at Norwegian provide a level of assurance for prospective investors.

Conclusion

It’s clear that NCLH has charted a path to recovery after the tumultuous events of 2020, with revenue projections indicating growth at the market rate of 9.29%. Despite facing the challenge of servicing a substantial debt incurred during the pandemic, NCLH is poised to maintain a net income margin of 5% from 2023 to 2028, albeit below some analysts’ expectations.

The DCF analysis suggests a modest overvaluation at the present, with a fair price of $16.31. However, the outlook for NCLH is undeniably promising, with a projected future price of $56.92, offering an exceptional upside of 231.5% or an annual return of 46%. While the company’s current cash reserves may not fully cushion against anticipated negative Free Cash Flow in 2023, the calculated dilution scenario demonstrates a viable path to financial stability.

Moreover, despite macroeconomic concerns surrounding potential economic downturns, historical data reveals the cruise industry’s resilience, even during challenging times like the 2008 financial crisis. Furthermore, NCLH benefits from a leadership team with a track record of sound decision-making, underscored by the CEO’s prior experience as the founder of Oceania Cruises. In light of these factors, I conclude that NCLH presents a compelling investment opportunity. With the potential for annual returns ranging from 35% to 46% through 2028, it may warrant consideration as a “strong buy” for investors seeking growth.

Read the full article here