Introduction

It’s time to talk about regional banks, especially one of my favorites: KeyCorp (NYSE:KEY). In this case, it does not mean that I believe KeyCorp is the best bank stock on the market. To me, KeyCorp is more of a trading vehicle that can be bought during times of distress. It’s also a cornerstone of the Midwest economy, with more than 972 full-service retail banking branches and a network of close to 1,300 ATMs in 15 states.

KeyCorp

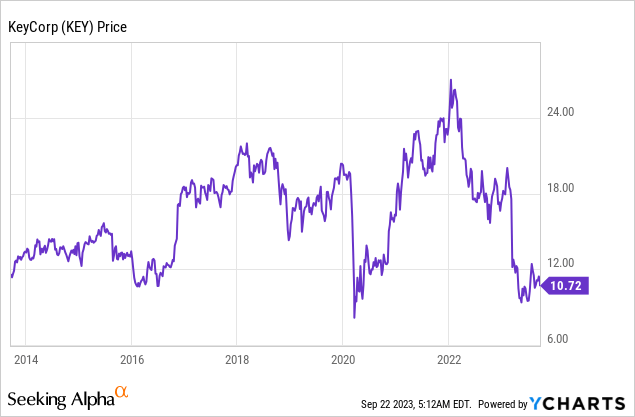

The bank, which has close to $150 billion in deposits, is one of the victims of the ongoing banking woes.

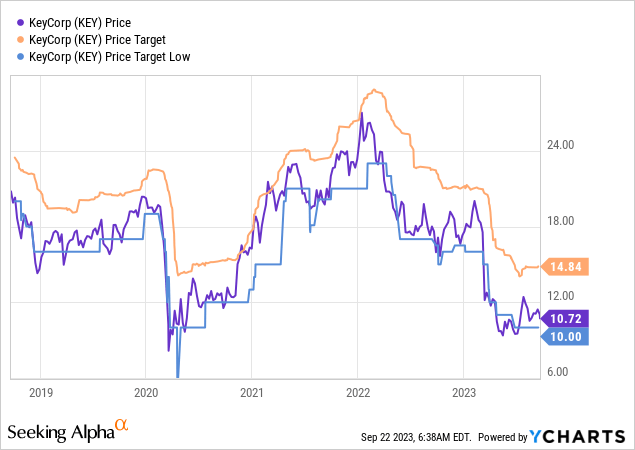

Shares of this Cleveland-based bank are worth 38% less than on December 31, 2022. Shares are down roughly 60% from their 2022 highs.

Hence, in this article, I’m revisiting the stock in light of this sell-off. We’ll discuss the bigger picture and the company’s recent developments and spend some time assessing the risk/reward of this 8%-yielding regional bank.

So, let’s get right to it!

Nobody Wants To Own Regional Banks

In general, regional banks are tricky investments. The long-term risk/reward tends to be bad due to steep corrections every time the economy runs into trouble.

Although this makes them fantastic trading vehicles that I have used a lot in the past, they do not make for the best sleep-well-at-night investments.

Right now, we’re once again in a very tricky situation.

After a number of bank defaults earlier this year that were caused by capital outflows and asset re-pricing issues, we’re now seeing new issues, this time related to real estate.

Earlier this month, the Wall Street Journal wrote an article titled Real-Estate Doom Loop Threatens America’s Banks.

Wall Street Journal

The article highlighted a very important issue.

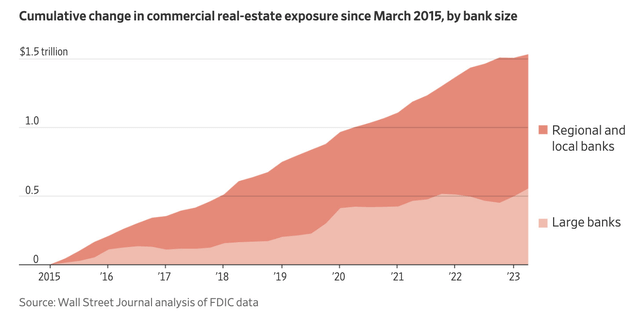

In the past decade, regional banks embraced commercial real-estate loans, fueling a surge in the market.

However, the present scenario paints a gloomier picture, with the commercial real estate market experiencing a severe downturn due to escalating interest rates and widespread high vacancies.

Wall Street Journal

This downturn casts a shadow over trillions of dollars that are tied up in loans and investments. This poses a significant threat not only to the banking sector but potentially to the broader economy.

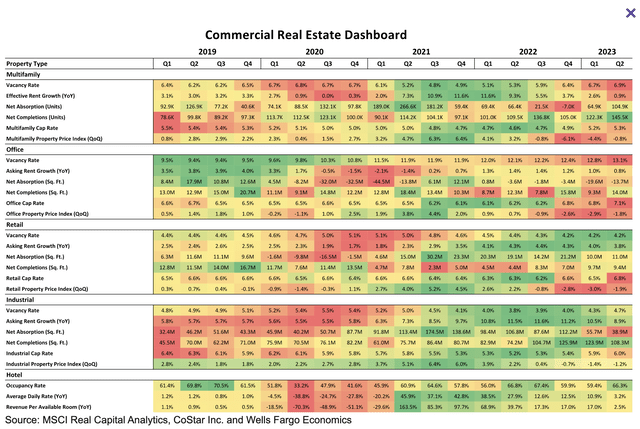

Looking at the table below, we see that the situation is deteriorating across the board. Even multifamily assets are now feeling the pain.

Wells Fargo

The Wall Street Journal makes the case that the risks that banks face from the commercial real estate sector are greatly underestimated, largely due to the intricate nature of indirect lending and an assortment of interconnected investments.

As the market deals with soaring interest rates and a surplus of vacant properties, a dangerous scenario looms—the possibility of a doom loop.

This could lead to a domino effect of reduced lending, plummeting property values, and subsequent losses, which could destabilize the banking sector.

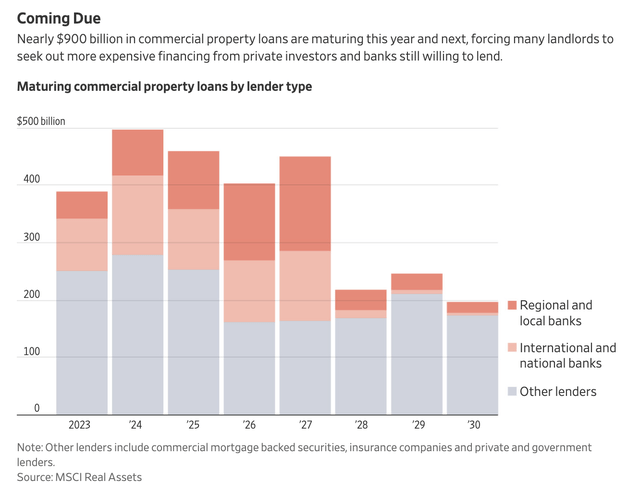

It also does not help that the next few years see a wave of debt maturities that will have to be refinanced at much higher rates.

Wall Street Journal

Hence, it won’t help too much when banks become more careful with lending. It will only further tighten the situation, making refinancing harder and causing defaults to potentially accelerate.

The problem is that if the Fed is forced to keep rates elevated, it could be put in a situation where it breaks something in the economy. That could likely trigger defaults on a bigger scale. It can avoid this by reaching its inflation goal over the next few months and cutting rates.

So far, this is increasingly unlikely, which has caused investors to flee banking and real estate stocks again.

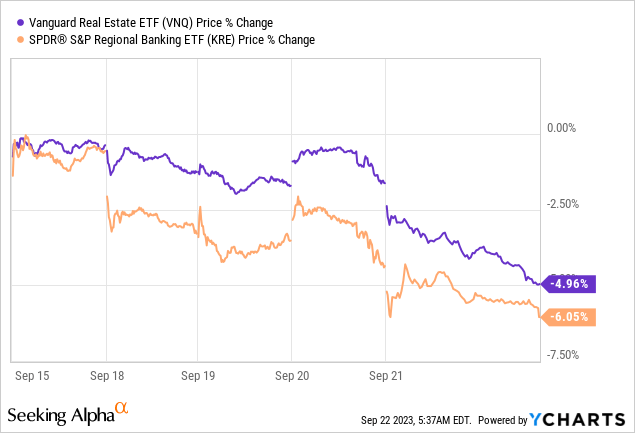

Since inflation came out higher than expected and the Fed commented that it will likely keep rates higher than expected in 2024, real estate and regional banking stocks have gained downside momentum, losing 5% and 6% over the past five days alone, respectively.

So, what is KeyCorp up to?

What’s Up With KeyCorp?

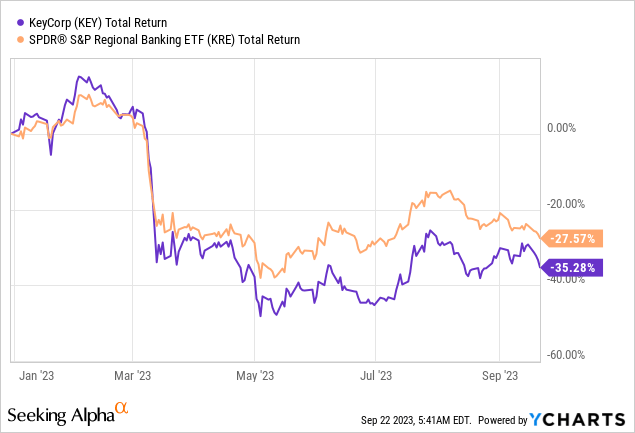

This is a question on a lot of people’s minds, as KEY has underperformed its peers by roughly 800 basis points this year.

During the recent Barclays Global Financial Services Conference, the company updated its investors on the developments it is witnessing.

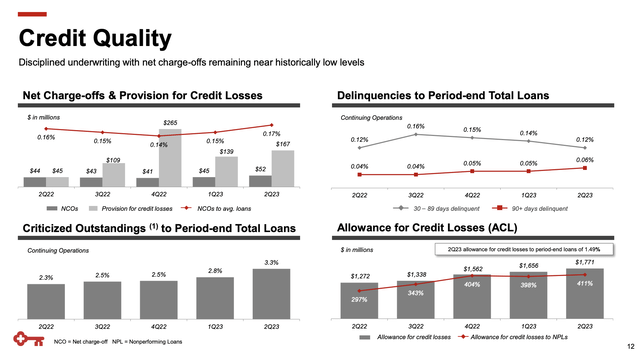

One of the most important things that was discussed is the company’s strong credit quality, with relatively low credit losses across the industry.

Over half of its C&I loans are investment-grade, and more than 70% of consumer originations have a FICO score of 760 or higher.

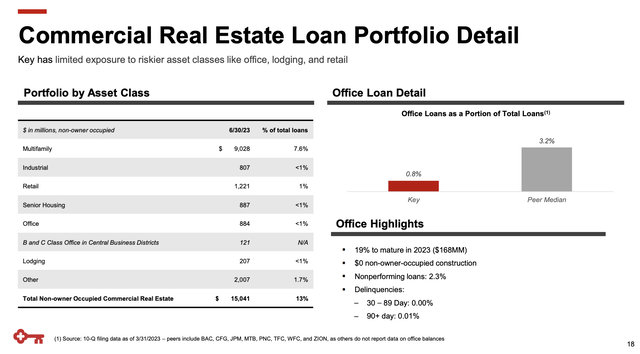

The company also has limited exposure to high-risk categories like leveraged lending and B and C-class office space.

In general, the company holds very low commercial office assets. Its total CRE portfolio accounts for just 13% of its total loans.

KeyCorp

Regarding office CRE developments, KeyCorp has observed a significant decline, but precise data is lacking due to limited trading activity.

The overall degradation in CRE value from peak levels is expected to be substantial. The notion of easily converting office spaces to multifamily units is not as straightforward as it may seem, according to the bank.

Also, regarding the company’s limited trading activity comments, I believe that prices could see steep declines the moment trading picks up. The only reason why trading is limited is because nobody is willing to refinance at higher rates. The moment some players are forced to sell, we could see higher trading activity at much lower prices.

For now, the situation is under control.

In the second quarter, the company affirmed that credit losses remained relatively low across the industry, underscoring their proactive measures in portfolio management.

During the 2Q23 earnings call, KeyCorp also emphasized its limited exposure to high-risk categories, such as leveraged lending, and detailed its focus on multifamily and affordable housing within the commercial real estate sector.

Looking at the numbers below, we see that delinquency rates remain at very subdued levels. The same goes for total net charge-offs as a percentage of average loans.

KeyCorp

On top of that, KeyCorp is proactive in optimizing its balance sheet and capital allocation. It plans to reduce risk-weighted assets by approximately $10 billion by the end of fiscal year 2023.

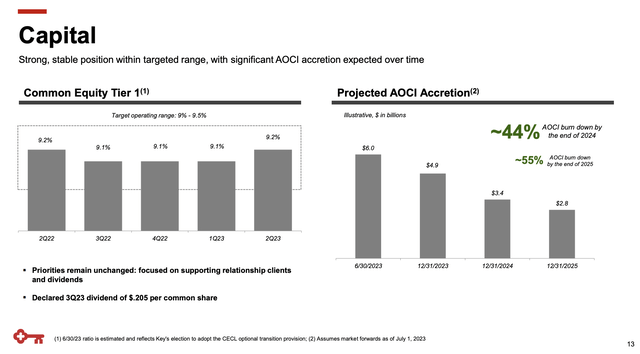

Its common equity tier 1 ratio is well within its target range. KeyCorp anticipates its common equity Tier 1 ratio to be above the targeted range of 9% to 9.5% by year-end.

KeyCorp

The company will prioritize full relationships and exit non-relationship business and non-strategic assets. KeyCorp’s strong fee-based businesses will play a significant role in reducing balance sheet exposure as capital markets normalize.

Speaking of the fee-based business, during the aforementioned conference, the company also highlighted that it boasts a robust fee-based business, with approximately 40% of its revenue generated from fees.

The company has leading positions in capital markets, payments, wealth management, and commercial real estate, all of which provide growth opportunities.

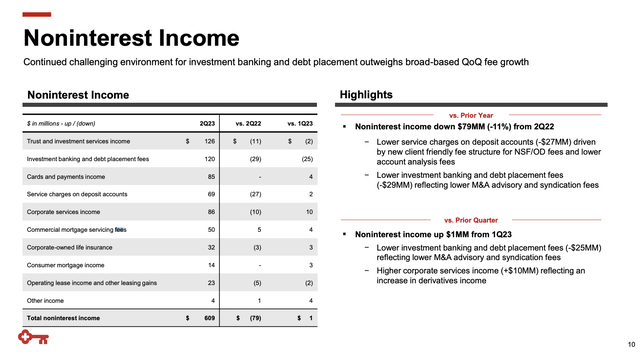

For example, in the second quarter, the company had $978 million in net interest income. Noninterest income was $609 million, led by trust and investment-related fees.

KeyCorp

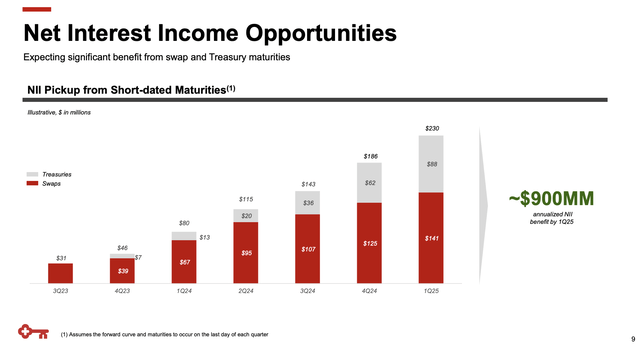

Even net interest income is expected to benefit from tailwinds.

KeyCorp expects a net interest income benefit of approximately $900 million annually by the first quarter of 2025. This anticipation is based on short-term swaps and treasuries re-pricing over the next six quarters.

KeyCorp

The company is also actively working on improving productivity and efficiency.

Earlier this year, the company successfully reduced its annual expense run rate by $200 million, representing 4% of annual spending.

KeyCorp plans to continue reducing expenses in the second half of 2023 and streamlining its operations. The goal is to position the company for success in the evolving financial environment.

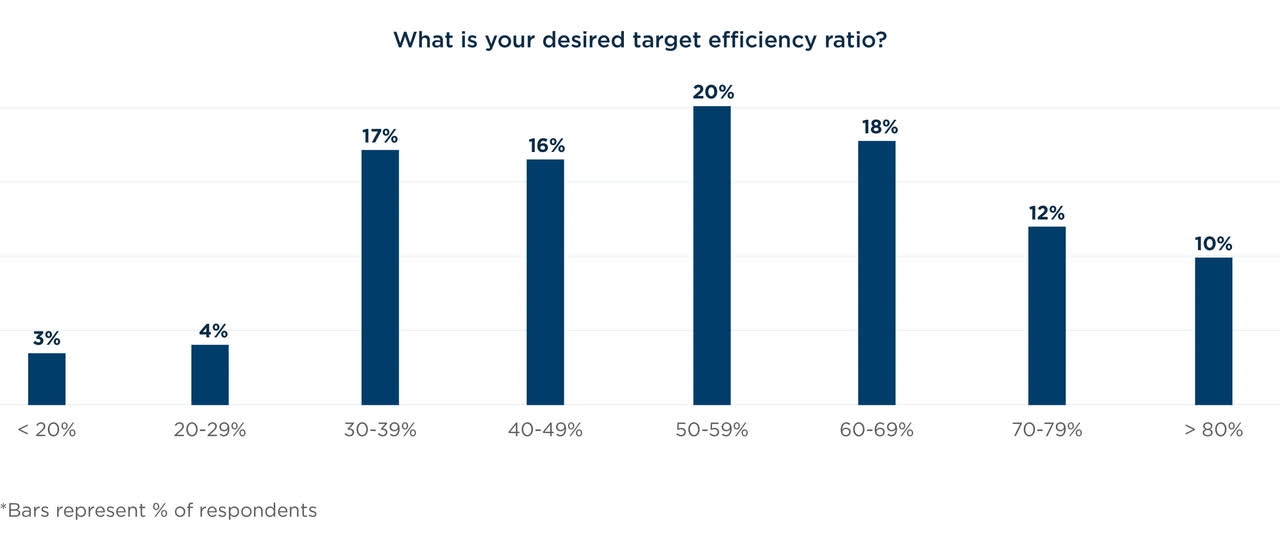

In the second quarter, the company had a cash efficiency ratio of 66.8%. That’s up from 59.5% in 2Q22.

Prior to the pandemic, most banking executives aimed for an efficiency ratio below 60%.

WestMonroe

The aforementioned streamlining plans are expected to result in a longer-term cash efficiency ratio of 54% to 56%.

Valuation

KeyCorp has been through some downgrades. Last month, it was one of the banks that was downgraded by S&P, as the rating agency is increasingly focused on asset quality risks.

S&P lowered grades one notch for KeyCorp, Comerica Inc., Valley National Bancorp, UMB Financial Corp. and Associated Banc-Corp, it said Monday in a statement, noting the impact of higher interest rates and deposit moves across the industry.

S&P also lowered its outlook for River City Bank and S&T Bank to negative and said its view of Zions Bancorp remains negative after the review.

Many depositors have “shifted their funds into higher-interest-bearing accounts, increasing banks’ funding costs,” S&P wrote in a note summarizing the moves. “The decline in deposits has squeezed liquidity for many banks while the value of their securities — which make up a large part of their liquidity — has fallen.”

In the case of KEY, the issue was the risk of long-term elevated rates and deposit outflows. In 2Q23, the bank saw a decline of 3% in average deposits.

Average deposits totaled $142.9 billion for the second quarter of 2023, down 3% from the year ago period and were relatively stable across the quarter, down approximately $500 million on average. Year-over-year, we saw declines in retail deposits, driven by elevated spend due to inflation, normalization from elevated pandemic levels and changing client behavior due to higher rates. The decrease in average deposit balances from the prior quarter reflects a continuation of the same trends. Regular seasonal outflows that we saw in April were more than offset in May and June. Deposits ended the period at $145.1 billion, up $1 billion from the prior quarter. – KEY 2Q23 Earnings Call

The company has an S&P long-term issuer credit rating of BBB with a stable outlook.

On the stock market, the company has been downgraded as well – albeit always after its stock had declined.

The current consensus price target is $14.80, which is 38% above the current price. That target used to be close to $28 last year.

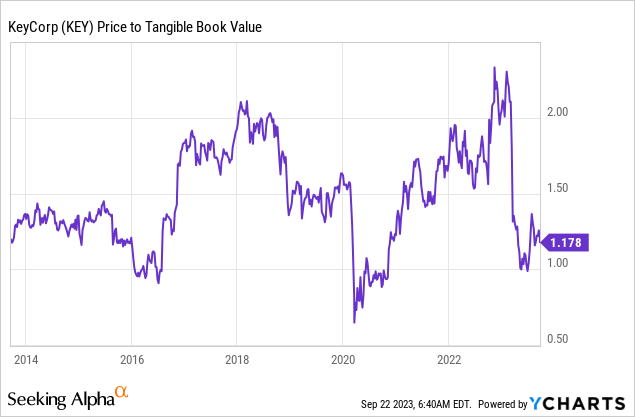

The company is trading at 1.2x its tangible book value. The longer-term median is 1.5x.

Essentially, the case can be made that KEY is trading between 25% and 30% under its fair value.

The problem is that KEY isn’t the issue here. It’s its market environment.

- The base case is 25% to 30% undervaluation. This would be the case if the macro environment remained like this without further deterioration.

- The bullish case is unlikely. It’s a normalization of inflation and interest rates without triggering a recession. This will allow default rates in CRE to remain subdued and improve consumer sentiment. KEY could easily go back to its 2022 highs.

- The bear case is what scares people right now. If the Fed is unable to fight inflation without triggering a major recession, we could see forced selling in CRE, higher default rates, and significant adjustments in the bank’s portfolio values.

I do not expect a 2008-style recession, but it does look like investors are starting to prepare for more headwinds.

So, while I do believe that KEY will remain a cornerstone in its markets with a bright future, I cannot make the case that it is a great investment right now.

I would love to see more weakness before jumping in. For now, I’ll stick to safer investments with more consistent returns and dividend growth.

Takeaway

KeyCorp, a cornerstone of the Midwest economy with its extensive branch network and solid credit quality, faces challenges amidst the banking sector’s ongoing woes.

The looming crisis in commercial real estate poses a significant threat, emphasizing the delicate balance between economic stability and rate adjustments.

KEY’s proactive measures, fee-based revenue streams, and ongoing efficiency improvements offer some resilience. However, downgrades and the stock’s undervaluation reflect the broader market’s concerns.

The future hinges on macroeconomic developments, making it key to monitor inflation, interest rates, and the Fed’s responses.

While KeyCorp remains a cornerstone in its markets, exercising prudence and awaiting more favorable market conditions might be the best approach here.

Read the full article here