Investment thesis

Toyota’s (OTCPK:TOYOF) cars are well-known for their longevity and high quality, which makes them good value for money. And that was the primary reason why the company’s cars consistently were global bestsellers yearly. However, the automotive industry is evolving rapidly, and the shift to electric vehicles [EVs] is moving rapidly. At the same time, Toyota is apparently lagging behind its competitors in the EV field. To me, this is an indication that Toyota will substantially lose its market share in the long term. It is also critical to emphasize that Toyota’s financial metrics have stagnated in the last decade, even considering the fact that the competition from EV manufacturers intensified relatively recently. Moreover, my valuation analysis suggests the stock is overvalued. All in all, I assign TOYOF a “Sell” rating.

Company information

Toyota Motor Corporation is one of the world’s leading automotive companies. Toyota’s automotive operations include designing, manufacturing, assembling, and selling passenger vehicles, minivans, and commercial vehicles such as trucks and related parts and accessories. According to the latest annual SEC filing, the company sold 8.8 million vehicles in fiscal 2023.

The company’s fiscal year ends on March 31. Toyota’s business segments are automotive operations, financial services operations, and all other operations. Automotive operations contribute about 90% of the total sales. The financial services business primarily involves financing dealers and their customers to purchase or lease Toyota vehicles.

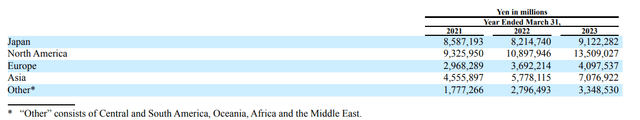

Toyota sells its vehicles in approximately 200 countries and regions, and North America is the largest market for the company.

Toyota’s latest annual SEC filing

Financials

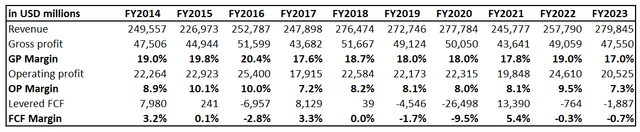

If I were asked to describe Toyota’s financial performance over the past decade with one word, it would be “stagnation”. Revenue compounded at a mere 1.3% CAGR, which is substantially lower than the global inflation rate. That said, the company’s revenue is in the secular decline if we ignore nominal figures and look from the real terms perspective. Profitability metrics also demonstrate a steady decline, and the FCF margin was razor-thin even in the company’s strongest years.

Author’s calculations

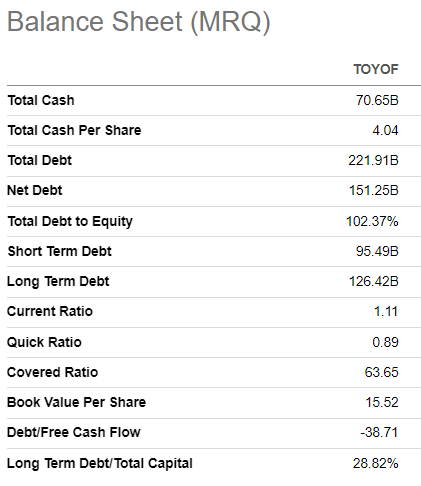

The company’s balance sheet is sound, with more than $70 billion in cash as of the latest reporting date and solid liquidity metrics. The vast $150 billion net debt should not mislead readers since it relates to the company’s financing segment. Capital allocation demonstrated by the management is solid, especially given all constraints, including low profitability metrics and capital-intensive business model. The company pays dividends and conducts stock buybacks. On the other hand, it is crucial to mention that dividend growth was unstable.

Seeking Alpha

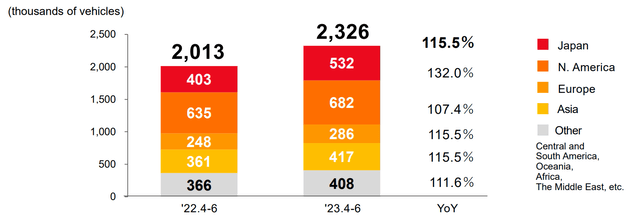

Toyota released its latest quarterly earnings on August 1. Revenue demonstrated strong growth momentum with a 15% YoY increase. The company’s profitability metrics followed the top line and demonstrated notable expansion. The operating margin improved YoY from 6.8% to 10.6%. The strength in quarterly earnings is mainly explained by the increased sales volume due to substantial headwinds related to the global semiconductor shortage in the same quarter last year.

Toyota’s latest earnings presentation

The upcoming quarter’s earnings are scheduled for release on November 1. Quarterly revenue is expected by consensus at $71.6 billion, which indicates a 15% YoY growth again. I expect it to be the last double-digit revenue growth quarter in the foreseeable future since the semiconductor shortage started easing in Q3 of FY 2023. Therefore, comparatives will become very tough to beat.

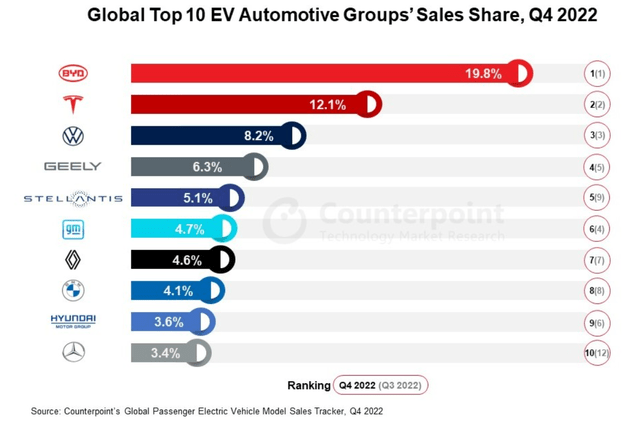

While current performance might bring a lot of optimism to investors, I think long-term prospects are very cloudy. Being the world’s largest car manufacturer is a big burden in the current rapidly evolving environment of rapid penetration of electric vehicles [EVs]. The larger the company’s scale is, the more difficult it is to address technological disruptions. While Toyota is well-known for the high-quality standards of its cars and their longevity, its strong reputation relates to its internal combustion engine [ICE] models. But ICE vehicles will be in the past soon, as the developed world is rapidly shifting to more eco-friendly EVs. For example, Europe already approved its ban on selling ICE cars starting from the year 2035. And Toyota is lagging behind in expanding its presence in the EV field. While Toyota is the leading ICE vehicle manufacturer, the company is not even in the top ten EV players.

counterpointresearch.com

It is also important to underline that other well-known legacy giant automakers like Volkswagen or GM are at the top and are holding notable market shares. These companies are also of massive scale, and for them, it is also very difficult to turn around, but they were able to bite relatively large pieces of the growing pie. To me, Toyota’s slow pace of response to the changing environment is a huge red flag, indicating that the business will highly likely continue stagnating. And the gap is highly likely to become wider because the competition is intensifying. Chinese EV makers are also becoming. powerful in the EV field, and they have an apparent cost advantage over its Japanese competitors due to substantially lower labor costs. I also think that there is almost zero probability that Toyota will ever catch the market leader, Tesla (TSLA), in the EV market. Tesla’s wide profitability metrics allow the company to invest heavily in innovation, and its unique Giga Press manufacturing technology gives the company massive cost advantages over legacy automakers. All these factors allow Tesla to initiate massive price wars to gain market share at the expense of competition. To conclude, in the long-term, Toyota is poised to lose its crown as the largest car manufacturer and it seems to me that the company is in the late stages of its business’s life cycle.

Valuation

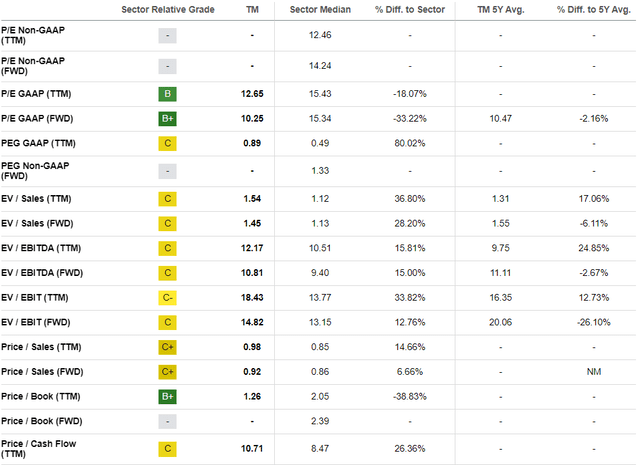

TOYOF rallied 36% year-to-date, significantly outperforming the broader U.S. market. The stock also outpaced the iShares MSCI Japan ETF (EWJ), demonstrating a 14% year-to-date price appreciation. Seeking Alpha Quant assigns the stock a decent “C” valuation grade, which means the stock is approximately fairly valued.

Seeking Alpha

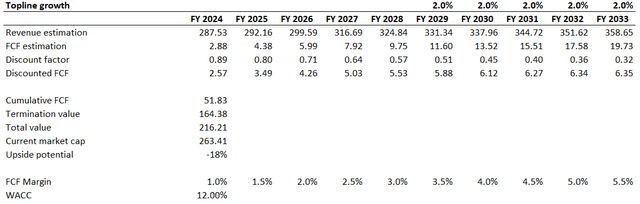

Comparisons of the current valuation multiples to the sector median and historical averages are mixed, so I need to expand my valuation analysis with the discounted cash flow [DCF] simulation. Due to the notable historical volatility in the FCF margin, I use an elevated 12% WACC for discounting. I have revenue consensus estimates up to FY2028 and project a 2% CAGR for the years beyond. I use a one percent FCF margin for my base year and expect a 50 basis points yearly expansion.

Author’s calculations

According to my calculations, the stock is about 18% overvalued. I would like to underline that the assumptions I have incorporated are rather optimistic, especially with respect to the FCF margin. That said, the stock is very unattractively valued.

Risks to my bearish thesis

Toyota has a vibrant history of almost 90 years of a successful business. The company weathered multiple crises and demonstrated a strong adaptability in tough times. That said, there is a possibility that the company can introduce something brand new to the market, and its disruptive technologies will allow Toyota to capture the notable EV market share rapidly. The company has hyper-scale and vast resources to continue investing in R&D to improve its technologies. For example, the company recently revealed its batteries for vehicles, which are capable of a thousand-kilometer driving range. But these are long-term plans, as the new battery plant is expected to begin producing new battery models in 2026. Overall, the company expects to sell 3.5 million EVs per year by the year 2030. This might look solid, but I prefer to add context here. For example, Tesla’s long-term goal is to sell 20 million EVs annually by 2030. While this long-term goal might look too aggressive, the company will likely deliver about 2 million EVs in 2023, seven years before 2030.

The second major risk I see is the lithium shortage risk, which might weigh on the EV industry. An imbalance in the supply-demand equation might skyrocket this commodity’s prices, which will hit the supply of EVs and might lead to the renaissance of ICE vehicles.

Bottom line

To conclude, TOYOF is a “Sell”. I have a firm conviction that the company’s business is in the secular decline, and the rapidly evolving automotive industry landscape will substantially undermine Toyota’s leading position in the industry. The company is lagging behind its competitors in the EV field, which I think will be a big problem in the foreseeable future. It is also important to mention that the valuation is unattractive.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here