As pretty much everyone knows, Dollar General (NYSE:DG) has been beaten down recently. Its stock price has fallen over 50% YTD, and just keeps dropping after every poor quarter. Today, the company is trading for ~11x 2022’s diluted EPS and roughly 16x the low end of their 2023 FY EPS guidance.

The company is experiencing a lot of issues right now (which we will discuss briefly below), but honestly I think a lot of these are short-term operational issues. They may not be – this may be a symptom of something worse. Management can’t really execute right now, and it looks like they overinvested in inventory in 2022 (but who didn’t).

What you really have to decide, though, is whether they can maintain their past growth rate once they get all of this figured out. Right now, they’re guiding for revenue growth of 1%-3% for FY 2023, and a significant decrease in margins and EPS. Is this a sign of a sustained trend?

Well, that all depends on a couple of things: (1) their growth initiatives and (2) competition. All of this macro stuff and problems with their customer and SNAP – that’s all short-term stuff in my view. There will still be customers shopping at Dollar General after 2023, you just have to figure out how many more they can gain in the future, and whether they can do it at sustained margins.

And to do that, you’ve got to look a little deeper and understand where Dollar General stores are, what they are, what they’re turning into, and how they’ll expand. You’ve got to understand what purpose these stores serve, and look beyond management’s statements and the common perception surrounding Dollar General.

But I’m not going to hide the ball here. For Dollar General to perform over the long term, it has to grow. And, to me, that comes down to one thing – the location of its future stores. I don’t know for sure where most of its past real estate growth has come from, but rural is the company’s bread and butter. If the majority of its future expansion plans are into rural areas (where there’s not much competition), then I believe shareholders will continue to see sustainable growth. But if the majority of growth is focused in urban areas or suburban areas, I think the company is looking at increasing competition, especially as it increases capital expenditures to make its stores look and operate more and more like its urban competitors. For reasons I discuss below, I think it’s possible the company has maxed out potential rural growth, and may now be facing a tougher road of urban and suburban growth that is filled with competition.

What Dollar General is Doing Right

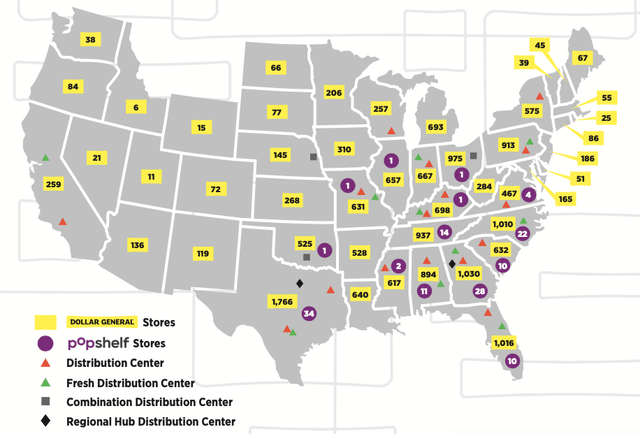

As it stands, Dollar General is still in a pretty enviable position. Its store coverage is pretty much unmatched, at 19,488 locations. Amazingly, there’s a Dollar General store within 5 miles of 75% of the U.S. population.

Dollar General 2022 Annual Report

And the location of its stores is, in my opinion, Dollar General’s largest competitive advantage. Roughly 80% of its stores are located in towns with 20,000 residents or less. This makes it by far the most dominant rural grocer in America. In a lot of areas it serves, it’s really the only option within 20-30 miles or so. Further, almost none of these rural markets are large enough to support multiple competitors, so no one (except maybe Family Dollar) is going to come in and try to compete with them in a large chunk of their footprint.

The remaining 20% of their store footprint is located in more urban and suburban areas, though they try to maintain a focus in lower income areas that aren’t served as well by big box retailers or other specialty grocery stores.

On top of its massive store footprint, Dollar General has an enviable financial track record, serving a customer base that honestly remains pretty loyal to it, even during tough times. And that’s actually a pretty good point to focus on here for a second. Dollar General usually doesn’t offer the cheapest prices. It can sometimes match the Walmarts (WMT) of the world, but that’s a challenge. What it offers (and why it can generate good returns) is convenience, quickness, and proximity. It offers consumers extreme convenience (in and out in no time) or it’s the only option (you either drive 30 minutes to an hour to Walmart or you go down the street to Dollar General). It has competitive prices, but it can’t compete overall with Walmart, Costco (COST), or Aldi in my view.

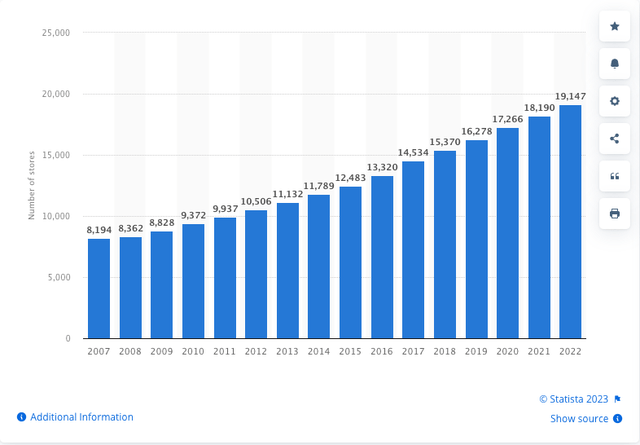

This has led to some steady growth over the years. Since 2015, Dollar General’s top line has grown at an average of 10.4% annually, and its earnings have grown by 12.4%. Even more impressive, on the back of significant buybacks, its EPS has increased by a CAGR of 17.3% over the same period.

Statista – Number of Dollar General Stores

During this time, Dollar General’s same-store sales (SSS) growth was typically 2.5%-3%, and the number of new stores increased by ~7,000. Over the same period, its ROIC grew from 12.6% to an impressive 19.2%. Dollar General’s ROE, of course, increased by much more, but that was primarily the result of increasing leverage.

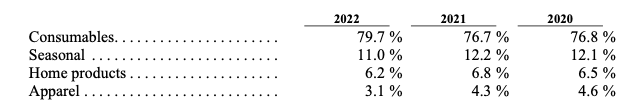

Today, Dollar General generates the vast majority of its sales (close to 80%) from consumables.

Dollar General 10-K

This is up from roughly 75% of sales in 2015. On the whole, these products have slightly lower margins than non-consumables, but they offer repeatable business. Customers come in and shop for consumables more regularly – it’s really the closest thing you can get to recurring revenue in retail. If Dollar General can get committed customers that buy groceries from Dollar General every week, then they can count on a higher number of repeat sales without spending as much on marketing to those customers.

This is good, but it also shows what kind of business Dollar General is – a small grocery business, meaning it competes (to some extent) with larger grocers. Over the last decade or so, Dollar General has taken further steps towards becoming a grocer.

It has added more freezer sections to more stores, it has started to roll out DG Fresh (produce and other perishables), and it has recently started to offer DG Wellbeing products (over the counter medicine and related products).

Dollar General currently has around 19,000 freezer/cooler units in its stores nationwide, and it thinks it can grow the total amount to ~65,000. This is quite the jump, and will likely require a pretty widespread expansion in square footage per store. Which is probably why management has said that 80% of their new stores and all of their relocations are going to be built in a larger store format.

The company has announced an expected 990 new stores to be built in 2023 (slightly lower than the last few years), and 120 relocations. Probably more important for this section of the write-up though, Dollar General is guiding for 2000 store remodels, with 80% of them being expanded into the 10,640 square foot Dollar General Traditional Plus (DGTP) stores, to primarily allow for more cooler/freezer space.

As of Q2 2023, Dollar General offers DG Fresh produce in 4,400 stores, and expects to reach 5,000 by the end of 2023. While this is typically more of a time-sensitive and low-margin business, it’s expected to bring in more repeat purchases. And I honestly believe it will be a pretty big boon to rural locations, where customers typically have to drive long distances for their produce.

Dollar General is also expanding DG Wellbeing, which includes 30% more selling space in a store and up to 400 additional items. It was available in 4,400 stores in 2022, and they hoped to expand to 5,500 by the end of 2023. These items look like they include OTC drugs and other personal hygiene products.

Dollar General had 190 PopShelf stores by the end of Q2 2023, and they expect to reach 230 by the end of 2023. While non-consumable revenue was hit pretty hard in Q2 2023 (decrease of 8.5%), management still expects PopShelf to be different – providing a treasure-hunt like environment where shoppers can find a variety of seasonal and home décor, health and beauty, home cleaning supplies, and party and entertainment goods – usually at $5 or less. They expect the total number of PopShelf stores will reach 3,000 over the long term.

I personally don’t see how this will do too well, even in rural areas. Obviously, I don’t know for sure, but 3,000 stores seems pretty ambitious. In urban areas, this puts them into more competition with Dollar Tree (DLTR) and Five Below (FIVE), and more regional non-consumable stores like Hudson’s Treasure Hunt, Hudson’s Dirt Cheap, and most importantly Amazon (AMZN).

Even in rural areas, where there’s not much local competition, I imagine that the PopShelf stores will be in direct competition with Amazon. And these rural customers have been conditioned over the last 10 years or so to expect low prices and fast delivery from the e-commerce giant.

Maybe Dollar General can handle itself with PopShelf in the more suburban and urban areas. Maybe it can compete against Dollar Tree and Five Below. I just don’t expect the opportunity to be as fertile as low-priced consumables in rural areas with no competition.

The Current Issues

Like I said, there are some shorter-term issues with Dollar General’s performance (that for some reason everyone focuses on), that probably won’t have that much of an impact on the company longer-term. I will address those briefly, but also dive into the actual structural issues facing the company going forward.

The short-term issues, to me, are the “demand” and “operational” issues that Dollar General has been dealing with over the last 6-12 months. They include things like supply chain problems, an inventory glut, poor staffing, cost inflation, and the extinguishment of SNAP benefits.

SNAP and Customer Demand

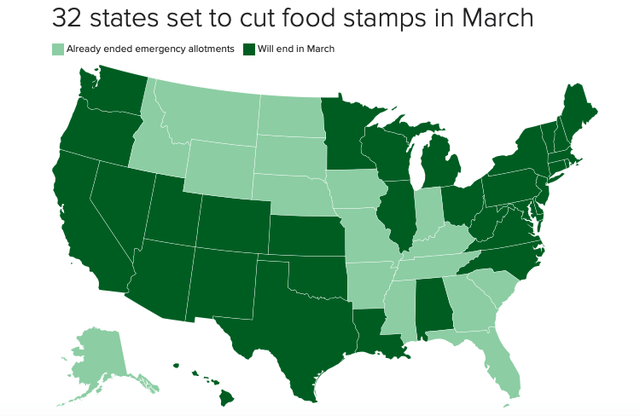

The Supplemental Nutritional Assistance Program (‘SNAP’) – basically an allowance for food given to poorer individuals and families by the U.S. government – was expanded pretty significantly during the pandemic. Now, those additional benefits are being phased out, and the SNAP payments are returning to normal.

CBS News

In most states, it’s estimated that people will lose, on average, $82 a month of additional benefits. Given Dollar General’s customer base, it’s likely that the company benefited from the increased SNAP program.

And just as those benefits are being phased out, the prices of goods and groceries across the board are starting to increase in price. This will likely have a one-two punch effect on Dollar General in the near future, with its customer base being punished by the higher prices and the reduced benefits.

I still believe that Dollar General has a pretty strong value proposition, but if it can’t maintain prices that are competitive (or sometimes lower than) the big box retailers, it’s likely most customers will give up convenience for lower prices when necessary.

Shoppers won’t go away, especially in the rural areas, but this is something to watch.

Inventory

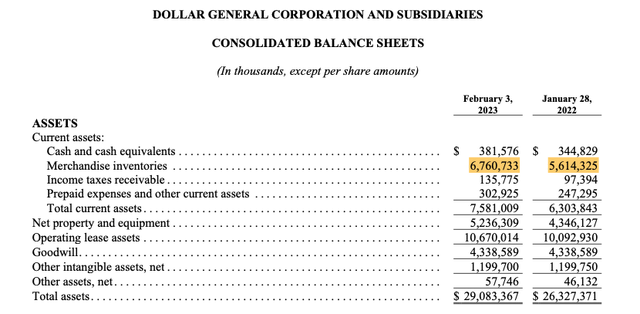

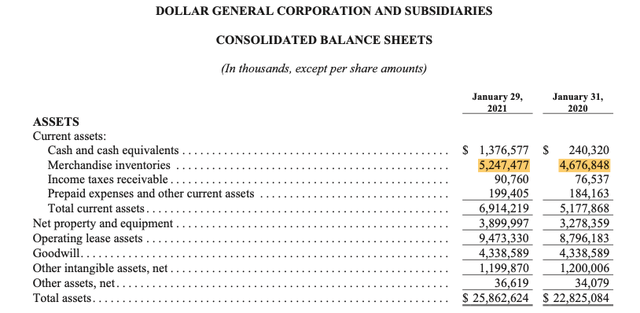

Dollar General increased its inventory by roughly 20% in 2022, and with decreasing demand, is now paying for that by discounting large chunks of excess inventory.

Dollar General 2022 10-K

Dollar General 2020 10-K

To deal with this, Dollar General said it is implementing product discounting and offering promotions, which are expected to impose a headwind of $95 million to operating income in the second half of 2023.

Staffing

Dollar General says it is “investing” an additional $150 million in staffing for FY 2023. That should lead to decreasing margins, but it honestly seems like it was overdue. This is anecdotal, but a lot of Dollar Generals you walk into are hit or miss. Many seem to be extremely understaffed, with products and carts filling the isles.

I don’t know for sure, but I expect there will be a pretty big push to raise wages, on top of increasing store personnel and worker hours, as Dollar General has already said it will do. As of 2022, ~92% of their employees made less than $15 an hour, a wage that is a major sticking point these days. Apparently, only half of Walmart’s employees earn less than $15 an hour.

Given the low wages and low employee count per store allow Dollar General to remain competitive on price, this could be a problem in the future.

Debt

The debt issue is a strange one, and may be the only one of these short-term issues that has any real effect on DG in the long run. And that’s mainly because the company arguably didn’t need the debt.

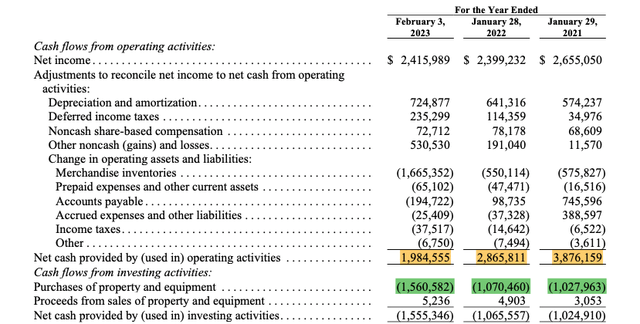

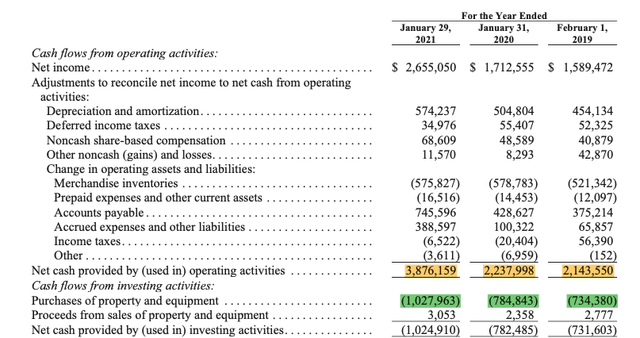

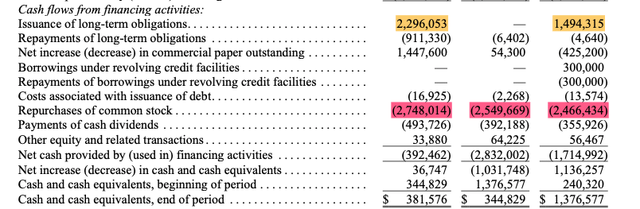

Take a look at its cash flow statement:

Dollar General 2022 10-K

Dollar General 2020 10-K

As you can see, even with the company’s explosive store growth numbers, it could still fund all of its capital expenditures (and these include growth capex) with cash flow from operations. In other words, the company probably didn’t need to take on debt to grow.

But the debt increased nonetheless. Dollar General had, for a while, maintained a steady debt load of $2.5-$3 billion. But in 2020, things started to change. The company’s total debt load grew from under $3 billion in 2019 to roughly $7.2 billion today.

Dollar General’s shares outstanding have decreased by roughly 20% since 2017. And just take a look at what the company is spending a lot of its cash on in 2022, 2021, and 2020:

Dollar General 2022 10-K

So, essentially, a lot of the debt was taken on to buy back shares in my view. That may come back to bite Dollar General, as they’ve had to cut out buybacks in 2023 and deal with rising interest rates and declining margins.

Competition and the Difference Between Rural and Urban

So, Dollar General has run into some recent problems, and growth has slowed to what looks like an estimate of 1.3-3% for 2023, while margins are down significantly. The real question is whether this is a short-term thing or a long-term problem. Can Dollar General start growing its top line at 8-10% a year again and increase margins at a steady rate as well? If so, steady stock buybacks would probably be able to juice returns enough to produce a pretty good return (and that’s saying nothing about multiple expansion).

But the key word here is “if”. If Dollar General can continue expanding. At just under 20,000 stores, it has the largest store footprint of any retailer nationwide (albeit a lot of stores are smaller at 7,500-8,000 square feet).

It’s extremely hard to quantify and prove, but I believe that Dollar General is running into significant competition from smaller grocers and local stores in the more urban areas it operates in. This is the case even if it restricts itself to areas that historically weren’t as well-served as other areas in a city.

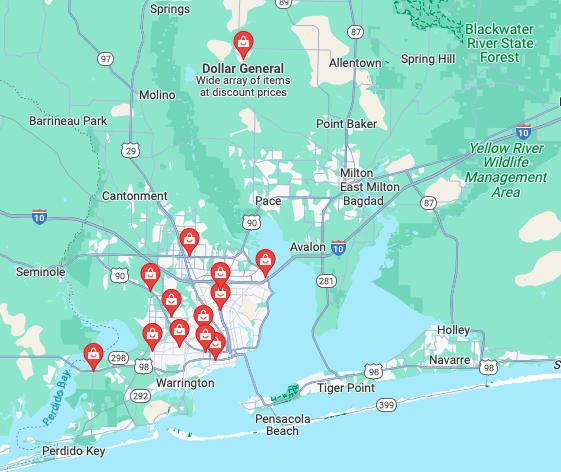

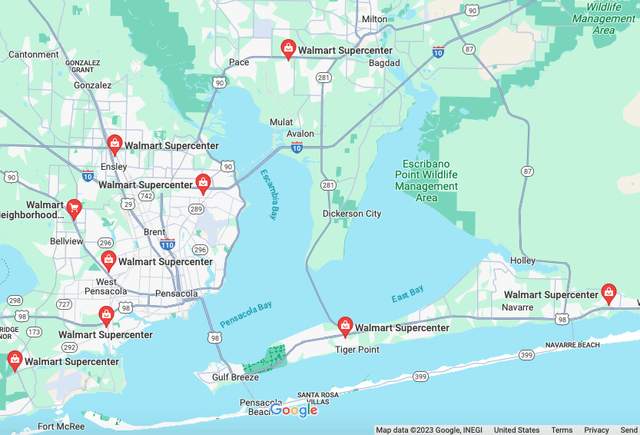

Just take a look at the map below of Pensacola, Florida – a pretty representative urban area for Dollar General in the Southeast. Here are the Dollar General locations in the area:

Google Maps – Dollar General Locations (Pensacola, FL)

Google Maps – Dollar General Locations (Pensacola, FL)

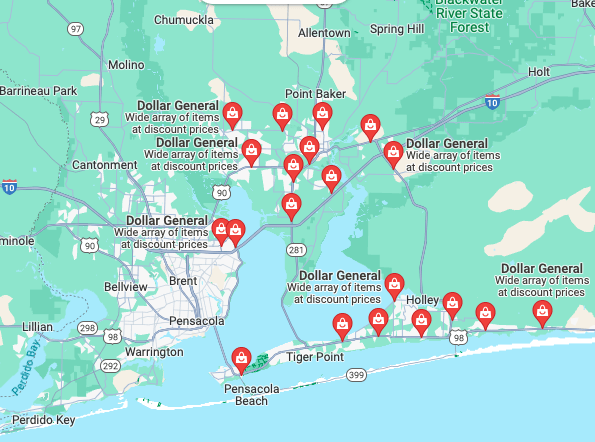

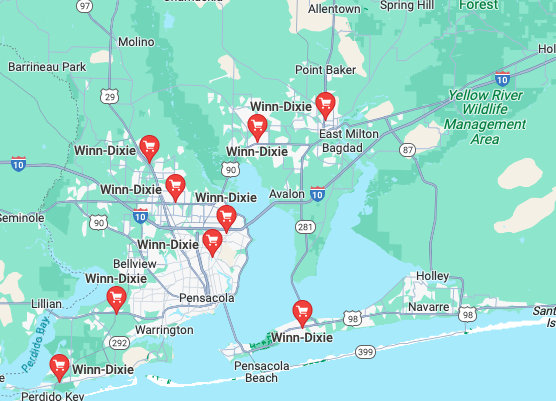

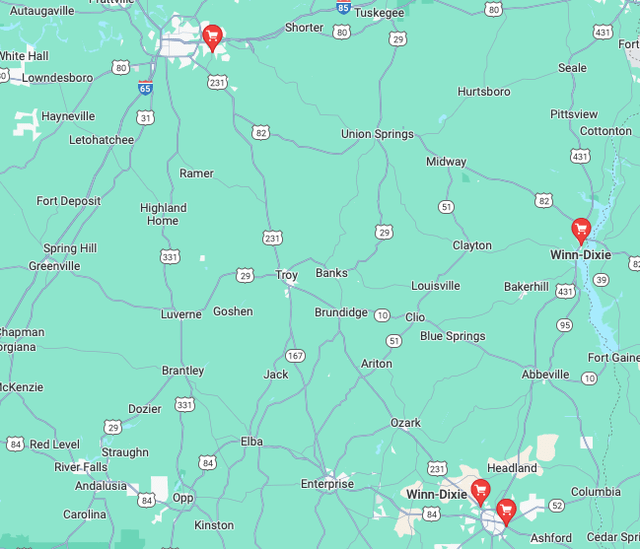

By comparison, here are the Winn Dixie (a smaller competitor who is now being acquired by Aldi) in the area:

Google Maps – Winn Dixie Locations (Pensacola, FL)

The overlap is pretty apparent, and it doesn’t matter that there aren’t as many Winn-Dixie locations as Dollar Generals. They cover the same general area, and they’re larger stores.

The same even goes for Walmart stores in this area. Even though the majority are supercenters, these urban areas are where Walmart is able to take market share from Dollar General. The convenience factor is still there, but people aren’t locked in geographically speaking.

Google Maps – Walmart Locations (Pensacola, FL)

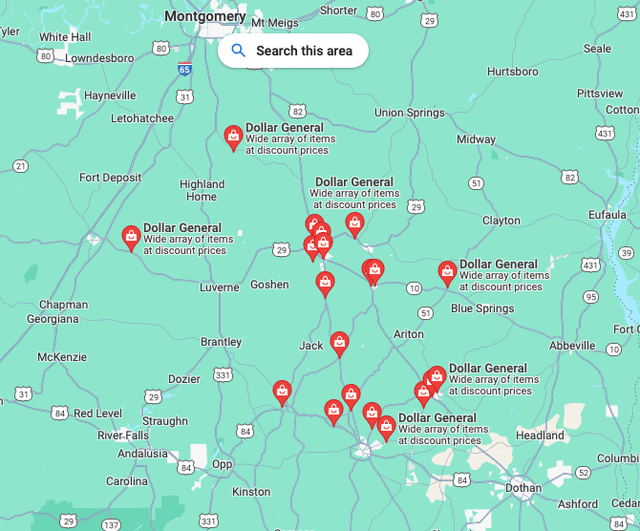

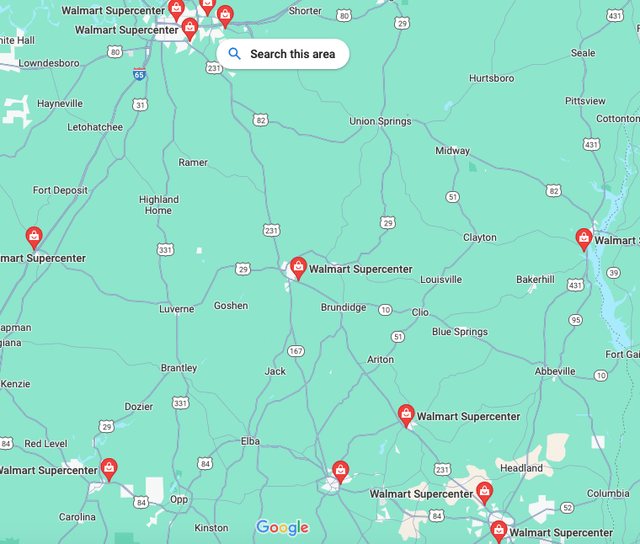

Compare this to Dollar General’s presence in the more rural stretch of Alabama between Dothan and Montgomery. You can see below that there’s a pretty formidable Dollar General presence:

Google Maps – Dollar General Locations (between Montgomery and Dothan, AL)

That same area is very sparsely populated when it comes to Walmart stores and Winn-Dixies. In fact, there are no known Winn-Dixies in the general area.

Google Maps – Walmart Locations (between Montgomery and Dothan, AL)

Google Maps – Winn Dixie Locations (between Montgomery and Dothan, AL)

As Dollar General transforms to become more like a normal grocery store every day, it starts to butt up against more of these competitors in urban areas. It’s adding coolers and DG Fresh produce to as many stores as it can, and 80% of every new build and every single relocation is being built in the larger store format.

For what it’s worth, I think this is a great idea in the rural areas it operates in. That’s why it’s such a strange conundrum. The more offerings Dollar General has – DG Fresh, increased freezer/cooler space, and DG Health and Wellness – the more money it’s going to be able to extract from people shopping at these more rural locations. You can drive for miles across Mississippi and Alabama and see Dollar Generals in the middle of nowhere, along highway routes that people frequent from their way to and from work, and clustered in small towns where the largest supermarket is 15 minutes to an hour or more away.

But in the more urban and suburban areas, it seems like Dollar General is running into more competition. It’s not just Walmart and Kroger (KR) (though those do tend to compete – now more so that DG has more frozen food and produce), but also drug stores like Walgreens (WBA) and CVS (CVS), and, perhaps most significantly, local state grocers that directly compete with Dollar General.

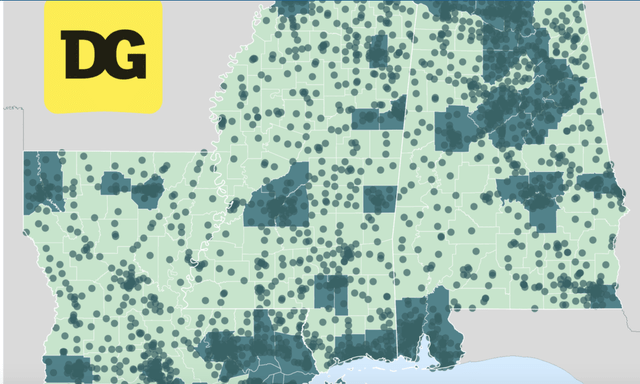

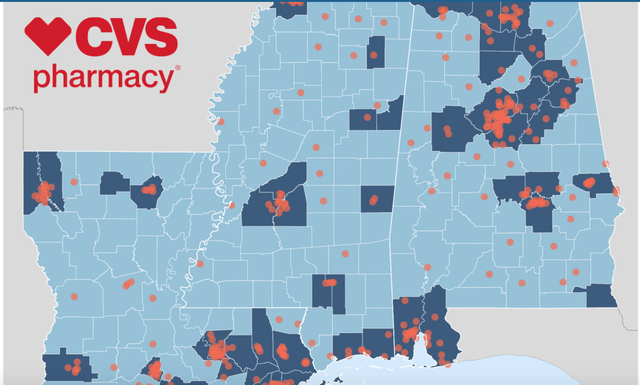

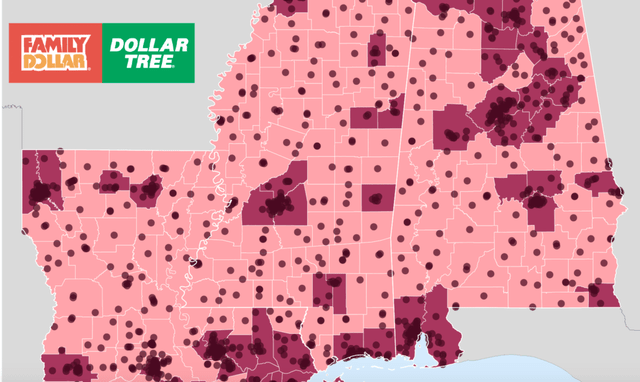

Below, you can also see three maps across Mississippi, Alabama, and Louisiana that show the typical overlap of Dollar General stores, CVS stores, and Dollar Tree/Family Dollar stores. It’s pretty obvious that Dollar General has the widest coverage, given its concentration on growing in more rural areas. CVS is primarily located in more urban areas, as is Family Dollar/Dollar Tree – though the Family Dollar/Dollar Tree stores do have decent rural coverage.

Mississippi Public Broadcasting

Mississippi Public Broadcasting

Mississippi Public Broadcasting

Lest you think this is just anecdotal, let me throw a statistic at you: Independent grocers now account for 33% of all retail sales, up from 25% a decade ago. Despite being larger (in-store square footage) than most Dollar Generals, these stores seem to compete directly with Dollar General.

You have to understand the consumer’s shopping habits and psyche. To most consumers, these stores are a place to go if you need to get something quickly or you just need a few things. Their prices don’t match the largest supermarkets and their selection isn’t as large either. They can’t compete directly with a Costco, Walmart, or Kroger. But their position sounds a lot like Dollar General’s place in the market.

Fortunately, many of these stores can’t afford to go into the more rural areas that Dollar General already serves – it’s just not worth competing. But they focus in urban and suburban areas, which though only 20% of Dollar General’s total locations, may be an area of forced expansion in the future.

Don’t get me wrong, I know that dollar stores have gained 90% in market share between 2008 and 2020. But a lot of it has come from rural areas – people who used to have to drive a good distance to Walmart. They have a larger share of the average household’s wallet than they used to.

The problem with all of this is that increased capex associated with growing store size could be a mixed bag. I think (though I may be wrong, and some disagree) that the increased store sizes and addition of more coolers/fresh/health and wellness products will be a net positive for rural locations. People purchase this stuff, and they usually have to drive somewhere to do it. If their local Dollar General offers it, they will most likely buy it from there.

In an urban setting, however, people are already purchasing this stuff from a store not too far away. It may be a little more inconvenient than Dollar General (or it may not – think about Walgreens, CVS, Aldi, and local small grocers – they’re easy to shop in), but someone who already purchases this stuff from a store nearby will be less likely to change their habits and get it at Dollar General as long as they have these other options.

Out of all the possible competition, I believe that Aldi could be the most serious for Dollar General. You obviously have Family Dollar, which basically mimics the Dollar General model, and they are competition. But I think the two are relatively interchangeable. If someone shops at either, they’ll probably shop at both – that’s a customer who will regularly go to a dollar store. Though I will note that Family Dollar hired a former Dollar General CEO as its current CEO. It seems likely that he’ll pursue a growth strategy similar to the one he undertook at Dollar General.

What Dollar General has to really watch out for, though, is losing customers completely to other convenient and cheap grocery stores. Because that’s basically what Dollar General has become – a quick and convenient (and sometimes cheap) grocery store. The biggest threat to that is the German retailer Aldi.

Aldi Corporate Website

Aldi was the fastest-growing traditional grocery store (by store count) in the U.S. last year – excluding dollar stores – opening 49 stores in 2022. Some may disagree, but I believe that it’s coming into direct competition with Dollar General more and more. The stores are a similar size – 10,000 square feet of selling space (compared to 10,640 for DGTP stores and 7,500 for traditional DG stores) – and they are focused in the Southeast.

In general, the customer profile of the two stores actually looks pretty similar. They both cater to lower income individuals and families. While I don’t necessarily think these characterizations are that accurate, a typical Aldi customer has been described as someone with extremely low discretionary income. Similarly, Dollar General has described its core customers as “low and fixed income households often underserved by other retailers.”

Aldi also has the lowest prices around – even beating Walmart, which typically beats Dollar General. Similar to Dollar General, it also stocks less items than big-box retailers, and focuses on making the stores easy to navigate so shoppers can get out quickly. But then again, there are some differences between Aldi and DG. Aldi doesn’t focus as much on name brands, offering roughly 90% cheap private label brands to shoppers.

Now, this is a model that Dollar General may be envious of, considering it’s trying to shift more of its shoppers to its own private labels (private labels made up about 20% of sales in 2022). But I don’t think it’s going to go the route of almost total off-brand goods. So, there still may be some slight differences between the two, and Dollar General could continue to capture customers who prefer name brand products.

But it’s still worrying. The rate at which Aldi is growing in Dollar General’s core markets (the urban and suburban ones, mind you) is alarming. And that growth just got even faster with the 2022 acquisition of Southeastern Grocers, Inc. (which includes Winn Dixie stores). The company will be adding 400 additional stores in the Southeast. It’s going to be the second largest (traditional) grocer in the U.S. with 2,800 stores (behind Walmart’s 5,000) – but I will note that Aldi is not the second largest on a total square footage basis and not the fastest growing when you take total squarer footage added into account. So, take that as you will, but I think it’s still a fast-growing competitor to Dollar General.

What’s The Growth Strategy?

So, it all comes down to where Dollar General grows in the future. At the end of 2022, management was predicting that the entire dollar store/small grocery industry could handle 16,000 more stores long-term, and Dollar General would capture a pretty large share.

But where will these stores be built? Is there enough demand in rural areas for a widespread increase in rural store openings? I don’t know. Today, roughly 80% of the U.S. population lives in an urban area. That leaves roughly 66 million consumers presumably living in rural areas. But, honestly what is a rural or urban area? The Census Bureau doesn’t do a very good job of defining it. Some people might think of 20,000 people as rural, but Walmart has stores in far smaller towns than that. So, many of those areas aren’t immune from competition.

It’s hard to say how many customers Dollar General serves in a year. Of course, it’s within 5 miles of 75% of the population, but these people don’t all visit a Dollar General. In its Q4 2022 Earnings Call, Dollar General management remarked that Dollar General had 90 million unique customer profiles for the brands partnering with DG Media to utilize. I don’t know if this is representative of the total customer count (it’s probably always changing), but I think it may be close.

Walmart serves roughly 240 million shoppers a week, and this is probably representative of their total unique customer numbers (since a lot of people shop there weekly). That’s roughly 72% of the US population. This year, Business Insider released data showing that roughly 40% of U.S. shoppers visit Dollar General 32 times a year. So, that’s not exactly weekly – closer to every two weeks. 40% of the total US population is 132 million. But I don’t know if you can count the entire U.S. population here (children and people who can’t physically shop have to be taken into account). I’ve seen the number of U.S. e-commerce shoppers thrown around at 260 million or so. I don’t know if that’s representative of total U.S. shoppers (which are probably higher than e-commerce shoppers), but we’ll just apply the 40% to that. 40% of 260 million is ~104 million shoppers that visit Dollar General (an estimate). This is pretty close to the 90 million unique customer profile Dollar General threw out, so we’ll go with that.

We know that 80% of Dollar General stores are in rural areas (with 20,000 or less in population). I don’t know for sure if this would mean that 80% of Dollar General’s customer base is rural – probably not, considering the urban stores may have more traffic and customers – but it’s likely that more than half are rural. Even if only 65% (of the estimated 90 million) or so are rural, that means Dollar General already reaches 58.5 million rural customers, leaving only ~7.5 million of the remaining rural customers (66 million) left to capture.

This USDA report from 2021 says that 46 million or so Americans live in non-metro counties (which typically have populations of 23,000 or less). Obviously, this is different than a town of 20,000 or less, but the rough approximation is actually pretty accurate. The real number of rural citizens is probably closer to 66 million or so, instead of the 46 million from this report, but the numbers are rough.

Obviously, this is rough math, but if the reality is anywhere close to this, then it’s likely that Dollar General is maxing out the number of rural customers it can capture. That means growth in new stores is probably expected to come from more urban areas. Though I will note that Dollar General has reiterated in its recent earnings calls that its DG Forward strategy is focused on dominating rural.

To me, this means that the best course of action is trying to capture a larger share of the rural customer’s wallet. This implies that the upgrade of multiple Dollar General stores and the addition of the DG Fresh, coolers/freezers, and DG Wellbeing is a good tactic for the rural locations.

The problem occurs when there’s a combination of (1) slowing sales growth and decreasing profitability at the store level and (2) increased investment in more expensive and larger stores. If Dollar General has to build a lot more stores in more urban and suburban areas with more competition, then it will be harder for them to grow SSS at the same level they have in the past.

They’ve said they’ll focus on dominating the rural market, so for investors’ sake, I hope a lot of their growth is focused on expanding these additional offerings in their rural stores – though they’re still continuing to open new stores despite the fact that the prospects may not look as great. One analyst on the Q2 2023 Earnings Call even said that new store productivity was 80% – the lowest in 10 years. I don’t know if that is true, but it’s kind of alarming. The company has noted that the new stores are still showing IRRs of 20% or so, and that they expect comp sales to continue to be 2-4% going forward in new stores too.

So, I don’t know. Is management right about this? The market doesn’t seem to think so. And, in my opinion, the market’s probably right. Dollar General has new management on board, and it’s possible that strategies have been crossed up and the numbers aren’t turning out as good as they looked a few years ago.

But I wouldn’t go about shorting Dollar General just yet. They entered their first international market in 2022 – Mexico – and I honestly think this could be promising. Central and South America could be great growth markets for Dollar General. Obviously, I have no idea how well a U.S. brand will do in those markets, but they seem like the logical next step. People counted McDonald’s (MCD) and probably Walmart out before they went international too.

Also, I’ll throw in their DG Media as well. It is Dollar General’s retail advertising arm for CPG companies, and could actually serve as a profit center for the company. I have no idea how things will turn out, but I will note that Dollar General probably has spending data on potential customers that a lot of other retailers don’t.

Valuation: What’s Baked In?

Dollar General’s management doesn’t really give a lot of guidance past the current year, but it has said that it expects 10% EPS growth over the long term. Traditionally, EPS growth like this has come from a variety of places – the main being: (1) top-line growth, (2) margin growth, and (3) stock buybacks.

The company can typically sustain 10% or more long-term EPS growth (it has in the past and it predicts it will in the future) by growing through 5% or so store expansion, 2-4% SSS growth, and buying back 5-6% of shares.

The top-line growth is arguably the most important component, considering it drives the remaining two. And that comes from SSS growth and new store openings.

Overall, the expected revenue growth of 1.3% on the low end isn’t all that bad when you compare it to 2019. I know, that was 4 years ago, but that’s arguably the baseline to compare growth to moving forward. The combined SNAP benefit increases and government stimulus during 2020-21 increased the wealth of Dollar General’s core customers more than any other event in history. They’re typically a group of consumers that doesn’t see any kind of increases in real wealth over time. So, the demand generated during this period could retreat some. I’m not saying that all of it will, and I’m not an expert on this. But growth of 50% over 2019’s number actually doesn’t sound that bad for FY 2023.

Over the medium-to-long term, net margins had grown from about 5.6% to just under 8% by 2020. But since then have shrunk back down to 6%. Take that as you may, but Dollar General was obviously a beneficiary of COVID, seeing increased store traffic and purchases per store.

That seems to have normalized since COVID, but the labor and supply chain disruptions have started to take a toll on the cost side of the income statement. Dollar General is generating savings from growing its owned tractor trailer fleet (which is expected to expand to 2,000 by the end of 2023), as well as trying to improve inventory management. But, as we discussed above, it may be having issues with store staffing that can only be corrected with higher-cost employees. This will likely lead to compressing margins over time, as the company will be unlikely to raise prices enough (it has to compete) to offset these expenses. Though the consolidation of the supply chain will probably help.

Basically, long term, I think the net margin will probably be 6% or so, even if it’s temporary compressed during 2023 and 2024. I don’t expect Dollar General to require any more debt to grow – its growth capex will probably still be fully funded by OCF, especially after inventory expenses are managed by the new inventory management system. Unfortunately, with capex increasing on account of the increased store re-modellings, relocations, and new store larger sizes, not much will be left over in terms of FCF. So, DG may not be able to maintain its buybacks at the same rate without taking on more debt, which it is probably less likely to do after the issues it’s experiencing this year.

All of this means that EPS growth will be hampered by a future lack of buybacks and a lack of margin expansion. This means that things will have to be driven by revenue growth. But, in my opinion, this may be equally unlikely.

As I discussed above, the short-term consumer demand issues will probably slow down revenue growth. But, even more so, the long-term growth rate could be impacted by the declining opportunities for growth in rural America – a market where Dollar General largely had a monopoly on convenient grocery retailing.

I myself wouldn’t bet on future growth much faster than 1-3% honestly. Given the potential limits on future rural growth and the competition in the urban markets, I don’t know how Dollar General will be able to sustain its past growth rate in the U.S. Obviously, international growth presents a potential counterbalance, but we really haven’t seen anything yet.

So, if you’re betting on Dollar General today, you’re probably either betting that (1) margins will improve going forward, even if growth doesn’t, and/or (2) the market will bestow a higher multiple on the company. Right now, it’s trading at 16x estimated 2023 earnings, and people seem to think that’s cheap because the stock has dropped 50%. I don’t think so. In my opinion, there are better companies out there available for a 16x PE. Yes, of course, Dollar General has traditionally been a great company, but if growth doesn’t rebound, I don’t really care. And good luck with the multiple expansion if growth fails to come back strong.

Of course, I could be horribly wrong about all of this. And this is why I said I would never short it. I think the added coolers/freezers, DG Fresh, and DG Wellbeing could be a pretty big boon for rural stores. Will they make up for slowing overall unit growth? I don’t know. International expansion is also something to watch out for.

Conclusion

Overall, Dollar General has run into some headwinds, and its stock has been beaten down. Many issues appear to be temporary, though they could be indicative of deeper issues. The real threat to Dollar General, in my opinion though, is the declining growth opportunities in rural America and the increasing competition in urban and suburban regions.

Read the full article here