“The best investment you can make, is an investment in yourself… The more you learn, the more you’ll earn.” —Warren Buffet

What is Financial Literacy?

Financial literacy refers to the ability to understand and effectively use various financial skills, including budgeting, saving, investing, debt management, and understanding financial concepts.

It is a crucial element for individuals to achieve financial well-being. It empowers people to take control of their financial lives and navigate the challenges and opportunities that arise.

Financial literacy equips individuals with the knowledge to make sound decisions, leading to greater monetary stability, reduced debt, and a higher quality of life. Moreover, a financially literate society can contribute to a stronger and more resilient economy.

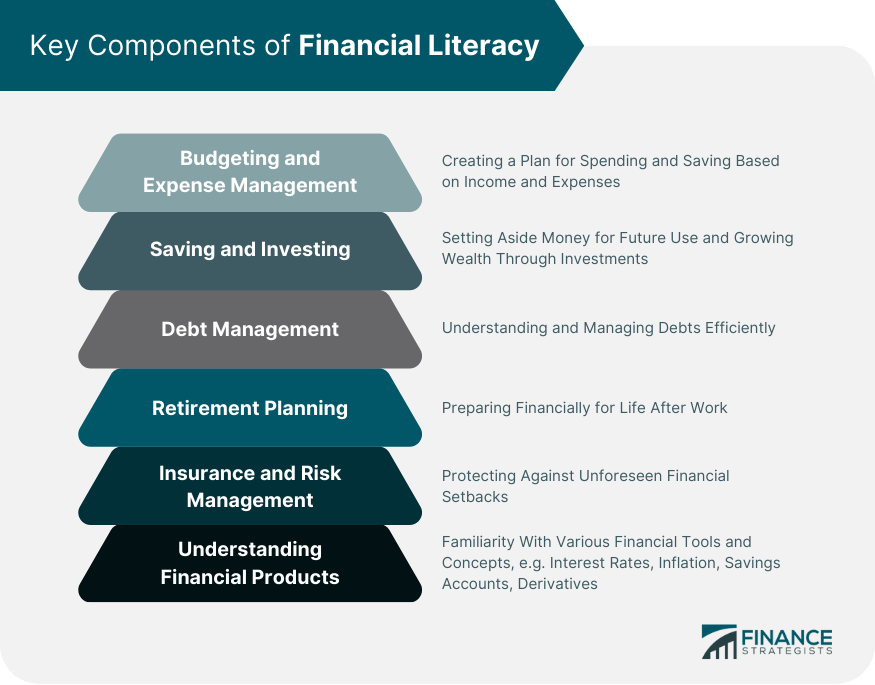

Key Components of Financial Literacy

Budgeting and Expense Management

Budgeting is the cornerstone of financial literacy. It involves creating a plan for spending and saving money based on one’s income and expenses.

Effective budgeting requires a clear understanding of one’s financial inflows and outflows, setting realistic goals, and monitoring spending habits.

Expense management goes hand-in-hand with budgeting. It is not just about tracking where the money goes, but also about making conscious decisions to eliminate unnecessary expenses and prioritize essential ones.

By mastering budgeting and expense management, individuals can live within their means, avoid accumulating debt, and save for future goals.

Saving and Investing

Saving is the act of setting aside a portion of one’s income for future use. It is a safety net for unexpected expenses and a means to achieve long-term goals. Investing, on the other hand, is the process of putting saved money into assets or ventures that can potentially yield returns.

While saving provides a cushion, investing allows money to grow. Understanding the difference between various investment vehicles, such as stocks, bonds, and mutual funds, and the associated risks and rewards, is crucial.

A financially literate person knows the importance of diversifying investments and the value of compound interest.

Debt Management

Debt, if not managed properly, can become a significant burden. Debt management is about understanding the terms of one’s debts, such as interest rates and repayment schedules, and creating a strategy to pay them off efficiently.

It is also about recognizing the difference between good debt (like a mortgage or student loans, which can be seen as investments in one’s future) and bad debt (like credit card debt from unnecessary purchases).

Being financially literate means avoiding high-interest debt, making timely payments, and understanding the implications of one’s credit score.

Retirement Planning

Planning for retirement is imperative to ensure a comfortable life in one’s later years. It involves understanding pension plans, 401(k)s, and other retirement savings options.

It also means being aware of the age at which one can start receiving Social Security benefits and how delaying benefits can increase monthly payouts. A comprehensive retirement plan considers factors like expected lifespan, desired retirement lifestyle, and potential healthcare costs.

Insurance and Risk Management

Life is unpredictable, and insurance serves as a safety net against unforeseen financial setbacks. Different insurance products, such as health, life, auto, and property insurance, offer protection against various risks.

Being financially literate involves understanding which types of insurance are essential based on one’s circumstances and ensuring adequate coverage. Risk management also includes strategies to minimize potential financial losses, such as diversifying investments or creating an emergency fund.

Understanding Financial Products and Concepts

The financial world is vast and ever-evolving, with a myriad of products and services available. A financially literate individual is familiar with basic financial concepts like interest rates, inflation, and taxation.

They also understand various financial products, from simple savings accounts to complex derivatives. This knowledge ensures that individuals can navigate the financial landscape, making informed decisions that align with their goals and risk tolerance.

The Benefits of Financial Literacy

Empowering Individuals

Financial literacy is more than just understanding concepts and numbers; it is about empowerment. When individuals are equipped with financial knowledge, they gain the confidence to take control of their financial destiny.

This empowerment translates to a sense of autonomy, where individuals no longer feel at the mercy of external financial forces or complex jargon. They can ask the right questions, challenge financial advisors, and ensure that their decisions align with their personal goals and values.

Making Informed Financial Decisions

With financial literacy comes the ability to sift through the myriad of financial options available and make decisions that best suit one’s needs.

Whether it is choosing the right investment vehicle, understanding the implications of a loan, or selecting an insurance policy, informed decisions lead to better outcomes. It is not just about avoiding pitfalls but also about maximizing opportunities.

For instance, a financially literate person might recognize the benefits of investing early due to compound interest or the advantages of tax-saving instruments.

Building Financial Security

Financial security is more achievable with financial literacy. By understanding how to save, invest, and manage debt, individuals can build a robust financial foundation.

This foundation ensures that they are prepared for life’s uncertainties, be it job loss, medical emergencies, or unexpected expenses.

Moreover, financial security is not just about the present. It is about ensuring a comfortable future, where one can afford life’s pleasures, support their family, and retire without financial worries.

Minimizing Financial Stress

Money-related stress is a significant concern for many, often leading to sleepless nights, strained relationships, and even health issues. Financial literacy acts as a buffer against such stress.

When individuals understand their finances, they can devise strategies to tackle financial challenges, be it paying off debt or handling a sudden expense. Moreover, the mere knowledge that one has the tools and understanding to navigate financial challenges can reduce anxiety.

It fosters a proactive approach, where individuals can anticipate financial needs and plan accordingly, rather than reacting to financial crises.

Strategies for Improving Financial Literacy

Education and Awareness Programs

The foundation of financial literacy often begins with structured education. Schools, colleges, and universities can play a pivotal role by integrating financial education into their curricula.

Courses on basic money management, economics, and personal finance can provide students with the foundational knowledge they need.

Beyond formal education, awareness programs, often initiated by governments or financial institutions, can target specific demographics, such as low-income families or senior citizens.

These programs can address unique financial challenges faced by these groups, offering tailored advice and resources.

Seeking Professional Advice

Financial advisors, planners, and counselors bring expertise and experience to the table. They can offer personalized advice, taking into account an individual’s financial situation, goals, and risk tolerance.

Whether it is planning for retirement, investing in the stock market, or buying a home, professional advisors can help navigate complex decisions. Moreover, as financial landscapes evolve, professionals can provide updated insights, ensuring individuals stay ahead of the curve.

Self-Study and Online Resources

In today’s digital age, a wealth of information is available at one’s fingertips. Numerous online platforms, websites, and apps offer courses, articles, tutorials, and tools related to financial education.

From understanding the basics of budgeting to diving deep into investment strategies, individuals can pace their learning based on their comfort and needs. Podcasts, webinars, and video tutorials offer diverse formats catering to different learning styles.

However, it is essential to ensure that the sources of information are credible and up-to-date.

Participating in Workshops and Webinars

Interactive learning often solidifies understanding. Workshops and webinars provide hands-on experience, allowing participants to engage with experts, ask questions, and discuss real-life scenarios.

These sessions can range from basic budgeting workshops for young adults to advanced investment seminars for seasoned professionals.

The collaborative nature of these events also offers networking opportunities, where participants can learn from peers, share experiences, and even discover new financial opportunities.

Networking and Learning from Peers

There is immense value in shared experiences. Networking with peers, whether informally or through structured groups, can offer fresh perspectives on financial management. Hearing about others’ financial successes and challenges can provide practical insights and lessons.

Moreover, peer discussions can lead to the discovery of new financial tools, products, or strategies that one might not have encountered otherwise. In a world where financial trends and products evolve rapidly, staying connected with a network can keep one updated and informed.

Overcoming Challenges to Financial Literacy

Psychological Barriers and Behavioral Biases

People’s minds are often wired with inherent biases that can influence financial decisions, sometimes to their detriment. For instance, many people suffer from ‘present bias,’ which prioritizes immediate rewards over future benefits, leading to inadequate savings or impulsive spending.

Another common bias is ‘loss aversion,’ where the fear of potential losses outweighs the desire for gains, potentially hindering investment opportunities. Overcoming these psychological barriers requires self-awareness.

By recognizing these biases, individuals can take steps to counteract them, such as setting up automatic savings plans to combat present bias or diversifying investments to mitigate the fear associated with loss aversion.

Financial education can also play a role in highlighting these biases, ensuring individuals are aware of their potential impact.

Lack of Access to Financial Education

Despite the importance of financial literacy, many individuals, especially in underserved communities, lack access to quality financial education. This gap can be due to various reasons, from inadequate school curricula to a lack of community resources.

Addressing this challenge requires a multi-faceted approach. Schools can integrate financial education into their programs, ensuring students receive foundational knowledge from a young age.

Community centers, non-profits, and financial institutions can also offer workshops and resources tailored to local needs. Additionally, leveraging technology can bridge this gap, with online platforms and apps providing scalable and accessible financial education.

Cultural and Socioeconomic Factors

Cultural norms and socioeconomic backgrounds can significantly influence one’s approach to money and financial decisions.

In some cultures, discussing money might be taboo, hindering open conversations about financial challenges or goals. Socioeconomic factors can also play a role, where individuals from lower-income backgrounds might prioritize immediate needs over long-term financial planning.

Overcoming these challenges requires sensitivity and tailored approaches. Financial education programs can be designed to respect and incorporate cultural values, ensuring they resonate with their target audience.

For those facing socioeconomic challenges, offering practical solutions, such as micro-savings programs or low-cost investment options, can make financial management more accessible and relevant.

Financial Literacy for Different Life Stages

Teens and Young Adults

The teenage years and early adulthood are formative periods when many individuals begin to interact with money in more significant ways, from receiving their first paycheck to managing student loans. It is a time of newfound independence, but also of financial vulnerabilities. Introducing essential concepts during this stage can set the foundation for responsible financial behaviors in the future.

Topics like basic budgeting, credit scores, and the dangers of high-interest debt can be particularly relevant. Moreover, with the rise of digital currencies and online investments, it is crucial for young adults to be educated about the potential risks and rewards of these platforms.

Working Professionals

As individuals progress in their careers and see an increase in their earnings, the complexity of their financial decisions grows. They might be considering buying a home, starting a family, or investing in the stock market.

For working professionals, financial literacy extends beyond basics. It broadens to understanding tax implications, evaluating employee benefits like 401(k) matching, and planning for children’s education.

Given the long-term implications of financial decisions made during this stage, such as mortgage terms or investment strategies, a deep understanding of financial principles is crucial.

Families and Parents

Starting a family introduces a new set of financial considerations. Parents need to consider immediate concerns, like budgeting for childcare or adjusting to a single income, and long-term planning, such as saving for their children’s education or securing life insurance.

Financial literacy for parents also involves teaching their children about money, ensuring the next generation is equipped with sound financial knowledge. Parents might also need to consider estate planning and setting up trusts to secure their family’s finances in unforeseen circumstances.

Pre-retirees and Retirees

As retirement approaches, financial decisions take on a heightened significance. Pre-retirees need to evaluate if their savings are sufficient for their retirement needs, understand the nuances of withdrawing from retirement accounts, and be aware of the potential tax implications.

For those already in retirement, financial literacy involves managing a fixed income, considering healthcare costs, and potentially evaluating downsizing or relocation options.

Given that retirees might be out of the workforce for several decades, understanding inflation’s impact and ensuring that their savings and investments can sustain them is paramount.

Promoting Financial Literacy

Government Initiatives and Policies

Governments can ensure that financial education is accessible to all citizens by integrating it into school curricula, launching public awareness campaigns, targeting specific demographics, or addressing timely financial issues.

Regulatory bodies can also play a part by ensuring transparency and fairness in financial products, making it easier for consumers to make informed decisions. Tax incentives for participating in financial education programs can further encourage citizens to boost their financial knowledge.

Corporate Social Responsibility

Businesses, especially those in the financial sector, have a vested interest in a financially literate customer base. As part of their Corporate Social Responsibility (CSR) initiatives, companies can offer financial education programs for their employees and the broader community.

Such programs can range from basic budgeting workshops to advanced investment seminars. By leveraging their expertise and resources, businesses can make a significant impact, ensuring that financial education is not just theoretical but also practical and actionable.

Moreover, by promoting financial literacy, businesses can build trust and foster stronger relationships with their customers.

Non-profit Organizations and Community Programs

Non-profit organizations often work at the grassroots level, addressing the unique financial challenges faced by specific communities. They can offer tailored financial education programs, taking into account cultural, socioeconomic, and demographic factors.

Community programs, often run by local leaders or volunteers, can provide hands-on workshops, one-on-one counseling, and peer-led discussions.

These initiatives can be particularly effective as they are rooted in the community’s context, ensuring that the financial education provided is relevant and resonates with the participants.

For example, the Financial Literacy Coalition is a group of individuals and firms that pool together their resources and expertise to promote financial education for the benefit of the American public.

Educational Institutions

Educational institutions, from primary schools to universities, are foundational pillars in promoting financial literacy. They ensure that students are exposed to financial concepts from a young age.

This early exposure can shape their financial behaviors and attitudes in adulthood.

Beyond formal education, institutions can also offer extracurricular workshops, invite financial experts for guest lectures, and provide resources like books or online courses.

Universities, in particular, can play a role in researching financial behaviors and developing innovative strategies to boost financial literacy.

Conclusion

Financial literacy is an indispensable skill in today’s complex financial landscape. From the foundational years of adolescence to the pivotal moments of retirement, understanding financial principles guides individuals through life’s myriad financial decisions.

The benefits of being financially literate extend beyond monetary gains; it empowers individuals, reduces stress, and fosters a sense of security. While challenges exist, from psychological biases to cultural barriers, they can be surmounted with targeted strategies and collaborative efforts.

Governments, businesses, educational institutions, and non-profits all play a crucial role in promoting financial education. As individuals and communities embrace financial literacy, they not only secure their financial futures but also contribute to a more informed and resilient society.

FAQs

1. What is financial literacy?

Financial literacy is the knowledge and understanding of financial concepts and tools, enabling individuals to make informed decisions about managing their money, assets, and investments.

2. How does financial literacy impact one’s overall well-being?

Financial literacy leads to better money management, reduced financial stress, and a more secure future, positively impacting mental and emotional well-being.

3. At what age should one start learning about financial literacy?

It’s beneficial to start learning about financial literacy during childhood or adolescence. Early exposure can instill good financial habits and decision-making skills that last a lifetime.

4. How can I improve my financial literacy?

You can enhance your financial literacy by taking financial education courses, reading books on personal finance, seeking advice from financial professionals, and regularly reviewing and updating your financial knowledge using credible online resources.

5. Are there free resources available for financial education?

Yes, many organizations, non-profits, and government agencies offer free resources, workshops, and online courses to promote financial literacy and education.

Read the full article here