It’s not surprise, well at least not to me. Warren Buffett and friends at Berkshire Hathaway are back to handily beating the market. I have long suggested that Berkshire is a no-brainer for retirees. Perhaps it’s a no brainer for investors in the accumulation stage as well. With a short term focus investors continually write off the world’s greatest investor. Time after time Mr. Buffett proves them wrong.

Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) has a very solid track record beating the S&P 500 (IVV) through the last two major market cycles – moving through the dot com crash and the financial crisis.

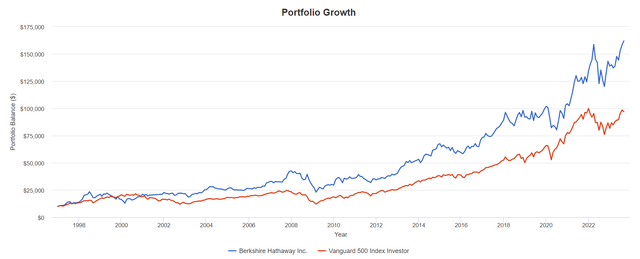

Berkshire vs the S&P 500 from 1997 (Portfolio Visualizer / Author)

The beat is only 2.1% per year, but the portfolio value is 67% greater.

But of course the greater gains came in previous decades. Berkshire has had a compounded annual gain of 19.8% from 1965 to 2022, compared with 9.9% for the S&P 500 during the same time.

In this post on MoneySense in early 2022 I reported how money was flowing to Berkshire Hathaway.

I have long touted Berkshire Hathaway as a very useful defensive holding. I would consider the stock a market correction hedge. It also gives you some value investing exposure. The company and stock tends to perform very well during times of market stress, and especially through major stock market corrections and recessions.

From that CNBC post…

…according to data from Bespoke Investment Group. Since 1980, Berkshire shares have beat the broader market over the course of six recessions by a median of 4.41 percentage points.

And during the bear markets…

Even more impressive is the stock’s performance during bear markets. During the same time period, the conglomerate outpaced the S&P 500 each time it dropped 20%, beating the broader index by a median of 14.89 percentage points.

This post on Seeking Alpha looks at the returns of Berkshire Hathaway versus the S&P 500 over 20 years. Note: The article was published in May of 2021.

That’s usually when market commentators start to write of Mr. Buffett. As a value investor, he will underperform during rip roaring bull markets where growth stocks rule.

And while Buffett and team have made some moves over the last 3 years, they have mostly been quiet. Here’s the portfolio tracker.

Apple and oil

Mr. Buffett has added some oil and gas exposure by way of Occidental (OXY) and has built up Chevron (CVX) to modest levels. That offers a level of inflation protection. For the record, I put oil and gas stocks on the table in 2020. I’ll give myself credit for being ahead of Mr. Buffett on that call, ha.

And Apple (AAPL) is still the beast in the public stock portfolio at a 45% weighting. OK, I was ahead on Apple as well 😉

As I wrote on my blog, the stock markets have stalled. They haven’t gone anywhere for two years or more. But Berkshire has separated from the markets.

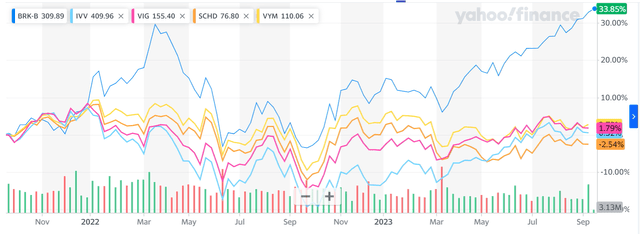

Here’s a 2-year chart tracking Berkshire vs the market and some popular dividend ETFs.

Berkshire vs others over 2 years (Portfolio Visualizer / Author)

Yes, that’s a price chart, but the dividends would do little to close the gap.

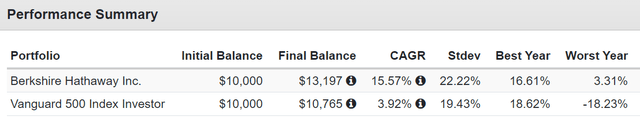

Here’s a total return table for the period…

Berkshire vs S&P 500 2-year (Portfolio Visualizer / Author )

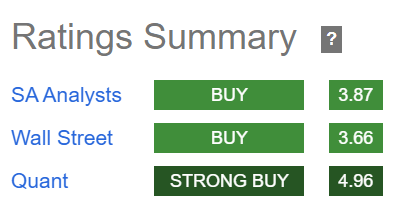

The market likes the valuation for Berkshire and the free cash flow generation. On Seeking Alpha, you’ll see that the stock lights up the Quant ratings and analysts’ recommendations across the board, and has for quite some time.

Seeking Alpha Quant ratings for Berkshire (Seeking Alpha )

And Warren Buffett is sitting on over $150 billion in cash, still waiting for a significant market correction. I’d suspect that the market is now rewarding that patience and the ability of the world’s greatest investor to pounce in any recession or market correction.

I use Berkshire Hathaway as part of my investment risk management. Berkshire is the largest individual stock holding in my wife’s accounts.

If we do get a meaningful stock market correction, Buffett and his team have nearly $150 billion in cash to go shopping for stocks at fire sale prices.

But even with the current slate of public stock, insurance holdings and other privately held operations, the growth prospects are surprisingly strong.

Looking at the full year, our Zacks Consensus Estimates suggest analysts are expecting earnings of $15.82 per share and revenue of $331.03 billion. These totals would mark changes of +13.24% and +9.58%, respectively, from last year.

The combination of that cash pile (that can earn attractive yields) and businesses that are growing and throwing off significant cash flow and share buy backs is enough to drive Berkshire higher, as the market is still mostly consumed with the prospects for the Magnificent Seven.

The future for Berkshire Hathaway

Of course, one of the main risks touted is the longevity of Warren Buffett and his copilot Charlie Munger. Buffett recently turned 93, while Charlie Munger will turn 100 on January 1. My opinion is that the company will be fine when the torch has to be passed to the younger managers. They are well trained.

In fact Todd Combs was the force behind building the Apple position. Combs is cited as the Berkshire Hathaway successor. One could argue that under Combs and other managers the company will apply a more modern approach rooted in the core of value investing and holding great companies for the longer term.

That said, in recent years under the leadership of Buffett Berkshire has been out in front, building oil and gas positions, plugging into the electric vehicle market (BYD) and other tech such as Snowflake (SNOW). They will continue to find value and growth in a challenging market.

And once again, a compelling reason to hold Berkshire is for the recession hedge. The company is sitting on the largest cash pile in history. Finding value in any recession will be like shooting fish in a barrel for Buffett and team.

That might have Berkshire well positioned for the next decade or two.

Unique structure

It is the unique multinational conglomerate structure of Berkshire Hathaway that is paying dividends.

Berkshire is the largest holding in my wife’s accounts. Here’s a post on the outperformance of our U.S. stock portfolio. In 2015 I skimmed 15 of the largest cap dividend achievers (VIG), those stocks were added to 3 picks by way of Apple, BlackRock (BLK) and Berkshire.

In Canadian dollar terms the Berkshire performance gets a currency boost, thanks to the strong U.S. dollar. U.S. stocks are a must and a wonderful hedge for Canadian and international investors.

The stock portfolio for 2023

I included Berkshire in Building the Dividend Growth Portfolio in 2023. Yes there are a couple of no-dividends outliers in that portfolio mix. I also had suggested that folks overweight Berkshire. To my eye, it is a must hold for the retiree. It can be incredibly tax efficient as an additional benefit.

I will track the performance of that 2023 portfolio concept. To date it is certainly underperforming that market. Growth and the magnificent 7 still dominate the returns for the market. That might change when value and profitability becomes the focus for investors.

Thanks for reading. Hit that Like button if you liked this post.

And pleasure ensure that you invest within your risk tolerance, and understand all tax implications. Retirees can certainly benefit from a comprehensive financial plan, and at the very least a retirement cash flow plan.

We’ll see you in the comment section.

Are you investing with the world’s greatest investor?

Read the full article here