Risk assets have been bid down aggressively in the past couple of months, as typically weak seasonality has taken hold. The equity indices have all come down since July as investors are selling everything, with the notable exception of cryptos. We all know cryptos have a mind of their own when it comes to the generally volatile trading action they produce, but cryptos are undoubtedly a risk asset. With the buoyant action we’ve seen in Bitcoin (BTC-USD) lately, stocks that are linked to cryptos – like Coinbase (NASDAQ:COIN), stand to do well so long as cryptos hold up.

Below, we’ll take a look at what is a fairly compelling setup technically in Coinbase, but balance it with some less-than-favorable fundamental factors. The last time I covered Coinbase, I downgraded the stock on a variety of factors. The stock has exploded higher since then, so I was wrong. Right now, I think the setup is better than it was a few months ago, but keep in mind this one moves quickly in both directions, so it’s not for everyone.

Critical support just below

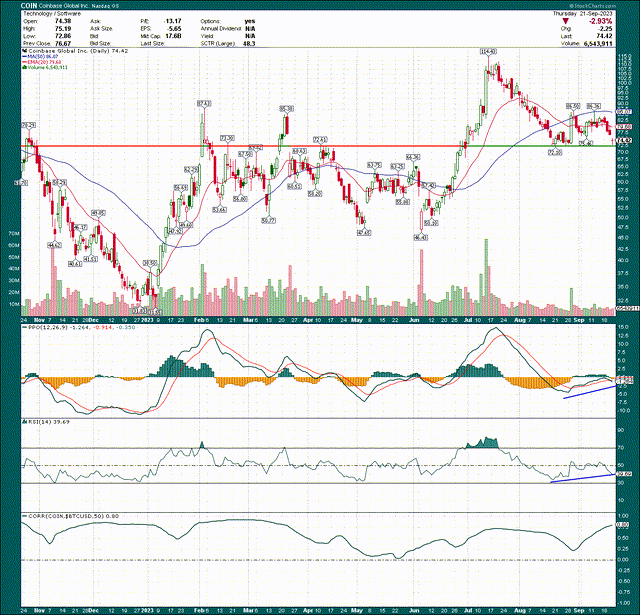

Let’s start with the chart, which shows a massive selloff from the high made several weeks ago. However, critically, support has not yet been lost.

StockCharts

That support level is ~$72, which Coinbase bounced off of yesterday. So long as that level holds, it’s a potential long. Below that, support levels get really messy, so I wouldn’t be interested if that level fails. Now, the PPO and the 14-day RSI both support the bulls as the pair are putting in a positive divergence. That doesn’t guarantee us a bounce here, but it certainly boosts the odds.

The bottom panel shows Coinbase’s correlation to that of Bitcoin, which has been extremely high recently. I’ve plotted a 50-day correlation, so it’s an intermediate-term indicator, but sits a 0.80 right now. That means the two are moving very closely to one another, so it’s quite useful to look at Bitcoin for clues as to Coinbase’s next move.

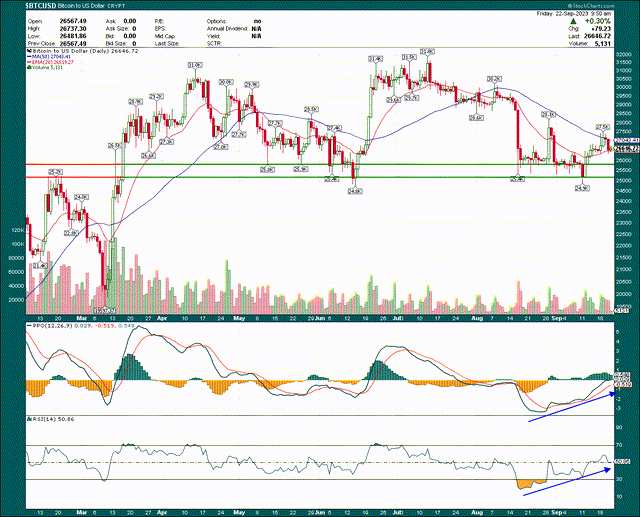

Bitcoin has been far from bullish in the past several months, but it’s held the zone of support near $25k a bunch of times this year. Just like the $72 level on Coinbase, this level is critical for Bitcoin and so long as it holds, the bulls are in control.

StockCharts

We see the momentum indicators have improved immensely recently, so again, the odds here are for higher prices so long as support holds.

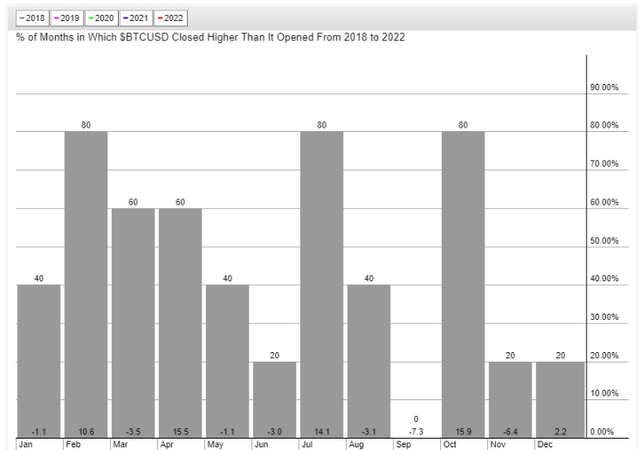

The other thing is that seasonality is unbelievably bullish for Bitcoin in October, which is just a week away.

StockCharts

In the past five years, October has been up 4 times and averaged 16% gains for Bitcoin. Seasonality is a secondary indicator, but this kind of overwhelming bullishness – literally the best month of the year for Bitcoin – is hard to ignore. Given the chart, and this seasonality, I’m inclined to think a run in Bitcoin is coming, and probably soon.

Here’s the problem

Coinbase’s fundamentals have deteriorated while the stock has held up pretty nicely, which means it’s now more expensive than it was. From a fundamental perspective, then, the outlook is not so rosy.

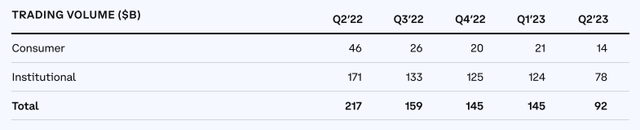

Trading volume has fallen off a cliff and is showing literally no signs of life.

Company presentation

Trading volume was off by about a third QoQ in the second quarter of this year, and a fraction of what it was a year ago. Coinbase needs trading volume to pick up for the fundamental case to improve, and it just hasn’t. On the plus side, trading volume tends to rise when cryptos are in a bull market, so if Bitcoin does see its typical rise into the fall months, it’s possible we see an uptick in Q4 trading volume. It’s way too early to know if that will occur, but if anyone needs Bitcoin and cryptos to rally, it’s Coinbase. Of course, a Bitcoin rally is no guarantee that volume will improve, and if it doesn’t, Coinbase’s fundamentals will likely remain weak. However, when cryptos do rally, it’s generally very good for firms that help transact in them.

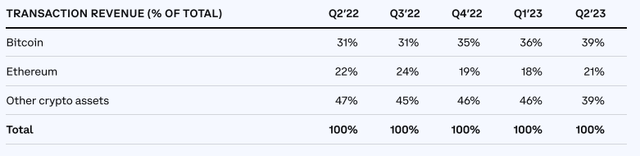

I’ve focused on Bitcoin because it’s the OG crypto and the largest, but it “only” accounts for about two-fifths of transaction revenue for Coinbase. The balance is in Ethereum (another fifth) and then everything else comprises the remaining two-fifths.

Company presentation

However, cryptos tend to trade directionally with each other, so using Bitcoin as a proxy for all cryptos works pretty well. Just know that Coinbase could certainly use a rally in Bitcoin, but it will take a full crypto bull market to fully recover the lost trading volume.

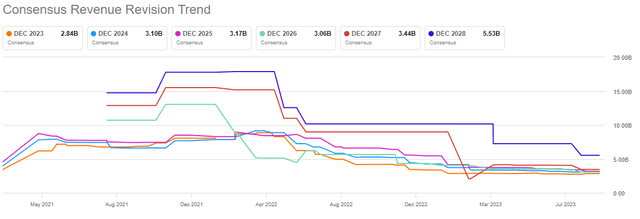

Now, revenue estimates for Coinbase have plummeted, as you’d expect given the decline in trading volume, which isn’t a good look for the bulls.

Seeking Alpha

However, the good news for the bulls is that estimates leveled out a while ago, and have been pretty flat. Does that mean the damage is done? Each investor can make that judgment for themselves, but it is beginning to look that way.

I mentioned the stock has become relatively more expensive in recent months, and below, we can see why.

TIKR

The stock’s P/S ratio is now up to 6.1X, which is near the highest it’s been since the spring of 2022. Shares had much higher valuations before that during the COVID buy-everything rally, when Bitcoin was over double the price it is today. However, that’s not indicative of today’s conditions, or anything close for that matter. I would be surprised if we see valuations like 10X or 12X or 14X sales again for that reason.

There’s no way for me to think the stock is cheap, and it almost looks like the stock has been bid up in anticipation of a bull market in cryptos. That’s not a great outcome for the bulls, as the fundamental case for Coinbase is pretty tenuous in my view given this valuation and collapse in trading volume.

If we wrap this up, we have a trading volume that is in a trough that seems to keep getting deeper. However, if Bitcoin is about to move meaningfully higher in October – as it generally does – that may be about to change. This would be the primary catalyst that could drive the stock higher in the coming months, should it occur.

I like the technical picture on the price chart for both Coinbase and Bitcoin, as both have held important support levels. But Coinbase’s valuation leaves a lot to be desired, and I cannot help but think shares have been bid up in anticipation of favorable seasonality for cryptos. With all of this in mind, I’m sticking a neutral rating on the stock. The valuation has me cautious, but so long as price support is respected, I cannot put a sell on it. Should support at ~$72 break decisively on a closing basis, I would not hang around as that would be a loss of major support. On the upside, the recent high in the mid-$80s would be the first stop.

Read the full article here