The Company

Bel Fuse Inc. (NASDAQ:BELFB) (NASDAQ:BELFA) is a $580 million market capitalization company that designs, manufactures, and markets a wide range of products used in various industries, including networking, telecommunications, computing, industrial, data transmission, military, aerospace, transportation, eMobility, automotive, medical, broadcasting, and consumer electronics. [Source: latest IR materials]

![Bel Fuse's IR materials [September 6, 2023]](https://ifintechworld.com/wp-content/uploads/2023/09/49513514-16951835280311725.png)

Bel Fuse’s IR materials [September 6, 2023]

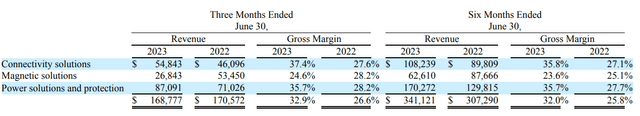

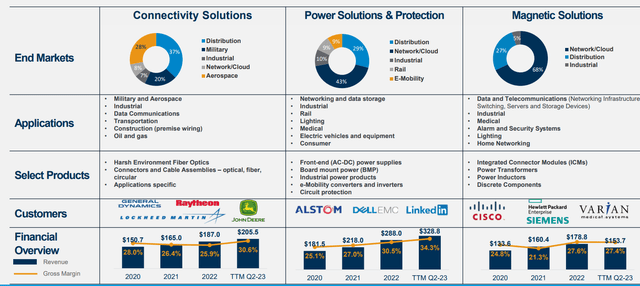

According to the latest 10-Q filing, in the first half of FY2023, Bel Fuse generated 50% of its revenues from Power Solutions and Protection, 32% from Connectivity Solutions, and 18% from Magnetic Solutions.

Bel Fuse’s 10-Q

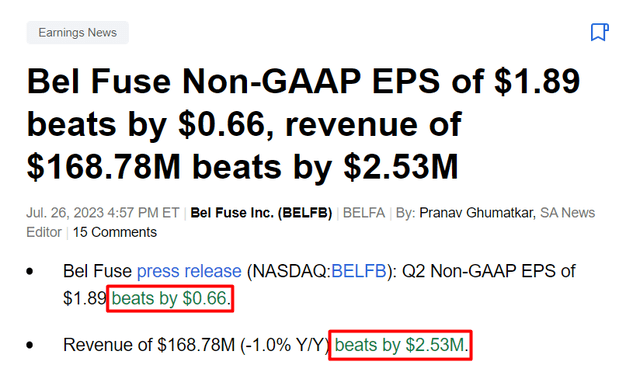

In Q2 FY2023, Bel Fuse reported sales of $169 million, showing a slight dip from the same period last year. However, the company celebrated a significant boost in gross margin, reaching 32.9%, up from 26.6% in Q2 2022. This improvement was driven by robust performances in the Power Solutions and Protection group, which recorded $87.1 million in sales, a 23% YoY increase, and a solid gross margin of 35.7%. The Connectivity Solutions group also achieved a new sales record, securing $54.8 million in Q2 2023 with a remarkable 37.4% gross margin. Conversely, the Magnetic Solutions group faced a challenging period, reporting $26.8 million in sales, a 50% decline from the previous year.

The firm’s backlog remained strong, with Power Solutions at $285 million, Connectivity Solutions at $112 million, and Magnetic Solutions at $53 million, totaling a company backlog of $450 million. Although there are doubts about the growth of the order backlog given the decline in sales – I would still like to see stronger sales growth than growth in the backlog – overall I hope that the backlog will be converted into real sales eventually in the coming quarters.

While expenses, notably SG&A, saw an uptick, the company made strategic debt reductions, bringing the outstanding balance down to $60 million with a fixed 2.5% interest rate (quite good for our current high-rate environment).

In terms of cash flow, the company generated $40.7 million in operating cash during H1 2023, resulting in $33.6 million in FCF, marking a $26 million improvement compared to 1H FY2022, the executives noted during the latest earnings call.

Overall, Q2 FY2023 results significantly exceeded market expectations:

Seeking Alpha News, author’s notes

My previous bullish article on Bel Fuse appeared in mid-June, a month before the release of Q2 FY2023 results. Unfortunately, despite the good results, the stock ultimately responded by dropping almost 20%, which came as a surprise to me.

Perhaps the reason for this is the relatively weak conversion of order backlog into actual sales and the rather cautious guidance. Although sales guidance was raised slightly, the disposal of the business in the Czech Republic and some other problems in general created some uncertainty among investors.

In the medium to long term, it seems to me that Bel Fuse will be supported by the growth of its end markets. Almost everywhere the company operates, its opportunity is abundant. And little by little, the company continues to increase its gross margin across different segments:

Bel Fuse’s IR materials

During the latest earnings call, the management provided an update on the firm’s facility consolidation efforts, noting that 2 of 4 projects are now fully complete. The consolidation of the Magnetic Solutions facility in China is progressing, with expectations of significant completion in Q3 and final touches extending into Q4. These consolidation efforts are expected to result in cost savings, so I expect to see more EBIT margin expansion going forward.

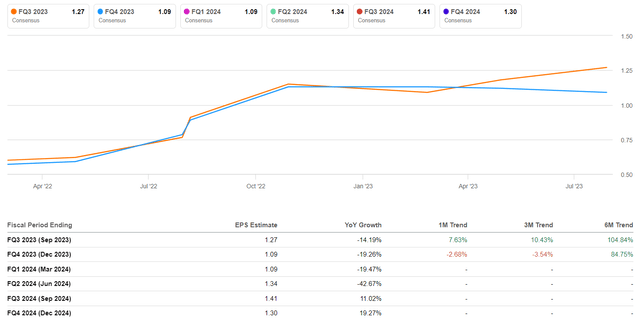

Let’s now take a look at the company’s valuation and what Wall Street analysts expect from Bel Fuse.

Valuation and Expectations

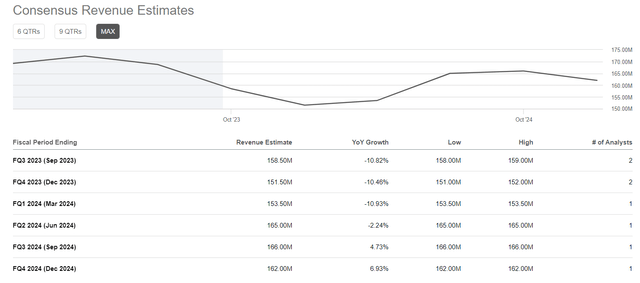

Bel Fuse anticipates Q3 2023 sales to fall within the range of $157 million to $165 million – that’s 1.6% higher than what’s currently priced in by the market.

Seeking Alpha Premium

The company also expects Q3 2023 gross margins to remain generally consistent with those of Q2 2023. Considering that Q3 is pretty strong for Bel, we will probably see another EPS surprise. That’s because the market still can’t get a good read on this small-cap company’s earnings and still hasn’t raised its 2024 consensus estimate, even though the company has plenty of global tailwinds and has been able to expand its margins lately.

Seeking Alpha Premium

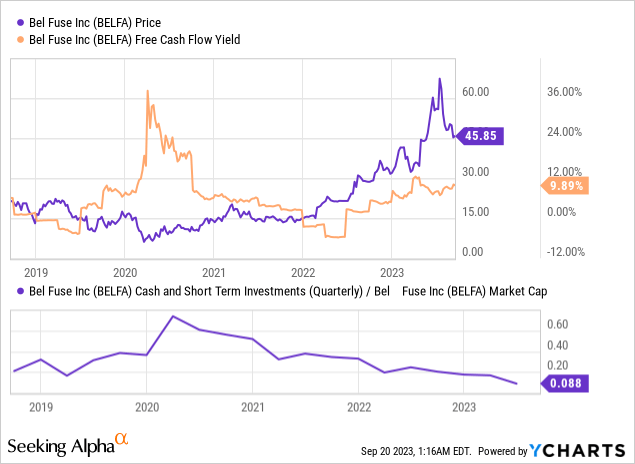

When I last wrote about the company, it had about 16% of its market cap in cash, which looked very solid. Now YCharts shows 8.8%, which is odd given the nearly 20% drop in share price and only a 7.4% drop in cash on the balance sheet. In any case, the FCF generation potential cannot be ignored – in the case of Bel Fuse, the FCF yield today is almost 10%, which makes the company very cheap by historical standards (can only be compared to the Covid period).

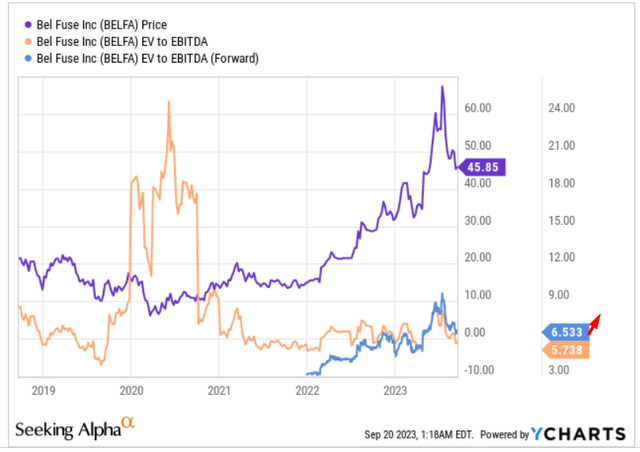

Assuming the margin stability in Q3/Q4 FY23, I still estimate that Bel Fuse’s EV/EBITDA multiple should be ~10x in 12 months, which I think is pretty conservative.

YCharts, author’s notes

Then even if the underestimated [in my view] EBITDA projections are correct [$88.8 million for FY2023], then the resulting enterprise value of $888 million should give us a market cap of $870.2 (net of net debt) – that’s 48.7% lower than Bel Fuse’s market cap as of today.

Given this, I conclude that today’s valuation of Bel Fuse allows the stock to continue its bullish trend.

The Bottom Line

Certainly, there are risks to bear in mind when evaluating Bel Fuse. To begin with, the company has a relatively low market capitalization of less than $1 billion, which can introduce volatility into its stock performance. Also, the company has two classes of stock, which complicates its capital structure. So when deciding between BELFA and BELFB, I would recommend opting for the non-voting shares BELFB as they tend to offer greater liquidity in the market.

In addition, it should be noted that Bel’s backlog has not yet conversed well into revenue this year, which makes forecasts somewhat uncertain – which may be why consensus estimates for Bel Fuse are so low despite a lot of new tailwinds.

Despite all the risks, I reiterate my previously given Buy rating on Bel Fuse stock and expect a gradual widening of the multiple amid rising margins and renewed operational growth. I expect the stock to grow 45-50% over the next 12 months, even if we experience a mild recession.

Thanks for reading!

Read the full article here