There’s an undeniable allure in discovering a small-cap stock with the potential to turn into a long-term growth narrative. Many investors, captivated by this vision, take a leap of faith on such stocks, hoping that while they might be modest and unprofitable now, the future could paint a different story. But the journey often demands patience. There are times when, despite our patience, the company lingers in the red, failing to transition into profitability. However, sometimes, the stars align, clearing the haze and revealing a potential path to financial success.

This narrative resonates with Identiv (NASDAQ:INVE), a company that has grappled with uneven growth and losses for a prolonged period. A cursory glance at its earnings history might be disheartening, characterized more by quarterly losses than profits, and even the gains have been modest. But now, there’s a beacon of hope on the horizon. That’s why, in my view, this under-the-radar small-cap gem warrants close scrutiny.

Lackluster Performance

Identiv operates as a digital security company across two distinct segments. The first, termed “Identity”, offers RFID-enabled IoT solutions to digitize and secure physical items, particularly tailored for niche applications.

An illustrative example can be found within the healthcare sector, where the company’s RFID solutions can transform medical devices, such as syringes, into smart objects. On the other hand, in its “Premises” segment, the company supplies technologies and tools — encompassing video surveillance, access readers, and video management systems — to ensure the security of buildings and locations, such as high-security government infrastructures.

Identiv operates in a highly-competitive market, facing bigger companies such as Honeywell (HON), Avery Dennison (AVY), and Zebra Technologies (ZBRA). However, in my view, Identiv has successfully established a distinct presence in both of its operational segments. The company is recognized for its high-end RFID-integrated IoT product offerings (it is one of the leading BLE-enabled RFID providers and integrators) and has gained commendable traction in the physical security market, securing contracts from US government customers and prominent SaaS companies. However, this positioning and reputation have not necessarily translated into impressive revenue growth or healthy net income figures.

Author

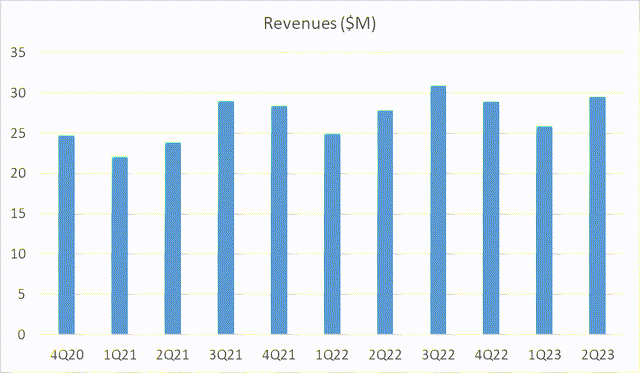

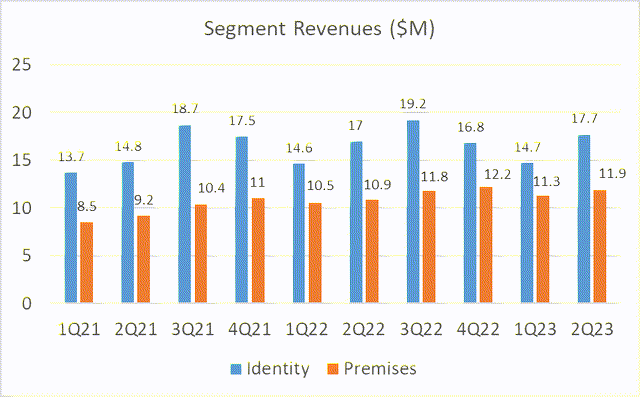

For instance, in the recently reported second quarter, Identiv posted revenues amounting to $29.6 million, with $17.7 million coming from Identity business and $11.9 million from Premises. While this marked the company’s all-time high for a second quarter, it only reflected a relatively subdued year-over-year growth rate of 6%. Diving deeper into the company’s performance by segment, we find uneven revenue growth patterns. Although both segments have displayed fluctuating revenue trajectories, the larger Identity segment has notably underperformed the Premises segment in the recent past. In the previous quarter, the revenues of the Identity segment saw a growth of just 4%, whereas the Premises segment reported a more robust growth of 9%.

Author

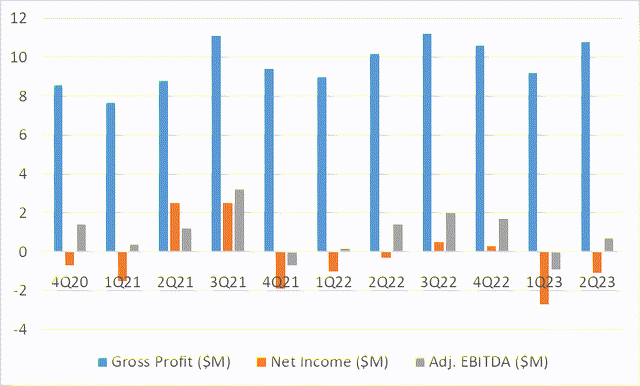

The company’s bottom-line provide a mixed picture. While Identiv consistently reports gross profits, a stable growth trajectory remains elusive. What’s even more concerning is that these gross profits haven’t always translated to net gains. A retrospective view of the past 10 quarters highlights this inconsistency: Identiv registered net profits in four quarters while reporting net losses in six. In 2023, the company posted a loss of $0.06 per share in Q2-2023, a regression from a loss of $0.02 per share the preceding year, and notably higher than the loss of $0.13 per share in Q1-2023. Even its EBITDA, after adjusting for non-recurring items, has shown signs of instability. Specifically, for Q2-2023, Identiv revealed a positive adjusted EBITDA of $0.69 million, a marked improvement from Q1-2023’s negative $0.93 million, but still a significant drop from $1.36 million reported in the corresponding quarter of the previous year.

Author

A Brighter Future

Despite the challenges, I believe not all is gloomy for Identiv.

It is worth noting that in the face of a global economic slowdown affecting the commodity retail space, Identiv’s Identity segment has managed to navigate adeptly. Despite the wider market downturn, the company’s business has witnessed growth. The reason? Identiv isn’t heavily reliant on the low-end retail or UHF-powered commodity tags, which have felt the most substantial impact of the slowdown. Instead, the firm zeroes in on specialty applications, where demand remains resilient against prevailing economic trends.

Identiv’s BLE-enabled RFID devices, catering to IoT and RFID-based solutions, have solidified the company’s position in the advanced medical devices industry. With minimum exposure to the retail sector, Identiv’s products predominantly find their way in the healthcare, supply chain management, mobile devices, and other verticals. The BLE-enabled RFID category has been growing, with the rise in demand for IoT solutions, which might help fuel the company’s growth.

That being said, it is hard to ignore the fact that Identiv, particularly its Identity segment, has exhibited growth hiccups and comparatively low profit margins when juxtaposed against the Premises segment. To illustrate, over the past six months, the Identity segment reported gross profit margins of a mere 22% in contrast to the impressive 56% from the Premises segment. Nevertheless, in my view, the Identity segment holds potential and may be on the cusp of a turnaround. There’s reason to believe that it could experience a surge in revenue and enhanced margins, potentially catalyzing the company’s to consistent net profitability.

My optimism is based on Identiv’s prowess in forging impactful partnerships and its ability to secure prominent clients, particularly for its premium RFID/NFC offerings. A testament to this is its collaboration with Wiliot, an Israel-based SaaS company, where Identiv was tasked to produce 25 million units of its acclaimed IoT Pixel tags for the Ambient IoT ecosystem.

I believe this alliance with Wiliot is a significant achievement for Identiv, signaling trust from one of the foremost names in the IoT Pixel tagging domain. Such endorsements could potentially unlock other opportunities, not just with Wiliot (which it has), but also with other players in this expanding sector. Reinforcing this sentiment, Wiliot has subsequently doubled down on its order, requesting an additional 25 million units.

Another reason to be hopeful about Identiv’s trajectory is its measures in growing its production capabilities. Until recently, Identiv manufactured its RFID/NFC products primarily at its Singapore facility, a capacity that was sufficiently geared to meet demands like Wiliot’s. However, to harness the potential of high-end, complex device production like Wiliot’s at a larger scale, a bigger, more efficient infrastructure was needed.

In response to this need, Identiv has inaugurated a state-of-the-art RFID production facility in Bangkok, Thailand, which will help it to not only grow volumes but also expand its margins. At peak capacity, this new hub can churn out 600 million units of single-pass RFID products annually, thereby tripling Identiv’s overall production volume. Since it came online in June, the facility had scaled to an annual production rate of 60 million units by August. As per the company’s forecast, this number is slated to surge to 200 million units per annum by year-end, an indication of the aggressive ramp-up envisioned. This should have a positive impact on the company’s revenues and profits.

What makes this expansion even more strategic is the cost advantage associated with the Thailand facility. Compared to its Singapore counterpart, the Bangkok facility offers tangible cost benefits, be it in terms of lease rates, labor, or other operational expenses. Identiv seems to recognize this financial advantage, evident in their strategy of directing more resources towards the Thai plant. There are even discussions about transferring certain resources from Singapore to Bangkok. In my view, this shift to the Thailand plant, with its cost efficiencies, might lift the profit margins meaningfully.

To date, the profit margins of this segment have been trailing notably behind the Premises business. With the infusion of low-cost production from Thailand, there’s a strong likelihood that the Identity segment’s gross profit margins will get a boost, thereby elevating Identiv’s overall finances in terms of revenue and net income.

I believe another pivotal development working in Identiv’s favor is the easing of supply chain disruptions, specifically those concerning the chip shortages. Like its industry peers, Identiv has weathered challenges in the past two years, with constricted supply chains escalating component costs and exerting pressure on its profitability. But the clouds seem to be parting. The supply chain situation has stabilized. Notably, component costs are on the decline, freight charges – especially airfreight – have seen a marked decrease, and there’s a notable reduction in lead times. In the company’s own words, circumstances have “fully normalized,” setting the stage for a potential downtrend in production costs in the upcoming quarters. As these cost-effective components get incorporated into Identiv’s production lines, it’s reasonable to anticipate a subsequent reduction in the Cost of Goods Sold (COGS), which, in my view, will bolster profit margins.

Moreover, the previous supply chain issues had forced Identiv to maintain high inventory levels, given the looming threat of crucial equipment shortages. Now, with the supply chain situation stabilizing, especially with lead times reverting to normalcy, Identiv is in a position to maintain standard inventory levels. Such an adjustment is likely to trim down the company’s working capital needs, paving the way for enhanced cash flow. As Identiv streamlines its inventory in the forthcoming months, I believe there’s a potential for significant free cash flow generation, further improving its financial health.

I think one of the key strengths of Identiv, from a financial perspective, has been its robust balance sheet, underscored by minimal debt. As of the end of the second quarter, the company boasted cash reserves nearing $22 million. It had also tapped into $10 million from its $20 million credit facility, resulting in a net debt position of roughly negative $12 million. Given the likelihood of free cash flow generation in the near horizon, I believe Identiv will start paying off its revolving debt, amplifying the strength of its already resilient balance sheet.

Takeaway & Risks

Identiv has indeed faced its share of challenges in the past, but the future seems promising. With the Thailand plant raising production of high-end offerings and the conducive cost structure of the new facility, I anticipate a positive uptick in the company’s revenues and profit margins. Additionally, the improvement in supply chain conditions augurs well for improved margins and cash flows. In my view, Identiv could be on the cusp of transitioning from losses to profits in the forthcoming quarters. Couple this with a potential surge in free cash flows, and we could see a more fortified balance sheet, which could, in turn, drive its share price higher. Given these factors, I view Identiv as a compelling recovery stock warranting investors’ attention.

However, the current valuation of the company might give some investors pause. The stock presently trades at a lofty 60-times forward earnings estimate, though its 1.6x forward sales ratio, based on data from Seeking Alpha, appears more reasonable. With a valuation grade of C- on Seeking Alpha, I believe that a cautious approach is appropriate. For those with an eye for value, it might be prudent to await a price correction before diving in.

That being said, it’s essential to consider potential risks as well. The cornerstone of Identiv’s recovery rests on its ability to increase production from the Thailand plant and seamlessly cater to Wiliot and other clients. Should there be any operational hiccups or a lag in scaling up production, this could delay or even derail its resurgence. Furthermore, the prevailing macroeconomic landscape is rife with uncertainties: from China’s ambiguous economic trajectory and potential softness in Europe’s manufacturing sector to high interest rates and inflation concerns in key regions like the US. If these factors dampen the demand for Identiv’s products or exert downward pressure on prices, the company’s promising outlook could get overshadowed. Investors would be wise to factor in these variables as well in their investment thesis.

Read the full article here