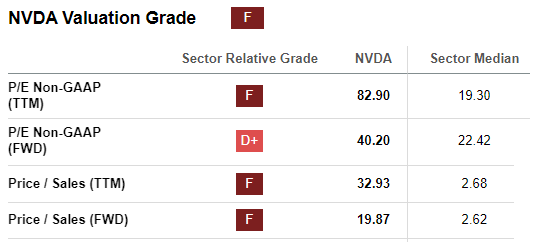

As emotions are running wild in the semiconductor sector, investor hype is driving share prices of the winners to exuberant levels of 20 times forward sales and 40 times forward Non-GAAP earnings.

Seeking Alpha

As dangerous as this is for future returns for the likes of Nvidia Corporation (NVDA), the opposite emotional response is occurring for the losers in the sector (or at least those facing temporary setbacks).

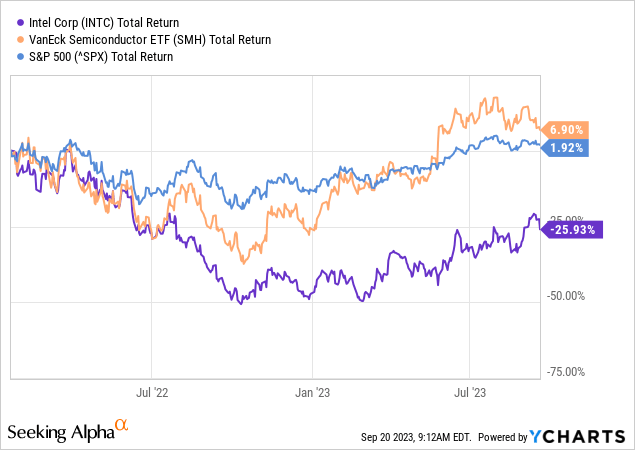

This appears to be the case of Intel (NASDAQ:INTC), which similarly to AMD back in 2016 is on the back foot and is experiencing a temporary period of losses. That is why, in early 2022 I called Intel – well-positioned to compete but hardly a short-term play.

From a business perspective, the company will likely continue to suffer in the short term, however, strategic positioning is still strong.

Source: Seeking Alpha

And it wasn’t a short-term play indeed as the stock returned a negative 26% since then during a period of time when both the S&P 500 and VanEck Semiconductor ETF (SMH) were in positive territory.

In September of last year, I reiterated my thesis and showed why success should not be expected in the near term.

The rest of 2022 will most likely remain challenging, however, taking the long-term perspective, Intel appears attractive at current levels.

Source: Seeking Alpha

Since then, however, Intel is up nearly 25% and this spurs a wave of optimism that the worst is now likely behind us.

Seeking Alpha

Although Intel is now likely to deliver far better future returns than it was in January 2022, I am still cautious about the near-term prospects.

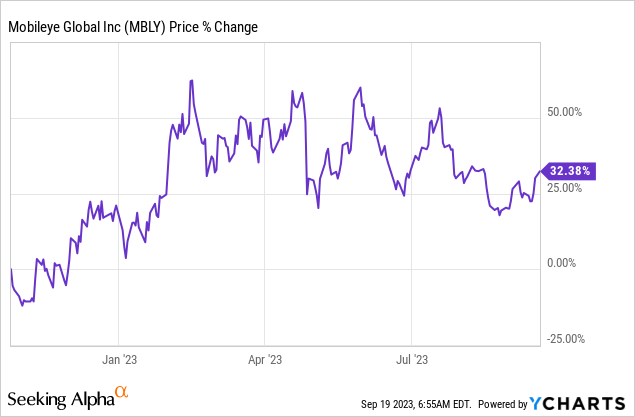

In my view, the business is on the right track, but the recovery will take time. In terms of capital allocation, Intel’s management has been taking the right steps to divest non-core businesses, focus on its foundry business and proceed with the IPO of Mobileye.

In late 2022, a lot of speculation was circulating that Mobileye’s IPO would be a big mistake, but it turns out that the deal was not out of desperation.

Having said all that, turning the business around would take time and the recent quarters have not been something to brag about as peers continue to make significant progress in the area of data centers and artificial intelligence.

Did We See The Bottom Already?

The last few quarters were nothing short of disappointment for Intel shareholders as the business continued to decline.

Although a lot of updates on the different parts of the business were given, the CEO’s opening sentences during Q2 of 2023 were quite telling.

Strength in client and data center and our efforts to drive efficiencies and cost savings across the organization all contributed to the upside in the quarter and a return to profitability.

Source: Intel Q2 2023 Earnings Transcript.

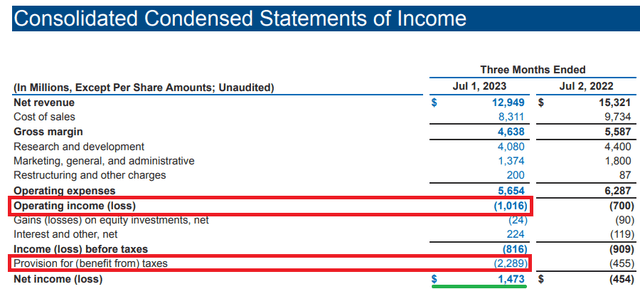

This extract was hard to take at face value for most investors, when Intel’s net revenue remains near record lows and the so-called ‘return to profitability’ was in fact a $1bn operating loss and the positive net income figure was due to the accounting treatment of corporate taxes.

Intel 10-Q SEC Filing

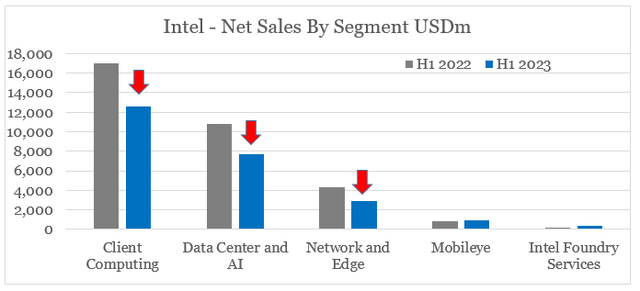

Almost every single business unit was also down significantly in sales during the first half of 2023, when compared to the same period a year ago.

prepared by the author, using data from SEC Filings

All that has only strengthened the bearish thesis on Intel and has made it nearly impossible for anyone with a short-term investment horizon to look favourably at the business.

But as I have said time and time again – Intel’s long-term strategy would not deliver results overnight.

That is why, a very important takeaway from the most recent quarter was that the likelihood that we have already passed the bottom in sales has increased significantly.

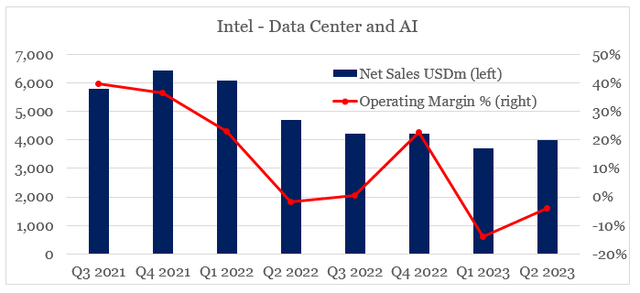

Data center CPU TAM contracted meaningfully in the first half of ’23. And while we expect the magnitude of year-over-year declines to diminish in the second half, a slower-than-anticipated TAM recovery in China and across enterprise markets has delayed a return of CPU TAM growth. CPU market share remained relatively stable in Q2 and the continued ramp of Sapphire Rapids contributed to CPU ASP improvement of 3% sequentially and 17% year-over-year.

Source: Intel Q2 2023 Earnings Transcript.

After a sharp fall of Intel’s Data Center and AI revenues in Q2 of last year, the net sales figure has remained relatively stable for the past few quarters, and we even noted a slight improvement from the prior 3-month period.

prepared by the author, using data from SEC Filings

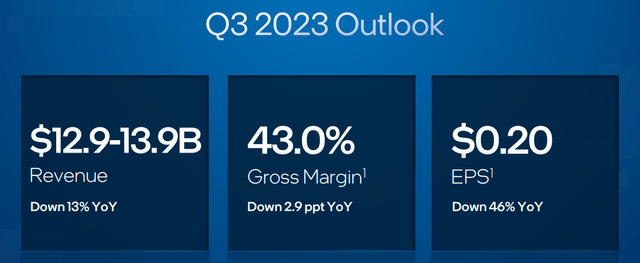

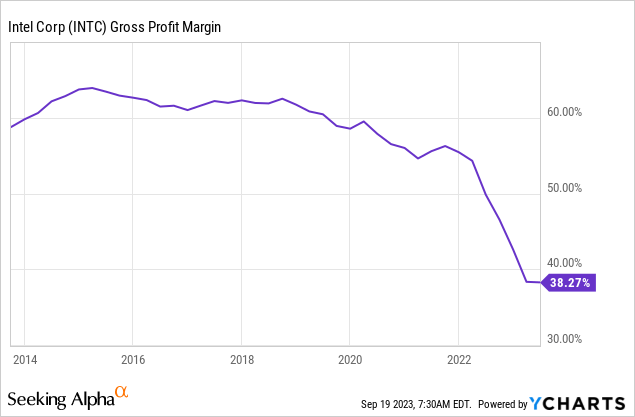

More importantly, however, this has now led to an expected gross margin for Q3 of this year of 43%.

Intel Investor Presentation

Even though this still represents a decline on a year-on-year basis, it is much higher than the current gross margin figure of 38%.

This is largely due to the expectation of revenue stabilizing which at the midpoint of the guidance is expected to return to sequential growth.

We had obviously beat revenue significantly and we got a good fall-through, given the fixed cost nature of our business. And so that really was what helped us really outperform significantly on the gross margin side in the second quarter.

In the third quarter, we do, obviously, at the midpoint, see revenue growth sequentially. And so that will be helpful in terms of gross margin improvement.

Source: Intel Q2 2023 Earnings Transcript.

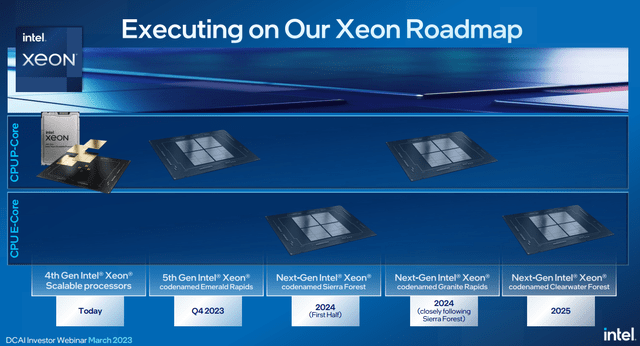

In front of Intel’s management, however, there’s still the hard task to convince investors in the viability of its Data Center roadmap. During the recent event, it became clear that Intel is on track to deliver the 5th Gen Xeon processors this December, but analysts are still waiting for more meaningful results.

Intel Investor Presentation

Horizons Mismatch

As encouraging as everything said above might sound for long-term investors, the recent uptick in Intel’s share price has been largely driven by the market’s anticipation that the bottom in profitability and revenue declines are behind us.

Here we should also mention the apparent mismatch in investment horizons between most equity investors and a business like Intel. In a similar fashion to ExxonMobil (XOM) in 2020, investors are looking for results to be delivered during the next quarter, but Intel’s management is concerned with the long-term competitiveness of the business.

We remain on track to 5 nodes in 4 years and to regain transistor performance and power performance leadership by 2025.

Source: Intel Q2 2023 Earnings Transcript.

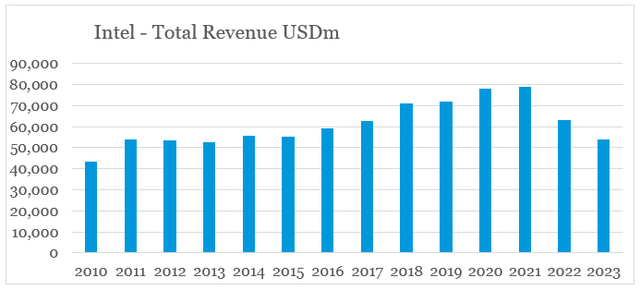

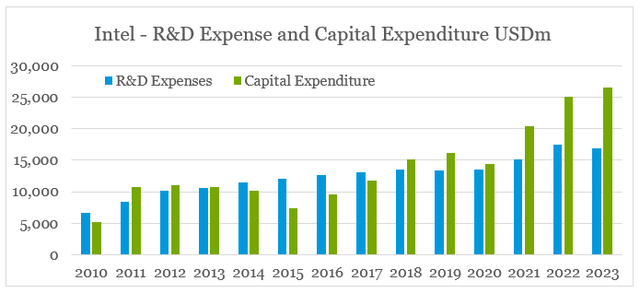

As I mentioned in my initial article on Intel, this required significant short-term pain as heavy reinvestments into the business needed to be made at a time when revenues were falling and competition was intensifying.

prepared by the author, using data from SEC Filings

The graph below, clearly illustrates Intel’s management commitment to its long-term targets by significantly ramping up both capital expenditures and research & development expenses when the total revenue figure is down meaningfully.

prepared by the author, using data from SEC Filings

This approach is exactly what I mean by roundabout investing, when companies avoid the most direct route to pleasing short-term oriented analysts and instead take the roundabout route by enduring more pain now for the greater good later on.

In the light of Intel’s impressive plan for fab expansion in the U.S. and across the globe it is very impressive that the current expectation is for the business to be breakeven in terms of free cash flow by the end of this year.

Our expectation is still by the end of the year to get to breakeven free cash flow. There’s no reason why we shouldn’t achieve that.

Source: Intel Q2 2023 Earnings Transcript.

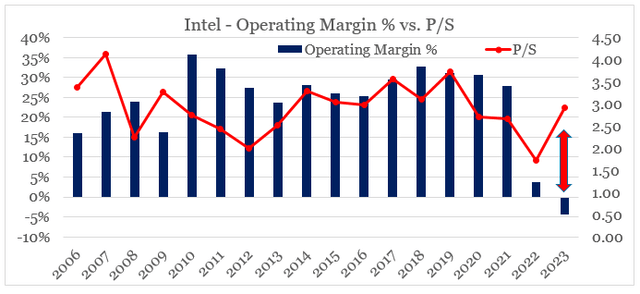

Nonetheless, scaling up the foundry business and turning around both the consumer and data center businesses will take time and operating margins are likely to remain low through the rest of the year. But as investors are already eagerly expecting a quick turnaround, a wide gap has opened between Intel’s Price-to-Sales multiple and its operating margin (see below).

I do expect this gap to close down eventually as profitability improves beyond FY 2023, but in the near term, this creates significant risks for sharp reversals in Intel’s share price.

prepared by the author, using data from SEC Filings and Seeking Alpha

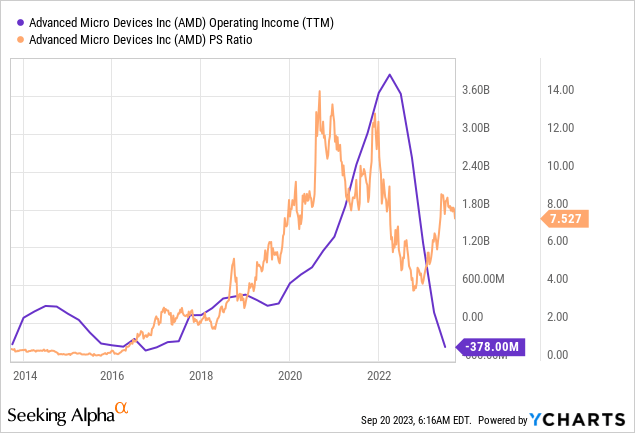

Having said that, in a similar fashion to AMD (AMD) in 2016 and 2017, we saw the P/S multiple remaining elevated even as the company was going through a loss-making period and the analysts were once again not very impressed by the company’s CPU roadmap based on the new Zen Core architecture.

Conclusion

The recent recovery in Intel’s share price holds some short-term risks, even though management continues to make the right decisions to turn the business around. Although investor sentiment continues to be near an all-time low for INTC, I remain optimistic about its long-term prospects. Shareholders should also be mindful of the investment horizon mismatch between the short-term oriented Wall Street Analysts and the long-term strategy of Intel’s management.

Read the full article here