Note:

I have covered SFL Corporation Ltd. (NYSE:SFL) previously, so investors should view this as an update to my earlier article on the company.

More than two years ago, I managed to make a great call near the bottom in shares of maritime infrastructure company SFL Corporation Ltd. or “SFL” after the second Seadrill (SDRL) bankruptcy within three years had caused substantial trouble for the company.

Offshore Drilling Exposure

As a reminder, SFL had guaranteed material amounts of bank debt related to offshore drilling rigs leased to Seadrill. These guarantees came into play when Seadrill filed for bankruptcy for the second time within three years in late 2020.

As a result, SFL had to shell out more than $100 million in cash to address the debt related to the worthless semi-submersible rig West Taurus, which was scrapped later on.

In addition, the company’s cash flows were impacted by an agreement with Seadrill to reduce the charter hire for the remaining rigs Linus and Hercules by approximately 30%.

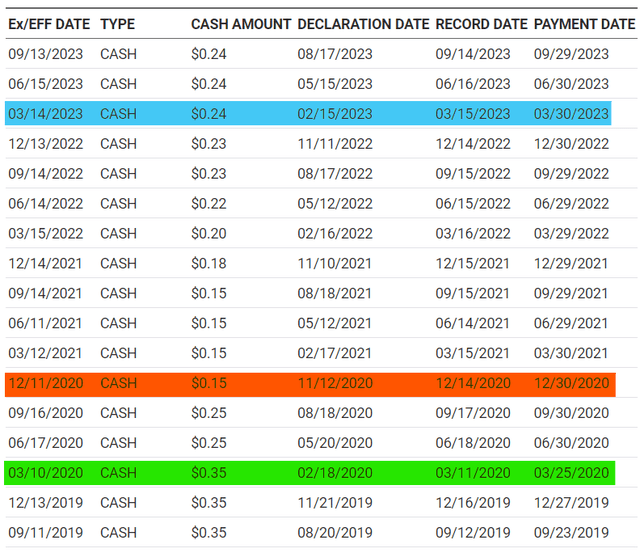

The material cash drain and uncertain medium-term outlook for the semi-submersible rig Hercules caused SFL to reduce the quarterly dividend by more than 50% from $0.35 to $0.15 per share over the course of 2020.

Adding insult to injury, the company decided to replenish its dwindling cash resources by selling 19.1 million of newly-issued shares into the open market for net proceeds of $150.9 million, thus resulting in outstanding shares to increase by more than 15%.

However, SFL has managed to overcome the impact from the Seadrill disaster in recent years and slowly increased its quarterly dividend back up to $0.24:

Nasdaq.com

Fast-forward to today.

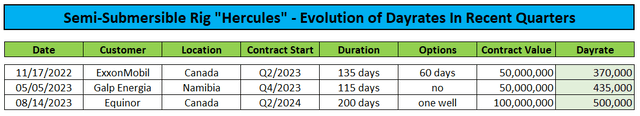

With COVID-related lockdowns seemingly behind us, a more-disciplined OPEC+ approach and recent geopolitical events having resulted in lasting tailwinds for oil and gas exploration, charter rates for offshore drilling rigs have increased to their highest levels in almost a decade.

This is very much evident by the company’s recently announced contract awards for the harsh-environment semi-submersible rig Hercules:

Press Releases

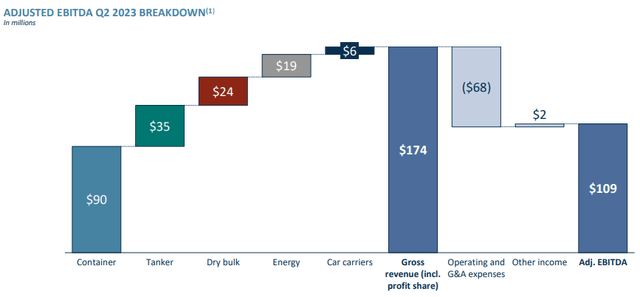

On the Q2 conference call last month, management stated expectations for the rig to contribute approximately $100 million in EBITDA over the next 12 months alone, which would be very close to the company’s most recent quarterly EBITDA run rate:

Company Presentation

However, investors shouldn’t expect a similarly stellar contribution from the company’s harsh environment jackup rig Linus as the unit continues to work in the North Sea under a long-term charter agreement with ConocoPhillips (COP). While the contract is based on a market-indexed rate, drilling activity in the North Sea has remained weak and is not expected to pick up before sometime next year.

Consequently, the rig’s EBITDA contribution is likely to remain limited for the time being.

Please note also that SFL is currently seeking almost $30 million in damages from Seadrill related to the recent redelivery of the Hercules, as stated in Seadrill’s H1/2023 report on form 6-K (emphasis added by author):

On March 5, 2023, Seadrill was served with a claim from SFL Hercules Ltd., filed in the Oslo District Court in Norway, relating to our redelivery of the rig West Hercules to SFL in December 2022. In its petition, SFL claims that the rig was not redelivered in the condition required under our contract with SFL and seeks damages in the amount of approximately NOK300 million (approximately $28 million). Seadrill filed a statement of defence on May 2, 2023 and SFL filed a further submission with additional claims on June 14, 2023. We are currently assessing the claim and intend to vigorously defend our position. Currently, we are unable to determine an amount or range of possible loss, if any.

A potential award would help offsetting some of SFL’s estimated $100 million investment for required upgrades and the Hercules’ special periodic survey, as stated by management on the Q1 conference call:

Hercules was redelivered to us in December and is currently out of service in connection with the scheduled special periodic survey or SPS and upgrade works in Norway and is managed by Odfjell Drilling. There were no revenues on the rig in the first and most of the second quarter while operating costs accrued. We estimate the total cost of the SPS and upgrades to approximately $100 million and the SPS is expected to be completed in June.

It has taken longer and become more expensive than originally estimated partly due to the condition of the rig at the time of redelivery. We’re reclaiming some of the expenses from Seadrill, but this is expected to take time as it involves a court process in Norway.

With Hercules finally contributing to the top and bottom line in the current quarter, resulting cash flows should more than offset the remaining payments related to the above-discussed upgrades and special survey of the rig.

However, the company’s fourth quarter should see the full impact of the Hercules contribution, as the rig’s earnings will no longer be offset by upgrade and survey costs. Given this issue, I wouldn’t be surprised to see SFL’s Q4 Adjusted EBITDA approaching $150 million.

Car Carrier Upside

But SFL has more things going for it than just the Hercules rig, as the company stands to benefit big time from the record charter rate environment for car carriers.

In May, the company agreed with Volkswagen on new three-year charter contracts for the vintage car carriers SFL Composer and SFL Conductor at vastly improved rates. Consequently, the pair’s annual EBITDA contribution is expected to increase from a paltry $9 million to a whopping $47 million.

On the flip side, Volkswagen will benefit from long-term charter agreements for two newbuild car carriers signed before the recent rally in charter rates.

But with these vessels currently under construction in Asia and the Volkswagen charters commencing upon arrival in Europe, SFL will likely be able to perform the vessels’ maiden voyages at elevated spot charter rates of $100,000+ per day thus resulting in an estimated $10 million one-time cash flow benefit.

Substantial Dividend Hike Potential

In addition to returning material amounts of capital to shareholders via dividends each quarter, SFL recently initiated a $100 million share repurchase program. So far, the company has acquired an aggregate of approximately 1.1 million shares at an average price of $9.27 per share.

Given the anticipated, significant increase in cash flows over the next few quarters, I firmly expect shareholders being rewarded by an estimated 25% quarterly dividend hike to $0.30 per share next year.

Assuming a 9% dividend yield, share price upside would be close to 15% which is decent for an income vehicle like SFL.

Risks

Investors often tend to scrutinize the company’s substantial debt load which represents approximately 70% of assets based on stated book values.

In addition, SFL’s large containership exposure is sometimes viewed as a cause for concern following the rapid decline in charter rates in recent quarters.

However, considering the company’s conservative chartering strategy with the vast majority of the fleet working on long-term charters, investors shouldn’t be overly concerned.

Moreover, due to management’s focus on long-term charters, SFL has not been a prime beneficiary of the recent boxship bonanza. As a result, earnings are unlikely to fall off a cliff when the company’s containerships are coming up for renewal going forward. In fact, only a small number of vessels will be up for renewal in the near term.

Bottom Line

With the company’s offshore drilling exposure having turned into a major tailwind as of late and projected vastly increased contributions from the car carrier segment, I firmly expect SFL Corporation to reward shareholders by additional stock repurchases and a substantial dividend hike next year.

Based on an assumed 9% dividend yield, I am assigning a 12-month price target of $13.35 to the shares. Including dividends, investor returns would calculate to approximately 23% at prevailing trading prices.

While shares have rallied by almost 30% from their May lows, I would advise investors to use any major weakness to initiate or add to existing positions.

Read the full article here