Some time ago I wrote an article on Qualcomm (QCOM) saying that its business outlook was not very good but at the very least its stock was cheap. Nvidia Corporation (NASDAQ:NVDA) stock is the exact opposite. Quite recently, its EPS has risen substantially, whilst its stock has surged to incredible highs, making it the most expensive semiconductor company.

Nvidia’s growth

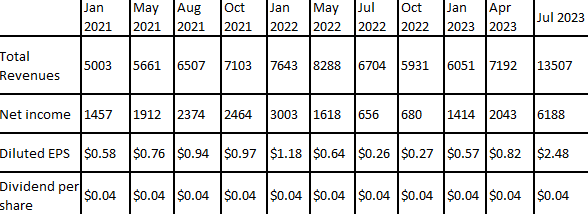

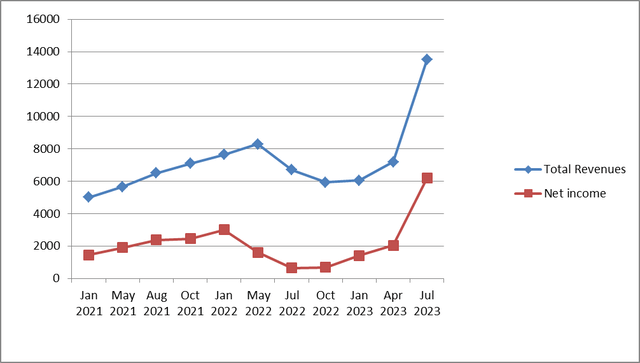

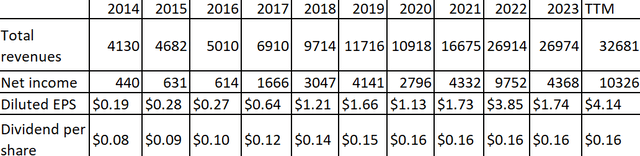

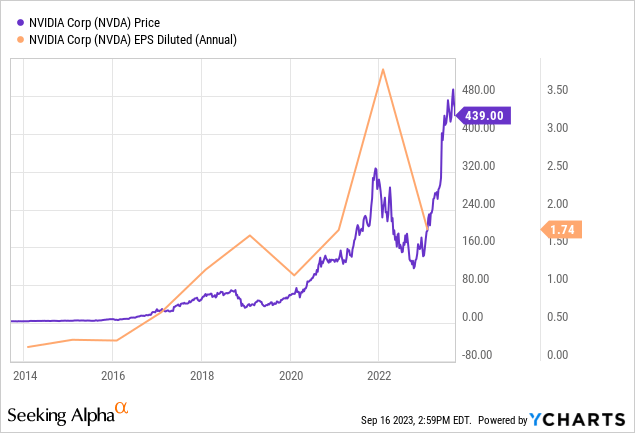

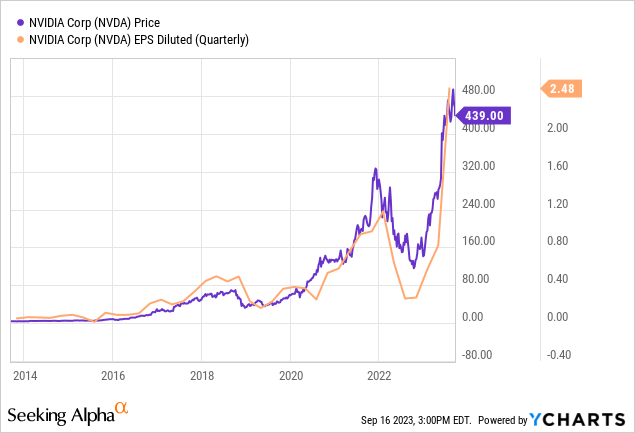

Very remarkable is the fact that Nvidia’s quarterly sales and earnings have risen dramatically at the beginning of the year 2023. Before that, the EPS growth was neither brilliant nor sustainable.

Seeking Alpha

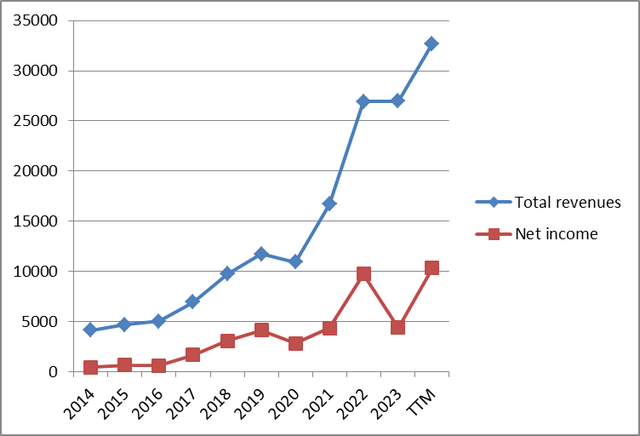

One might say that growing EPS and rising net income must lead to higher dividends.

Prepared by the author

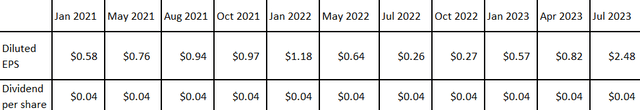

But this is not happening. Nvidia has been paying the same quarterly dividend of $0.04 for 11 quarters. This does not seem to be a great positive for the stockholders.

Seeking Alpha

Some might say that quarterly earnings are volatile, e.g., seasonal.

But Nvidia is not consistent in reporting annual sales and EPS either. In 2022, the revenues and earnings surged dramatically.

Seeking Alpha

This can be well seen in the graph below. Just in the last several years did the sales and earnings growth really accelerate.

Prepared by the author

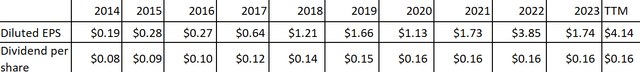

Again, it can be well seen from the table below that in spite of the brilliant EPS growth, Nvidia has not changed its dividend payouts since 2020.

Seeking Alpha

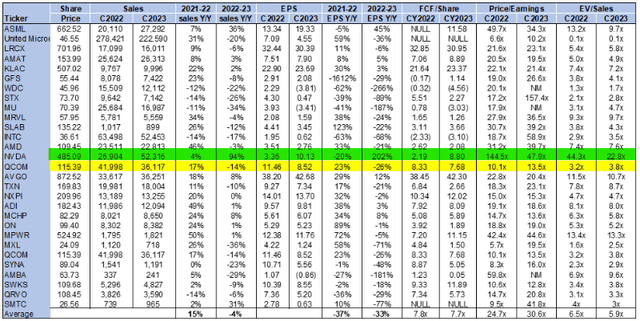

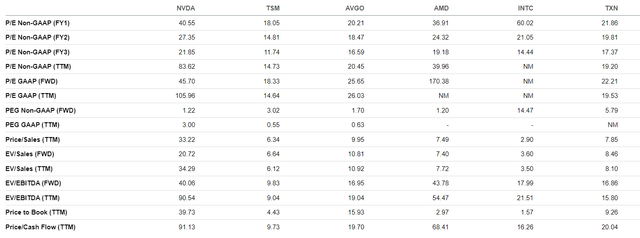

The table below compares Nvidia to the businesses of its peers, with Nvidia (highlighted in green) and Qualcomm (highlighted in yellow). I compared two of these semiconductor businesses because Nvidia is one of the most expensive companies, whilst Qualcomm is one of the cheapest. I will cover NVDA’s valuations in some more detail below.

Seeking Alpha

But it can be well seen that 2022-2023 earnings and sales have surged dramatically, especially compared to its peers. But the problem is that these sudden and somewhat illogical financial improvements can be temporary. Value investors like Benjamin Graham prefer to buy companies that have been recording sustainable EPS and sales for a while. Sure, past performance is not a guarantee of future performance. But at the very least sound and consistent past performance inspires some trust.

Nvidia – AI charm

Apart from surging earnings, investors are charmed with Nvidia’s exposure to artificial intelligence.

Nvidia’s website claims that the company has “the world’s most advanced AI platform with full-stack innovation in computing, software, and AI models and services.“

Nvidia’s website

AI is used in several parts of its business, namely AI Supercomputer, an all-in-one AI training service that gives enterprises immediate access to their own supercomputer, AI Platform Software that accelerates the data science pipeline and streamlines the development and deployment of production AI and AI Models and Services – cloud services for customizing and operating text, visual media, and biology-based generative AI models for the business.

The point I am making is that the company is heavily exposed to artificial intelligence, one of the most popular industries today. This, in turn, makes investors overenthusiastic and willing to overpay for Nvidia’s stock. Unfortunately, such excitement in one sector does not normally end well because all asset bubbles eventually burst. I will explain this later.

Downside risks

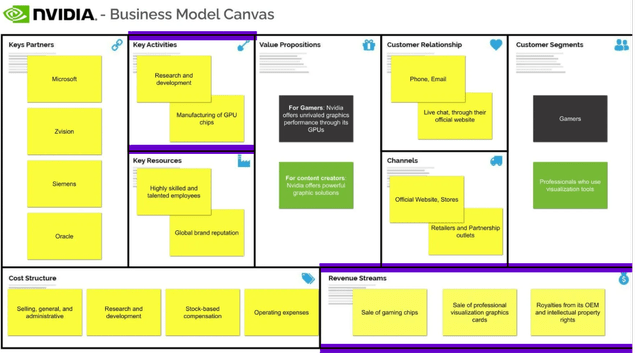

The biggest revenue sources for Nvidia are visualization graphics cards and gaming chips.

Business Model Analyst

The problem is that chip manufacturer Taiwan Semiconductor Manufacturing Co Ltd (TSM) makes chips designed by Nvidia. The point I am making is that NVDA relies too much on Taiwan’s manufacturing facilities even though the U.S.-China tensions and the resulting political risks are far too high. However, the management does not seem to consider this to be a big risk. “In all of our supply chain discussions, we feel perfectly safe,” Jensen Huang, Nvidia’s CEO, told media reporters. But relying so much on Taiwan does not make sense in the current situation, in my view.

Then, the exuberant outlook for Nvidia is the risk itself. When there are so many investor expectations, there is always a substantial risk they may not come true. After all, the AI bubble may eventually burst the way it happened to the Dot.com bubble or the property market in 2008. When an asset class becomes very popular, there is hardly any upside potential. A recession may also come. The company’s valuations, meanwhile, are really high.

Valuations

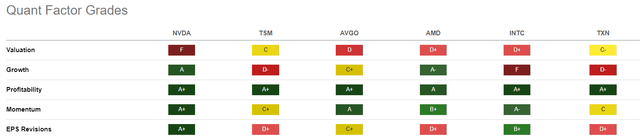

Here on Seeking Alpha’s website, I found a very interesting comparative table. It shows Nvidia’s as well as its rivals’ valuations.

Seeking Alpha

Intel (INTC) and Advanced Micro Devices, Inc. (AMD) seem to be very expensive companies. But by many measures, NVDA seems to be the costliest one of the six companies from the table above.

As I have mentioned before, Nvidia’s earnings have surged but so has its stock price. This can be well seen from the two diagrams below, the first one showing the company’s annual earnings and the second one showing quarterly EPS.

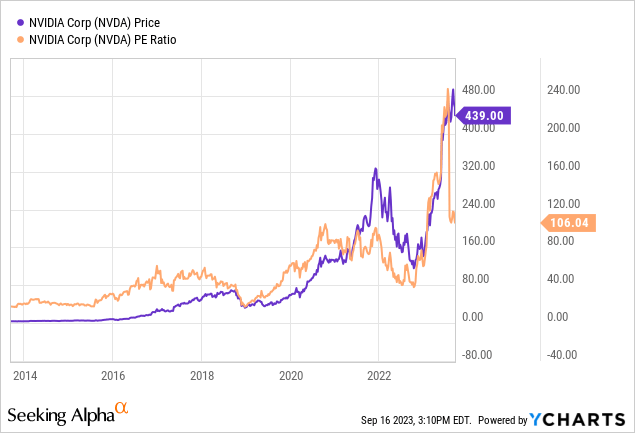

In spite of the recent P/E ratio correction, it is still at multi-year highs.

We might assume that it is normal for a large, profitable, and high-growth company like Nvidia to have a P/E ratio higher than the S&P 500’s average of 25. However, the company’s high earnings growth is already factored in the stock price.

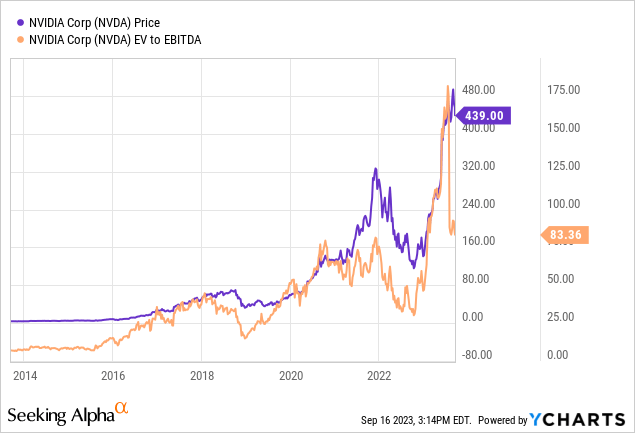

The same is true of the company’s EV-to-EBITDA ratio. It is now somewhat off its highs. However, it is far above the traditional “good” range of less than 10.

Upside risks

Seeking Alpha

Nvidia is a high-growth company, it is highly profitable and its investors adore it. The momentum is, therefore, strong. So, both technically and fundamentally, its stock can continue growing for a while.

Nvidia’s competitive advantage is its strong brand recognition. The company is also highly innovative, it has brilliant connections with its clients and suppliers. Nvidia is committed to innovation, which has allowed it to be the dominant player in the gaming industry. As I have mentioned before, the company has a strong presence in artificial intelligence and even autonomous vehicles. NVDA’s network of other technology companies has allowed it to access new markets. It seems likely that the company will take advantage of advances in new technologies because of its willingness to invest in strategies that allow it to remain competitive and meet its customers’ changing needs.

Conclusion

Nvidia is a technically developed and brilliant company that has been recording whopping EPS growth in the recent couple of years. However, investors’ enthusiasm and all the positive developments have already been priced in by investors, in my opinion. The company’s stock seems to be overvalued. Much of the market’s interest is due to the company’s exposure to AI, quite an overhyped topic in the recent couple of years. There are plenty of downside risks, including the tensions around Taiwan and a potential recession.

Read the full article here