It has been over a year since we last took a deep dive into Targa Resources (NYSE:TRGP) with an article entitled Targa Resources: Back in the Buy Zone, and it is time to revisit the company to see how their business is progressing. At that time, we reviewed what Targa was doing with all their newfound cash flow and dove into the economics of their recent $3.55B Lucid acquisition. The Lucid G&P system is located on the Delaware side of the Permian Basin, and is one of Targa’s primary systems for growth both in the Permian and their overall company.

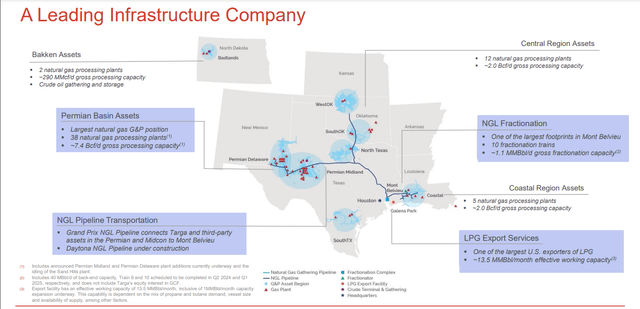

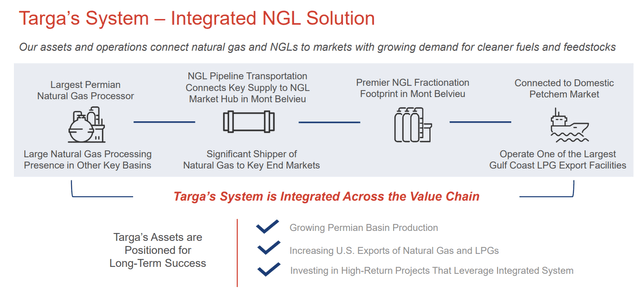

Targa has a sprawling midstream presence in the US across 6 states and multiple basins. Their growth and claim to fame is tied to the Permian Basin where they boast the largest natural gas G&P system with 38 natural gas processing plants and 7.4 Bcf/d of gross processing capacity. These assets (along with their other G&P assets) feed their NGL (natural gas liquids) transportation business, which feeds their fractionation assets in Mount Belvieu, which feeds various markets in the Gulf Coast region as well as their growing export business. Targa is one of the few mid-cap midstream companies to organically grow and integrate the entire value chain from well to water to burner tip.

Targa’s US Midstream Footprint (Targa Resources)

They currently have about 90 rigs running on their Permian G&P system (27% of all Permian rigs) and this system continues to expand. Targa added 770MMcf/d of processing capacity in 2021 in the Permian and are on pace to add another 1.6 Bcf/d through 2025. In addition, they are investing close to $4B in 2023 and 2024 in a continuing effort to expand and vertically integrate their growing business by adding additional gas processing capacity, NGL transportation, 2 new fractionation trains in Mount Belvieu and additional NGL export capacity. The purpose of this article is to determine if Targa Resource is worthy of additional investment – should we hold it, sell it or buy it? With that in mind, let’s dive into the details.

A Vertically Integrated Midstream Company

As a refresher course, let’s review the components of an integrated midstream company. For those seasoned pros who understand all of this, feel free to skip this section.

When an oil or gas well delivers hydrocarbons to the surface, the mixture that is brought to the surface must go through extensive processes to make those products are marketable, and midstream companies are instrumental to that process. We often think that an oil well is an oil well and a natural gas well is a natural gas well, but in truth, many wells, especially in the Permian tend to be a hybrid of the two delivering both products in varying ratios. At the wellhead, infrastructure is used to separate crude oil, condensate, the gross natural gas stream and water.

Condensate at the well is called lease condensate and you can think of it as an extremely light form of oil. It is similar to lighter fluid – the kind used to help light charcoal briquettes, although condensate can range in color from clear to amber. The natural gas stream includes both the natural gas used in everyday residential cooking and heating, but it also includes heavier hydrocarbons called natural gas liquids (NGLs) and other impurities that must be removed to make it pipeline ready for end-use. Gathering pipelines run from each well to aggregate the natural gas from the field and deliver it to the natural gas plant for processing. These gathering lines are either owned by the E&P company that owns the wells or the midstream company that owns plants and pipelines further downstream. The purpose of the natural gas plant is to remove the valuable NGLs and impurities from the natural gas stream and deliver both natural gas and NGLs to markets further downstream.

After plant processing, the natural gas is now considered pipeline ready and can travel on massive natural gas pipelines out of the basin that are as large as 42-48” in width and travel several hundreds of miles further downstream. The NGLs (or plant condensates) travel on so-called Y-grade pipelines to fractionation complexes on the gulf coast, the mid-continent and other places. The grandaddy of all fractionation complexes is the sprawling complex in Mont Belvieu, TX, the location of Targa’s fractionation and storage assets. From there, the fractionation trains separate the Y-Grade into the individual hydrocarbon components – ethane, propane, butane, iso-butane and natural gasoline. These purity products are then sold to end-use markets, put into storage for later use and/or exported to markets overseas.

Focused on Natural Gas and NGLs

A midstream company can own any one of the assets described above from gathering and processing lines to the export docks, pipelines and storage facilities. Targa tends to focus on the NGL value chain but will invest in key infrastructure to gain access to those products. You won’t see them investing purely in a natural gas basin like the Haynesville or the Appalachia region – rather, they focus on the oiler plays like the Permian and Gulf of Mexico, and the oilier sections of the Anadarko, Barnett, Eagleford and Badlands in North Dakota.

They will invest in the large 42” natural gas pipelines from the Permian to the gulf coast if they view natural gas pipelines as a bottleneck. They are currently contemplating funding a 563-mile natural gas pipeline system called Apex from the Permian to Jefferson County, TX because they anticipate needing another pipeline in post-2024 to feed the growing natural gas from the Permian basin, but they will cede the build to another midstream company if one arises.

In Jan 2022, Targa sold their 25% interest in the GCX, a 42” natural gas pipeline for $857MM, while subsequently increasing their investments in their fractionation assets and NGL pipelines. In the past, they have sold crude gathering assets. It’s clear that Targa is primarily focused primarily on the natural gas and NGL value chains where they can touch the molecule multiple times, so to speak, and where the investments tend to run into the hundreds of millions.

Targa’s Integrated Value Chain (Targa Resources)

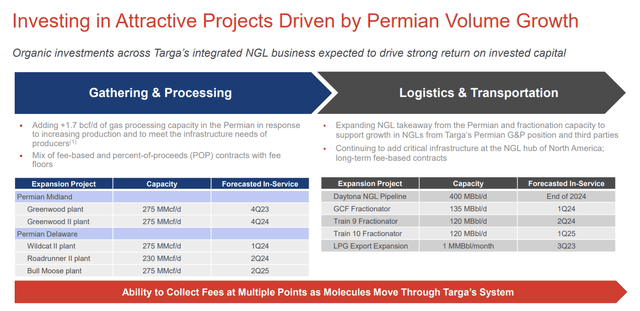

New Projects

As mentioned, they are also in the process of spending over $4B on growth capex to build more natural gas plants for both the Midland and Delaware sides of the basin, a new NGL Y-grade pipeline system called Daytona which will expand their Grand Prix pipeline and move additional barrels from the Permian to the gulf coast, 2 more fractionation trains in Mount Belvieu (120 MBbl/day each) simply named trains 9 and 10 and an expansion of their export capacity on the gulf coast. The Gulf Coast Fractionator (GCF) is a restart of a plant in Mount Belvieu that was idled a few years back and they plan to spend about $25MM for that project. They own a 38.75% interest in it.

You might think with all this infrastructure being built that Targa has an army of folks running around building plants and laying pipeline, but that’s not true. Midstream companies operate these assets, but they don’t build them. That job is done by third-party companies that specialize in developing these projects.

Targa Resources Project List (Targa Resources)

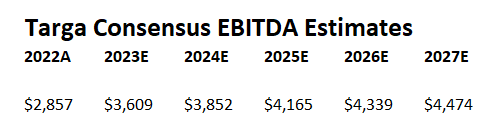

Targa EBITDA expectations

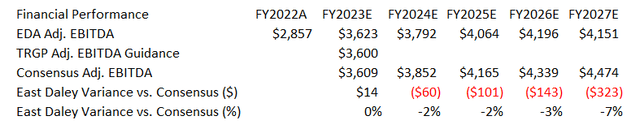

With all that growth in mind, let’s dive into the growth expectations for Targa by looking at consensus EBITDA guidance for Targa. Note, Targa has only provided guidance through 2023, and estimate it at between $3.5B to $3.7B with a midpoint at $3.6B. Unlike the frantic pace of growth in 2022 where midstream companies were revising their guides upwards every quarter, Targa provided guidance earlier in the year and it has remained rock-solid at $3.6B. Figures for the consensus EBITDA Estimates are in millions of dollars.

Targa Consensus EBITDA (East Daley Analytics)

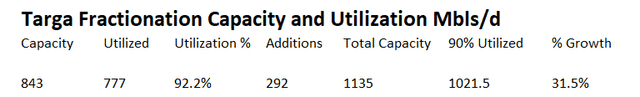

Based on the consensus EBITDA estimates, their business is expected to grow by 24% in the next 4+ years. If we drill down just into the fractionation business and use that as a proxy for the growth of their entire business, we see that the fractionation business is scheduled to grow by 31.5% once they complete Frac Train 9 & 10 and add the growth from the restart of GCF.

They currently have 843 Mbls/d of nameplate capacity. Fractionation plants typically run at 90% of their nameplate capacity and we call this their effective capacity (the amount that they can use on a consistent basis). A plant can run at higher rates but typically a midstream company will want to dial this back to 90% eventually. The effective capacity for Targa will increase by 31.5%, but this may not translate across their business, and they may reach a point where they have spare effective capacity.

Targa’s Fractionation Capacity & Utilization (Targa Resource’s Annual Report and Investor Presentations)

Lower EBITDA estimates from analysts argue that despite the hefty growth in the Permian, their legacy assets in the Barnett, Eagle Ford, Louisiana, Oklahoma and the Badlands will act as a drag on EBITDA in 2026 and 2027 and deflate this to $4151 by year-end 2027 or 15% growth. Here are East Daley Analytics’ estimates for Targa based on a more muted guide:

East Daley’s Estimates for Targa Resources EBITDA (East Daley Analytics)

Estimating future EBITDA for a company as complex as Targa with commodity-based sensitivities is extremely challenging even for the company’s accountants, which is why midstream companies like Targa have shied away from giving long-range guidance. Instead, it is better to take these estimates with a grain of salt and use them as temporary guideposts that will be adjusted over time based on commodity prices, market changes, acquisitions, organic investments, etc.. In any case, it is clear that Targa is still in growth mode.

Targa’s Trading Range

With EBITDA estimates in mind, let’s take a quick look at where Targa is trading relative to its earnings. Typically, a stock will trade in a range based on some earnings metric and a competent analyst will search for patterns. A good one for Targa is Enterprise Value to EBITDA. As a reminder, enterprise value is the sum of market capitalization (price of the stock multiplied by the number of shares) plus debt. (For the purposes of this article, I’m including diluted shares in my calculations). This is a metric that shows you the cost to buy a company relative to its earnings. For example, in June of 2022 Targa announced the acquisition of Lucid and at the time of the purchase, they bought them for 7.5 x estimated 2023 EBITDA or $3.55B which tells us that EBITDA in 2023 was estimated to be $473MM.

As a rule of thumb, midstream companies like Targa are currently paying 6-8x EBITDA for assets that are growing and paying around 3x EBITDA for assets whose earnings are declining over time like their recent Eagle Ford acquisition. Lucid is growing fast, so it was purchased near the high end of the growing EBITDA range. With the 7.5 x EBITDA metric noted as a fair value of growing mid-sized assets, we can turn our attention back to Targa and calculate that so far in 2023, Targa has traded between 7.37 to 8.98 times 2023 estimated EBITDA of $3.6B. If we go back to 2022, Targa traded between 7.12 to 9.17 times 2022 EBITDA.

Conclusion and Positioning

Based on a current price of $85.15 and a 2023 EBITDA estimate of $3.6B, Targa is currently at the high end of that range of 8.81 x EBTIDA (or 8.23 times 2024 consensus EBITDA). The higher valuation in my view is the result of stronger crude prices which have soared over $90/bbl WTI – Targa is getting a sympathetic lift with energy prices. A fair value target for Targa is about 8.5 x 2024 consensus EBITDA or $89.70.

A downside target might be 7.5 x 2024 consensus EBITDA or $72.71. When valuations get stretched too far the downside, Targa tends to step in with opportunistic buybacks and accumulate shares. A short-term sell side target could be reached at about 9 x 2024 consensus EBITDA or $98.19. Knowing this, patience is the key. Although you can participate by selling out of the money calls and puts for pennies at these targets, it is best to sell them as we near those targets to reap the greatest returns, or simply participate directly in the stock when we reach targets. Conversely, once these targets are reached, act quickly because Targa may not stay in those zones for long.

Read the full article here