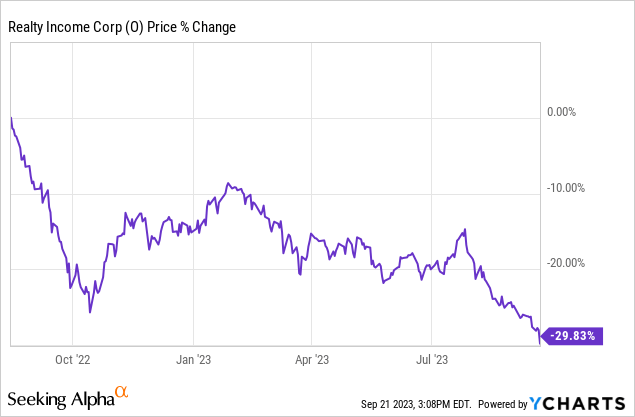

Realty Income (NYSE:O) is among the bluest of the blue-chip REITs and offers investors an attractive current dividend yield and over quarter century dividend growth streak that is backed by a strong business model and balance sheet. That said, due to skyrocketing interest rates, its stock has taken a beating since August of last year:

That said, its fundamentals remain rock-solid, even as other peers – notably W.P. Carey (WPC) – falter in the face of high costs of capital and fresh commercial real estate headwinds.

In this article, we will discuss why we think O stock is such a compelling SWAN stock during a time when peers like WPC are struggling.

#1. O’s Portfolio Management Has Been Prudent

WPC just announced that it is going to be spinning off and selling its office portfolio, resulting in a dividend cut in the process. The reason for the dividend cut is because its office portfolio makes up ~16% of its rent, so the loss in AFFO per share from selling these office assets (at what will likely prove to be dilutive valuations) – combined with WPC management’s stated desire to reduce its payout ratio – are forcing their hand.

In contrast, O spun off its office properties a while ago, but kept its dividend in place. The reason for this was because O’s scale was large enough and its dividend payout ratio was kept at a prudent enough level that it did not feel the need to trim its dividend in the process. Moreover, it spun off these assets during a time when the cost of capital was lower than it is today, and office assets were not in the doghouse of market sentiment like they are now.

Moreover, in years past O focused primarily on acquiring recession resistant and e-commerce headwind resistant assets, such that 92% of its current rent is from these types of tenants (and over 40% comes from investment grade tenants). As a result, during the severe recession of 2008-2010, the COVID-19 lockdowns of 2020, and the retail apocalypse of the past half decade, O’s occupancy rates have remained extremely high (O boasts a 98.2% historical median and 96.6% all-time low year-end occupancy rate).

While WPC was viewed by many as having a stronger portfolio than O’s due to its superior exposure to industrial real estate, its greater exposure to office real estate and hurried exit from the sector ended up being the Achillies heel to its dividend. In contrast, O’s prudent portfolio management has fueled its consistent performance through multiple periods of headwinds.

#2. O’s Cost of Capital Management Has Been Best-in-Class

In addition to managing its portfolio extremely well over the years, O has also managed its cost of capital better than many of its peers. Between taking care of its leverage metrics in order to obtain a sector-best A- credit rating, opportunistically issuing new shares at healthy premiums to NAV, carefully managing its payout ratio, and locking in debt at attractive terms and fixed interest rates, O has ensured that it always has sufficient capital on hand to continue fueling dividend growth.

O’s leverage ratio is 5.3x, which is a good bit lower than peers such as WPC, whose leverage ratio is 5.7x. This makes its NAV per share and AFFO per share more resistant to sharp increases in interest rates, such as we have experienced over the past two and a half years.

Moreover, it has been careful to keep its payout ratio in a healthy range of 76%-79% in recent years. This has resulted in it retaining plenty of equity along with its access to lower cost debt than many of its peers (thanks to its A- credit rating) and opportunistic issuance of new equity to continue generating growth for the portfolio. When combined with its contractual rent escalators, O has been able to generate a mid-single digit AFFO per share CAGR despite having a huge real estate portfolio already.

Last, but not least, O is weathering the current period of higher interest rates quite well thanks to its focus on conservative debt management. In addition to its fairly low leverage ratio, it has a conservative weighted average term to maturity of 6.7 years on its debt (much longer than WPC’s weighted average term to maturity of 3.9 years, for example) and 92% of its debt is at fixed interest rates, providing good protection against rising interest rates. Moreover, with 96% of its debt unsecured, it has an enormous pool of untapped liquidity in its unencumbered real estate portfolio should it ever need to go that route.

#3. O Stock’s Valuation Provides A Healthy Margin Of Safety

In addition to the safety provided by its strong balance sheet and real estate portfolio that has weathered numerous headwinds and challenges over the years, O stock’s current valuation provides investors with an additional layer of safety of principal against long-term value destruction. With interest rates likely near or at their peak, now seems like a great time to buy a truly great real estate business at a discount to its private market value (i.e., net asset value, or “NAV”).

O currently trades at a 9% discount to its NAV, despite typically trading at a ~1.2x premium to its NAV. Moreover, it trades at an EV/EBITDA of 15.11x compared to its typical average of ~19x and it trades at a P/AFFO of 13.24 despite typically trading at a 18x multiple of its AFFO. Last, but not least, its NTM dividend yield of 5.8% is well above its historical average of ~4.5%.

Risks To Consider

While O’s dividend appears to be on a strong foundation and likely to continue growing well into the foreseeable future, shareholders should keep in mind that – like all publicly traded companies – there is a very real risk of principal loss in the short-term.

As we pointed out at the beginning of this article, interest rates pose the biggest risk to O’s intrinsic value. If interest rates remain higher for longer – especially if they rise further – O stock could very possibly experience further downside in the future. Therefore, investors should not invest in O if they have a lengthy time horizon and do not plan on needing the cash for the foreseeable.

Put differently, O is a SWAN stock for income-focused investors who want dependable monthly income checks, not for investors who cannot handle short-term volatility in the market value of their holdings.

Investor Takeaway

With very strong fundamentals, low risk, and a potential upside catalyst from a reversal in interest rates in the not-too-distant future, now looks like a great time to double down on this SWAN REIT at a time when peers that looked like SWANs are wilting under pressure. While WPC and many other investment-grade triple net lease REITs are attractive buys from a valuation perspective, for investors who want a management team, business model, and balance sheet that stand unwaveringly behind their dividend, there is only one Monthly Dividend Company.

Read the full article here