Founded in 1997 and headquartered in San Jose, California, Align Technology, Inc. (NASDAQ:ALGN) has revolutionized the dental industry with its flagship product, the Invisalign system. This former market darling possesses lots of positive characteristics and the stock is getting close to a buying opportunity. As we shall see, however, it’s not quite there yet.

Introduction to Align

Best known for its state-of-the-art clear aligners designed for orthodontic treatments, Align Technology has expanded its product portfolio to include various other dental products and services. With a market capitalization of $24.3 billion and zero debt, the company is a dominant player in the dental care industry. But what has driven its recent financial performance, and what does the future hold for Align Technology?

Revenue and Profitability

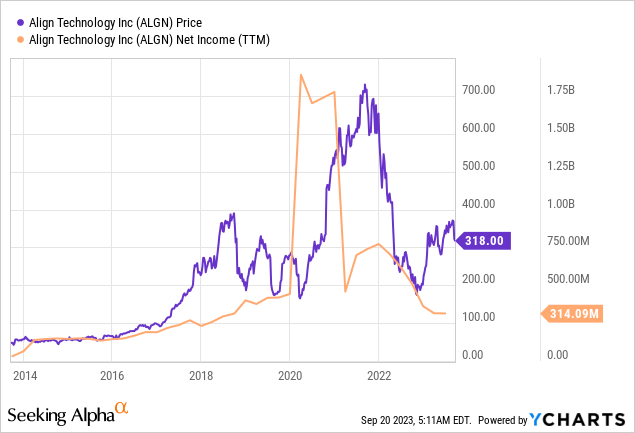

As of its latest financials, Align Technology has generated revenue of $3.7 billion, with net income totaling $314 million over the past 12 months. The company also recorded $843 million in adjusted EBITDA and $612 million in free cash flow. Positive earnings have been a staple of this company’s history. Adjusting for approximately $1 billion of cash and investments the enterprise value now sits at around $23.3 billion.

Revenue Segmentation

Align Technology’s revenue can be categorized into two segments:

1. Clear Aligner: Sold under the Invisalign brand, clear aligners contribute to about 83% of the company’s revenue, generating a 71% gross profit margin.2. Systems and Services: This sector, which includes Imaging Systems and CAD/CAM services, makes up the remaining 17% of the revenue and has a gross profit margin of 62%.

Valuation Metrics

- Enterprise value to revenue: 6.3x

- Enterprise value to EBITDA: 27.6x

- Enterprise value to free cash flow: 38x

- Price to earnings: 77.4x

Operating Margins

With operating expenses exceeding $2 billion, Align Technology’s operating margin hovers at around 15%, which is below the historical average of 23%. This decline can be attributed to increasing direct costs, most likely due to inflationary pressures.

Global Presence

Geographically, the majority of Align’s revenue comes from outside the United States:

- United States: $1.65 billion (44% of LTM revenue)

- Switzerland: $1.21 billion (32% of LTM revenue)

- Other International: $879 million (24% of LTM revenue)

Cash Management

Align Technology has consistently generated substantial free cash flows. Its management has judiciously utilized these funds in three primary ways:

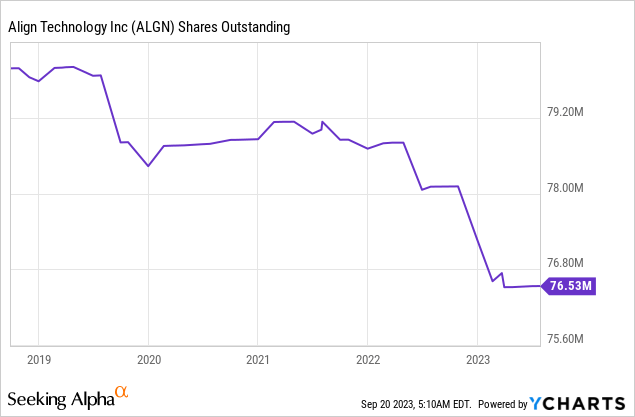

- Share buybacks: The number of outstanding shares has decreased by 5% over the last five years.

- Acquisitions: The company acquired Exocad in 2020 for over $400 million and recently announced the acquisition of Cubicure, a 3D printing pioneer.

- Reinvesting: The capital expenditure is approximately double the historical depreciation/amortization, indicating that management sees internal growth opportunities.

Fluctuating Revenue Growth

Align Technology was previously a favorite among Nasdaq growth investors. Although looking at the historical financials it’s not clear why. Certainly, the company has had good times with good profitability. But over the years, the company’s revenue growth has also seen its fair share of ups and downs:

- 2017: 36%

- 2018: 34%

- 2019: 22%

- 2020: 3%

- 2021: 60%

- 2022: -6%

- 2023: 7% (expected)

- 2024: 12% (expected)

- 2025: 12% (expected)

Competitive Landscape

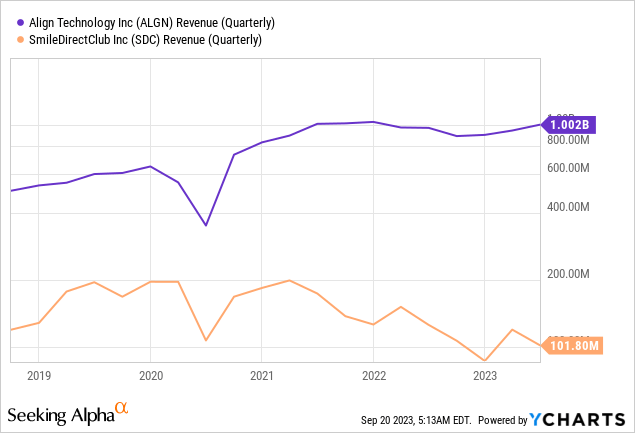

In 2019, fears arose that Align Technology might face disruptive competition from SmileDirectClub (SDC), an online platform for ordering aligners. Smile DirectClub provides customers with a telehealth service that drastically cuts the cost and hassle associated with normal orthodontics. However, SmileDirectClub simply hasn’t worked out, as a business or as a stock. While SmileDirectClub has reported four consecutive years of declining revenue, Align Technology has managed to sustain its dominance. This is likely due to Align’s strong execution and the established relationships it has built up with dental professionals and customers. It’s also testament to the strength of the Invisalign brand.

Consumer Engagement & Marketing

But Align’s success is also a result of adept marketing strategies that have propelled the business over the last few difficult years. This marketing has consisted of effective use of digital advertising and social media. In Q2 2023 alone, consumer marketing impressions reached 10.3 billion, coupled with 30.9 million website visits. Align Technology has been leveraging top media platforms and social media influencers to raise brand awareness, particularly focusing on the largest segment of the orthodontic market- teens.

Company earnings transcript

Investment Outlook and Future Projections

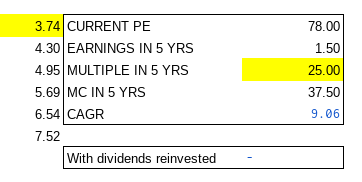

There is some uncertainty around Align’s growth prospects within the investor community. But the underlying trend is relatively clear. Millions of people need aligners and Align will benefit from that. Align’s 10 year revenue growth rate is just over 20% a year. However, since Align is a more mature company than it was in the past, and with the introduction of new competitors I feel a more conservative growth rate should be modeled. So, if Align can maintain a 15% annual growth rate in revenue for the next five years and return to an 18% net income margin (in line with its historical margin performance), it should generate roughly $1.5 billion in profits by the end of that period. Apply a 25-times multiple to that number leads to a valuation of $45 billion. From today’s market cap that translates into an investment return of 9% per year.

Author’s workings

Although the numbers don’t suggest a compelling investment opportunity, it’s important to note that Align Technology has a history of exceeding market expectations. Moreover, with a potential market of over 500 million people needing aligners, the company can outperform if expectations are exceeded. Notably, a 20% revenue growth rate and a higher multiple of 30 times earnings would see the expected return jump to 15.6% PA.

Concluding Thoughts

While the stock is currently down more than 50% from its peak in 2021, and its latest acquisition led to an 8% dip in share price, Align Technology remains a significant and profitable player in a growing market. Its strong financials, innovative product range, and robust marketing strategies make it a good company to watch. Align has potential to reward shareholders from current prices. But a lower share price would make this a more compelling opportunity.

Read the full article here