Overview

Automation, Robotics and Artificial Intelligence are keywords, concepts and megatrends that stoke greed and fear in many an investor heart. However, why are these themes so important? As you may have seen reported, the world population is not only aging but in many countries, it is declining. This poses a significant dilemma; a shrinking labor force may need to produce the goods and services for an expanding non-productive (retired) population. While immigration may solve part of this problem, automation, robotics, and AI are very likely to be needed to augment (if not replace) human resources. This applies to most sectors including health care, legal, financial, agriculture, transport, and manufacturing to name a few.

Thus, companies involved in this megatrend have captured investor attention and (NASDAQ:BOTZ) is one of the largest ETFs in the sector. It was created in September 2016, has about US$2.2bn in AUM and is managed by Global X.

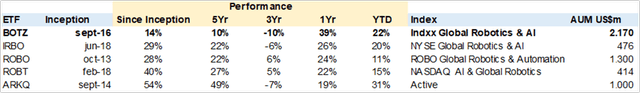

BOTZ Peer Comparison (Created by author Data from Seeking Alpha)

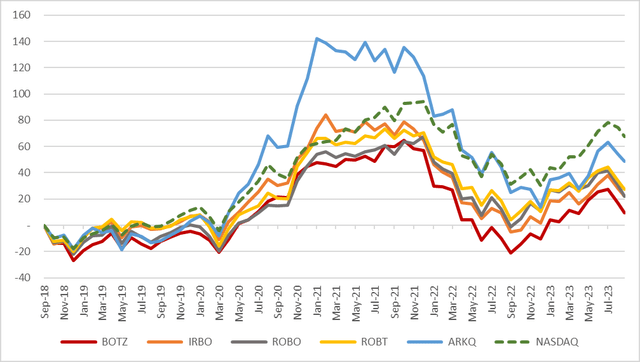

Performance, since inception, has been mediocre vs. peers and the Nasdaq (NDX). Outperformance in the last 12 months is primarily due to a 14% position in Nvidia (NVDA). Can the current portfolio outperform? To answer this, I conducted a weighted consensus estimate analysis on 99% of the positions and found the ETF to have an EPS growth rate of 25% trading at a PE of 31.5x YE24 and potential upside of 25%.

BOTZ vs Peers and NASDAQ Since Inception (Created by author with data from Capital IQ)

Looking Under the Hood

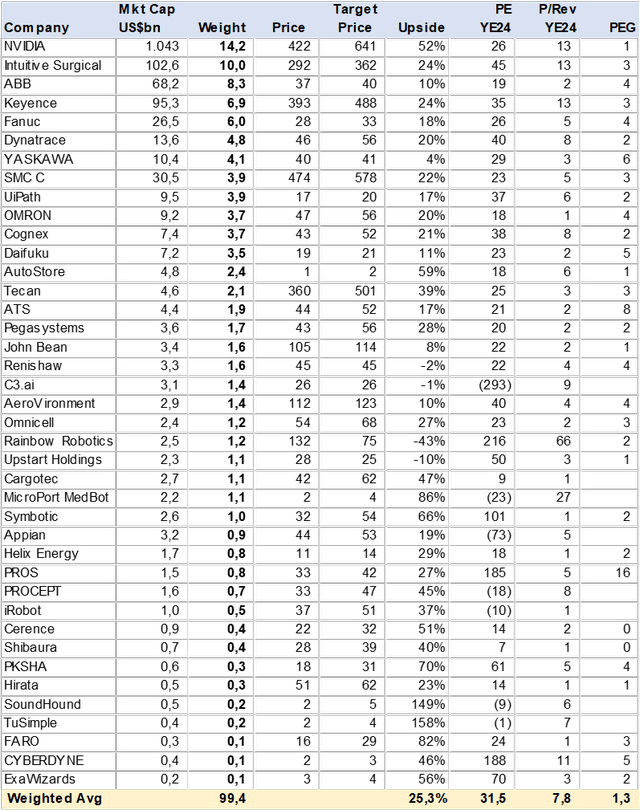

I analyzed 40 stocks, or 99% of the portfolio, using consensus estimates. I found a relatively concentrated ETF, with 50% of the position in just 6 stocks. However, the rest of the portfolio is quite diverse and includes 12 Japanese stocks and many others that I consider emerging companies without positive earnings yet. BOTZ appears to offer a good balance between large cap and small cap that could turbocharge upside potential.

The portfolio has a weighted 25% upside potential based on consensus price target with 25% EPS growth and 31.5x PE for a PEG of 1.3x, which I found very attractive.

BOTZ Consensus Price Target and Valuation (Created by author with data from Capital IQ)

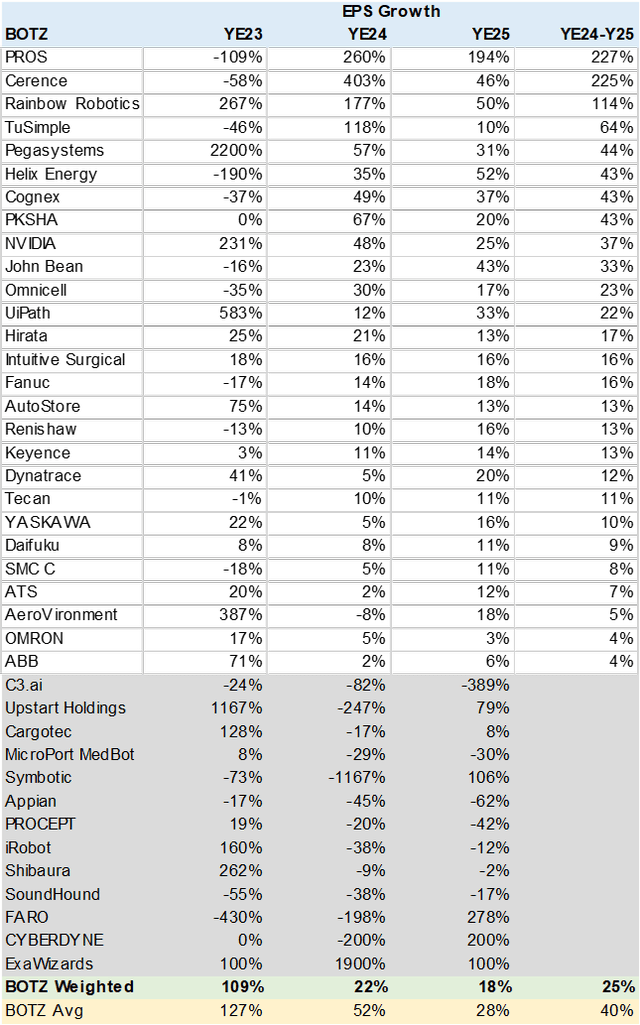

EPS Growth 25% in YE24-YE25

BOTZ, as mentioned above, appears to have very high growth according to consensus estimates. Looking at an unweighted, EPS, growth is above 57% in the YE24-YE25 time frame, represented by several small caps. PROS (PRO), Cerence (CRNC) and Rainbow stand out. On the weak side is ABB (OTCPK:ABBNY). Note that I adjusted these EPS growth rates for a large portion of the portfolio that does not have positive earnings yet or are moving from losses to gains.

BOTZ Consensus EPS Growth (Created by author with data from Capital IQ)

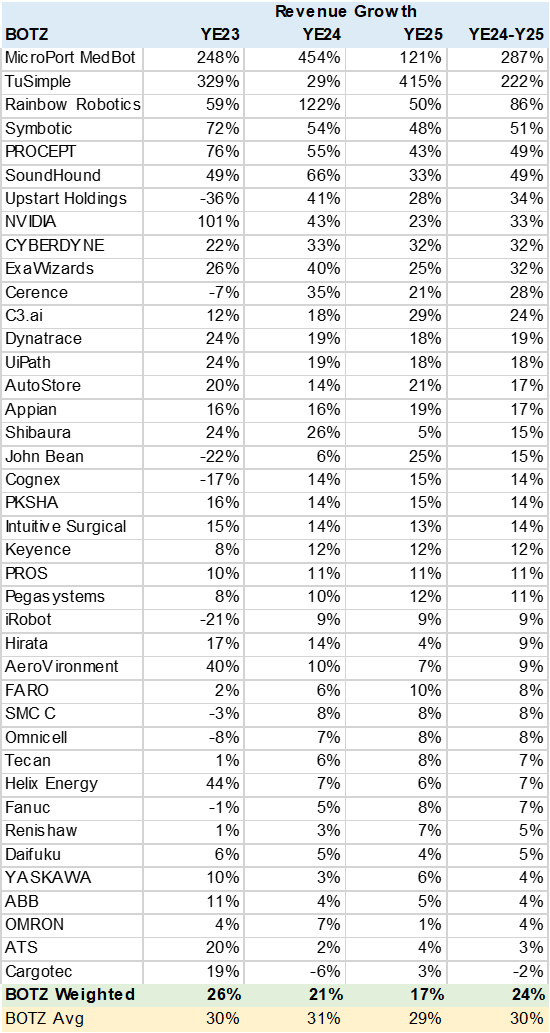

Revenue Growth 24% YE24-YE25

Given that many stocks are not yet EPS positive, I also looked at consensus revenue to get a better sense of the portfolio growth potential longer term. This sector has upside surprise risk in my view. Here we see weighted revenue estimated to grow 24% with an average (not weighted) of 41%. Outliers are MicroPort (OTCPK:SGMMY), TuSimple (TSP) and Rainbow.

BOTZ Portfolio Consensus Revenue Growth (Created by author with data from Capital IQ)

Conclusion

In my view, BOTZ is BUY. It has a well-balanced portfolio of very high growth stocks in the key robotics and AI sector with a 25% upside potential on consensus price targets for YE24. Valuation is surprisingly inexpensive on a relative bases, with a PEG (PE to Growth) of 1.3x. Consensus EPS estimates point to an EPS growth of 25% on a PE YE24 of 31.5x. At the same time, about 43% of the BOTZ portfolio are non-US stocks that are not easily accessible otherwise.

Read the full article here