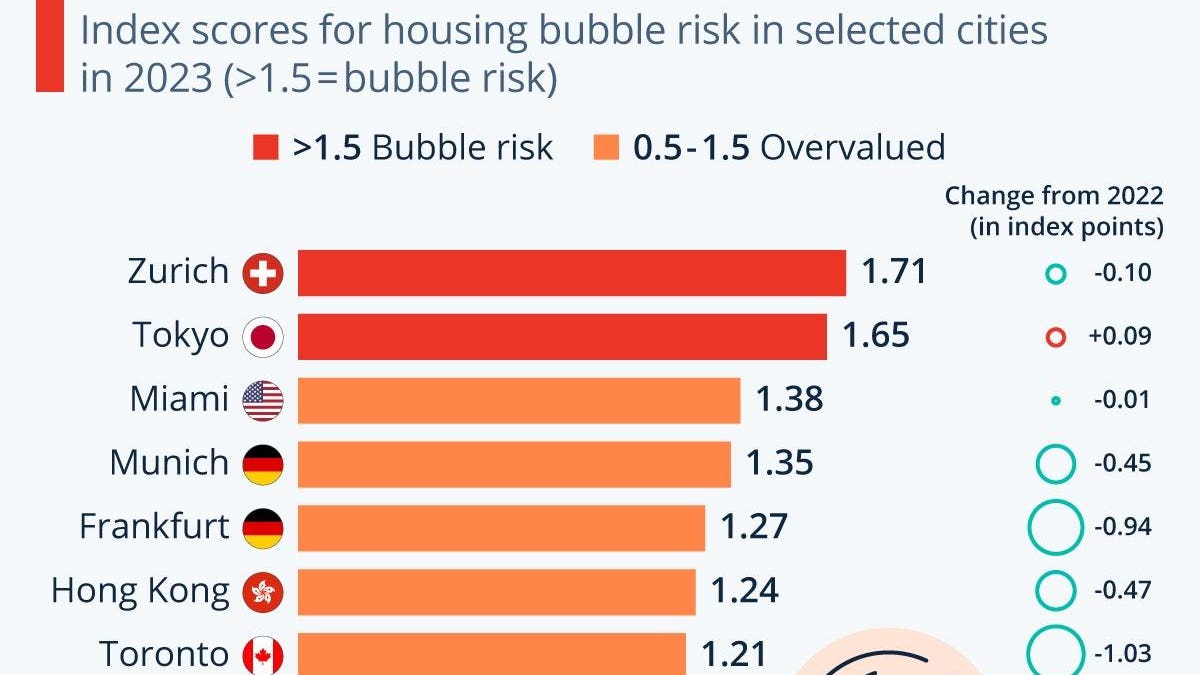

The global risk of housing bubbles has decreased sharply in 2023. A report released Wednesday by Swiss bank UBS concludes that out of 25 cities surveyed, only two were at risk of a housing bubble this year, down from nine each in the previous two reports. The data shows that even places known for their chronically high prices of housing exited bubble territory and were now merely classified as overpriced, including Tel Aviv, Hong Kong, Frankfurt and Toronto.

UBS identified rising interest rates causing the end of cheap financing in the real estate sector for the change. Inflation-adjusted international home prices experienced the sharpest decrease since the 2008 global financial crisis as a result of these changes. The report states that especially the most unaffordable markets couldn’t take the added pressure from increased interest and slumped.

Two cities most notorious for unaffordable home prices retained their bubble risk—Zurich and Tokyo. The leader of the list, Zurich, saw a slight decrease in its score, while Tokyo saw a slight increase. The Swiss market in general has not fully adapted to the changed market conditions yet, according to UBS. This also becomes visible in the virtually unchanged score of Geneva, which caused it to rise in rank opposite other cities where bubble risk decreased substantially. For Tokyo, the report cites the market’s defensive qualities which remain attractive to foreign investors.

One way bubble risk can end as a result of interest rates giving prices another push is overwhelmed buyers pivoting back to the rental market, dampening demand and house prices in the process. This is especially likely in markets where renting is somewhat cheaper than buying. Another way a correction can take place is when cities have a lot of buy-to-let activity, which lost profitability in the course of rising interest rates. This can free up capacity in the housing market and also lower prices.

Decline all around

In some cities, the decline of housing bubble risk started earlier than 2023. Hong Kong, long listed among the top cities for housing bubble risk, decline to rank 5 in 2022 and rank 6 this year—exiting bubble territory faster than other cities. This is due to a compounded crisis of downward pressures not restricted to high interest, in this case demand gaps due to isolating Covid-19 restrictions, economic turmoil in Mainland China as well as an aging society.

Miami remained the highest-ranked U.S. city in 2023—at a score of 1.38 rated just 0.13 index points below bubble risk territory. The city also saw only very slight changes from 2022—unlike other cities which are now found much lower down the ranking. Housing prices in Miami have continued an increase that is above the U.S. average. The relative strength of the city’s housing market can be explained by its comparably low income-to-house-price levels and population influx to the U.S. sun belt. New York and San Francisco are now found in the fair-valued category after experiencing Covid-19 and quality-of-life related deflators on top of pressure from interest. Los Angeles is the only housing market in the U.S. other than Miami that UBS views as overvalued, but it has also become more affordable since last year.

—

Charted by Statista

Read the full article here