The dramatic increase in interest rates experienced over the last two years has caused a traumatic upheaval in the commercial real estate market. This has resulted in some of the best real estate assets in the world to be available at some of the most attractive prices in 20 years. Such an opportunity exists in the common stock of Crown Castle (CCI), which has seen its price decline by 40% over the last year and trades near its 52-week lows. The company is facing a period of slowing growth after the rapid expansion that occurred with the deployment of 5G technology, while the Sprint merger with T-Mobile (TMUS) has resulted in some churn in towers, and of course higher interest rates have increased financing costs. Long-term investors willing to look past these short-term issues can potentially look forward to very attractive long-term capital appreciation and dividends, with the current dividend yield a mouth-watering 6.45%. I believe the stock has 50% upside over the next 3-5 years.

Crown Castle is in the business of providing the infrastructure necessary to facilitate wireless communications and growth, via cell towers, fiber, and small cells throughout the United States. The company owns over 40,000 towers and over 120K small cells, along with over 85,000 miles of Fiber. Small cells help add more capacity in denser markets, where it may be harder to add additional towers, whereas towers are the most efficient way to deploy spectrum over large areas of both population and geography. Wireless companies have had to spend well over $100B to acquire spectrum between 2020-2022, so infrastructure providers such as CCI and AMT are hugely beneficial in that they dramatically reduce the upfront investment required to utilize that spectrum. Wireless data usage has grown very robustly for decades now, as innovations such as the iPhone and 5G have demanded increasing amounts.

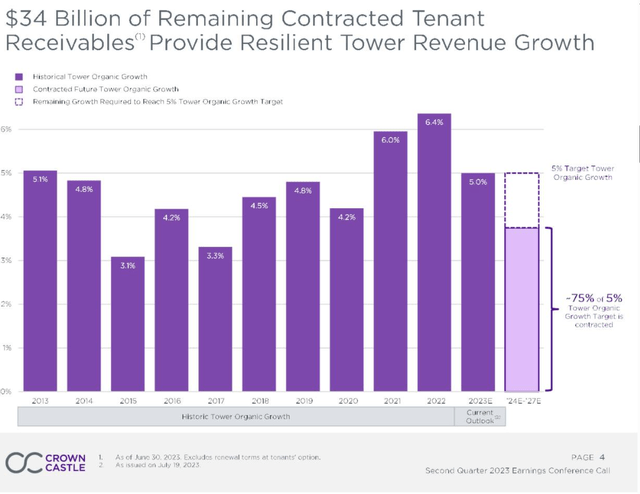

Often it isn’t totally clear what end-uses the networks will be built for initially, but as capacity has grown, more technologies have found ways to take advantage of it, such as Uber, or more recently fixed wireless, where companies like T-Mobile and Verizon are trying to double the number of fixed wireless customers over the next few years. Fixed wireless isn’t a new concept, but the capacity and latency were never available until 5G technology has enabled it to be available now and companies are anxious to now provide it. Crown Castle and the wireless industry recently experienced a period of rapid growth with 5G development from 2020-2022, where tower growth was greater than 6%, and the CCI dividend grew by 9-11% per annum. As that period of growth has subsided, the major wireless players are pulling back at the same time, while the T-Mobile acquisition of Sprint has led to some redundant tower churn.

CCI management believes that through 2027, tower growth will be 5% per year on average, excluding the Sprint churn, and that 75% of that has been contracted already, often via lease escalators. They see a growth floor of 3.75%, while retaining ample upside potential if growth perks up again and more new leases are signed. The company values stability and to accomplish this uses fixed escalators as opposed to CPI-linked ones that can be less predictable. CCI pursues holistic long-term agreements designed to maximize the economic value, while also providing visibility in long-term cash flows. The company complements its portfolio of towers with fiber and small cells, which allows the company to capitalize on long-term growth and data demand irrespective of how carriers choose to deploy spectrum and densify their networks. The company expects double-digit small cell organic growth beginning in 2024, as the company deploys its 60,000-node backlog, providing a line of sight of doubling on-air nodes over the next several years. CCI is seeing good returns from collocating additional customers on to existing fiber assets. For example, in Phoenix where Sprint churn wasn’t an issue, CCI saw its yield expand from 9% to 11% in a year, as they roughly doubled nodes on-air from 1,400 to 2,800. The company sees 3% fiber solutions growth by the end of the year. By 2025 and beyond, CCI intends to return to its long-term annual dividend per share growth target of 7-8%.

Crown Castle Q2 Investor Presentation

Management has been prudent in how it has been handling its debt, via nearly doubling the average maturity length of its debt over the last few years and eschewing the use of most floating rate debt. The debt is properly staggered so there aren’t any individual periods where a huge percentage of the debt stack needs to be refinanced. As of Q2, CCI had issued $2.4B in fixed rate bonds this year, with a weighted average rate of 5%, which is quite reasonable given the environment. The company exited Q2 with 4.6x net debt to adjusted EBITDA, and more than $6B of available liquidity, although adjusted EBITDA was higher than normal due to Sprint payments. Only 7% of debt matures through 2024 and the weighted average maturity of the debt has risen from five to eight years, while floating debt exposure has declined from 32% to 9%, since the company achieved an investment-grade rating.

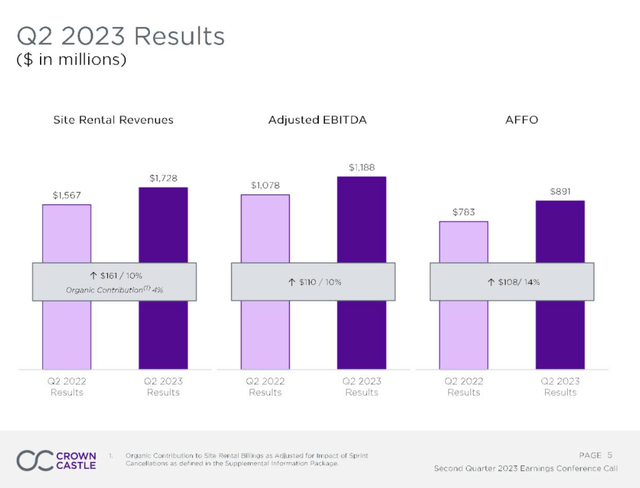

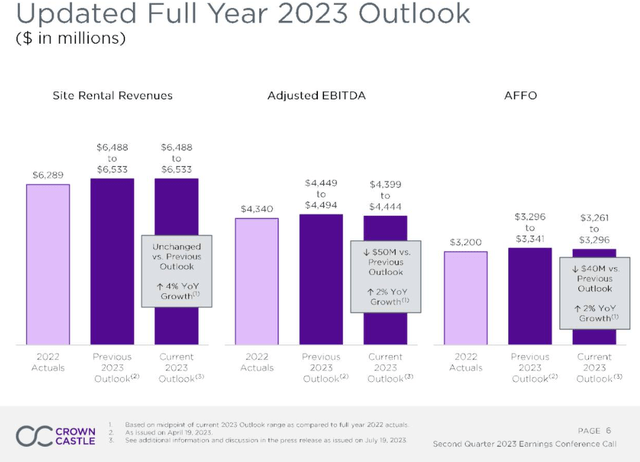

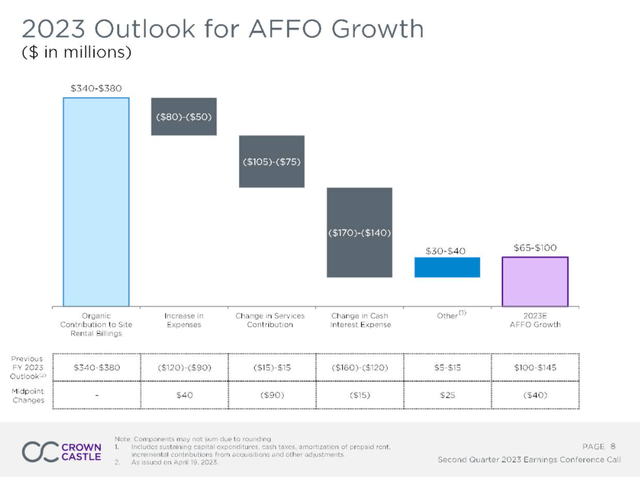

CCI disappointed investors in reporting its Q2 results as a decline in tower activity of more than 50% caused the company to reduce its outlook for services gross margin by $90MM. Higher interest rates resulted in $15MM of additional interest expense, so combined the outlook was reduced by $105MM. The company is making efforts to reduce costs, so the net impact to AFFO was expected to only be $40MM.

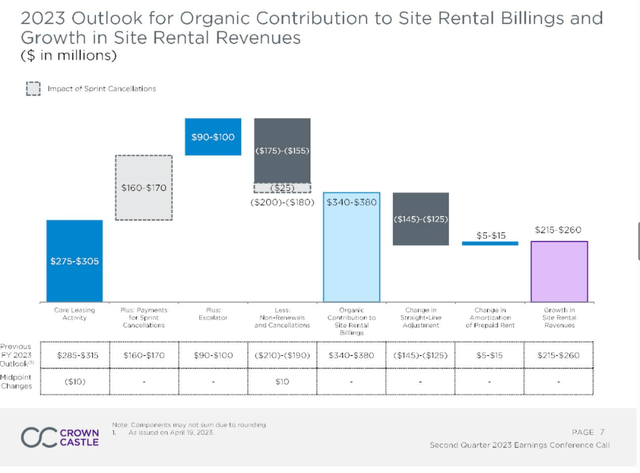

Not all was bad though, as CCI reported nearly 6% tower organic growth, and 12% organic growth on a consolidated basis, or 4% when adjusted for the impact of the Sprint cancellations. CCI saw growth of 14% in AFFO and 10% in adjusted EBITDA in part due to the Sprint cancellations. Most of the impact of the Sprint cancellations occurred in Q2, including a net contribution to site rental billings of $100MM. The impact of Sprint can be seen in the slide below. Discretionary CAPEX is expected be $1.4-$1.5B, or $1B net of expected prepaid rent.

Well after Q2 results, on July 24th, CCI disclosed a restructuring plan to reduce costs, which included cutting total employees by about 15% and discontinuing installation services as a product offering within the Towers segment. The company expects to incur roughly $120MM of charges, mostly taken in Q3 and Q4 of this year.

Crown Castle Q2 Investor Presentation Crown Castle Q2 Investor Presentation Crown Castle Q2 Investor Presentation Crown Castle Q2 Investor Presentation

At a recent price of $96.74 and a market cap of roughly $42B, CCI trades at about 13x adjusted FFO, and the enterprise value of $70B, equates to an EV/adjusted EBITDA of 15.8. The stock pays a quarterly dividend of $1.56, which will grow over time, equating to a yield of 6.45%. This is a stock that has traded at dramatically higher multiples, albeit aided by a robust growth period and ZIRP interest rate policies that elevated valuations on REITS. I believe as the company executes its business plan and overcomes the short-term hurdle of the Sprint churn, the stock can revisit an 18-20x adjusted FFO multiple and converge the gap with its main competitor American Tower (AMT). This, combined with expected growth in FFO and the dividend, should lead to solid double-digit per annum gains in the stock over the next 3-5 years. Now is an opportune time to buy high quality real estate while it is on sale, as is definitely the case with CCI, where you’ll be paid handsomely to wait.

Read the full article here